- Canada

- /

- Renewable Energy

- /

- TSX:SXI

There Could Be A Chance Synex Renewable Energy Corporation's (TSE:SXI) CEO Will Have Their Compensation Increased

Shareholders will probably not be disappointed by the robust results at Synex Renewable Energy Corporation (TSE:SXI) recently and they will be keeping this in mind as they go into the AGM on 25 November 2022. The focus will probably be on the future strategic initiatives that the board and management will put in place to improve the business rather than executive remuneration when they cast their votes on company resolutions. In our analysis below, we discuss why we think the CEO compensation looks acceptable and the case for a raise.

View our latest analysis for Synex Renewable Energy

How Does Total Compensation For Daniel Russell Compare With Other Companies In The Industry?

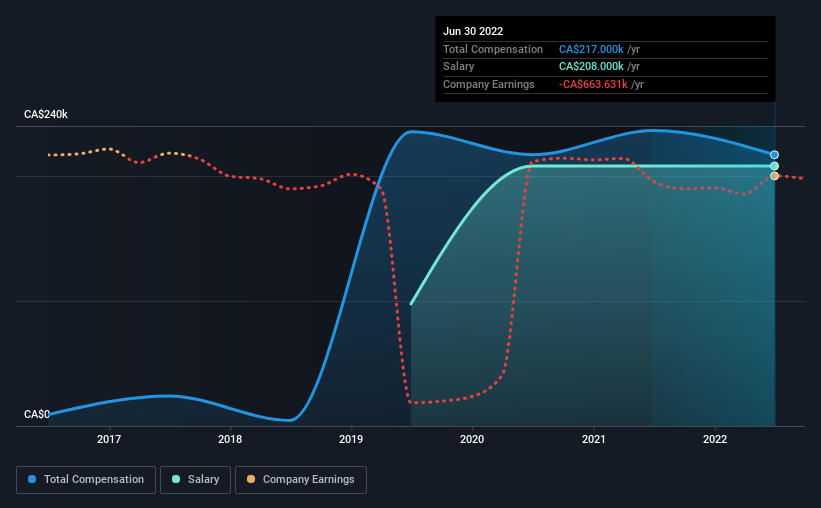

According to our data, Synex Renewable Energy Corporation has a market capitalization of CA$11m, and paid its CEO total annual compensation worth CA$217k over the year to June 2022. That's a notable decrease of 8.2% on last year. Notably, the salary which is CA$208.0k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below CA$267m, we found that the median total CEO compensation was CA$552k. In other words, Synex Renewable Energy pays its CEO lower than the industry median. Furthermore, Daniel Russell directly owns CA$1.6m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | CA$208k | CA$208k | 96% |

| Other | CA$9.0k | CA$28k | 4% |

| Total Compensation | CA$217k | CA$236k | 100% |

Talking in terms of the industry, salary represented approximately 29% of total compensation out of all the companies we analyzed, while other remuneration made up 71% of the pie. Synex Renewable Energy pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Synex Renewable Energy Corporation's Growth

Synex Renewable Energy Corporation's earnings per share (EPS) grew 98% per year over the last three years. In the last year, its revenue is down 6.1%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Synex Renewable Energy Corporation Been A Good Investment?

Synex Renewable Energy Corporation has served shareholders reasonably well, with a total return of 22% over three years. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

Daniel receives almost all of their compensation through a salary. The company's overall performance, while not bad, could be better. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 2 warning signs for Synex Renewable Energy you should be aware of, and 1 of them can't be ignored.

Switching gears from Synex Renewable Energy, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:SXI

Synex Renewable Energy

Through its subsidiaries, develops, owns, and operates electric power generation facilities.

Slight with weak fundamentals.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026