- Switzerland

- /

- Building

- /

- SWX:DOKA

European Stocks Estimated Below Fair Value In May 2025

Reviewed by Simply Wall St

In May 2025, European markets have shown resilience, with the pan-European STOXX Europe 600 Index climbing 3.44% as easing tariff concerns contributed to positive momentum across major stock indexes. Amid this backdrop of economic growth and fluctuating inflation rates, identifying stocks that are estimated to be trading below their fair value can present potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| ILPRA (BIT:ILP) | €4.60 | €8.88 | 48.2% |

| SNGN Romgaz (BVB:SNG) | RON5.80 | RON11.19 | 48.2% |

| CTT Systems (OM:CTT) | SEK211.20 | SEK416.05 | 49.2% |

| Truecaller (OM:TRUE B) | SEK76.05 | SEK149.09 | 49% |

| Lectra (ENXTPA:LSS) | €24.15 | €48.03 | 49.7% |

| Stille (OM:STIL) | SEK188.00 | SEK367.98 | 48.9% |

| dormakaba Holding (SWX:DOKA) | CHF698.00 | CHF1394.44 | 49.9% |

| Bactiguard Holding (OM:BACTI B) | SEK32.00 | SEK62.29 | 48.6% |

| Expert.ai (BIT:EXAI) | €1.328 | €2.60 | 48.9% |

| Northern Data (DB:NB2) | €24.62 | €48.68 | 49.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Neste Oyj (HLSE:NESTE)

Overview: Neste Oyj is a company that, along with its subsidiaries, supplies renewable diesel and sustainable aviation fuel across Finland, the Nordic countries, the Baltic Rim, other parts of Europe, the United States, and internationally; it has a market capitalization of €7.26 billion.

Operations: Neste Oyj's revenue is primarily derived from its Oil Products segment at €12.10 billion, Renewable Products at €7.30 billion, and Marketing & Services at €4.51 billion.

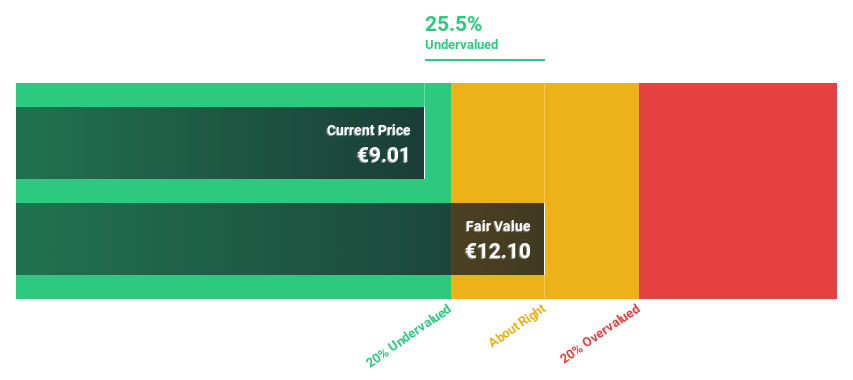

Estimated Discount To Fair Value: 23%

Neste Oyj appears to be trading at a significant discount, with its current price 23% below the estimated fair value of €12.27. Despite recent financial challenges, including a net loss of €40 million in Q1 2025 and reduced renewable diesel production, the company forecasts higher sales volumes for both renewable and oil products in 2025. While revenue growth is expected to outpace the Finnish market, profitability is anticipated over the next three years amidst high share price volatility.

- Our earnings growth report unveils the potential for significant increases in Neste Oyj's future results.

- Navigate through the intricacies of Neste Oyj with our comprehensive financial health report here.

dormakaba Holding (SWX:DOKA)

Overview: dormakaba Holding AG offers access and security solutions globally, with a market capitalization of CHF2.93 billion.

Operations: The company's revenue is primarily derived from Access Solutions, contributing CHF2.44 billion, and Key & Wall Solutions and OEM, which account for CHF496.40 million.

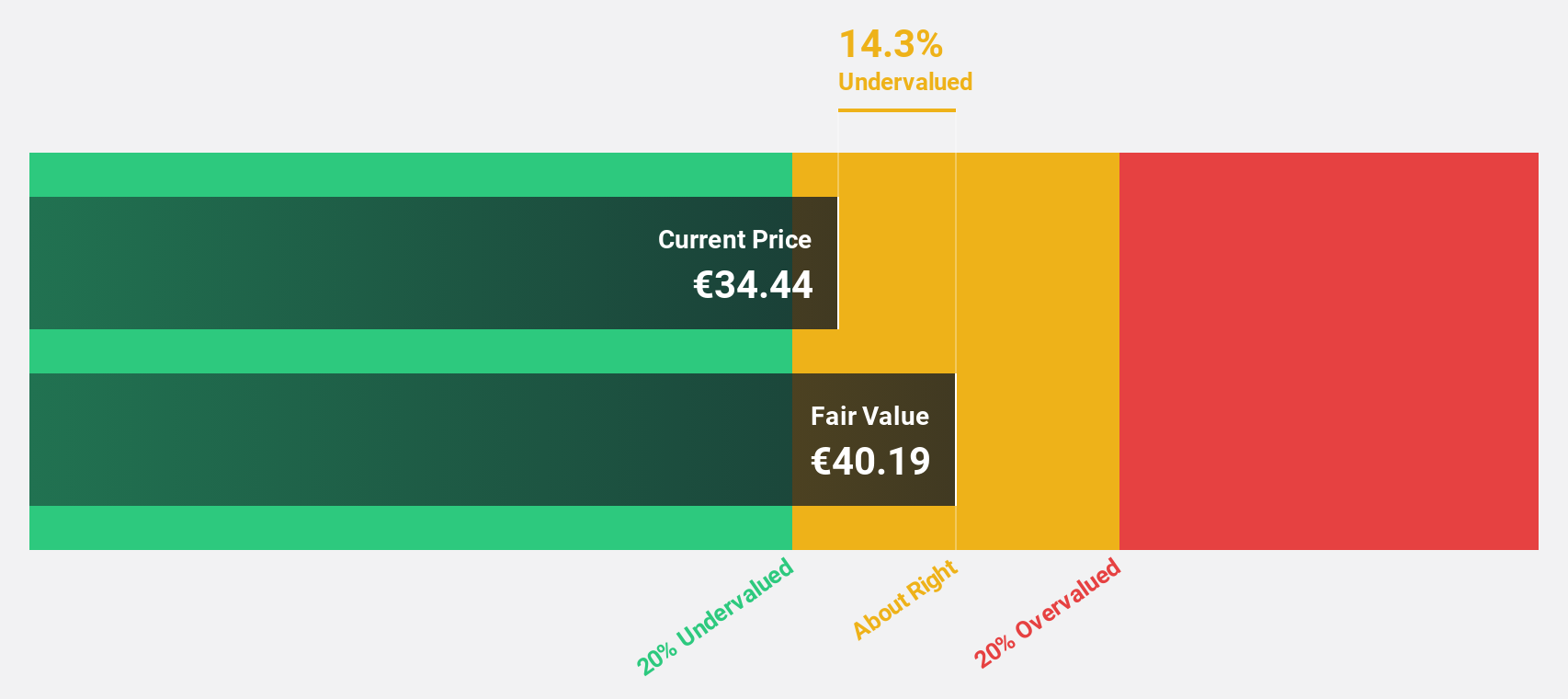

Estimated Discount To Fair Value: 49.9%

dormakaba Holding's current trading price of CHF 698 is significantly below its estimated fair value of CHF 1,394.44, highlighting potential undervaluation based on cash flows. Despite a slower revenue growth forecast (3.9% annually) compared to the Swiss market, earnings are expected to grow significantly at 27.5% per year over the next three years. Recent financials show improved profitability with net income rising from CHF 24.9 million to CHF 50.4 million in H1 2025 amidst high debt levels and one-off items impacting results.

- In light of our recent growth report, it seems possible that dormakaba Holding's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in dormakaba Holding's balance sheet health report.

Voestalpine (WBAG:VOE)

Overview: Voestalpine AG is involved in processing, developing, manufacturing, and selling steel products across Austria, the European Union, and internationally with a market cap of €4.08 billion.

Operations: The company's revenue is primarily derived from its Steel Division (€5.84 billion), Metal Forming Division (€3.22 billion), Metal Engineering Division (€4.25 billion), and High Performance Metals Division (€3.31 billion).

Estimated Discount To Fair Value: 11.4%

Voestalpine's current price of €23.78 is slightly below its estimated fair value of €26.85, suggesting some undervaluation based on cash flows. The company's earnings are projected to grow significantly at 43.68% annually, though revenue growth remains modest at 0.9% per year, exceeding the Austrian market average. Despite recent index exclusion and lower guidance with an expected EBITDA of €1.3 billion for 2024/25, Voestalpine trades favorably compared to peers and industry standards.

- Insights from our recent growth report point to a promising forecast for Voestalpine's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Voestalpine.

Key Takeaways

- Get an in-depth perspective on all 171 Undervalued European Stocks Based On Cash Flows by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:DOKA

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives