The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Fortis (TSE:FTS), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Fortis

How Fast Is Fortis Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. Fortis boosted its trailing twelve month EPS from CA$2.65 to CA$2.94, in the last year. There's little doubt shareholders would be happy with that 11% gain.

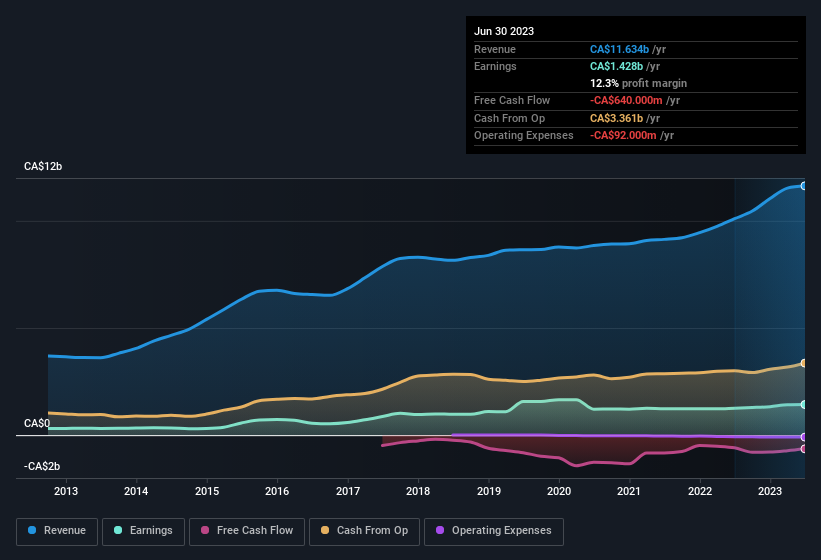

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Fortis maintained stable EBIT margins over the last year, all while growing revenue 15% to CA$12b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Fortis.

Are Fortis Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Although we did see some insider selling (worth CA$156k) this was overshadowed by a mountain of buying, totalling CA$1.8m in just one year. This adds to the interest in Fortis because it suggests that those who understand the company best, are optimistic. It is also worth noting that it was President David Hutchens who made the biggest single purchase, worth CA$1.0m, paying CA$53.33 per share.

The good news, alongside the insider buying, for Fortis bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold CA$27m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 0.1%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Is Fortis Worth Keeping An Eye On?

As previously touched on, Fortis is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Fortis (at least 1 which doesn't sit too well with us) , and understanding these should be part of your investment process.

The good news is that Fortis is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FTS

Fortis

Operates as an electric and gas utility company in Canada, the United States, and the Caribbean countries.

Good value with proven track record and pays a dividend.