- Canada

- /

- Transportation

- /

- TSX:CP

How Regulatory Scrutiny of Meridian Speedway Operations Could Influence Canadian Pacific Kansas City’s (TSX:CP) Competitive Edge

Reviewed by Sasha Jovanovic

- In recent days, Norfolk Southern raised concerns about Canadian Pacific Kansas City Southern’s handling of intermodal rail traffic on the Meridian Speedway, citing increased transit times and a shift of freight to trucks, and formally requested regulatory intervention from the Surface Transportation Board.

- The dispute highlights underlying pressures in North American rail logistics as customers evaluate service reliability between rail and trucking options.

- Let's examine how regulatory scrutiny over operational changes on a key corridor may shape Canadian Pacific Kansas City's investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Canadian Pacific Kansas City's Investment Narrative?

Canadian Pacific Kansas City’s story has long been centered on its powerful North American network and its recent operational expansions, such as the new import-export hub in Kansas City and ongoing collaborations in Texas. For investors, the thesis has balanced steady profit growth, a rising dividend, aggressive share buybacks, and unique infrastructure positioning, despite some relative valuation concerns and modest returns compared to Canadian peers. The recent regulatory complaint from Norfolk Southern, however, introduces fresh scrutiny to the reliability and profitability of intermodal traffic on a vital corridor. While CPKC management disputes the claims and attributes changes to broader market forces, any formal regulatory action could alter short-term risks, possibly affecting upcoming earnings catalysts. With the company due to report results soon, the Meridian Speedway issue could shape the discussion, but unless transit problems escalate or customers shift away more rapidly, the impact likely remains contained for now.

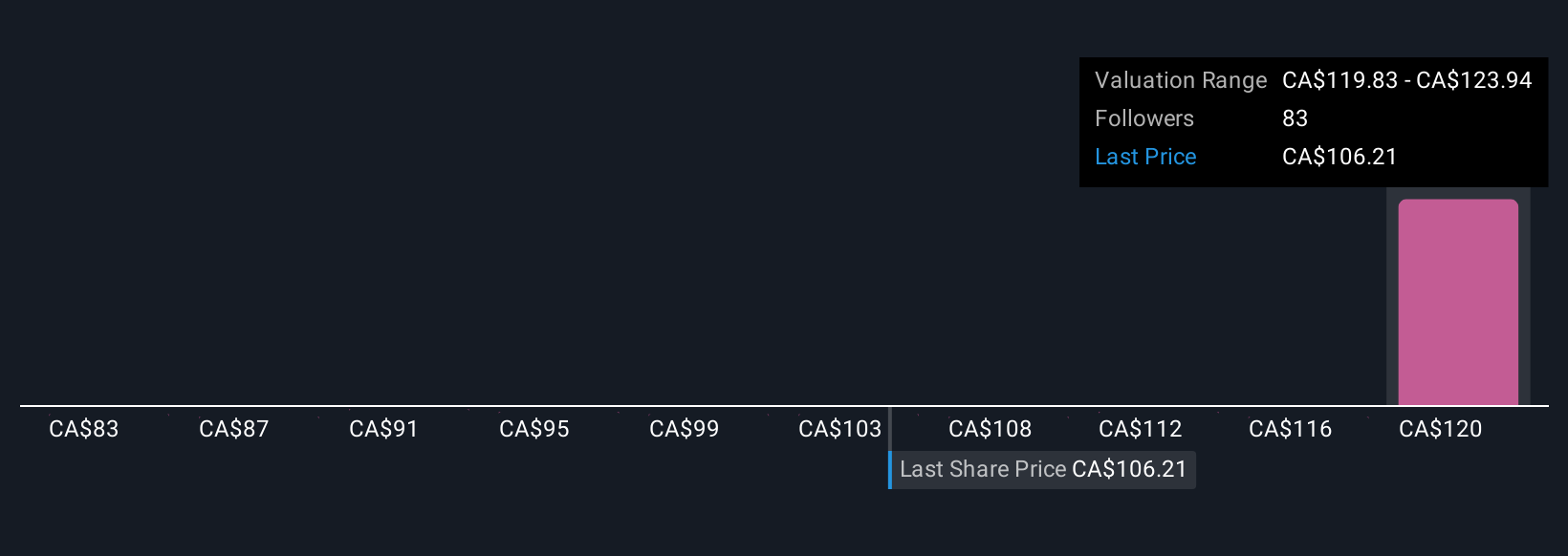

On the other hand, investors should keep a close eye on regulatory reviews along CPKC’s key routes. Canadian Pacific Kansas City's shares have been on the rise but are still potentially undervalued by 13%. Find out what it's worth.Exploring Other Perspectives

Explore 12 other fair value estimates on Canadian Pacific Kansas City - why the stock might be worth 24% less than the current price!

Build Your Own Canadian Pacific Kansas City Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Pacific Kansas City research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Canadian Pacific Kansas City research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Pacific Kansas City's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CP

Canadian Pacific Kansas City

Owns and operates a transcontinental freight railway in Canada, the United States, and Mexico.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives