- Switzerland

- /

- Commercial Services

- /

- SWX:OFN

Shareholders May Not Be So Generous With Orell Füssli AG's (VTX:OFN) CEO Compensation And Here's Why

Key Insights

- Orell Füssli will host its Annual General Meeting on 13th of May

- Total pay for CEO Daniel Link includes CHF434.0k salary

- The total compensation is 209% higher than the average for the industry

- Over the past three years, Orell Füssli's EPS grew by 14% and over the past three years, the total shareholder return was 29%

CEO Daniel Link has done a decent job of delivering relatively good performance at Orell Füssli AG (VTX:OFN) recently. As shareholders go into the upcoming AGM on 13th of May, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for Orell Füssli

Comparing Orell Füssli AG's CEO Compensation With The Industry

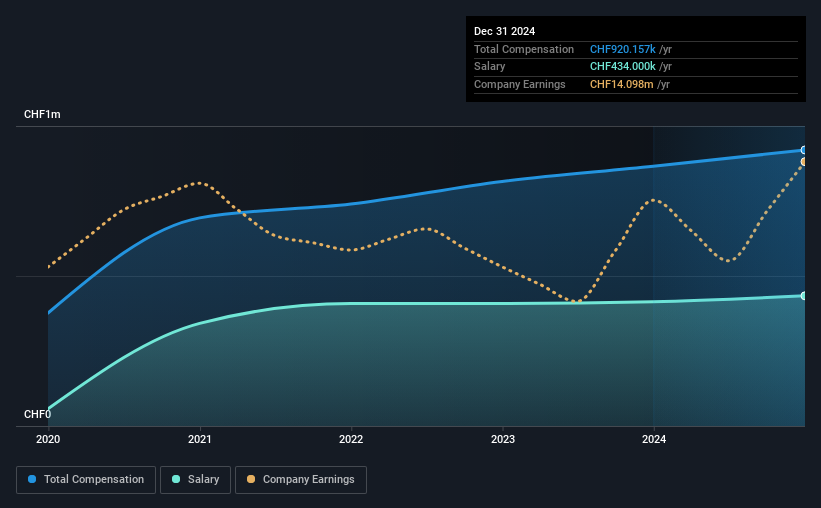

At the time of writing, our data shows that Orell Füssli AG has a market capitalization of CHF198m, and reported total annual CEO compensation of CHF920k for the year to December 2024. That's a modest increase of 6.3% on the prior year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CHF434k.

For comparison, other companies in the Switzerland Commercial Services industry with market capitalizations ranging between CHF82m and CHF329m had a median total CEO compensation of CHF298k. This suggests that Daniel Link is paid more than the median for the industry. Moreover, Daniel Link also holds CHF102k worth of Orell Füssli stock directly under their own name.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CHF434k | CHF414k | 47% |

| Other | CHF486k | CHF452k | 53% |

| Total Compensation | CHF920k | CHF866k | 100% |

Talking in terms of the industry, salary represented approximately 54% of total compensation out of all the companies we analyzed, while other remuneration made up 46% of the pie. Orell Füssli pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Orell Füssli AG's Growth Numbers

Orell Füssli AG's earnings per share (EPS) grew 14% per year over the last three years. Its revenue is up 8.7% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Orell Füssli AG Been A Good Investment?

With a total shareholder return of 29% over three years, Orell Füssli AG shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for Orell Füssli that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:OFN

Orell Füssli

Engages in security printing and technology, book retailing, and publishing business in Switzerland Germany, rest of Europe and Africa, North and South America, Asia, and Oceania.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)