- Switzerland

- /

- Specialty Stores

- /

- SWX:MOZN

Top Dividend Stocks On SIX Swiss Exchange For Income Growth

Reviewed by Simply Wall St

After a weak start and a subsequent period in negative territory, the Swiss market briefly edged into positive territory before ending marginally down, with the benchmark SMI closing at 12,193.07. Amidst this volatility, identifying strong dividend stocks on the SIX Swiss Exchange becomes crucial for investors seeking income growth and stability in their portfolios.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Cembra Money Bank (SWX:CMBN) | 5.10% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.72% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.49% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.83% | ★★★★★★ |

| EFG International (SWX:EFGN) | 4.77% | ★★★★★☆ |

| TX Group (SWX:TXGN) | 4.40% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 4.83% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 3.83% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.74% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 3.50% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Banque Cantonale Vaudoise (SWX:BCVN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Banque Cantonale Vaudoise provides a range of financial services in Vaud Canton, Switzerland, the European Union, North America, and internationally, with a market cap of CHF7.65 billion.

Operations: Banque Cantonale Vaudoise operates through various revenue segments, offering financial services across multiple regions including Switzerland, the European Union, and North America.

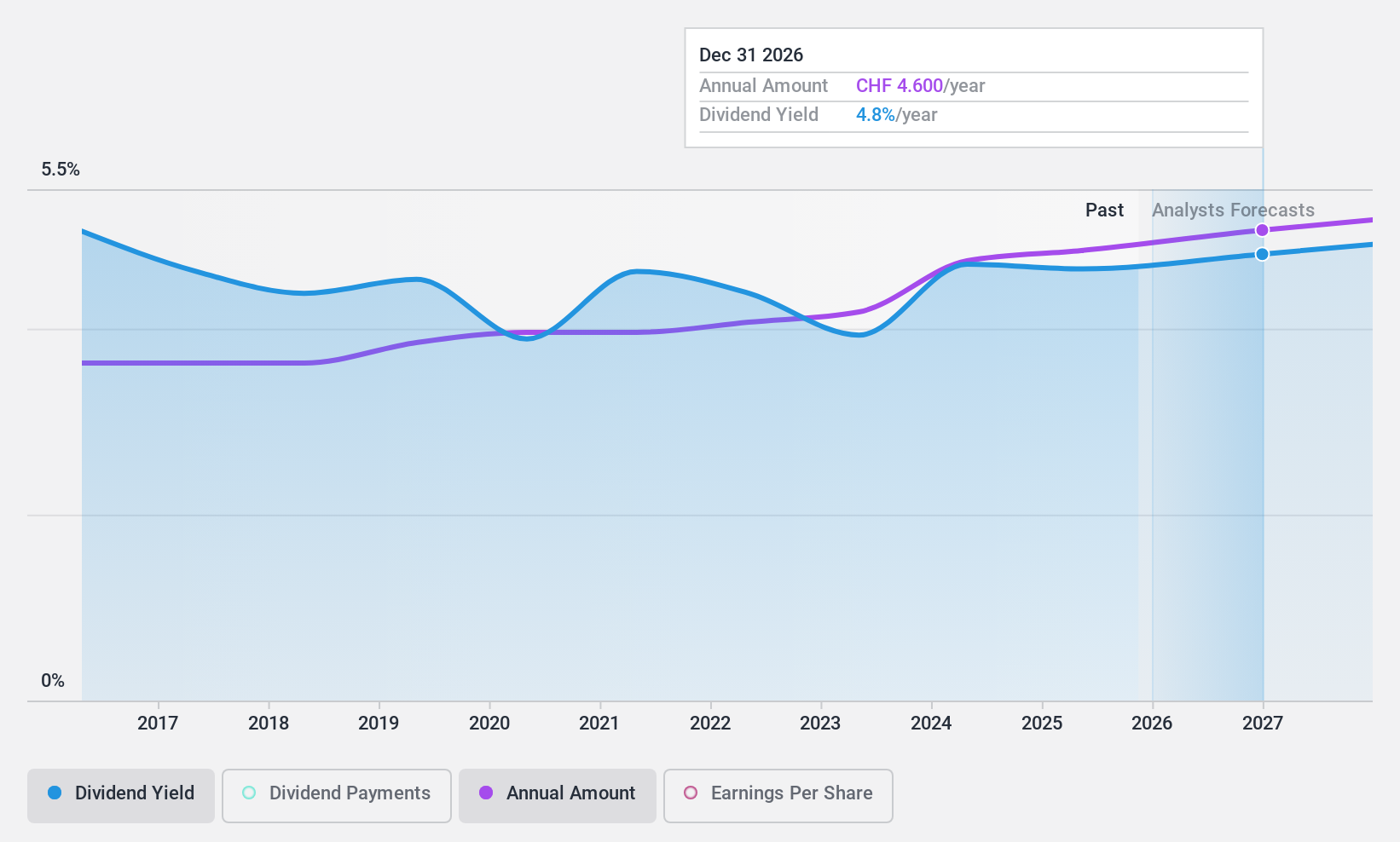

Dividend Yield: 4.8%

Banque Cantonale Vaudoise offers a stable and reliable dividend, with payments growing consistently over the past decade. The current payout ratio of 78.7% ensures dividends are covered by earnings, and this is expected to remain sustainable in three years at 87.3%. Despite a slight decline in net income to CHF 221.1 million for the first half of 2024, its dividend yield of 4.83% ranks in the top quartile among Swiss payers, supported by a favorable price-to-earnings ratio of 17x compared to the market average.

- Click to explore a detailed breakdown of our findings in Banque Cantonale Vaudoise's dividend report.

- Upon reviewing our latest valuation report, Banque Cantonale Vaudoise's share price might be too optimistic.

Liechtensteinische Landesbank (SWX:LLBN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Liechtensteinische Landesbank Aktiengesellschaft offers banking products and services in Liechtenstein, Switzerland, Germany, Austria, and internationally with a market cap of CHF2.18 billion.

Operations: Liechtensteinische Landesbank's revenue segments include CHF313.30 million from Retail & Corporate Banking and CHF241.83 million from International Wealth Management.

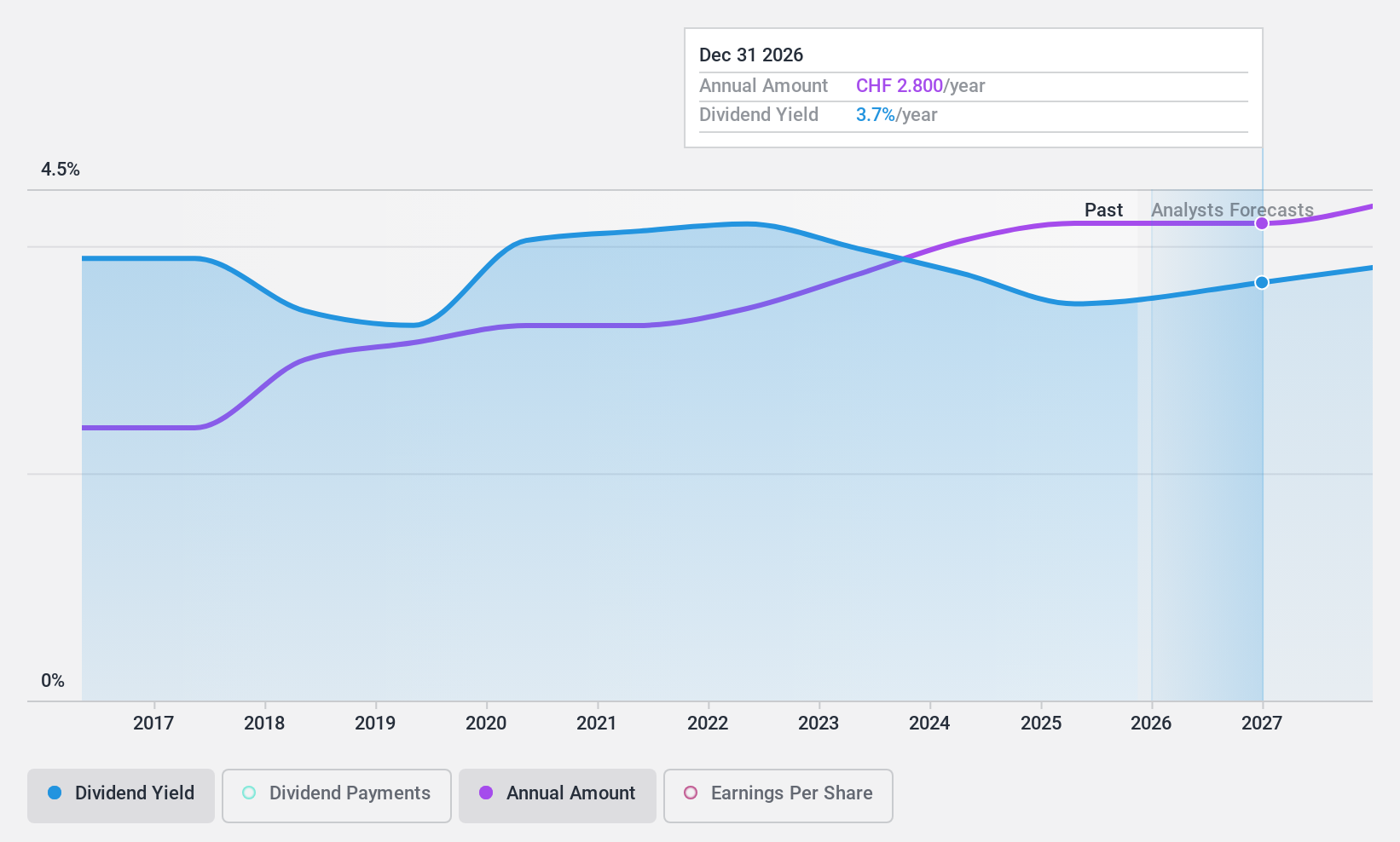

Dividend Yield: 3.8%

Liechtensteinische Landesbank offers a dividend yield of 3.79%, below the top quartile in Switzerland, and has shown volatility over the past decade. Despite this, dividends are well covered by earnings with a payout ratio of 49.7%, both currently and forecasted for three years. Recent earnings show stability, with net income rising slightly to CHF 90.16 million for the first half of 2024, though net interest income declined compared to last year.

- Delve into the full analysis dividend report here for a deeper understanding of Liechtensteinische Landesbank.

- Our comprehensive valuation report raises the possibility that Liechtensteinische Landesbank is priced lower than what may be justified by its financials.

mobilezone holding ag (SWX:MOZN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mobilezone Holding AG, operating through its subsidiaries, offers mobile and fixed-line telephony, television, and internet services for various network operators in Germany and Switzerland, with a market cap of CHF591.87 million.

Operations: Mobilezone Holding AG generates revenue of CHF727.71 million from its operations in Germany and CHF291.80 million from its activities in Switzerland.

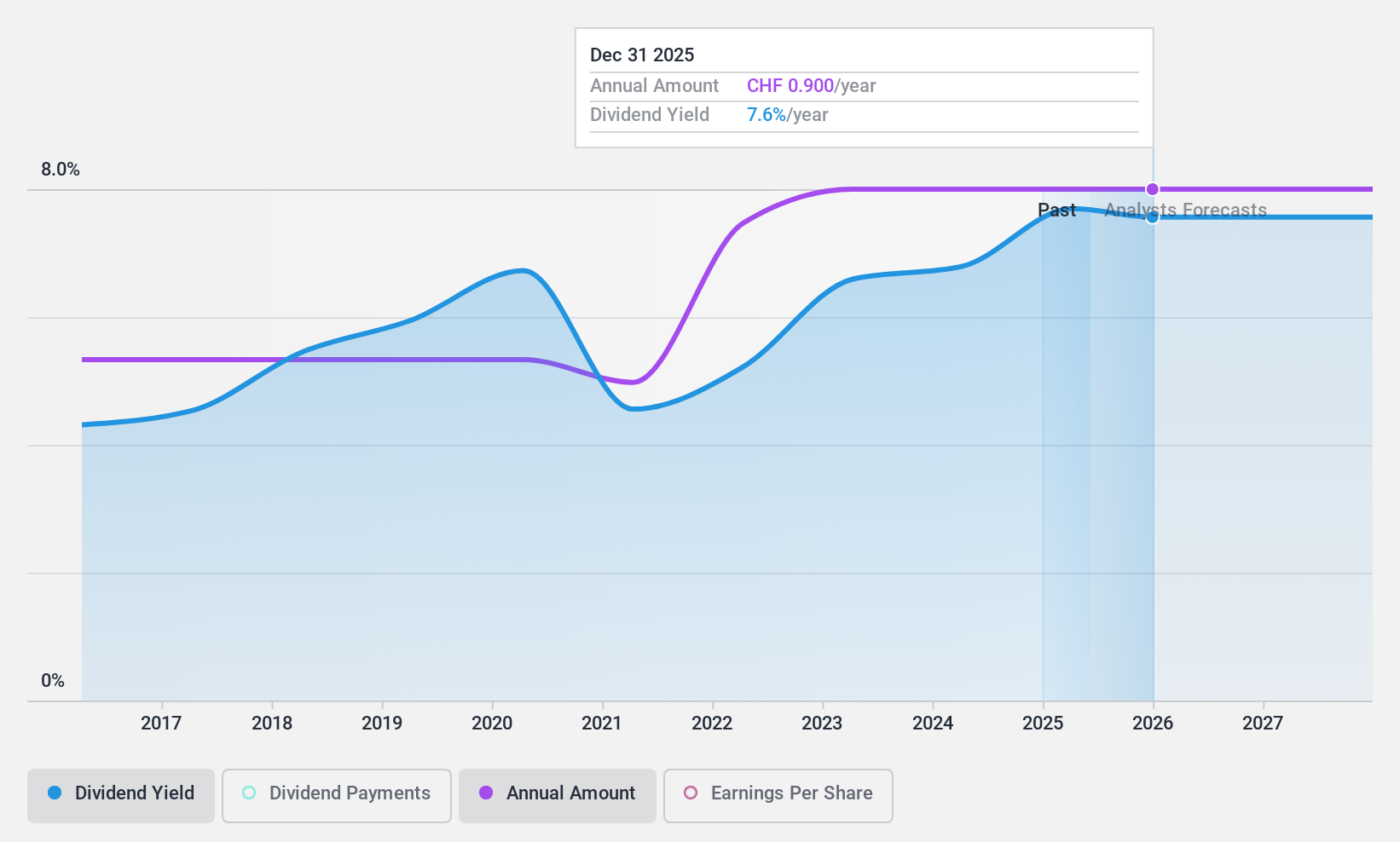

Dividend Yield: 3.6%

mobilezone holding ag offers a dividend yield of 3.62%, which is below the top quartile in Switzerland. Despite this, dividends are covered by earnings and cash flows with payout ratios around 79-80%. However, dividends have decreased over the past decade and are considered unreliable. The company trades at a favorable valuation with a price-to-earnings ratio of 12.1x, lower than the Swiss market average, but its debt coverage by operating cash flow is weak. Recent earnings showed stable sales growth but slight declines in net income and EPS compared to last year.

- Take a closer look at mobilezone holding ag's potential here in our dividend report.

- According our valuation report, there's an indication that mobilezone holding ag's share price might be on the cheaper side.

Summing It All Up

- Click this link to deep-dive into the 26 companies within our Top SIX Swiss Exchange Dividend Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:MOZN

mobilezone holding ag

Provides mobile and fixed-line telephony, television, and internet services for various network operators in Germany and Switzerland.

Established dividend payer with adequate balance sheet.