- Canada

- /

- Transportation

- /

- TSX:CNR

Canadian National Railway (TSX:CNR) Faces Labor Challenges Despite Strong Q2 Growth and Strategic Opportunities

Canadian National Railway (TSX:CNR) is navigating a dynamic landscape marked by both opportunities and challenges. Recent highlights include a 7% revenue growth in Q2 and significant safety improvements, juxtaposed against rising labor costs and operational inefficiencies. In the discussion that follows, we will delve into Canadian National Railway's financial health, operational inefficiencies, strategic growth initiatives, and external threats to provide a comprehensive overview of the company's current business situation.

Unlock comprehensive insights into our analysis of Canadian National Railway stock here.

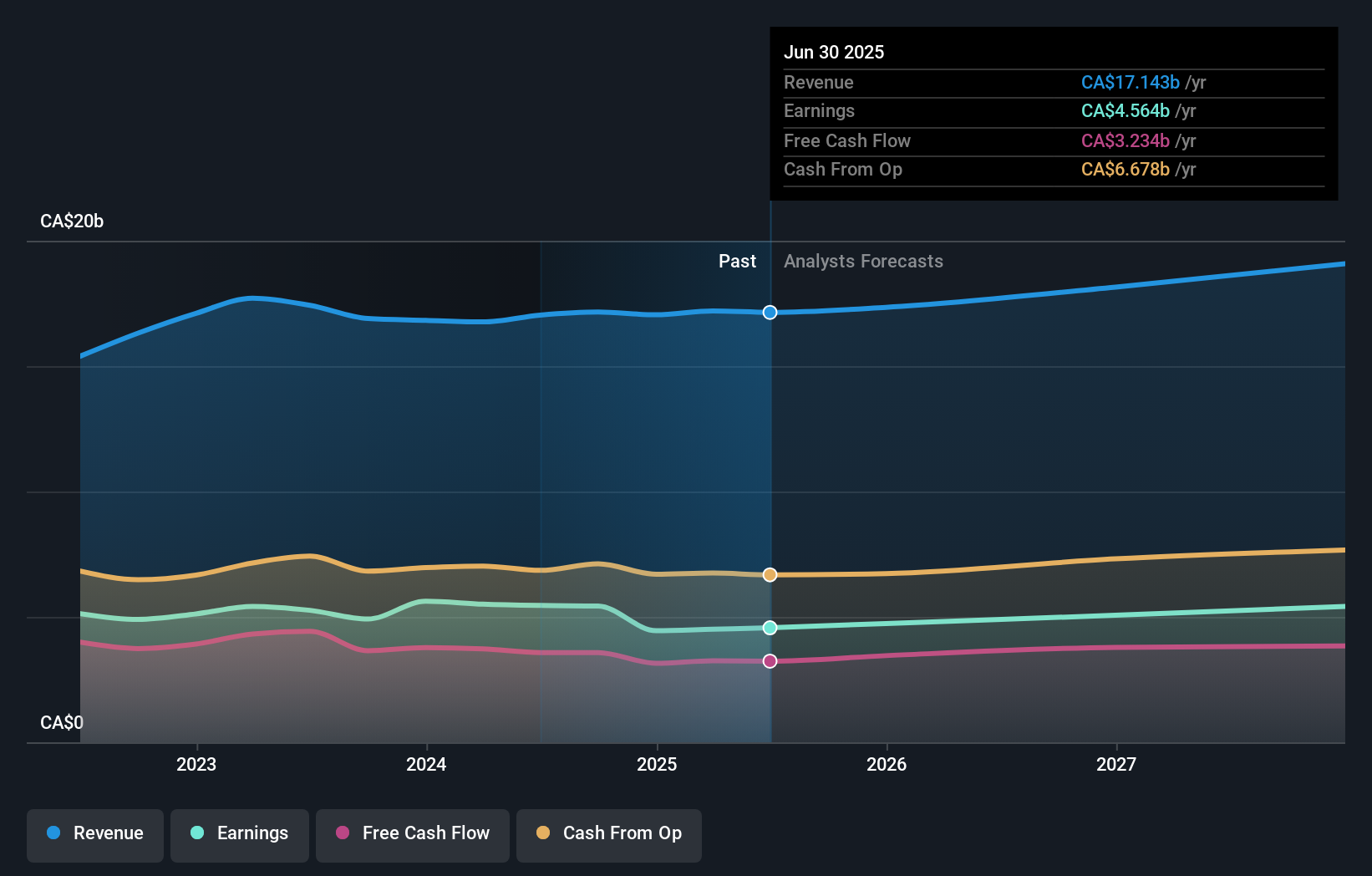

Strengths: Core Advantages Driving Sustained Success For Canadian National Railway

Canadian National Railway (CNR) has demonstrated robust growth initiatives, as highlighted by CEO Tracy Robinson, who expressed optimism about the company's specific growth initiatives coming online effectively. The company's commitment to strong customer service and operational performance, particularly in the East and South regions, has resulted in improved velocity and on-time metrics. Additionally, CNR's revenue grew by 7% in the second quarter compared to last year, driven by stronger pricing, higher volume, and favorable foreign exchange, as noted by Chief Commercial Officer Remi Lalonde. Safety improvements have also been significant, with a 22% improvement in the accident frequency ratio, according to Chief Network Operations Officer Patrick Whitehead. Furthermore, CNR is considered a good value with a Price-To-Earnings Ratio of 18.9x, significantly lower than both the North American Transportation industry average of 28.3x and the peer average of 26.7x.

Weaknesses: Critical Issues Affecting Canadian National Railway's Performance and Areas For Growth

Despite these strengths, CNR faces several challenges. Labor issues have been a significant concern, with prolonged negotiations impacting business, particularly in the international Intermodal segment, as mentioned by Tracy Robinson. Operational inefficiencies have also been noted, especially in the South, due to lower grain and coal volumes. Cost increases are another area of concern, with labor costs rising by 13% compared to last year, driven by higher average headcount, general wage increases, and higher pension costs, as highlighted by CFO Ghislain Houle. Additionally, some operational metrics, such as network train speed and 32-hour cars, have not met last year's performance levels, according to Chief Field Operations Officer Derek Taylor. For a more comprehensive look at how these weaknesses could impact Canadian National Railway's financial stability, explore our section on Canadian National Railway's Past Performance.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

CNR has several strategic opportunities to enhance its market position. The company expects to carry intermodal momentum through its Western gateways in the second half of the year, as noted by Remi Lalonde. Strategic initiatives, such as selling service reliability for international intermodal through Western gateways, leverage the strategic benefit of the Rupert option. Growth in the petroleum and chemicals segment is also anticipated, with good momentum expected on both sides of the border. Additionally, CNR is hopeful about the Iowa Northern acquisition, which could further strengthen its market position, as mentioned by Tracy Robinson. Learn more about how these opportunities could impact Canadian National Railway's future growth by reviewing our analysis of Canadian National Railway's Future Performance.

Threats: Key Risks and Challenges That Could Impact Canadian National Railway's Success

CNR faces several external threats that could impact its growth and market share. Labor disruptions remain a significant risk, with the company's full-year guidance revised to mid- to high single-digit EPS growth, assuming no labor disruptions on the rails or at the ports, as highlighted by Tracy Robinson. Economic factors, such as persistent inflation and modest interest rate cuts, have resulted in tepid industrial production, as noted by CFO Ghislain Houle. Competitive pressures in the domestic business, combined with an oversupply of truck capacity, pose additional challenges, as mentioned by Remi Lalonde. Regulatory challenges, including government-mandated duty and rest period rules in Canada, have complicated crew scheduling, according to Chief Network Operations Officer Patrick Whitehead. These factors collectively present significant risks to CNR's long-term success.

Conclusion

In conclusion, Canadian National Railway (CNR) is well-positioned for sustained success due to its robust growth initiatives, strong customer service, and operational performance, particularly in the East and South regions. However, the company must address critical challenges such as labor issues, rising costs, and operational inefficiencies to maintain its competitive edge. Strategic opportunities, including leveraging intermodal momentum through Western gateways and expanding in the petroleum and chemicals segment, present significant growth potential. Despite external threats like labor disruptions and economic factors, CNR's Price-To-Earnings Ratio of 18.9x, significantly lower than the North American Transportation industry average of 28.3x and the peer average of 26.7x, underscores its strong value proposition and potential for future performance.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:CNR

Canadian National Railway

Engages in the rail, intermodal, trucking, and related transportation businesses in Canada and the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives