- Canada

- /

- Other Utilities

- /

- TSX:ACO.X

Four Days Left To Buy ATCO Ltd. (TSE:ACO.X) Before The Ex-Dividend Date

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see ATCO Ltd. (TSE:ACO.X) is about to trade ex-dividend in the next 4 days. You can purchase shares before the 2nd of December in order to receive the dividend, which the company will pay on the 31st of December.

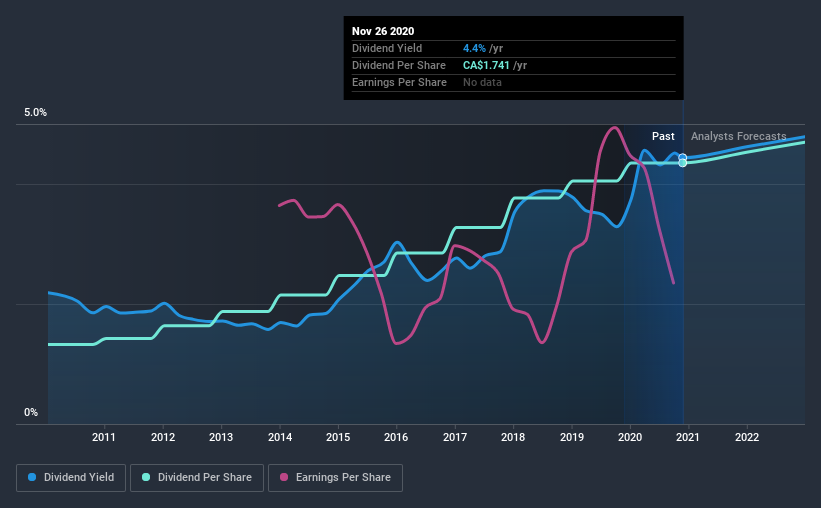

ATCO's next dividend payment will be CA$0.44 per share. Last year, in total, the company distributed CA$1.74 to shareholders. Last year's total dividend payments show that ATCO has a trailing yield of 4.4% on the current share price of CA$39.23. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether ATCO can afford its dividend, and if the dividend could grow.

See our latest analysis for ATCO

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. ATCO paid out more than half (73%) of its earnings last year, which is a regular payout ratio for most companies. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Fortunately, it paid out only 29% of its free cash flow in the past year.

It's positive to see that ATCO's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Readers will understand then, why we're concerned to see ATCO's earnings per share have dropped 8.5% a year over the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. ATCO has delivered an average of 13% per year annual increase in its dividend, based on the past 10 years of dividend payments. Growing the dividend payout ratio while earnings are declining can deliver nice returns for a while, but it's always worth checking for when the company can't increase the payout ratio any more - because then the music stops.

The Bottom Line

From a dividend perspective, should investors buy or avoid ATCO? We're not enthused by the declining earnings per share, although at least the company's payout ratio is within a reasonable range, meaning it may not be at imminent risk of a dividend cut. Overall, it's not a bad combination, but we feel that there are likely more attractive dividend prospects out there.

With that being said, if dividends aren't your biggest concern with ATCO, you should know about the other risks facing this business. For instance, we've identified 2 warning signs for ATCO (1 makes us a bit uncomfortable) you should be aware of.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading ATCO or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade ATCO, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:ACO.X

ATCO

Engages in the energy, logistics and transportation, shelter, and real estate services in Canada, Australia, and internationally.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives