Will Early Debt Redemption Reshape Cargojet's (TSX:CJT) Investment Narrative and Financial Flexibility?

Reviewed by Simply Wall St

- Cargojet Inc. recently announced that it will redeem in full, on October 9, 2025, all outstanding 5.25% senior unsecured hybrid debentures worth CA$115 million, ahead of their original maturity, funded using a portion of the CA$250 million raised from its June 2025 senior notes offering.

- This move highlights Cargojet’s active debt management and may improve balance sheet flexibility by optimizing interest costs ahead of planned debt maturities.

- We'll examine how this planned debt redemption and refinancing effort could influence Cargojet's investment narrative and perceived financial strength.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Cargojet Investment Narrative Recap

To own Cargojet stock, you need to believe in its core air cargo network, the durability of major Amazon and DHL contracts, and ongoing gains from e-commerce growth. The planned debt redemption, funded by recent lower-cost notes, demonstrates proactive balance sheet management, but is unlikely to materially shift the most important catalyst, customer contract renewals, or mitigate the biggest near-term risk, which remains revenue concentration with key customers like Amazon and DHL.

Among recent announcements, the extension of Cargojet’s agreement with DHL until 2033 most directly reinforces its efforts to fortify long-term revenue streams. This renewal is highly relevant, as it provides greater visibility and support for Cargojet’s growth narrative despite ongoing industry and trade route uncertainties.

However, despite the improved financial flexibility, investors should be aware of the continued risk from Cargojet’s heavy dependence on just a few major clients, especially if contract terms or shipping volumes change...

Read the full narrative on Cargojet (it's free!)

Cargojet is expected to achieve CA$1.1 billion in revenue and CA$111.6 million in earnings by 2028. This outlook assumes a 3.7% annual revenue growth rate and a CA$34.1 million decline in earnings from the current CA$145.7 million.

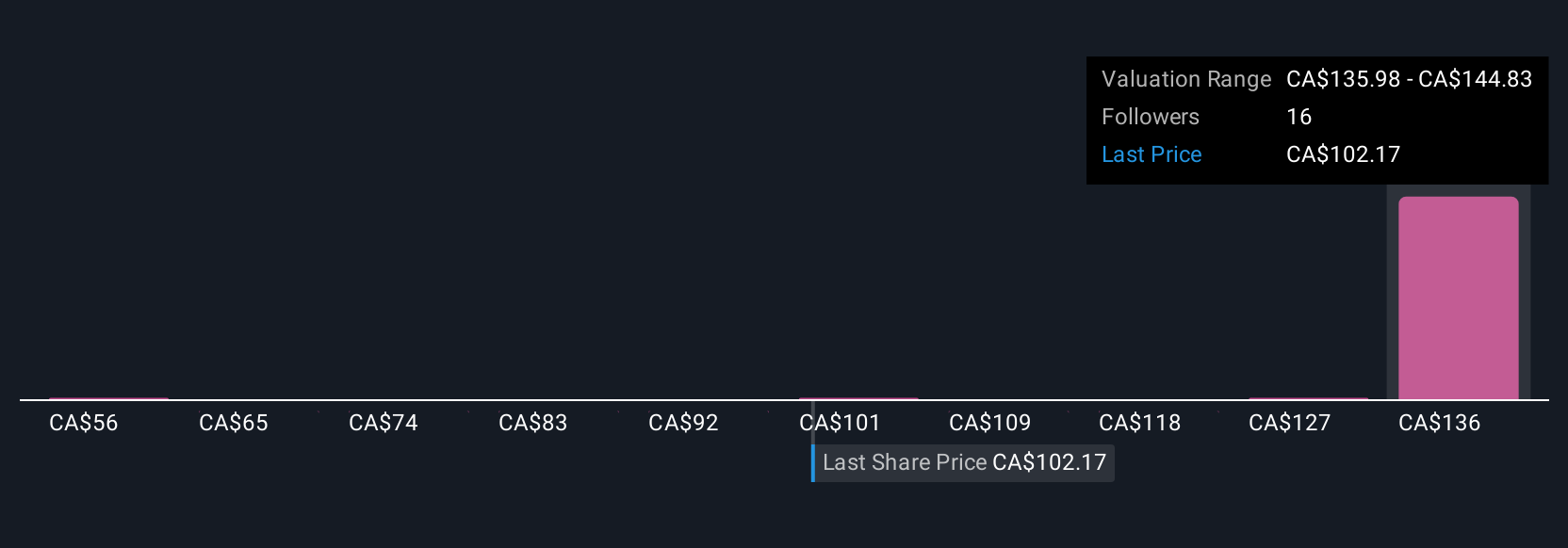

Uncover how Cargojet's forecasts yield a CA$144.83 fair value, a 41% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community set Cargojet’s fair value between CA$56.31 and CA$144.83, reflecting a wide spectrum of views. With ongoing reliance on Amazon and DHL for core revenues, you will want to consider several alternative viewpoints about Cargojet’s future performance.

Explore 5 other fair value estimates on Cargojet - why the stock might be worth as much as 41% more than the current price!

Build Your Own Cargojet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cargojet research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cargojet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cargojet's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CJT

Cargojet

Provides time-sensitive overnight air cargo services and carries in Canada.

Undervalued with acceptable track record.

Market Insights

Community Narratives