- Canada

- /

- Other Utilities

- /

- TSX:CU

Evaluating Canadian Utilities Stock After 12% Year-to-Date Rally in 2025

Reviewed by Bailey Pemberton

If you’re weighing what to do with Canadian Utilities stock right now, you’re not alone. It’s been a steady climber on the TSX, quietly rewarding patient investors over both the short and long term. In just the past week, the stock edged up 0.4%, adding to a strong 2.4% gain over the last month. Year-to-date, it’s up an impressive 12.2%, and if you zoom out to a full year, Canadian Utilities has surged 15.4%. Over the last five years, we’ve seen an almost 48% climb. Those gains haven’t all come in a straight line. However, they do hint at sustained optimism and perhaps shifting perceptions around risk, especially as the utility sector responds to evolving market conditions and demand for stable, regulated returns.

But with this healthy track record, a smart investor has to ask, is the current price still attractive, or is the best already priced in? Our valuation checks show a score of 3 out of 6, meaning Canadian Utilities looks undervalued in about half of the traditional measures analysts typically use. So what does this really mean for you, and how do the different valuation methods stack up against each other? Let’s dig into the numbers, explore how the pros analyze value, and save the most insightful approach for last.

Approach 1: Canadian Utilities Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is designed to estimate a company’s value by projecting its future cash flows and then discounting them back to their present value. This method helps investors determine the intrinsic worth of a stock based on its ability to generate cash over time.

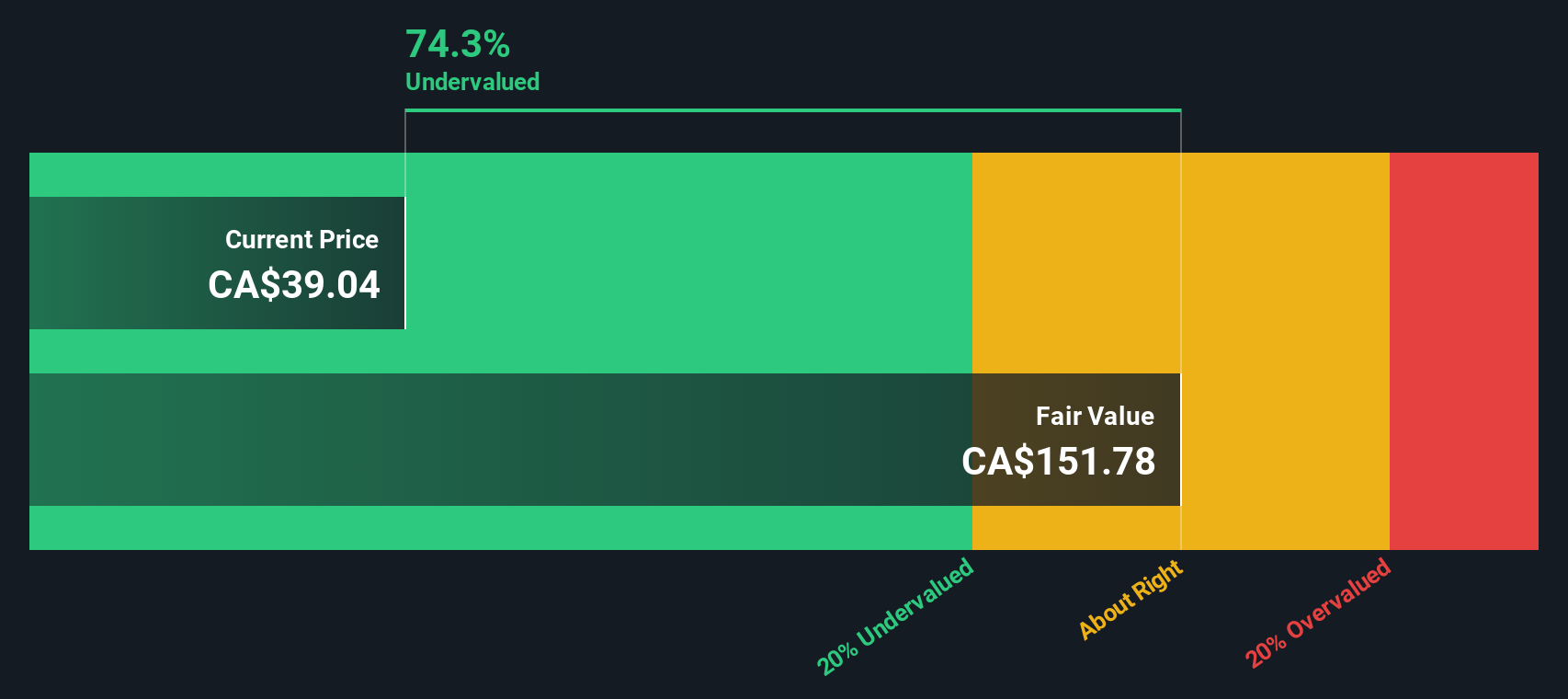

Canadian Utilities currently reports trailing twelve month Free Cash Flow (FCF) of CA$556.5 Million. Analyst forecasts, covering the next five years, predict FCF will climb steadily, reaching CA$1.64 Billion by 2029. Beyond that, projections are extrapolated by Simply Wall St, resulting in a ten-year outlook that continues to reflect gradual annual FCF growth. All these figures are calculated in Canadian Dollars, matching both the listing and reporting currency.

Based on this 2 Stage Free Cash Flow to Equity model, the DCF analysis arrives at an intrinsic value of CA$151.78 per share. This methodology implies the current share price is trading at a substantial 74.3% discount to what the underlying cash flows suggest it's worth. According to this metric, the stock could be considered undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Canadian Utilities is undervalued by 74.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Canadian Utilities Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies like Canadian Utilities because it directly relates the company’s current share price to its reported profits. For stable, established companies, the PE ratio gives investors a fast way to gauge whether a stock looks cheap or expensive relative to its earnings power.

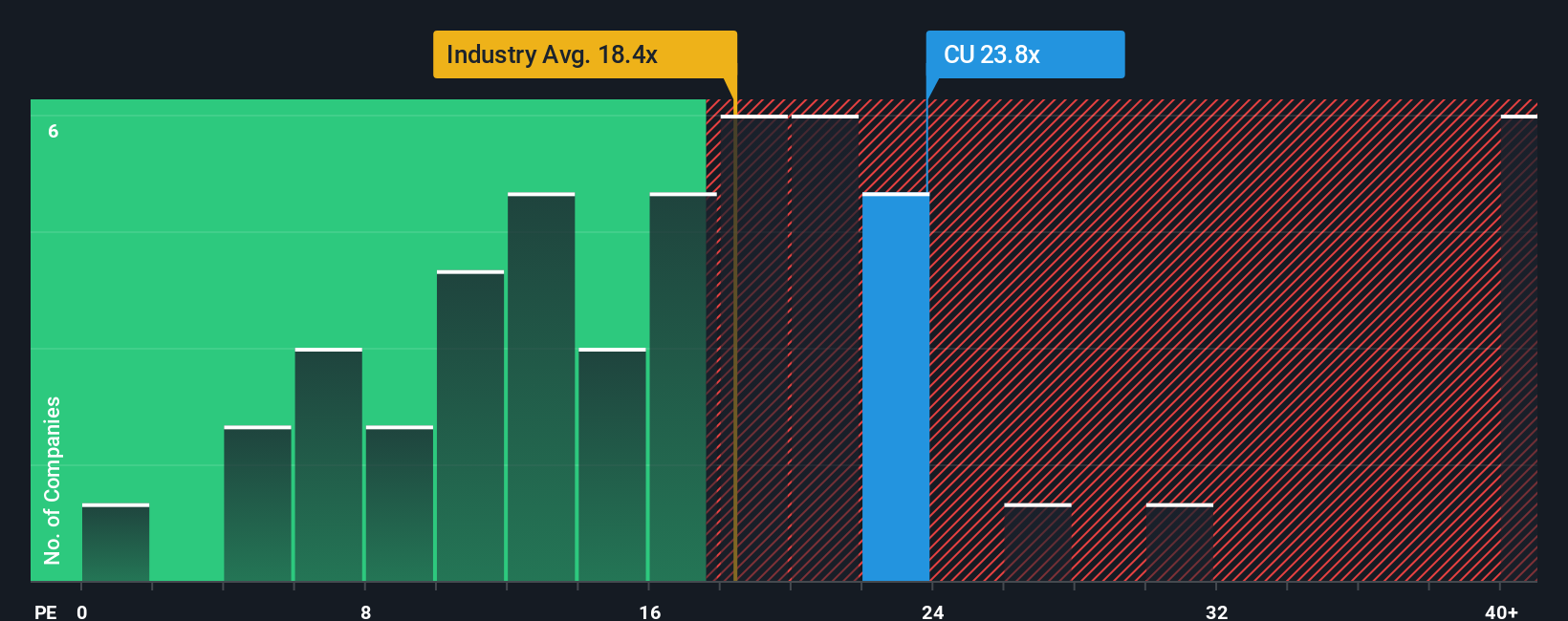

What’s considered a “fair” PE ratio depends on several factors, such as how quickly a company is expected to grow and the level of risk in its business. Higher growth prospects often justify a loftier PE, while added risks or slower growth push it lower. Right now, Canadian Utilities trades at a PE of 23.8x, compared to the Integrated Utilities industry average of 18.4x and a peer group average of 29.8x.

Simply Wall St also calculates a proprietary “Fair Ratio” in this case, 20.3x which estimates a justified multiple based on specifics like Canadian Utilities’ actual earnings growth, profit margins, industry dynamics, size, and risk profile. Unlike a straight peer or sector comparison, the Fair Ratio delivers an apples-to-apples metric that is tailored to the company itself, providing a more robust valuation benchmark.

With Canadian Utilities trading at a 23.8x PE versus a Fair Ratio of 20.3x, the stock appears slightly overvalued by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Canadian Utilities Narrative

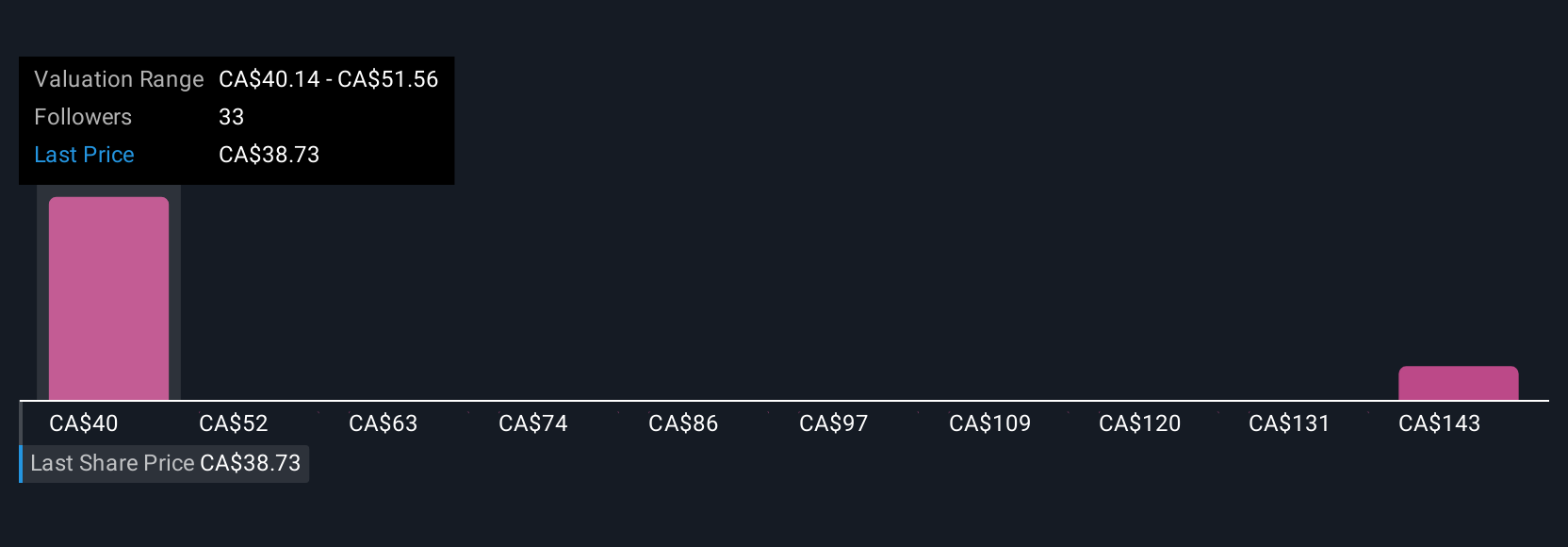

Earlier we mentioned that there’s an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple way to connect your story or view of a company, like Canadian Utilities, to a financial forecast and an estimated fair value. Instead of relying only on numbers and ratios, Narratives let you bring together your own perspective, including your assumptions about future revenues, margins, and company catalysts, and see what those mean for the stock’s fair value.

On Simply Wall St’s platform, millions of investors use the Community page to easily create, compare, and update Narratives, making it accessible whether you’re a seasoned investor or just starting out. Narratives help you decide when to buy or sell by showing how your fair value estimate compares to the current market price and updating instantly when new news or earnings data appears.

For example, with Canadian Utilities, one investor might create a Narrative expecting rapid growth from grid modernization and project a fair value near CA$40.14 per share. Another investor, concerned about regional risks and rising costs, could see a much lower fair value. By crafting your own Narrative, you can make smarter, more personalized decisions about when the stock is a buy, a hold, or a sell.

Do you think there's more to the story for Canadian Utilities? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CU

Canadian Utilities

Engages in the electricity, natural gas, renewables, pipelines, and liquids businesses in Canada, Australia, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives