- Canada

- /

- Transportation

- /

- TSX:TFII

TFI International (TSX:TFII) Eyes Growth with Product Innovations and AI Investments Amid Market Challenges

Reviewed by Simply Wall St

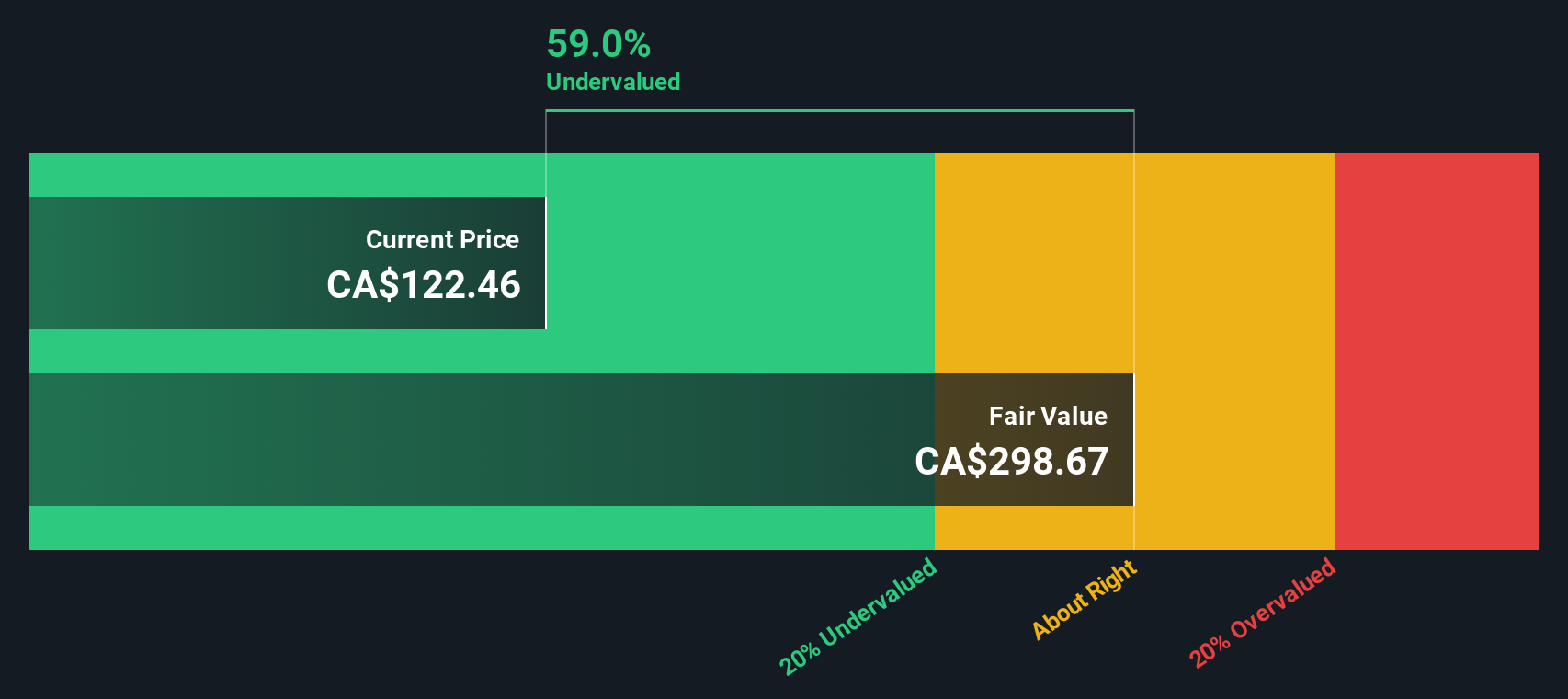

TFI International (TSX:TFII) is making headlines with its anticipated annual earnings growth of 23.2% and a projected high return on equity of 24.9% in three years, signaling strong financial health. Despite trading significantly below its estimated fair value, the company is addressing challenges such as operational inefficiencies and rising costs, while exploring growth avenues through innovation and market expansion. This report examines key areas including financial performance, growth strategies, operational challenges, and regulatory impacts.

Unlock comprehensive insights into our analysis of TFI International stock here.

Key Assets Propelling TFI International Forward

TFI International's financial health is underscored by its forecasted earnings growth of 23.2% annually, outpacing the Canadian market. This is bolstered by a projected high return on equity of 24.9% in three years. The company's commitment to innovation is evident from its significant R&D investments, leading to the introduction of three new product innovations set to launch in Q1 next year. Alain Bedard, CEO, emphasized the importance of customer satisfaction, which has reached an all-time high, reflecting strong customer loyalty. Additionally, TFI is trading at CA$202.49, significantly below its estimated fair value of CA$457.17, suggesting potential undervaluation in the market.

Vulnerabilities Impacting TFI International

TFI faces challenges such as a current return on equity of 17.1%, which is below the desired threshold of 20%. Operational inefficiencies, particularly in the supply chain, have impacted the company's ability to meet demand, as highlighted by Bedard. Rising operational costs are another concern, with measures being implemented to improve efficiency. The net profit margin has decreased to 5.7% from the previous year's 7%, and the high net debt to equity ratio of 91% poses financial risks.

Growth Avenues Awaiting TFI International

Opportunities for TFI include significant earnings growth potential over the next three years, with the company exploring emerging markets for expansion. This strategic focus could diversify revenue streams and reduce reliance on existing markets. Investments in AI and automation are expected to enhance operational efficiency and customer experience, positioning TFI for future growth. Discussions with key players for strategic partnerships could further enhance market position and drive growth.

Regulatory Challenges Facing TFI International

TFI is navigating economic headwinds and regulatory challenges that could impact operations. Bedard noted the importance of adapting to regulatory changes, which could pose hurdles. Supply chain vulnerabilities remain a significant risk, with proactive steps being taken to mitigate these issues, as noted by analyst Ken Hoexter. These external factors could influence sales and profitability, requiring careful management.

Conclusion

TFI International's projected annual earnings growth of 23.2% and an anticipated return on equity of 24.9% in three years highlight its strong growth trajectory, driven by significant R&D investments and high customer satisfaction. However, challenges such as operational inefficiencies, a current return on equity of 17.1%, and a net profit margin decline to 5.7% underscore the need for strategic improvements. The company's exploration of emerging markets and investment in AI and automation offer promising avenues for diversification and efficiency gains. Notably, with its current trading price at CA$202.49, well below the estimated fair value of CA$457.17, there is a compelling case for potential growth and market correction, provided TFI effectively navigates its operational and regulatory challenges.

Taking Advantage

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if TFI International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:TFII

TFI International

Provides transportation and logistics services in the United States, Mexico, and Canada.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026