As European markets continue to show resilience with the STOXX Europe 600 Index and major stock indexes on the rise, investors are keenly observing opportunities amid steady inflation rates and strong business activity. In such a climate, identifying undervalued stocks can be crucial for those looking to capitalize on potential growth while navigating the complexities of today's economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Talgo (BME:TLGO) | €2.59 | €5.12 | 49.4% |

| Pandora (CPSE:PNDORA) | DKK889.60 | DKK1750.62 | 49.2% |

| Nordisk Bergteknik (OM:NORB B) | SEK12.05 | SEK23.59 | 48.9% |

| Mentice (OM:MNTC) | SEK9.92 | SEK19.58 | 49.3% |

| Lingotes Especiales (BME:LGT) | €5.65 | €11.06 | 48.9% |

| Hanza (OM:HANZA) | SEK129.60 | SEK258.05 | 49.8% |

| doValue (BIT:DOV) | €2.828 | €5.64 | 49.9% |

| Cicor Technologies (SWX:CICN) | CHF194.00 | CHF385.33 | 49.7% |

| ArcticZymes Technologies (OB:AZT) | NOK30.30 | NOK59.56 | 49.1% |

| Aquafil (BIT:ECNL) | €1.93 | €3.85 | 49.8% |

Underneath we present a selection of stocks filtered out by our screen.

Banca Monte dei Paschi di Siena (BIT:BMPS)

Overview: Banca Monte dei Paschi di Siena S.p.A. offers retail and commercial banking services in Italy, with a market capitalization of €22.22 billion.

Operations: The company's revenue segments include €960.60 million from Corporate Banking, €185.60 million from Wealth Management, €2.14 billion from Retail Banking (including Widiba), and €268.40 million from Large Corporate & Investment Banking.

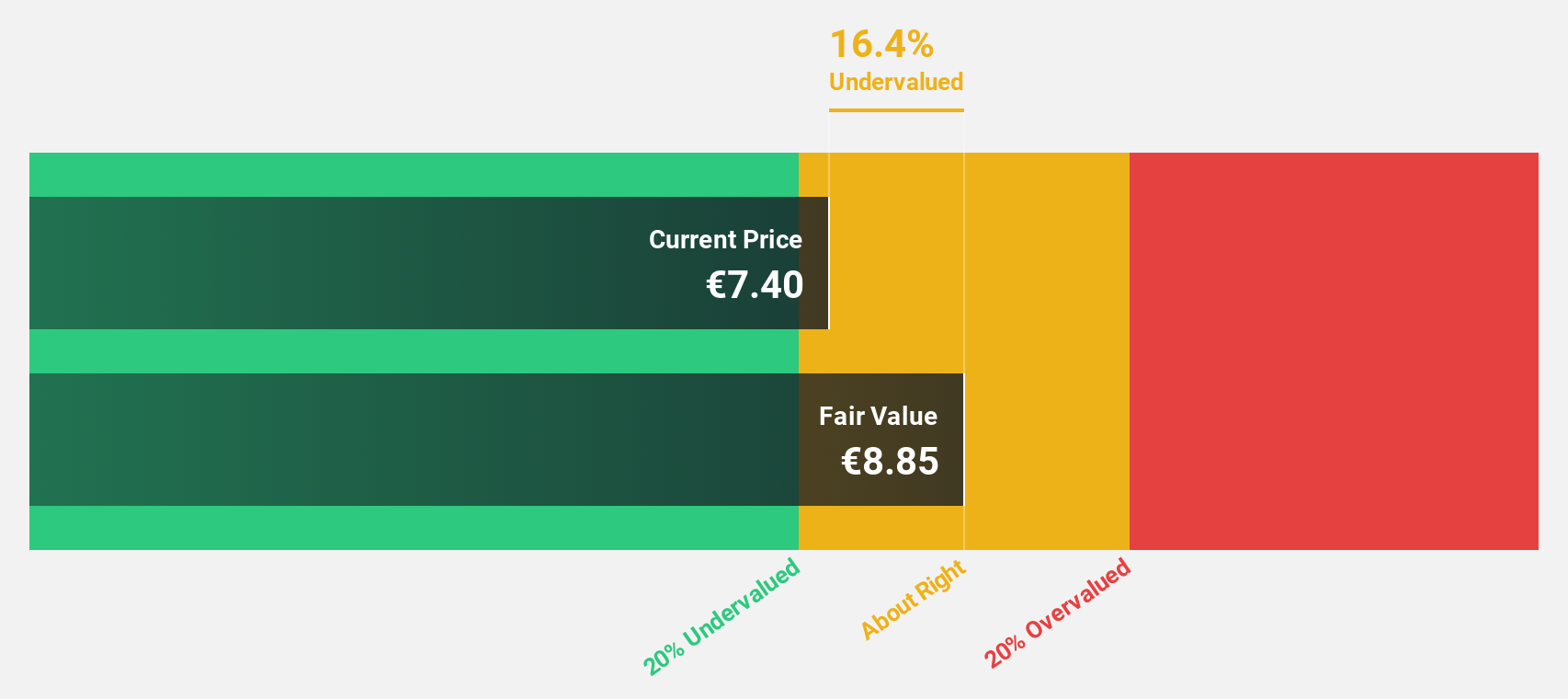

Estimated Discount To Fair Value: 17.4%

Banca Monte dei Paschi di Siena, trading at €7.31, is undervalued relative to its fair value estimate of €8.85, though not significantly so. Its earnings are forecast to grow 15.9% annually, surpassing the Italian market's growth rate. However, challenges include a high level of bad loans (3.9%) and low allowance for these loans (65%). Recent inclusion in major indices like S&P EUROPE 350 may enhance visibility among investors despite profit margin declines and shareholder dilution over the past year.

- According our earnings growth report, there's an indication that Banca Monte dei Paschi di Siena might be ready to expand.

- Unlock comprehensive insights into our analysis of Banca Monte dei Paschi di Siena stock in this financial health report.

Metsä Board Oyj (HLSE:METSB)

Overview: Metsä Board Oyj operates in the folding boxboard, fresh fibre linerboard, and market pulp sectors both in Finland and internationally, with a market cap of €1.13 billion.

Operations: The company generates revenue of €1.83 billion from its operations in the folding boxboard, fresh fibre linerboard, and market pulp sectors.

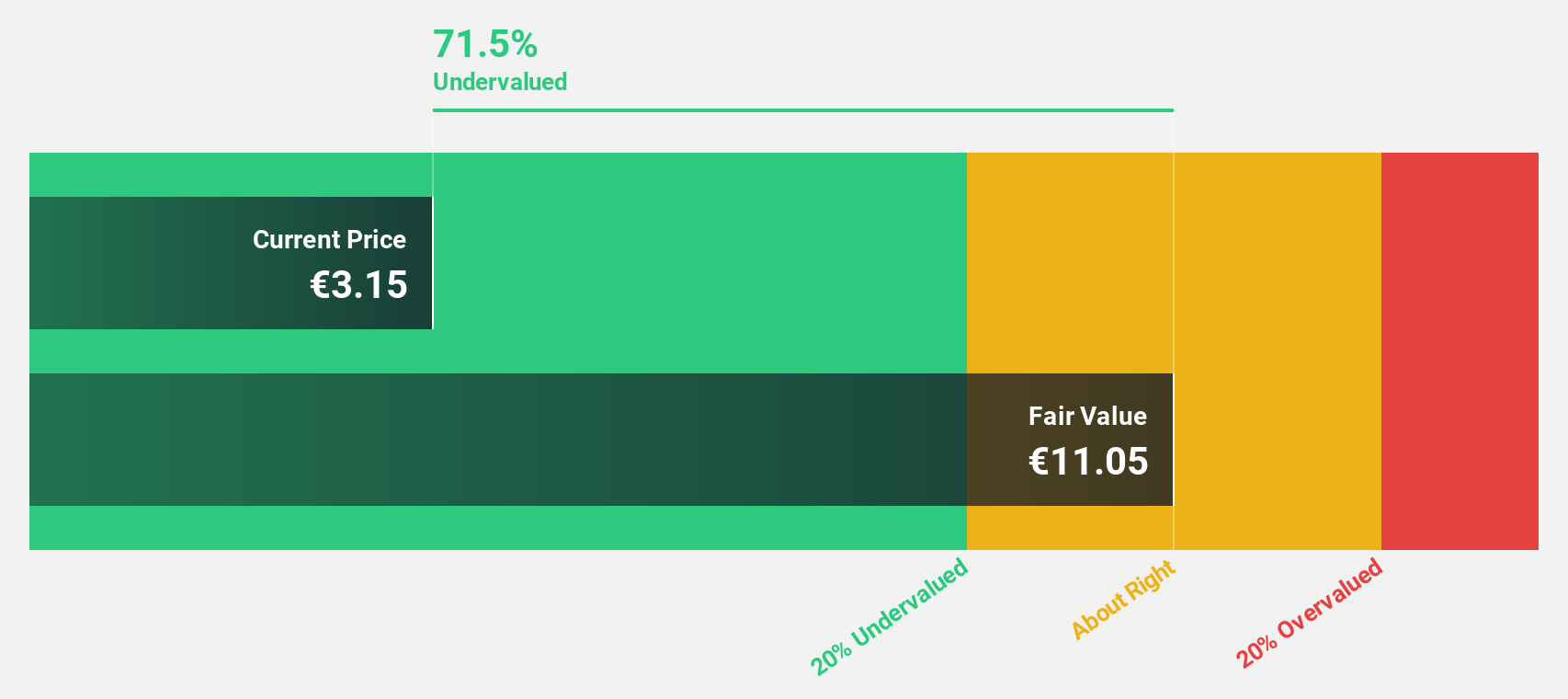

Estimated Discount To Fair Value: 40.6%

Metsä Board Oyj, priced at €3.01, is significantly undervalued with a fair value estimate of €5.07. Despite recent losses and volatile share prices, its earnings are projected to grow 114% annually over the next three years, outpacing the Finnish market's revenue growth rate of 4%. The company has secured a €250 million credit facility linked to sustainability goals and completed a €60 million modernization project at its Simpele mill, enhancing product quality and supporting fossil-free production ambitions.

- Our earnings growth report unveils the potential for significant increases in Metsä Board Oyj's future results.

- Click to explore a detailed breakdown of our findings in Metsä Board Oyj's balance sheet health report.

SGS (SWX:SGSN)

Overview: SGS SA offers inspection, testing, and certification services across Europe, Africa, the Middle East, Latin America, North America, and the Asia Pacific with a market cap of CHF17.64 billion.

Operations: The company's revenue segments include Business Assurance (CHF775 million), Testing & Inspection - Natural Resources (CHF1.59 billion), Testing & Inspection - Health & Nutrition (CHF915 million), Testing & Inspection - Industries & Environment (CHF2.29 billion), and Testing & Inspection - Connectivity & Products (CHF1.31 billion).

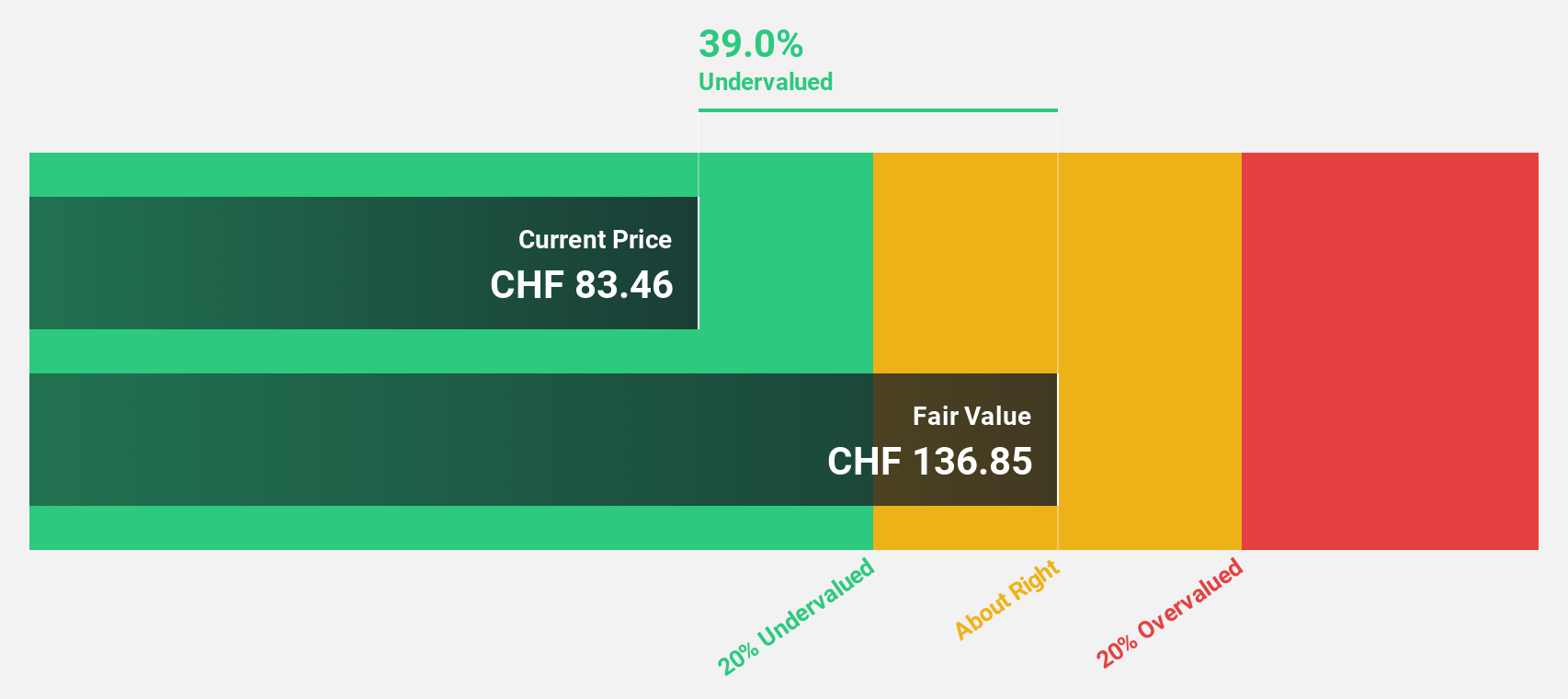

Estimated Discount To Fair Value: 33.4%

SGS, trading at CHF91.12, is undervalued with a fair value estimate of CHF136.91. Despite high debt levels and modest revenue growth forecasts of 5.9% annually, its earnings are expected to grow faster than the Swiss market at 11.3%. Recent strategic partnerships, like the expanded alliance with EcoVadis for ESG services and Diginex for sustainable finance solutions, enhance SGS's position in growing markets and may bolster future cash flows despite current dividend coverage concerns.

- The analysis detailed in our SGS growth report hints at robust future financial performance.

- Navigate through the intricacies of SGS with our comprehensive financial health report here.

Key Takeaways

- Embark on your investment journey to our 214 Undervalued European Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banca Monte dei Paschi di Siena might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BMPS

Banca Monte dei Paschi di Siena

Provides retail and commercial banking services in Italy.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives