- Canada

- /

- Renewable Energy

- /

- TSX:CPX

Capital Power (TSX:CPX) Is Up 6.8% After Executive Team Expansion Focused on U.S. Renewables - Has The Bull Case Changed?

Reviewed by Simply Wall St

- Capital Power Corporation recently appointed Ferio Pugliese as Senior Vice President, Chief Corporate Officer, and added Roger Huang as Vice President, Corporate Development and U.S. Renewables, further expanding its executive team.

- These leadership changes reflect a focus on accelerating growth and strengthening expertise in renewables, corporate development, and innovative energy solutions.

- We'll examine how these leadership appointments may influence the company's investment narrative, particularly regarding its ambitions in U.S. renewables.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Capital Power Investment Narrative Recap

To be a shareholder in Capital Power, you need to believe in the company’s ability to deliver stable cash flows while rapidly expanding into renewables, especially in the United States. The recent appointments of Ferio Pugliese and Roger Huang further support Capital Power’s push for growth and expertise in renewables, but their addition is not expected to materially change the immediate integration risk posed by recent large acquisitions, which remains the key short-term catalyst and risk to monitor.

Of the recent announcements, the acquisition of Hummel Station and Rolling Hills Generating assets stands out as most relevant in context. These U.S.-based asset purchases, funded by new debt offerings, heighten both the integration risk and pressure to achieve the expected financial returns, making executive experience in areas like corporate development and transformation even more crucial.

Yet, in contrast, investors should be aware that rapid portfolio growth increases the risk that integration challenges could affect both earnings consistency and...

Read the full narrative on Capital Power (it's free!)

Capital Power's outlook projects CA$4.1 billion in revenue and CA$507.1 million in earnings by 2028. This requires 5.0% yearly revenue growth, but an earnings decrease of CA$106.9 million from the current earnings of CA$614.0 million.

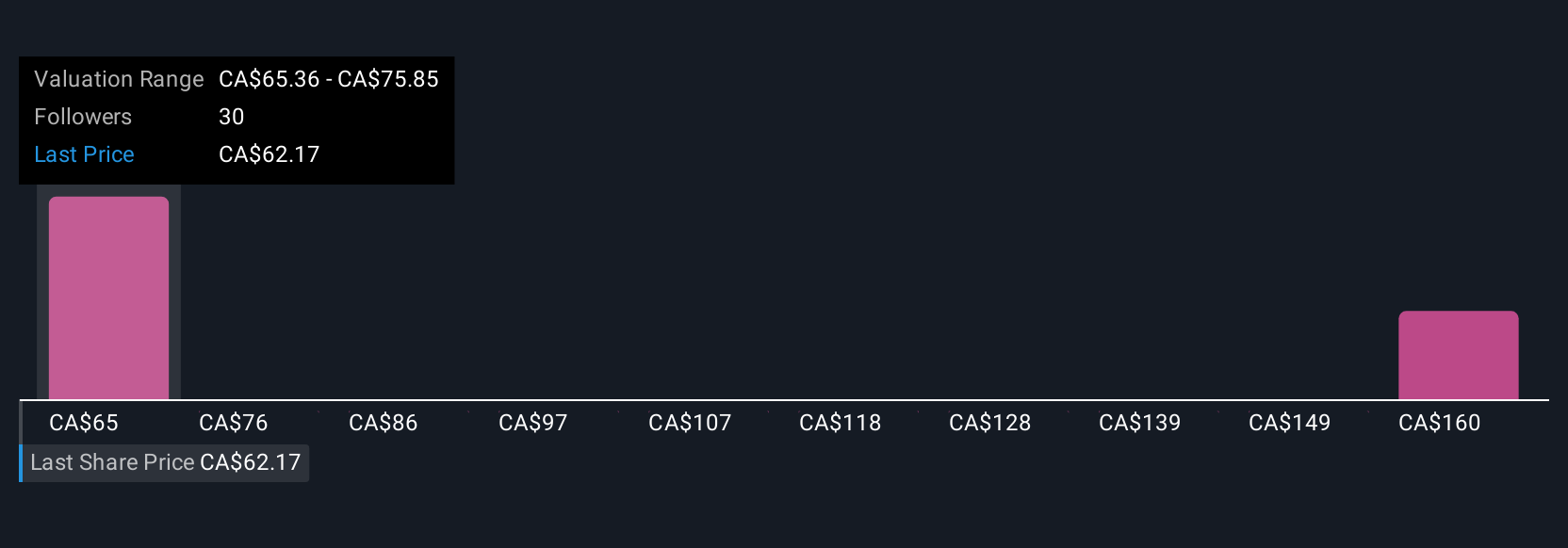

Uncover how Capital Power's forecasts yield a CA$65.36 fair value, a 3% upside to its current price.

Exploring Other Perspectives

With two fair value estimates from the Simply Wall St Community ranging from CA$65.36 to CA$170.68, opinions on Capital Power’s true worth span more than double. Given the ongoing integration risk linked to recent US acquisitions, consider how different outlooks on execution and profitability might shape your expectations for the company’s future performance.

Explore 2 other fair value estimates on Capital Power - why the stock might be worth just CA$65.36!

Build Your Own Capital Power Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Capital Power research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Capital Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Capital Power's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CPX

Capital Power

Develops, acquires, owns, and operates renewable and thermal power generation facilities in Canada and the United States.

Moderate, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives