- France

- /

- Aerospace & Defense

- /

- ENXTPA:SAF

3 Stocks That May Be Trading Below Estimated Value In January 2025

Reviewed by Simply Wall St

As global markets continue to navigate the evolving landscape of U.S. trade policies and AI-driven optimism, major indices like the S&P 500 have reached record highs, reflecting investor confidence amid political shifts and economic adjustments. In this context of heightened market activity, identifying stocks that may be trading below their estimated value becomes crucial for investors seeking opportunities in a climate marked by both growth potential and uncertainty.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.73 | 49.8% |

| Guangdong Mingyang ElectricLtd (SZSE:301291) | CN¥50.90 | CN¥101.57 | 49.9% |

| World Fitness Services (TWSE:2762) | NT$92.70 | NT$184.63 | 49.8% |

| 74Software (ENXTPA:74SW) | €26.50 | €52.89 | 49.9% |

| Solum (KOSE:A248070) | ₩18950.00 | ₩37756.10 | 49.8% |

| Dynavox Group (OM:DYVOX) | SEK68.20 | SEK136.07 | 49.9% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥26.02 | 49.8% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥25.57 | CN¥51.06 | 49.9% |

| St. James's Place (LSE:STJ) | £9.31 | £18.53 | 49.8% |

| Netum Group Oyj (HLSE:NETUM) | €2.82 | €5.63 | 49.9% |

We'll examine a selection from our screener results.

CVC Capital Partners (ENXTAM:CVC)

Overview: CVC Capital Partners plc is a private equity and venture capital firm that focuses on middle market secondaries, infrastructure, credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales and spinouts with a market cap of €22.86 billion.

Operations: CVC Capital Partners plc generates revenue through its operations in private equity and venture capital, specializing in areas such as middle market secondaries, infrastructure, credit, management buyouts, leveraged buyouts, growth equity investments, recapitalizations, strip sales and spinouts.

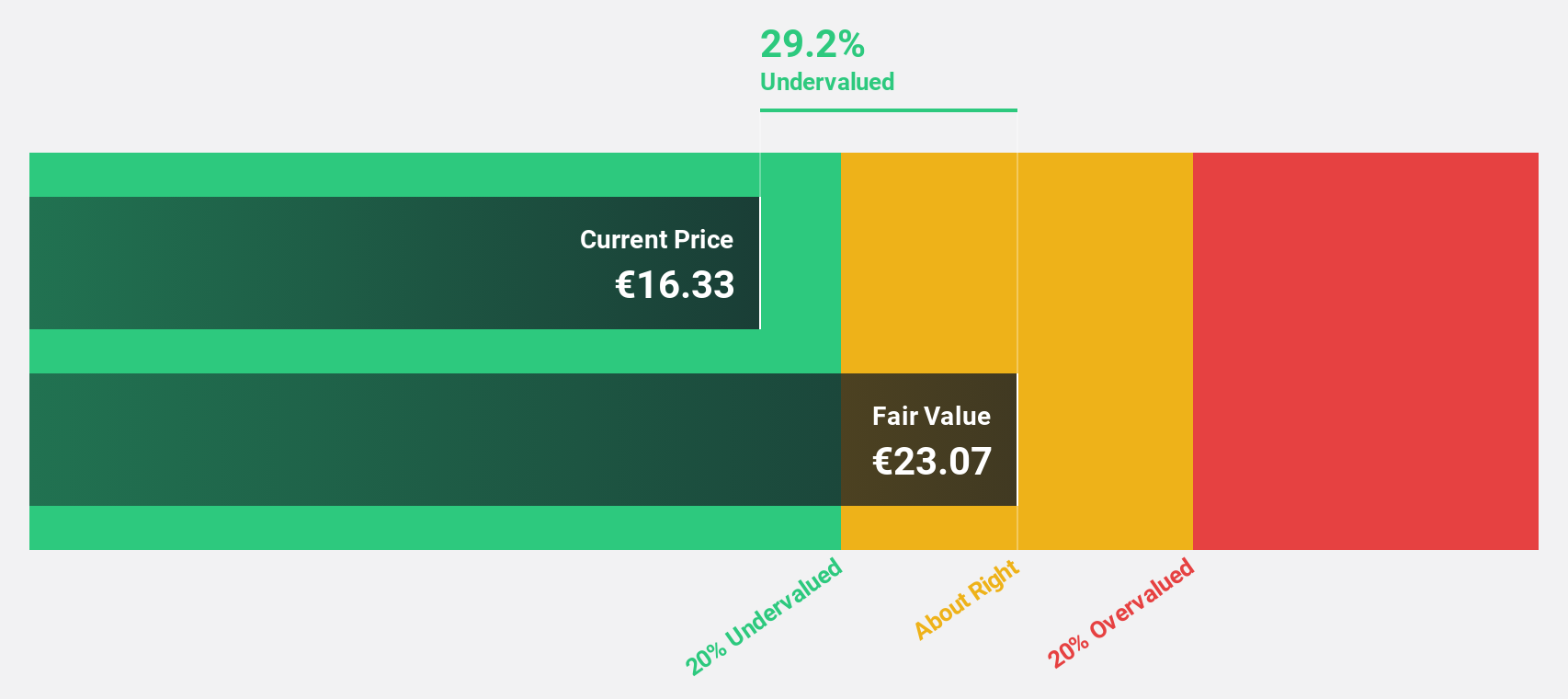

Estimated Discount To Fair Value: 18.8%

CVC Capital Partners is trading at €21.62, below its estimated fair value of €26.62, indicating it may be undervalued based on cash flows. The company's earnings are forecast to grow significantly at 32.9% annually, outpacing the Dutch market's growth rate of 14.5%. However, CVC carries a high level of debt which could impact financial flexibility. Recent M&A discussions regarding Telecom Italia and HealthCare Global Enterprises highlight strategic shifts that could influence future valuations and operational focus.

- In light of our recent growth report, it seems possible that CVC Capital Partners' financial performance will exceed current levels.

- Navigate through the intricacies of CVC Capital Partners with our comprehensive financial health report here.

Safran (ENXTPA:SAF)

Overview: Safran SA, with a market cap of €98.56 billion, operates globally in the aerospace and defense sectors through its subsidiaries.

Operations: The company's revenue is primarily derived from Aerospace Propulsion (€12.66 billion), Aeronautical Equipment, Defense and Aerosystems (€9.91 billion), and Aircraft Interiors (€2.73 billion).

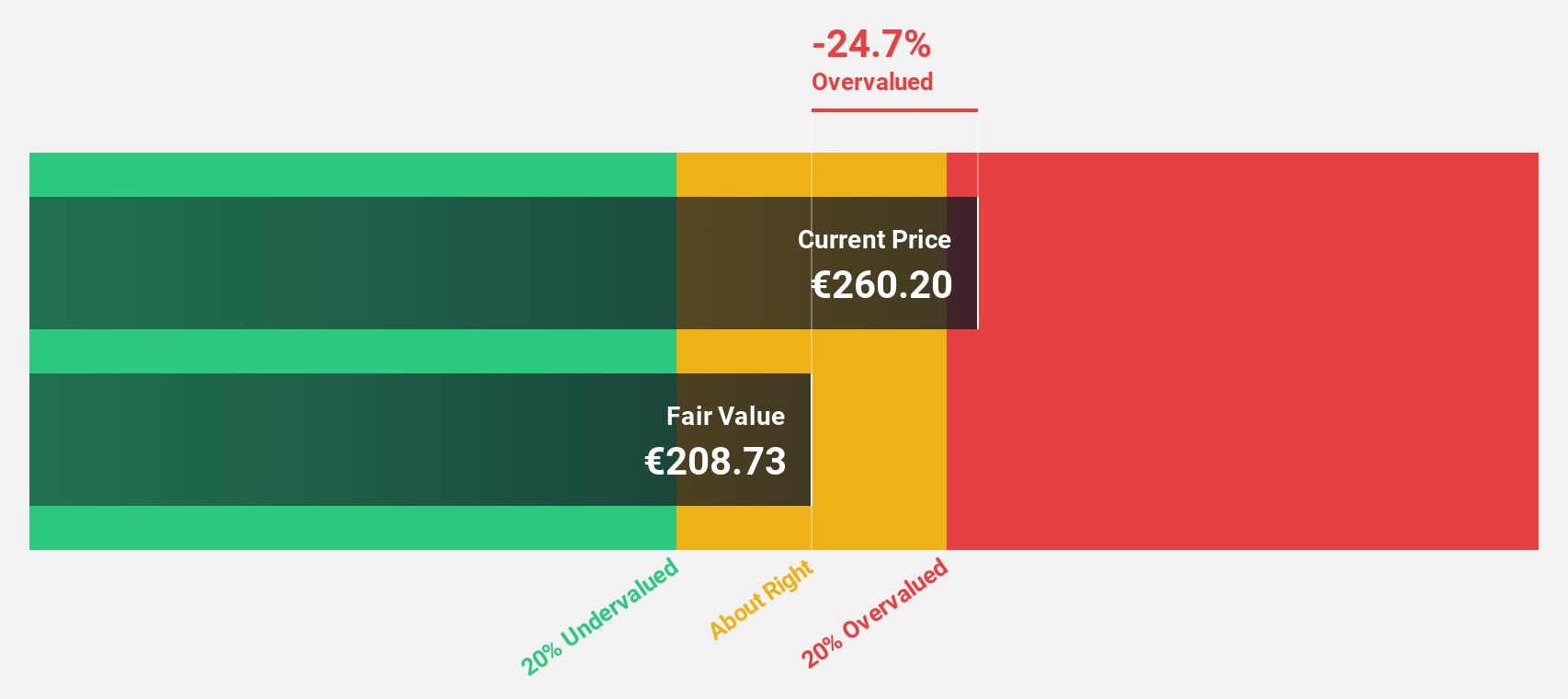

Estimated Discount To Fair Value: 17.8%

Safran is trading at €235.1, below its estimated fair value of €285.91, suggesting undervaluation based on cash flows. Revenue growth is expected to outpace the French market at 10.2% annually, with earnings projected to rise by 19.3%. Despite a decline in profit margins from last year, Safran's strategic buyback plan of up to €5 billion and potential acquisitions aim to enhance core business strength and future profitability.

- The analysis detailed in our Safran growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Safran.

SGS (SWX:SGSN)

Overview: SGS SA offers inspection, testing, and verification services across Europe, Africa, the Middle East, the Americas, and the Asia Pacific with a market cap of CHF15.85 billion.

Operations: The company generates revenue from its Business Assurance segment amounting to CHF755 million.

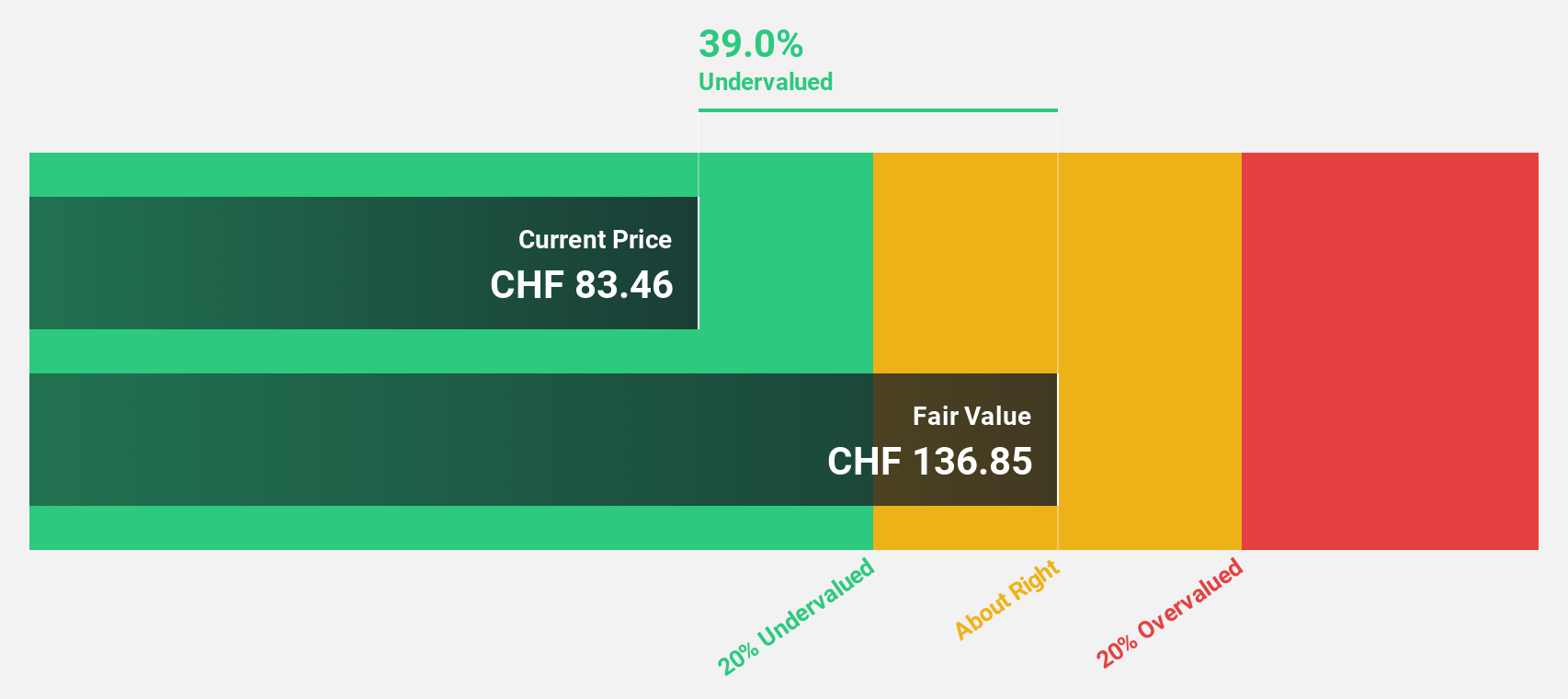

Estimated Discount To Fair Value: 31.5%

SGS is trading at CHF89, significantly below its estimated fair value of CHF129.96, highlighting undervaluation based on cash flows. Earnings are forecast to grow by 12.2% annually, surpassing the Swiss market's growth rate. However, its dividend coverage is weak with a 3.6% yield not fully supported by earnings. The company is in advanced merger talks with Bureau Veritas, potentially forming a major European testing and certification entity valued at almost $35 billion.

- Our expertly prepared growth report on SGS implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of SGS.

Next Steps

- Delve into our full catalog of 888 Undervalued Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAF

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives