- Canada

- /

- Consumer Finance

- /

- TSX:PRL

3 Stocks Estimated To Be Undervalued By Up To 46.3%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate adjustments and mixed economic signals, investors are keenly observing the performance of major indices like the Nasdaq, which recently achieved a record high despite broader market declines. In this environment, identifying undervalued stocks can be particularly appealing as they may offer potential opportunities for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Clear Secure (NYSE:YOU) | US$26.67 | US$53.13 | 49.8% |

| Shandong Bailong Chuangyuan Bio-Tech (SHSE:605016) | CN¥16.64 | CN¥33.16 | 49.8% |

| Shenzhen King Explorer Science and Technology (SZSE:002917) | CN¥9.59 | CN¥19.09 | 49.8% |

| Musashi Seimitsu Industry (TSE:7220) | ¥4020.00 | ¥8038.95 | 50% |

| Xiamen Bank (SHSE:601187) | CN¥5.68 | CN¥11.35 | 50% |

| Gaming Realms (AIM:GMR) | £0.36 | £0.72 | 49.8% |

| MicroPort NeuroScientific (SEHK:2172) | HK$9.18 | HK$18.27 | 49.8% |

| BYD Electronic (International) (SEHK:285) | HK$39.85 | HK$79.36 | 49.8% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP291.30 | CLP579.37 | 49.7% |

| Constellium (NYSE:CSTM) | US$10.91 | US$21.69 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

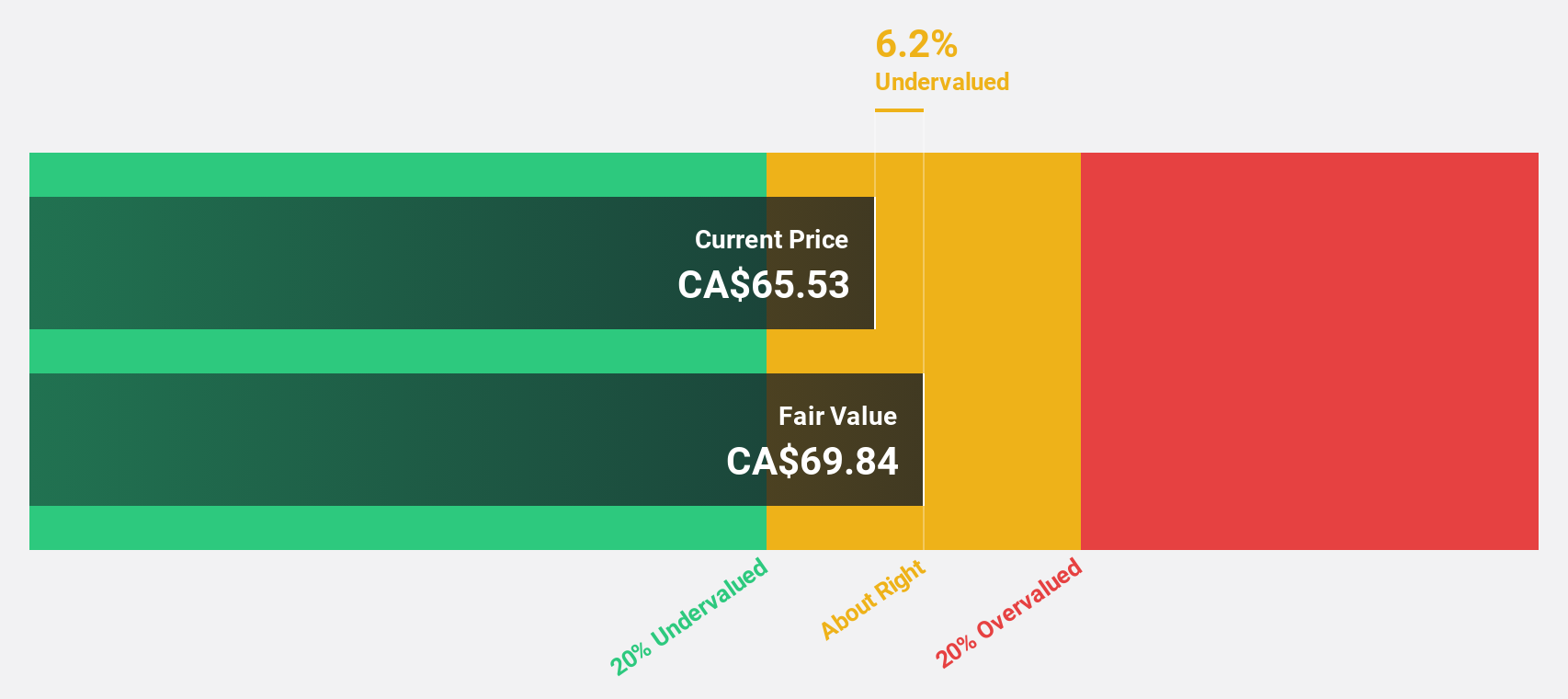

Exchange Income (TSX:EIF)

Overview: Exchange Income Corporation operates in aerospace and aviation services, equipment, and manufacturing sectors globally, with a market cap of CA$2.64 billion.

Operations: The company's revenue is derived from its aerospace and aviation segment, which generated CA$1.61 billion, and its manufacturing segment, which contributed CA$1.01 billion.

Estimated Discount To Fair Value: 35.1%

Exchange Income, trading at CA$55.82, appears undervalued with an estimated fair value of CA$86.06. Despite recent shareholder dilution and dividends not fully covered by earnings or free cash flows, the company shows potential with forecasted revenue growth of 9.4% annually—outpacing the Canadian market—and significant projected earnings growth of 26.7% per year over the next three years. Recent quarterly results indicated increased sales and net income compared to last year.

- Our expertly prepared growth report on Exchange Income implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Exchange Income with our comprehensive financial health report here.

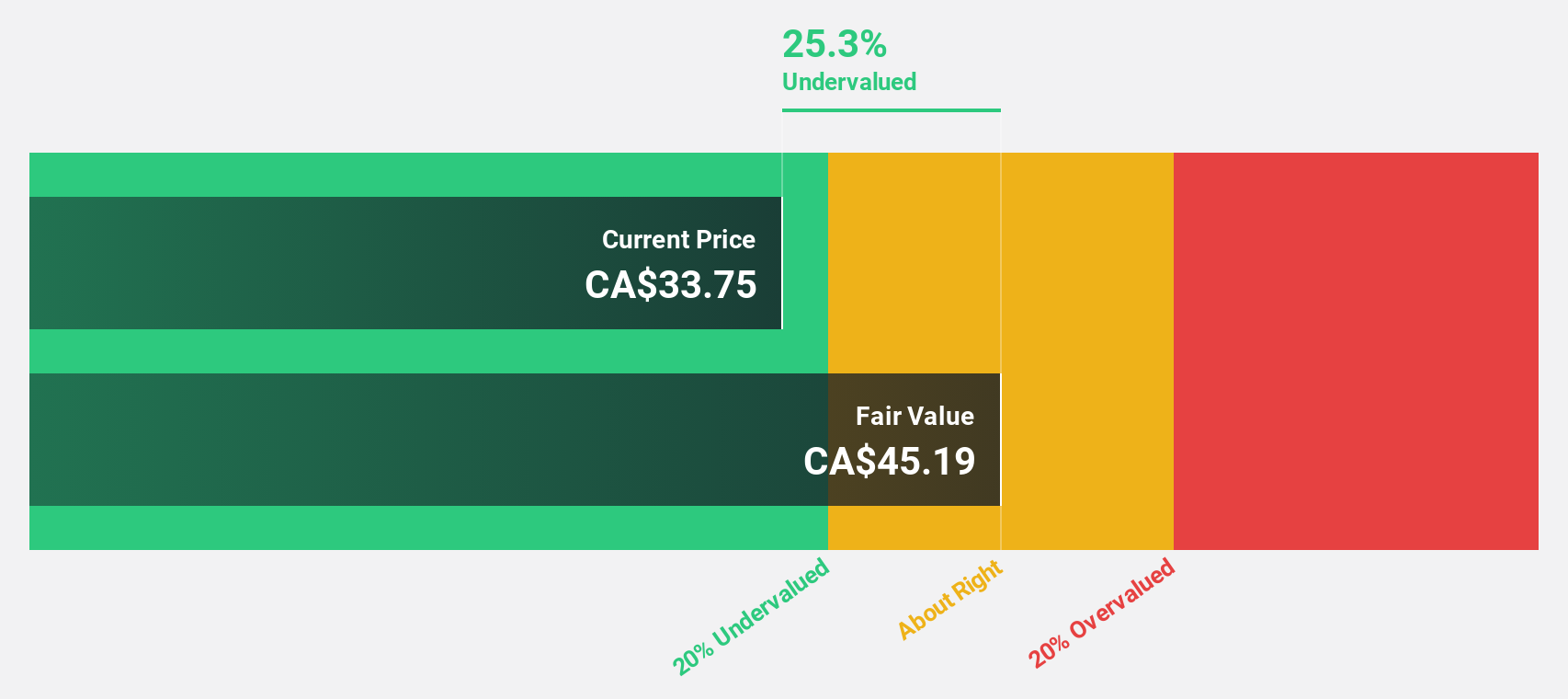

Propel Holdings (TSX:PRL)

Overview: Propel Holdings Inc. is a financial technology company with a market cap of CA$1.43 billion.

Operations: The company's revenue segment includes providing lending-related services to borrowers, banks, and other institutions, amounting to $416.43 million.

Estimated Discount To Fair Value: 46.3%

Propel Holdings, trading at CA$35.99, is significantly undervalued with a fair value estimate of CA$67.01. Despite substantial insider selling and past shareholder dilution, the company shows promise with forecasted earnings growth of 37.6% annually over the next three years and revenue growth outpacing the Canadian market at 25% per year. Recent earnings results highlighted increased sales and net income year-over-year, supporting its potential for strong future cash flows.

- The growth report we've compiled suggests that Propel Holdings' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Propel Holdings.

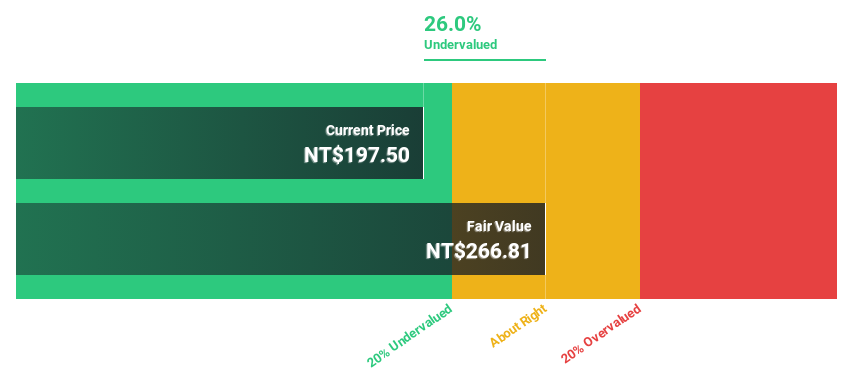

Formosa International Hotels (TWSE:2707)

Overview: Formosa International Hotels Corporation, along with its subsidiaries, operates tourist hotels in Taiwan and internationally, with a market cap of NT$24.72 billion.

Operations: The company's revenue segments include NT$2.35 billion from the Room Segment, NT$677.68 million from Leasing, NT$3.19 billion from Catering, and NT$167.98 million from Technical Services and Management.

Estimated Discount To Fair Value: 27.1%

Formosa International Hotels is trading at NT$194, significantly below its estimated fair value of NT$266.24, indicating potential undervaluation based on cash flows. Despite a recent decline in quarterly earnings and revenue, the company is forecasted to grow earnings by 9.55% annually, outpacing the Taiwan market's growth rate of 6.1%. While offering a dividend yield of 5.87%, it's not well-covered by current earnings, posing a risk for income-focused investors.

- According our earnings growth report, there's an indication that Formosa International Hotels might be ready to expand.

- Take a closer look at Formosa International Hotels' balance sheet health here in our report.

Where To Now?

- Investigate our full lineup of 874 Undervalued Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PRL

Exceptional growth potential with proven track record.

Market Insights

Community Narratives