- Canada

- /

- Other Utilities

- /

- TSX:AQN

Why Algonquin Power & Utilities' (TSE:AQN) Earnings Are Better Than They Seem

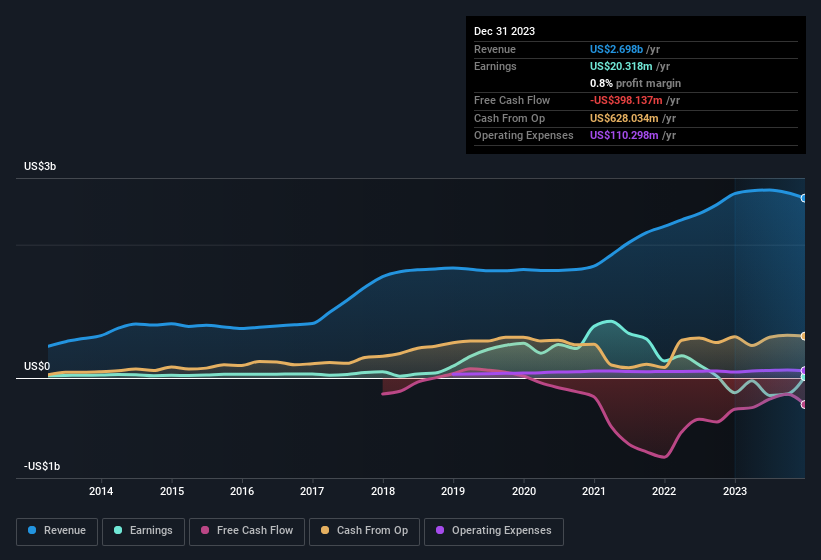

Algonquin Power & Utilities Corp.'s (TSE:AQN) recent earnings report didn't offer any surprises, with the shares unchanged over the last week. Our analysis suggests that shareholders might be missing some positive underlying factors in the earnings report.

View our latest analysis for Algonquin Power & Utilities

The Impact Of Unusual Items On Profit

For anyone who wants to understand Algonquin Power & Utilities' profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit was reduced by US$207m due to unusual items. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. In the twelve months to December 2023, Algonquin Power & Utilities had a big unusual items expense. As a result, we can surmise that the unusual items made its statutory profit significantly weaker than it would otherwise be.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

An Unusual Tax Situation

Just as we noted the unusual items, we must inform you that Algonquin Power & Utilities received a tax benefit which contributed US$86m to the bottom line. This is meaningful because companies usually pay tax rather than receive tax benefits. The receipt of a tax benefit is obviously a good thing, on its own. And since it previously lost money, it may well simply indicate the realisation of past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Our Take On Algonquin Power & Utilities' Profit Performance

In its last report Algonquin Power & Utilities received a tax benefit which might make its profit look better than it really is on a underlying level. But on the other hand, it also saw an unusual item depress its profit. Considering all the aforementioned, we'd venture that Algonquin Power & Utilities' profit result is a pretty good guide to its true profitability, albeit a bit on the conservative side. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. For example, Algonquin Power & Utilities has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about.

Our examination of Algonquin Power & Utilities has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:AQN

Algonquin Power & Utilities

Operates in the power and utility industries.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)