- Canada

- /

- Transportation

- /

- TSX:CNR

Canadian National Railway (TSX:CNR) Valuation in Focus Following Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

Canadian National Railway (TSX:CNR) shares recently dipped amid a quiet period, which has prompted investors to look closely at its long-term performance and current valuation. The stock’s latest moves have attracted attention among those tracking Canadian transportation companies.

See our latest analysis for Canadian National Railway.

While Canadian National Railway’s share price has given up nearly 10% so far this year, the trend is hardly unique in the sector. Momentum has faded, with a 1-year total shareholder return of -15.1% highlighting recent challenges that go beyond last week’s dip.

If Canadian National Railway’s recent moves have you curious about other sectors showing resilience, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

This recent dip raises a critical question for investors: Is Canadian National Railway undervalued right now, or are markets already pricing in all of its potential for future growth?

Most Popular Narrative: 12.6% Undervalued

According to the most followed valuation narrative, Canadian National Railway’s fair value sits notably above the recent closing price. This suggests that recent market weakness may be overstating headwinds. The stage is set for a deeper look at what analysts believe could be driving future gains for investors willing to look beyond near-term volatility.

CN continues to deliver same-store pricing above rail cost inflation and is leveraging strong network performance to win market share in domestic intermodal, suggesting pricing power and improved margin potential as volumes return.

What’s sparking this bullish view? There is a bold financial projection built on ambitious assumptions about profit margins, network efficiency, and a future valuation multiple that raises eyebrows across the sector. Ready to discover the numbers that could shift Canadian National Railway’s long-term trajectory? Take a closer look at the beliefs that drive this high-conviction fair value and see how it all adds up.

Result: Fair Value of $151.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic headwinds and flat volume growth could challenge Canadian National Railway’s ability to translate efficiency gains into sustained long-term earnings momentum.

Find out about the key risks to this Canadian National Railway narrative.

Another View: DCF Model Suggests Valuation Risks Remain

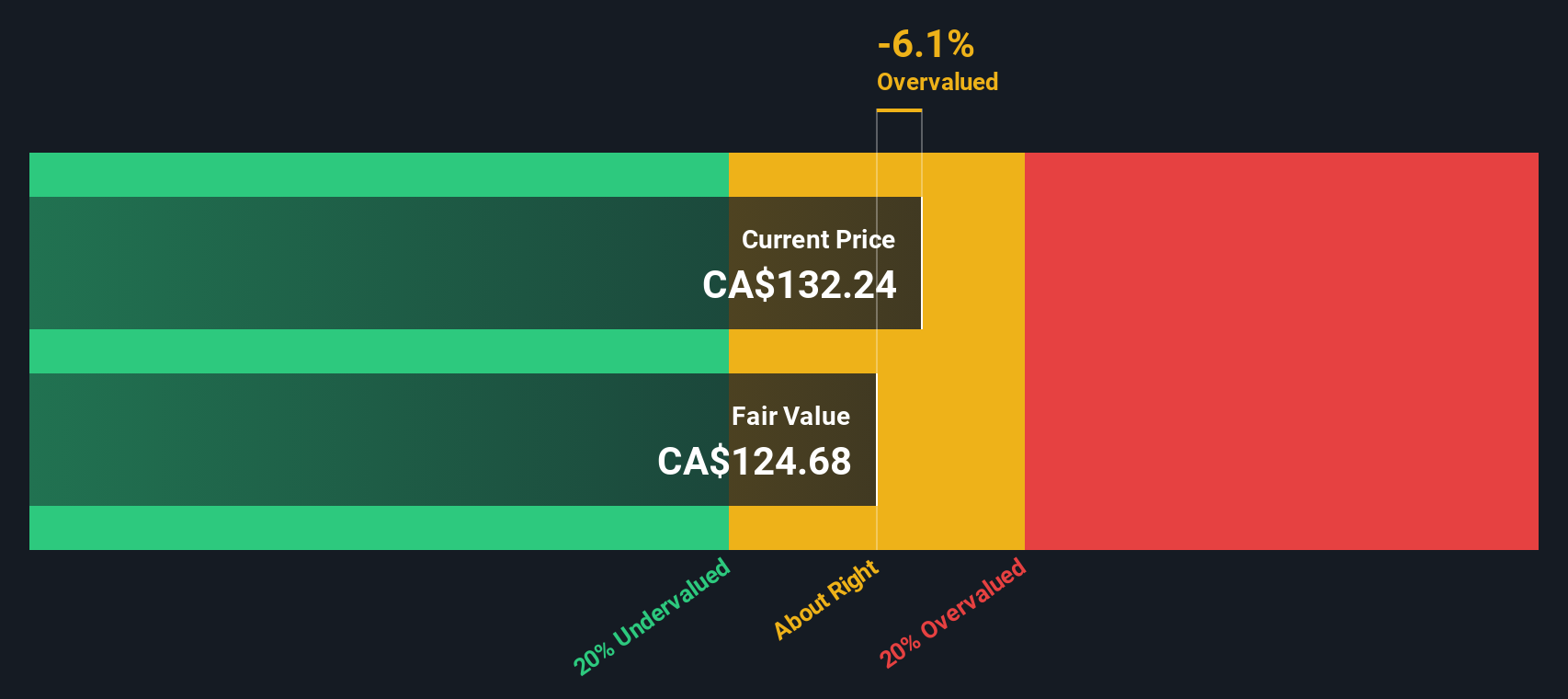

While the consensus price target sees Canadian National Railway as undervalued, our DCF model offers a cooler take. According to this approach, the current share price of CA$132.24 actually sits above our estimated fair value of CA$124.72, which hints at possible downside risk if growth stalls or discount rates rise again. Could the market be leaning too optimistic, or is there more resilience than the numbers suggest?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Canadian National Railway for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Canadian National Railway Narrative

If you want to put these figures to the test or chart out your own scenario, you can shape your own outlook in just a few minutes with Do it your way.

A great starting point for your Canadian National Railway research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Staying ahead means constantly finding new opportunities. Use Simply Wall Street’s screener to zero in on stocks with strong upside potential, innovative growth stories, and reliable income prospects so you never miss your next winning idea.

- Uncover new tech frontiers and fuel your portfolio with tomorrow's disruptors by starting with these 25 AI penny stocks.

- Supercharge your income strategy by tapping into these 18 dividend stocks with yields > 3%, featuring companies with yields above 3% and sustainable payout records.

- Catch emerging trends early. Target promising ventures with robust financials thanks to these 3579 penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CNR

Canadian National Railway

Engages in the rail, intermodal, trucking, and related transportation businesses in Canada and the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives