- Canada

- /

- Renewable Energy

- /

- TSX:BEPC

Brookfield Renewable Corporation (TSE:BEPC) Surges 27% Yet Its Low P/E Is No Reason For Excitement

The Brookfield Renewable Corporation (TSE:BEPC) share price has done very well over the last month, posting an excellent gain of 27%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

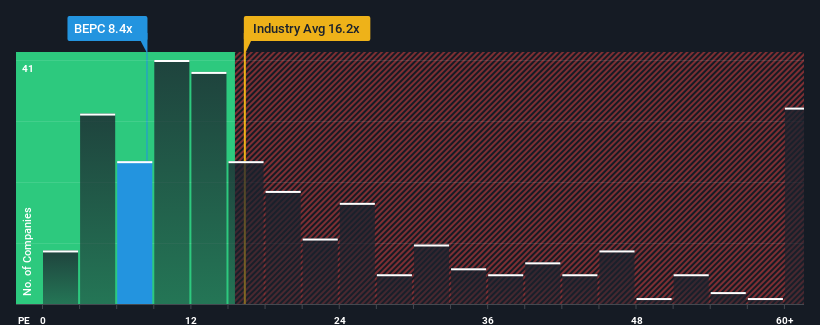

In spite of the firm bounce in price, Brookfield Renewable's price-to-earnings (or "P/E") ratio of 8.4x might still make it look like a buy right now compared to the market in Canada, where around half of the companies have P/E ratios above 15x and even P/E's above 31x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Brookfield Renewable's negative earnings growth of late has neither been better nor worse than most other companies. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. You'd much rather the company wasn't bleeding earnings if you still believe in the business. In saying that, existing shareholders may feel hopeful about the share price if the company's earnings continue tracking the market.

See our latest analysis for Brookfield Renewable

Is There Any Growth For Brookfield Renewable?

Brookfield Renewable's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 6.0%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 32% per annum as estimated by the four analysts watching the company. Meanwhile, the broader market is forecast to expand by 6.8% per year, which paints a poor picture.

With this information, we are not surprised that Brookfield Renewable is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Brookfield Renewable's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Brookfield Renewable's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 5 warning signs for Brookfield Renewable (2 make us uncomfortable!) that we have uncovered.

Of course, you might also be able to find a better stock than Brookfield Renewable. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Renewable might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:BEPC

Brookfield Renewable

Owns and operates a portfolio of renewable power and sustainable solution assets.

Reasonable growth potential and fair value.

Market Insights

Community Narratives