- Switzerland

- /

- Professional Services

- /

- SWX:ADEN

Is Adecco Group (SWX:ADEN) Reinventing Its Competitive Edge With New AI Leadership Program?

Reviewed by Sasha Jovanovic

- Recently, LHH, a global business unit of the Adecco Group, introduced the AI Leadership Transformation Program, which blends General Assembly's AI curriculum with EZRA's digital coaching to help enterprise leaders gain critical capabilities for an AI-first workforce.

- This initiative underscores the growing gap in AI-specific leadership training that exists today, with less than half of companies offering such programs, and highlights Adecco’s efforts to position itself at the forefront of workforce development.

- We'll now examine how Adecco Group's new focus on AI leadership training could shift the company's investment outlook and industry standing.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Adecco Group Investment Narrative Recap

To be a shareholder in Adecco Group, you need conviction that the business can adapt as workforce needs shift more rapidly toward flexible staffing, upskilling, and AI-enabled HR solutions. Adecco's launch of the AI Leadership Transformation Program aligns with the largest short-term catalyst, demand for specialized, higher-margin services, but does not yet have a material impact on the most pressing risk: margin compression linked to competition and pricing power challenges.

Among recent announcements, the January 2025 expansion of Adecco’s partnership with Bullhorn, focusing on AI-driven recruitment efficiency in Germany and Italy, ties most closely to this push into AI leadership development. Both moves aim to capture value from digital transformation and skill shortages, supporting Adecco’s ongoing efforts to improve operational resilience and market differentiation.

On the other hand, investors should be aware of the growing threat of digital staffing platforms that could...

Read the full narrative on Adecco Group (it's free!)

Adecco Group's outlook anticipates €24.3 billion in revenue and €458.6 million in earnings by 2028. This scenario is based on a 2.0% annual revenue growth rate and reflects an earnings increase of €168.6 million from the current level of €290.0 million.

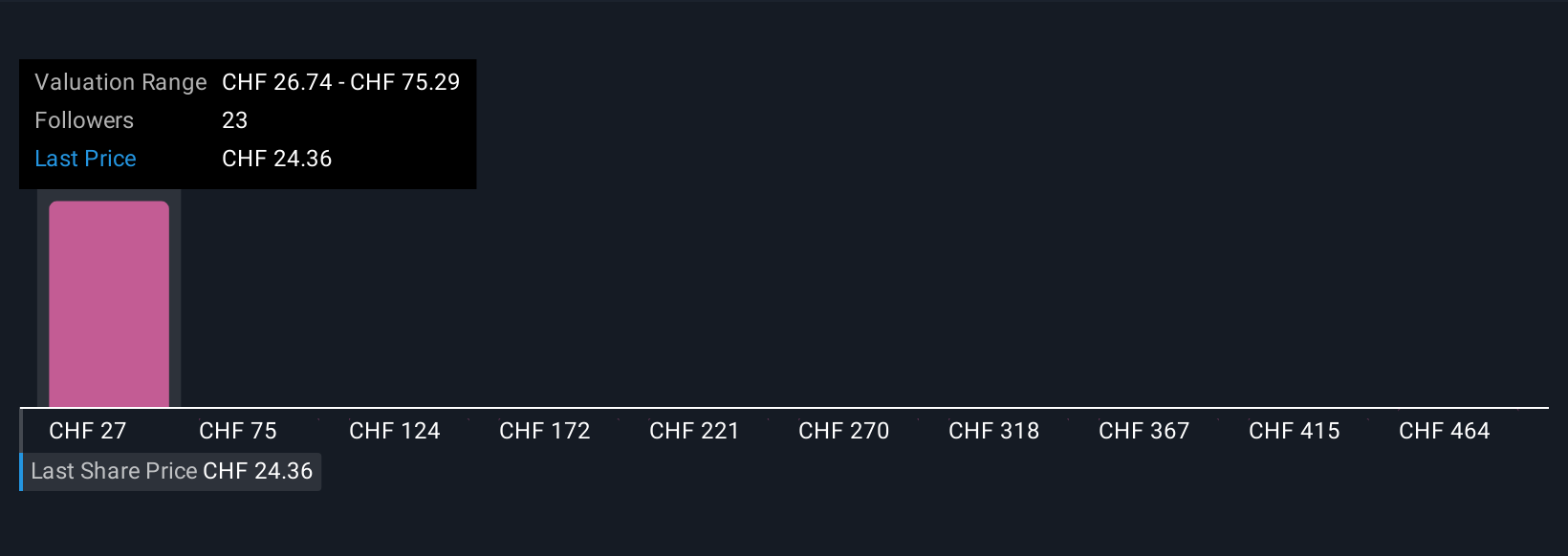

Uncover how Adecco Group's forecasts yield a CHF26.74 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Four retail investors from the Simply Wall St Community value Adecco Group shares between CHF26.74 and CHF512.30. Despite optimism around digital growth, margin pressure from competitors remains a central focus for many in the community.

Explore 4 other fair value estimates on Adecco Group - why the stock might be worth just CHF26.74!

Build Your Own Adecco Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adecco Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Adecco Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adecco Group's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ADEN

Adecco Group

Provides human resource services to businesses and organizations in Europe, North America, the Asia Pacific, South America, and North Africa.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives