TELUS (TSX:T) Commits C$70 Billion To Expand Canada's Network And Community Initiatives

Reviewed by Simply Wall St

TELUS (TSX:T) announced a major commitment to boost its network infrastructure via a $70 billion investment plan, expanding its connectivity and sustainability initiatives. During the past month, TELUS's stock price moved 7%, aligning closely with broader market trends despite flat market movement in recent days. The company's dividend increase and robust earnings report may have supported this price movement. While the anticipation around TELUS's growth in sectors like 5G and AI aligns with industry dynamics, overall market conditions, and specific earnings announcements from other tech giants likely exerted a more generalized influence across stocks.

We've spotted 2 weaknesses for TELUS you should be aware of.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent announcement of TELUS's C$70 billion investment in its network infrastructure bears significant potential for the company's revenue and earnings projections. By enhancing its connectivity and sustainability initiatives, TELUS aims to align with growth areas like 5G and AI, potentially driving substantial future earnings growth. The expected financial leverage could contribute positively to TELUS's financial flexibility, which is pivotal given the company's existing debt and competitive market pressures.

While TELUS's share price has seen a modest 7% movement recently, the broader picture over the longer term shows a 19.54% total return including dividends over five years. This performance offers context for investors, especially since the company's 1-year performance outpaced the Canadian Telecom industry, which returned 14.1%. However, TELUS underperformed the broader Canadian market this past year, which returned 13.9%.

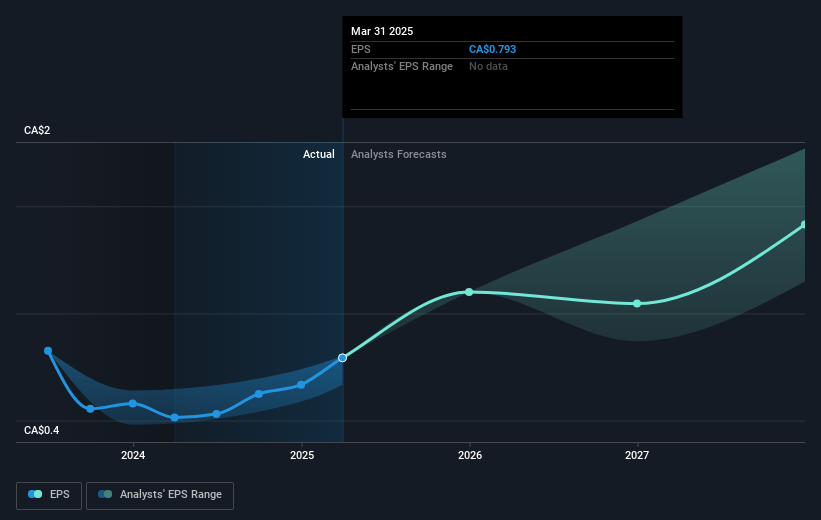

The price target of CA$23.04, compared to the current share price of CA$20.99, suggests a 7.9% potential upside. TELUS's commitment to growth sectors could enhance its operational efficiency, potentially increasing margin expansion and strengthening its earnings capacity. Yet, with TELUS's revenue forecast to grow at a slower rate than the Canadian market, the incremental impact of its strategic initiatives will be critical in closing the gap toward analyst expectations and justifying the price target set by consensus analysts.

Examine TELUS' earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)