TSX Value Picks That May Be Trading Below Their Worth In November 2025

Reviewed by Simply Wall St

As October closed with markets near record highs, Canadian investors are navigating a landscape shaped by easing trade tensions and cautious central bank policies. In this environment, identifying undervalued stocks on the TSX requires a keen eye for companies that demonstrate resilience amid shifting economic signals and possess strong fundamentals that may not yet be fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vitalhub (TSX:VHI) | CA$10.22 | CA$18.35 | 44.3% |

| SSR Mining (TSX:SSRM) | CA$27.49 | CA$45.60 | 39.7% |

| Savaria (TSX:SIS) | CA$21.80 | CA$40.47 | 46.1% |

| Kinaxis (TSX:KXS) | CA$170.63 | CA$285.75 | 40.3% |

| Haivision Systems (TSX:HAI) | CA$5.12 | CA$8.57 | 40.3% |

| GURU Organic Energy (TSX:GURU) | CA$5.68 | CA$8.97 | 36.7% |

| CEMATRIX (TSX:CEMX) | CA$0.40 | CA$0.77 | 48% |

| Boyd Group Services (TSX:BYD) | CA$215.38 | CA$404.11 | 46.7% |

| Artemis Gold (TSXV:ARTG) | CA$33.00 | CA$61.83 | 46.6% |

| Americas Gold and Silver (TSX:USA) | CA$5.28 | CA$8.83 | 40.2% |

We'll examine a selection from our screener results.

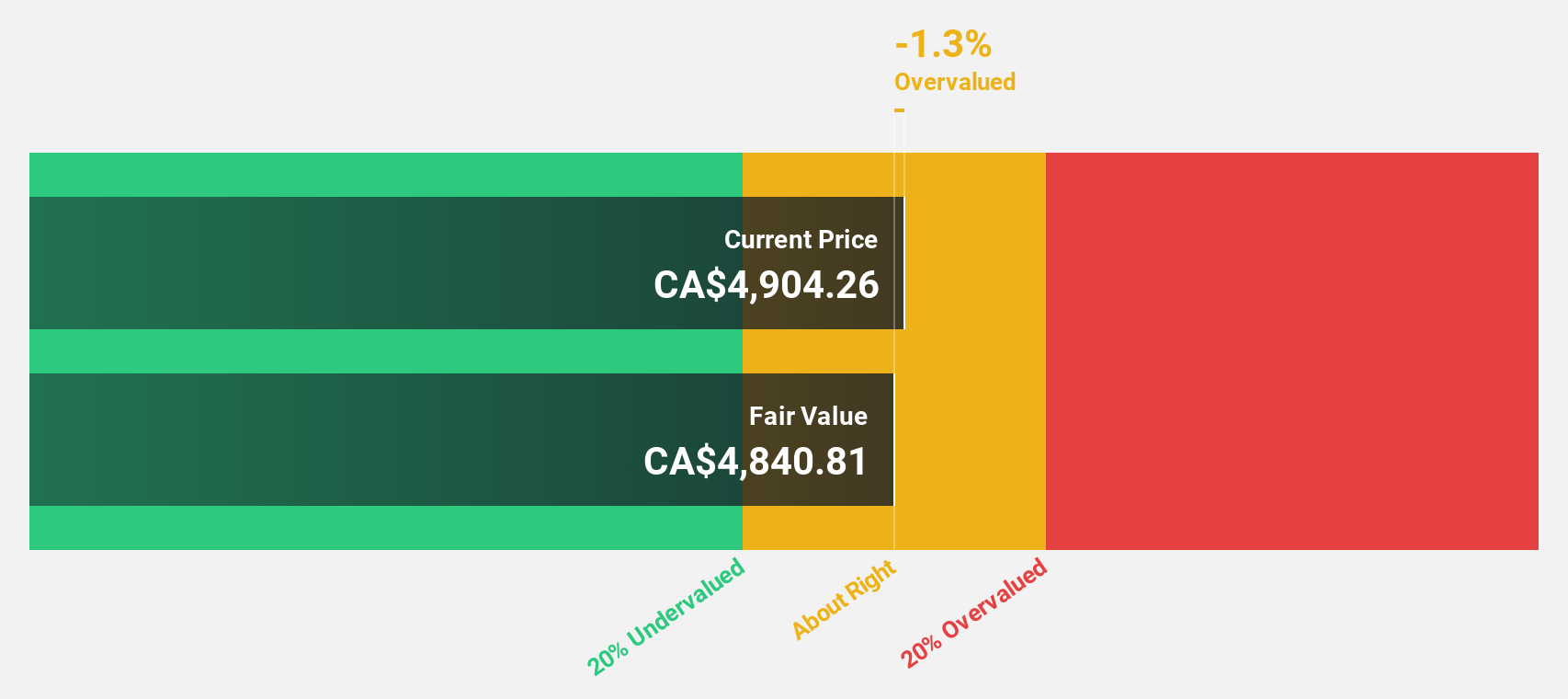

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc. acquires, builds, and manages vertical market software businesses to provide mission-critical solutions for public and private sectors, with a market cap of CA$74.32 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated $10.74 billion.

Estimated Discount To Fair Value: 32.4%

Constellation Software is trading at CA$3570.98, significantly below its estimated fair value of CA$5284.17, suggesting it may be undervalued based on cash flows. Despite high debt levels, the company's earnings are forecast to grow at 22.7% annually, outpacing the Canadian market's 11.7%. Recent leadership changes saw Mark Miller replace Mark Leonard as President due to health reasons, which could influence strategic direction moving forward.

- Our expertly prepared growth report on Constellation Software implies its future financial outlook may be stronger than recent results.

- Take a closer look at Constellation Software's balance sheet health here in our report.

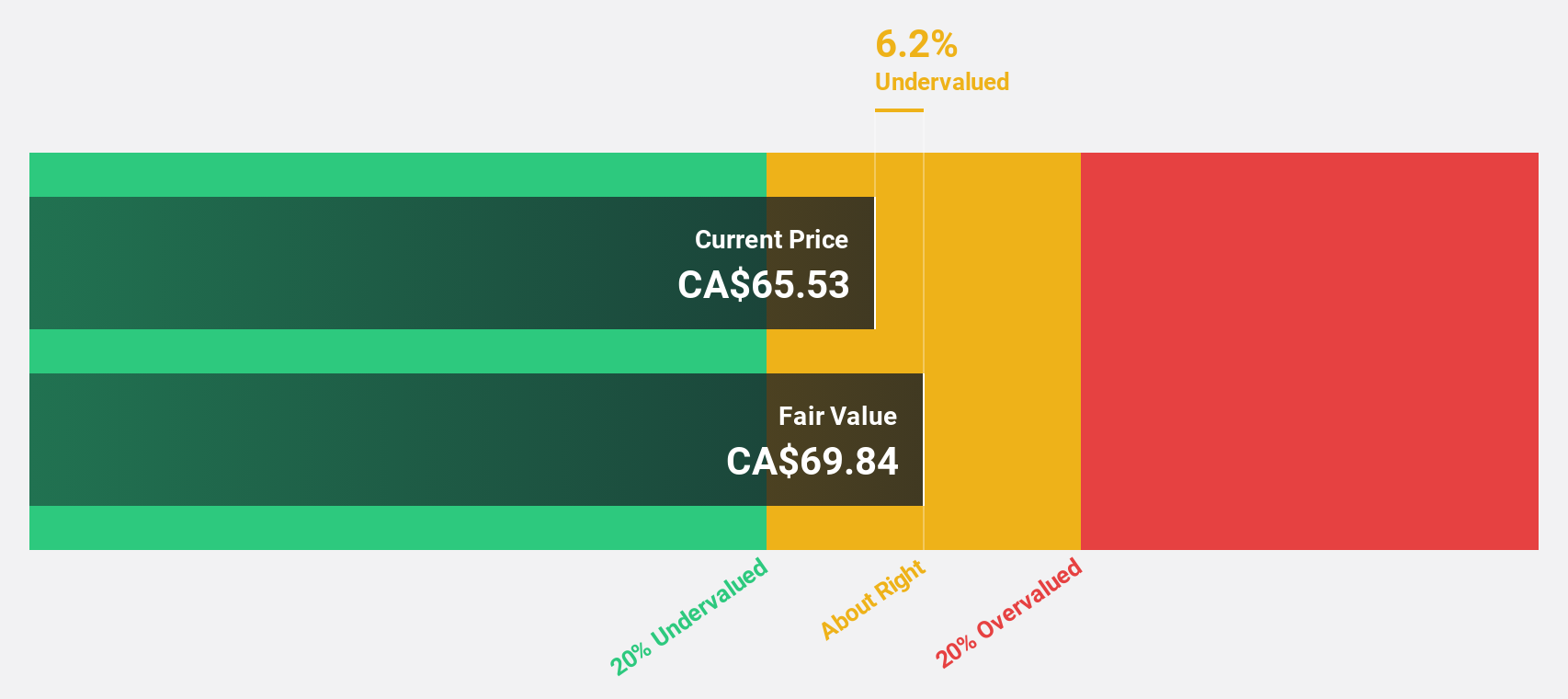

Exchange Income (TSX:EIF)

Overview: Exchange Income Corporation operates in aerospace and aviation services, equipment, and manufacturing sectors globally, with a market cap of approximately CA$4.20 billion.

Operations: The company's revenue is derived from CA$1.69 billion in aerospace and aviation services and equipment, and CA$1.10 billion in manufacturing businesses.

Estimated Discount To Fair Value: 32.1%

Exchange Income Corporation is trading at CA$77.46, which is 32.1% below its estimated fair value of CA$114.07, highlighting potential undervaluation based on cash flows. Earnings are forecast to grow significantly at 32.5% annually, surpassing the Canadian market's growth rate of 12.1%. However, interest payments and dividends are not well covered by earnings or free cash flows, posing financial risks despite recent consistent dividend declarations of CA$0.22 per share monthly through October 2025.

- In light of our recent growth report, it seems possible that Exchange Income's financial performance will exceed current levels.

- Dive into the specifics of Exchange Income here with our thorough financial health report.

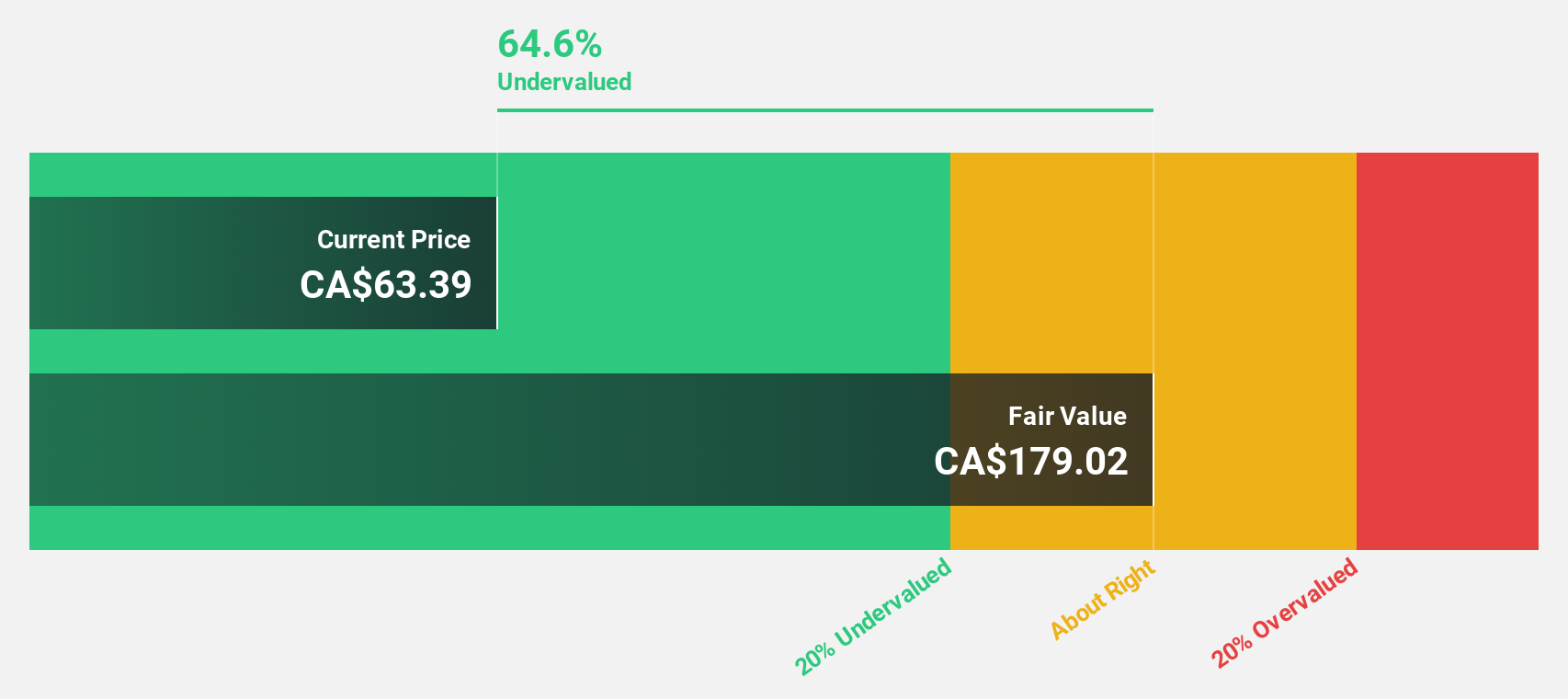

Tourmaline Oil (TSX:TOU)

Overview: Tourmaline Oil Corp. is involved in the acquisition, exploration, development, and production of petroleum and natural gas properties in the Western Canadian Sedimentary Basin, with a market cap of CA$23.47 billion.

Operations: The company's revenue segment consists of CA$4.87 billion from its petroleum and natural gas properties in the Western Canadian Sedimentary Basin.

Estimated Discount To Fair Value: 30.8%

Tourmaline Oil is trading at CA$61.70, significantly below its estimated fair value of CA$89.13, suggesting undervaluation based on cash flows. Despite a forecasted revenue growth of 22.2% annually, surpassing the Canadian market's 4.9%, earnings are projected to grow at a moderate 16.8%. Recent earnings showed decreased quarterly net income year-over-year, highlighting potential challenges in sustaining its dividend yield of 5.75%, which isn't well covered by free cash flows.

- Insights from our recent growth report point to a promising forecast for Tourmaline Oil's business outlook.

- Click to explore a detailed breakdown of our findings in Tourmaline Oil's balance sheet health report.

Next Steps

- Unlock more gems! Our Undervalued TSX Stocks Based On Cash Flows screener has unearthed 19 more companies for you to explore.Click here to unveil our expertly curated list of 22 Undervalued TSX Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CSU

Constellation Software

Acquires, builds, and manages vertical market software businesses to develop mission-critical software solutions for public and private sector markets.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion