- Canada

- /

- Transportation

- /

- TSX:CNR

How Investors Are Reacting To Canadian National Railway (TSX:CNR) Expanding Cold Chain Logistics with Congebec Partnership

Reviewed by Sasha Jovanovic

- Congebec and Canadian National Railway recently announced a partnership to build a state-of-the-art temperature-controlled facility within CN’s Calgary Logistics Park, combining CN’s rail strengths with Congebec’s refrigerated logistics expertise to improve cold chain infrastructure across North America.

- This initiative reflects a significant step toward creating a more resilient cold supply chain, aiming to ease congestion, reduce emissions, and address ongoing supply disruptions for perishables throughout Canada and the United States.

- We’ll explore how integrating advanced cold chain capabilities through this partnership could influence Canadian National Railway’s growth and operational efficiency outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Canadian National Railway Investment Narrative Recap

Canadian National Railway appeals to investors who believe in the essential role of rail in North American supply chains and the value of ongoing infrastructure investments amid industry headwinds. The recently announced Congebec partnership could support CN’s push for higher revenue from intermodal and perishables in the medium term, but it does not meaningfully shift the main near-term catalyst, which remains volume recovery in core segments, nor does it diminish the risk posed by persistently weak industrial demand. One of this year’s most relevant announcements is CN’s Q2 2025 earnings release, which showed net income growth even as sales dipped year over year. This result set highlights how profit growth can be achieved through cost discipline and margin management, yet underscores that top-line pressures from weak commodity and industrial volumes are still front and center for shareholders tracking the company’s overall outlook. But, against this, investors should be aware that if volume recovery stalls...

Read the full narrative on Canadian National Railway (it's free!)

Canadian National Railway's outlook anticipates CA$19.6 billion in revenue and CA$5.6 billion in earnings by 2028. This scenario relies on a 4.6% annual revenue growth rate and a CA$1.0 billion increase in earnings from the current level of CA$4.6 billion.

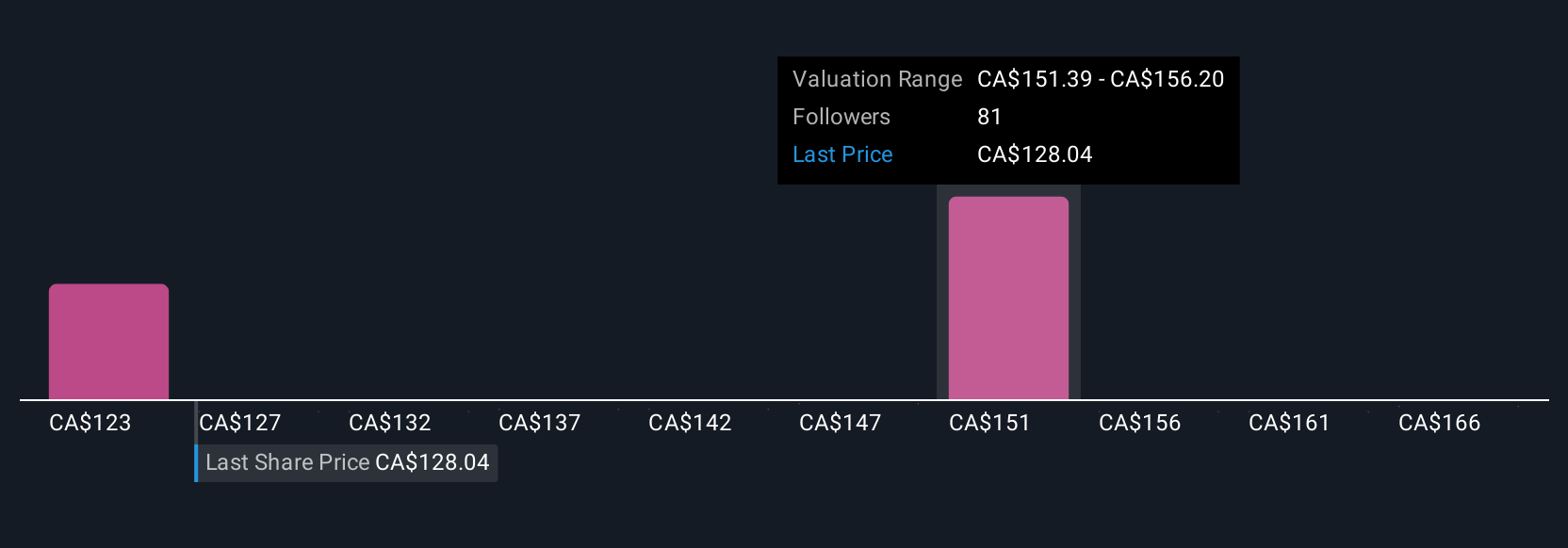

Uncover how Canadian National Railway's forecasts yield a CA$151.33 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Fifteen fair value estimates from the Simply Wall St Community span from CA$116.67 to CA$170.48 per share, with retail investor opinions often diverging by over CA$50. As you weigh these perspectives, consider how the risk of long-term volume stagnation continues to shape expectations for CN’s future performance.

Explore 15 other fair value estimates on Canadian National Railway - why the stock might be worth as much as 25% more than the current price!

Build Your Own Canadian National Railway Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian National Railway research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Canadian National Railway research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian National Railway's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNR

Canadian National Railway

Engages in the rail, intermodal, trucking, and related transportation businesses in Canada and the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives