- Switzerland

- /

- Media

- /

- SWX:TXGN

Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, with the Nasdaq reaching new heights amid broader index declines and central banks adjusting interest rates, investors are increasingly focused on strategies that can provide stability and income. In this environment, dividend stocks stand out as a potential option for those looking to balance growth with regular income streams.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.43% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.95% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.77% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.25% | ★★★★★★ |

Click here to see the full list of 1967 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

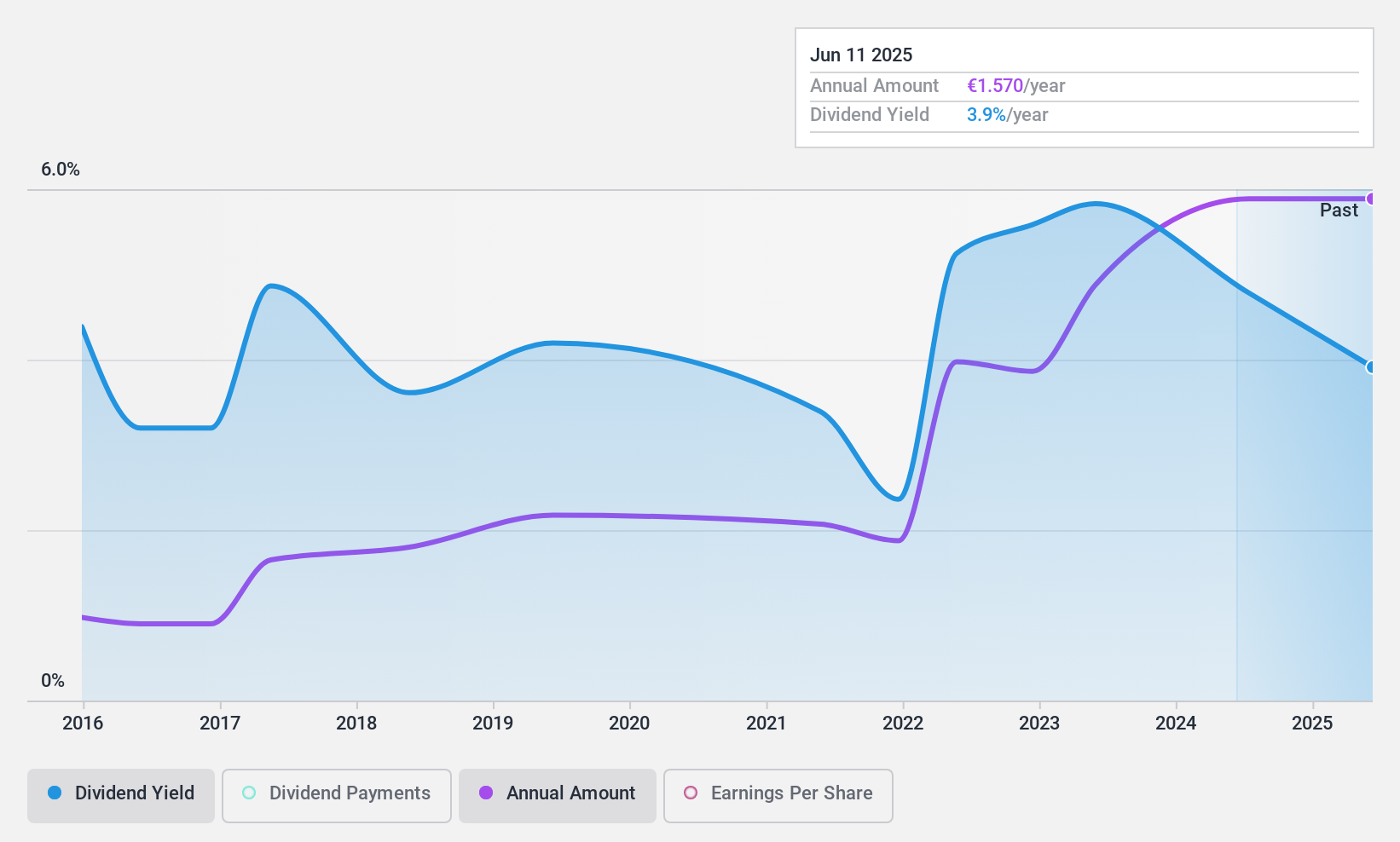

Clínica Baviera (BME:CBAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Clínica Baviera, S.A. is a medical company that operates a network of ophthalmology clinics and has a market cap of €501.98 million.

Operations: Clínica Baviera, S.A. generates its revenue primarily from its ophthalmology segment, which accounted for €252.47 million.

Dividend Yield: 4.9%

Clínica Baviera's dividend sustainability is supported by a payout ratio of 66.6% and a cash payout ratio of 69%, indicating coverage by earnings and cash flows. Despite this, the dividend history has been unreliable over the past decade, with volatility in payments. Recent earnings growth, with sales reaching €189 million for the first nine months of 2024, suggests potential for future stability. However, its current yield of 4.92% lags behind top Spanish market payers at 5.62%.

- Get an in-depth perspective on Clínica Baviera's performance by reading our dividend report here.

- Our expertly prepared valuation report Clínica Baviera implies its share price may be lower than expected.

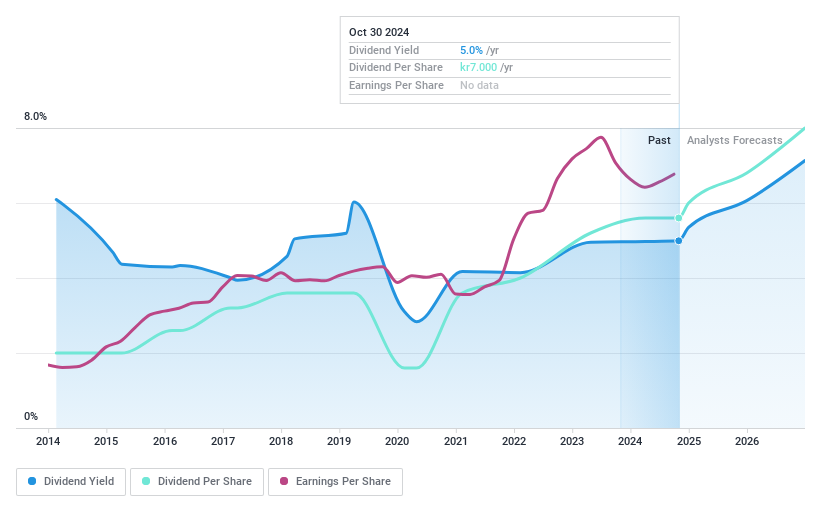

Ework Group (OM:EWRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ework Group AB (publ) offers total talent solutions specializing in IT/OT, R&D, engineering, and business development across Sweden, Denmark, Norway, Finland, Slovakia, and Poland with a market cap of SEK2.34 billion.

Operations: Ework Group AB (publ) generates revenue through its specialized talent solutions in IT/OT, R&D, engineering, and business development across multiple European countries.

Dividend Yield: 5%

Ework Group's dividend yield of 5.04% ranks in the top 25% of Swedish market payers, yet its dividend history has been unreliable and volatile over the past decade. Although cash flows cover dividends with a reasonable cash payout ratio of 61.6%, earnings coverage is insufficient, as indicated by a high payout ratio of 91.9%. Recent financial performance shows slight improvements in net income and EPS, but revenue has declined year-over-year for nine months ending September 2024.

- Click to explore a detailed breakdown of our findings in Ework Group's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Ework Group shares in the market.

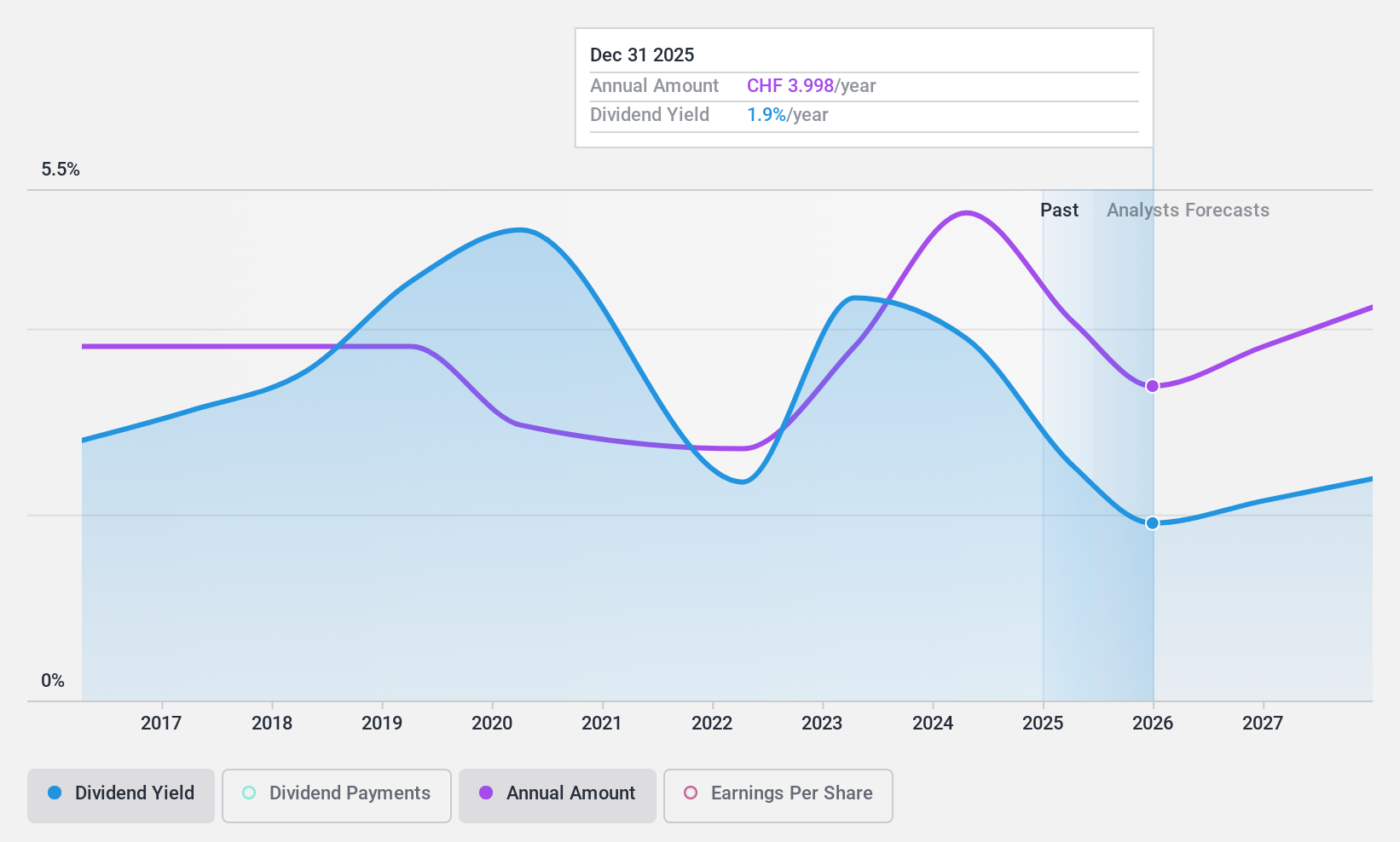

TX Group (SWX:TXGN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TX Group AG operates a network of platforms offering information, orientation, entertainment, and support services in Switzerland, with a market cap of CHF1.83 billion.

Operations: TX Group AG's revenue is derived from several segments: Tamedia (CHF427 million), Goldbach (CHF299.10 million), 20 Minutes (CHF115.60 million), TX Markets (CHF126.40 million), and Groups & Ventures (CHF159.40 million).

Dividend Yield: 3.5%

TX Group's dividend yield of 3.46% is below the Swiss market's top 25%, and its dividend history has been unreliable over the past decade, despite recent increases. The company's dividends are well-covered by both earnings, with a payout ratio of 59.6%, and cash flows at 43.4%. Trading significantly below estimated fair value, TX Group recently became profitable and was added to the S&P Global BMI Index in September 2024.

- Delve into the full analysis dividend report here for a deeper understanding of TX Group.

- The analysis detailed in our TX Group valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Unlock our comprehensive list of 1967 Top Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TXGN

TX Group

Operates a network of platforms and participations that provides users with information, orientation, entertainment, and support services in Switzerland.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives