- Spain

- /

- Construction

- /

- BME:OHLA

3 European Stocks Estimated To Be 39.7% To 44.8% Below Intrinsic Value

Reviewed by Simply Wall St

As European markets continue to navigate mixed performances amid hopes for easing trade tensions between China and the U.S., investors are increasingly focused on identifying opportunities within this complex landscape. With the pan-European STOXX Europe 600 Index rising for a fourth consecutive week, attention turns to stocks that may be undervalued, offering potential value in an environment shaped by shifting economic policies and market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| ILPRA (BIT:ILP) | €4.54 | €8.77 | 48.2% |

| SNGN Romgaz (BVB:SNG) | RON5.77 | RON11.06 | 47.8% |

| CoinShares International (OM:CS) | SEK79.90 | SEK158.59 | 49.6% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.91 | €3.72 | 48.7% |

| Befesa (XTRA:BFSA) | €26.82 | €52.07 | 48.5% |

| Lectra (ENXTPA:LSS) | €24.10 | €47.39 | 49.1% |

| Claranova (ENXTPA:CLA) | €2.84 | €5.47 | 48.1% |

| illimity Bank (BIT:ILTY) | €3.666 | €7.26 | 49.5% |

| Expert.ai (BIT:EXAI) | €1.328 | €2.58 | 48.6% |

| HBX Group International (BME:HBX) | €10.32 | €19.79 | 47.8% |

Let's explore several standout options from the results in the screener.

Obrascón Huarte Lain (BME:OHLA)

Overview: Obrascón Huarte Lain, S.A. operates in the construction and concession sectors across various regions including the United States, Canada, Latin America, Europe, and internationally with a market cap of €383.81 million.

Operations: The company's revenue primarily comes from its construction segment, which generated €3.35 billion, followed by its industrial segment with €294.99 million.

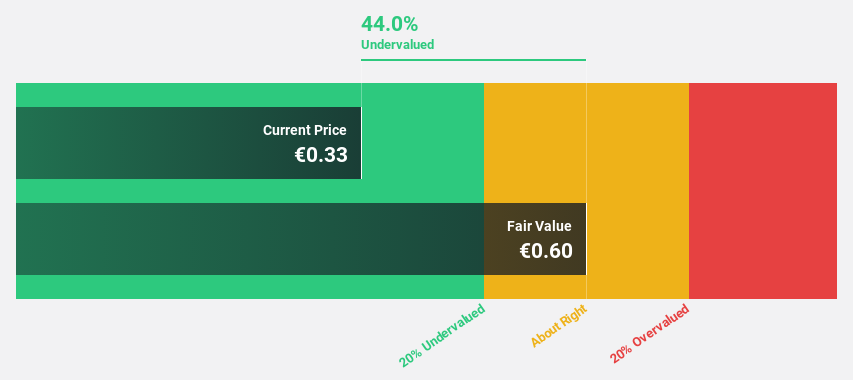

Estimated Discount To Fair Value: 44.8%

Obrascón Huarte Lain (OHLA) is trading at a significant discount, with its share price below fair value by more than 20%, making it an attractive option for those seeking undervalued stocks based on cash flows. Despite revenue growth forecasts of 4.8% annually, which outpace the Spanish market, OHLA faces challenges such as recent auditor concerns about its ability to continue as a going concern and shareholder dilution over the past year.

- Insights from our recent growth report point to a promising forecast for Obrascón Huarte Lain's business outlook.

- Unlock comprehensive insights into our analysis of Obrascón Huarte Lain stock in this financial health report.

Dätwyler Holding (SWX:DAE)

Overview: Dätwyler Holding AG produces and sells elastomer components for various industries, including healthcare and mobility, across multiple continents, with a market cap of CHF2.05 billion.

Operations: Dätwyler Holding AG's revenue is primarily derived from its Healthcare Solutions segment, which accounts for CHF446 million, and its Industrial Solutions segment, contributing CHF664.80 million.

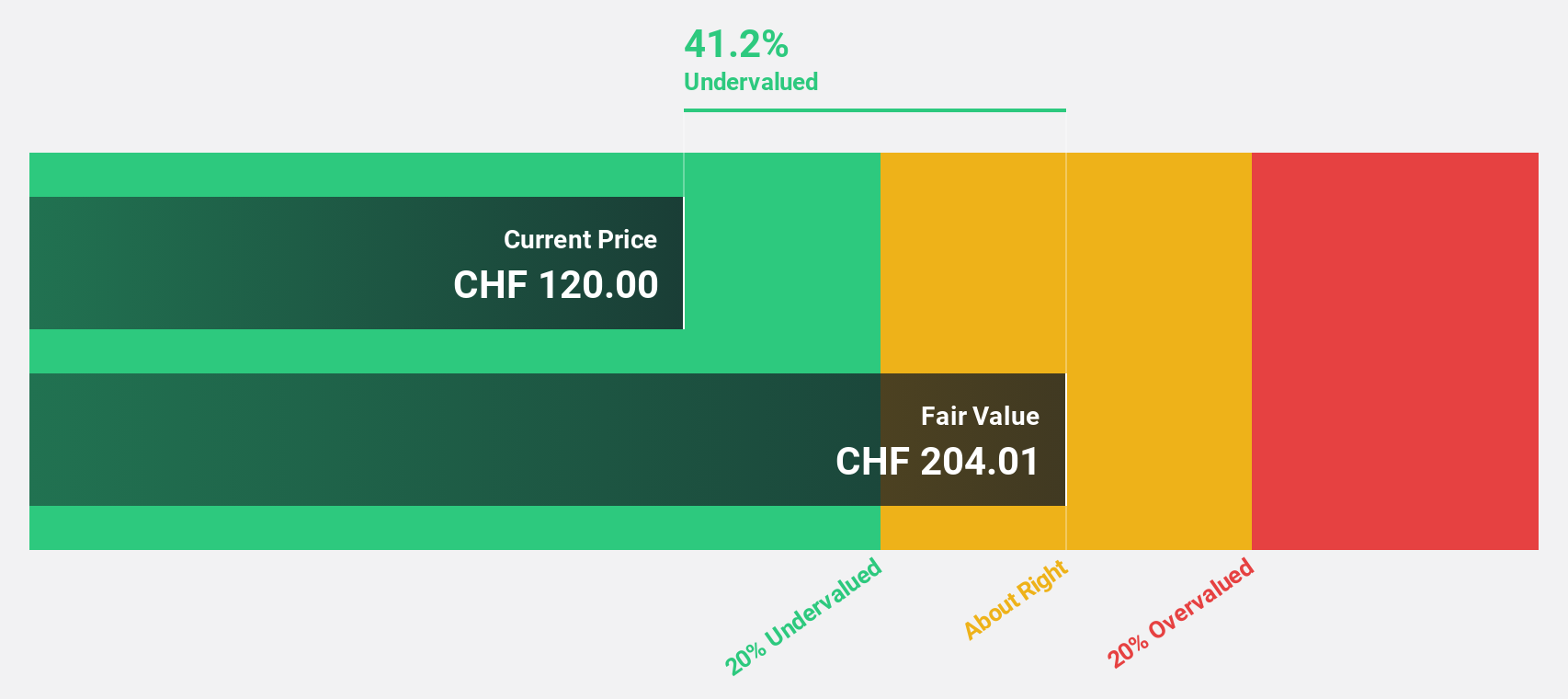

Estimated Discount To Fair Value: 41.6%

Dätwyler Holding is trading at CHF120.4, significantly below its estimated fair value of CHF206.2, highlighting its potential as an undervalued stock based on cash flows. Despite a high debt level and recent profit margin contraction from 5.8% to 2.8%, the company anticipates robust earnings growth of 34.1% annually over the next three years, outpacing the Swiss market's forecasted growth rate of 11%. However, dividend coverage remains inadequate due to large one-off items impacting results.

- Our expertly prepared growth report on Dätwyler Holding implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Dätwyler Holding's balance sheet by reading our health report here.

Carl Zeiss Meditec (XTRA:AFX)

Overview: Carl Zeiss Meditec AG is a medical technology company operating in Germany, the rest of Europe, North America, and Asia with a market cap of approximately €5.36 billion.

Operations: The company's revenue is primarily derived from two segments: Ophthalmic Devices, including Surgical Ophthalmology, which generates approximately €1.70 billion, and Microsurgery, contributing around €472.67 million.

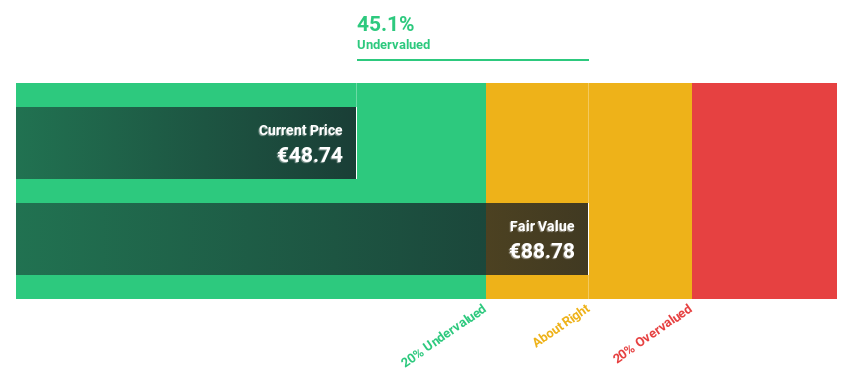

Estimated Discount To Fair Value: 39.7%

Carl Zeiss Meditec is trading at €61.2, well below its estimated fair value of €101.57, indicating potential undervaluation based on cash flows. Recent earnings show a slight decline in net income despite increased sales, with profit margins falling from 12.7% to 7.2%. While revenue growth is forecast at 6.9% annually, slower than desired for high-growth stocks, earnings are expected to grow significantly faster than the German market's average rate.

- The analysis detailed in our Carl Zeiss Meditec growth report hints at robust future financial performance.

- Dive into the specifics of Carl Zeiss Meditec here with our thorough financial health report.

Where To Now?

- Delve into our full catalog of 175 Undervalued European Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:OHLA

Obrascón Huarte Lain

Engages in the construction and concession businesses in the United States, Canada, Mexico, Chile, Peru, Colombia, Spain, Central and Eastern Europe, Northern Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026