Halfway off the lows and halfway off the highs, the Canadian market is navigating a period of cautious optimism, with the TSX down just 4% from its record high, buoyed by strong gains in the materials sector. As investors look for opportunities amidst this uncertain backdrop, penny stocks—though an outdated term—remain relevant as they highlight smaller or less-established companies that can offer great value when backed by solid financials. In this article, we explore three penny stocks on the TSX that stand out for their financial strength and potential to deliver long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.63 | CA$60.69M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.67 | CA$67.7M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.64 | CA$405.83M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.17 | CA$611.96M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.76 | CA$285.52M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.55 | CA$512.4M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.51 | CA$126.99M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.48 | CA$93.89M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.49 | CA$14.61M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.24 | CA$45.42M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 929 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Roots (TSX:ROOT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Roots Corporation, along with its subsidiaries, designs, markets, and sells apparel, leather goods, footwear, and accessories under the Roots brand in Canada and internationally with a market cap of CA$99.51 million.

Operations: The company generates revenue primarily through its Direct-To-Consumer segment, accounting for CA$223.26 million, and its Partners and Other segment, contributing CA$39.66 million.

Market Cap: CA$99.51M

Roots Corporation, with a market cap of CA$99.51 million, has shown financial challenges as it reported a net loss of CA$33.44 million for the year ending February 2025, reversing from a net income the previous year. Despite being unprofitable and having short-term assets that do not cover long-term liabilities, Roots has taken steps to manage its capital structure by reducing its debt-to-equity ratio over five years and initiating a share repurchase program to enhance shareholder value. The company's management and board are experienced, which may provide stability amid current volatility challenges.

- Unlock comprehensive insights into our analysis of Roots stock in this financial health report.

- Examine Roots' earnings growth report to understand how analysts expect it to perform.

Thor Explorations (TSXV:THX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Thor Explorations Ltd., along with its subsidiaries, is a gold producer and explorer with a market capitalization of CA$405.83 million.

Operations: Thor Explorations generates revenue primarily from the Segilola Mine Project, which contributed $193.13 million.

Market Cap: CA$405.83M

Thor Explorations Ltd., with a market cap of CA$405.83 million, has demonstrated significant growth, reporting US$193.13 million in revenue for 2024, driven by the Segilola Mine Project. The company’s net income surged to US$91.17 million from US$10.87 million the previous year, showcasing strong profitability and a robust return on equity of 45.3%. Recent drilling results at the Douta-West licence indicate promising exploration potential that could enhance its resource base further. Despite short-term liabilities exceeding assets, Thor's debt is well-covered by operating cash flow, and it recently initiated a dividend policy reflecting financial confidence.

- Get an in-depth perspective on Thor Explorations' performance by reading our balance sheet health report here.

- Assess Thor Explorations' future earnings estimates with our detailed growth reports.

Ynvisible Interactive (TSXV:YNV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ynvisible Interactive Inc. develops and sells electrochromic displays in Europe and North America, with a market cap of CA$23.34 million.

Operations: There are no specific revenue segments reported for Ynvisible Interactive Inc.

Market Cap: CA$23.34M

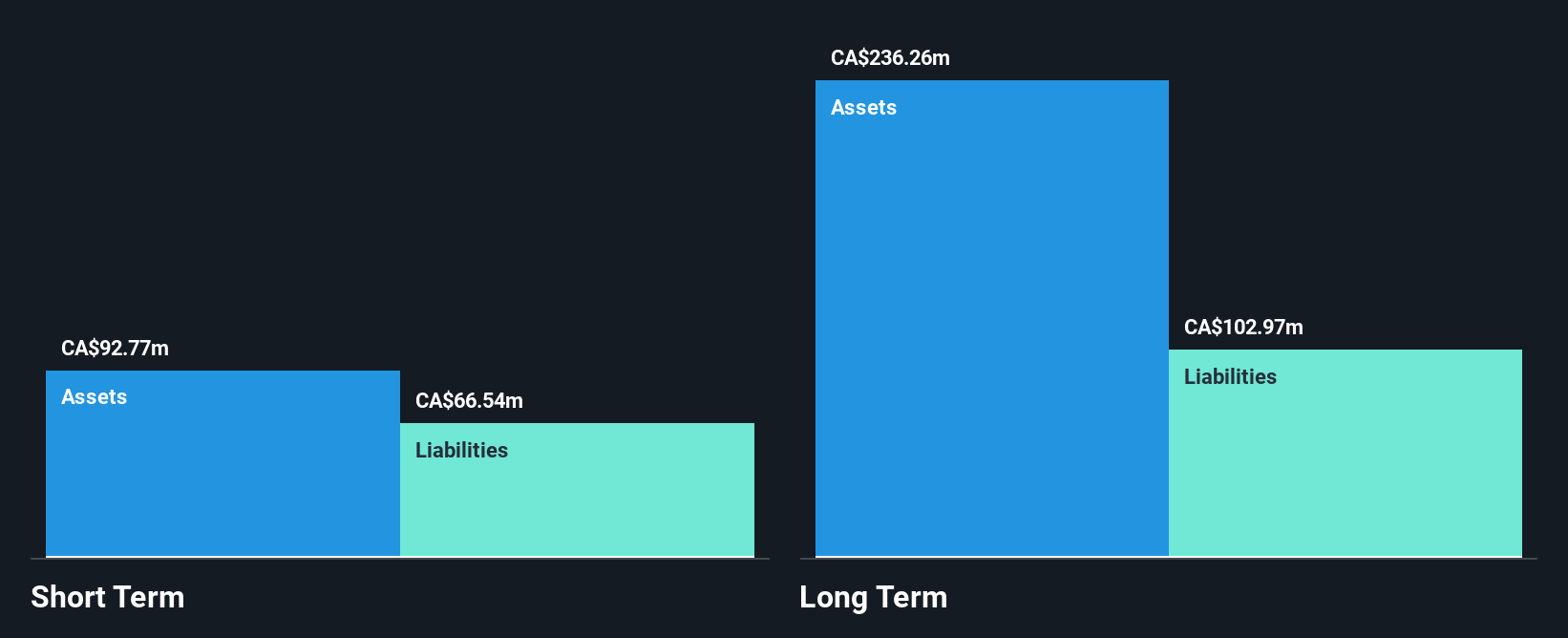

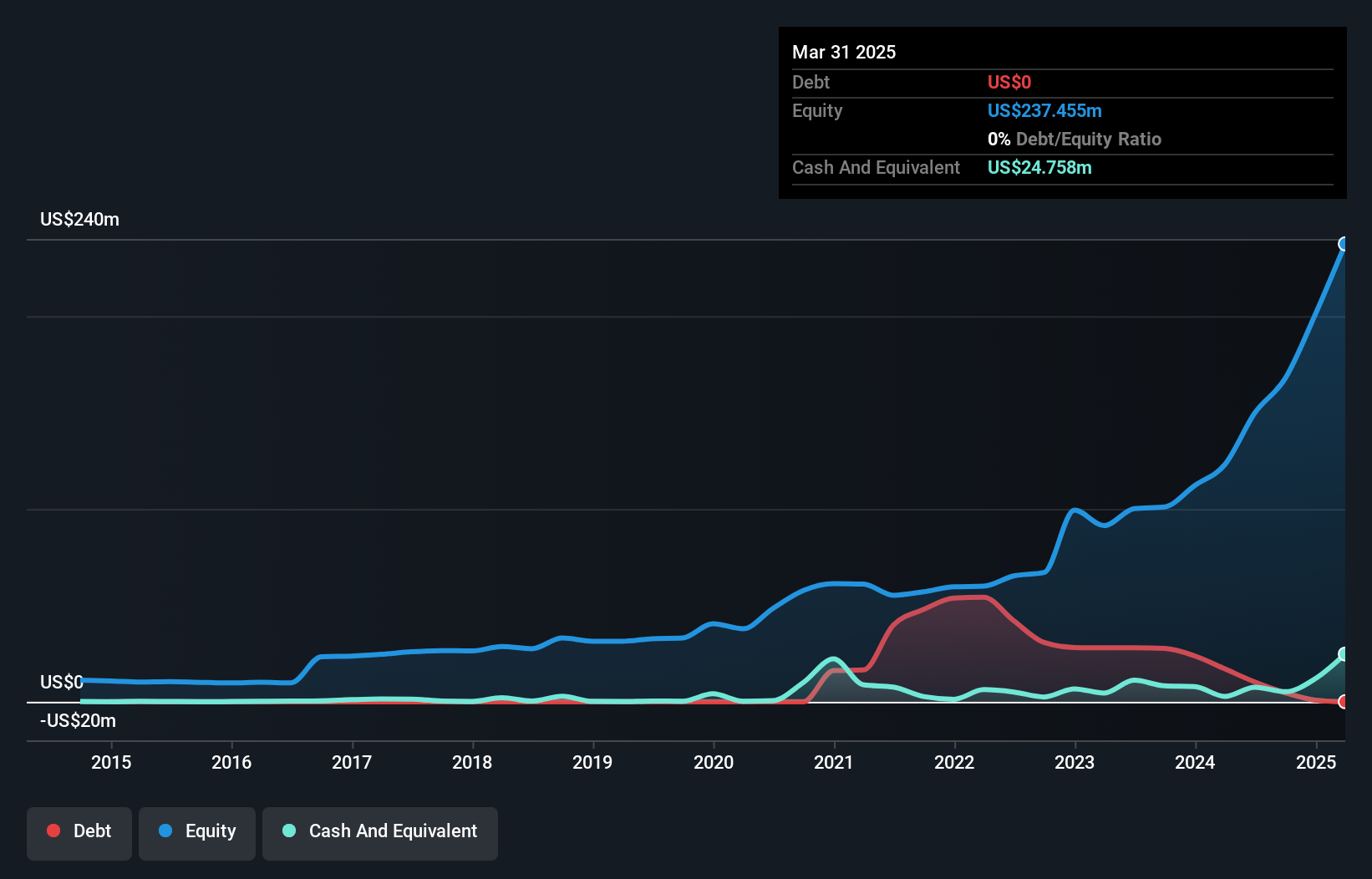

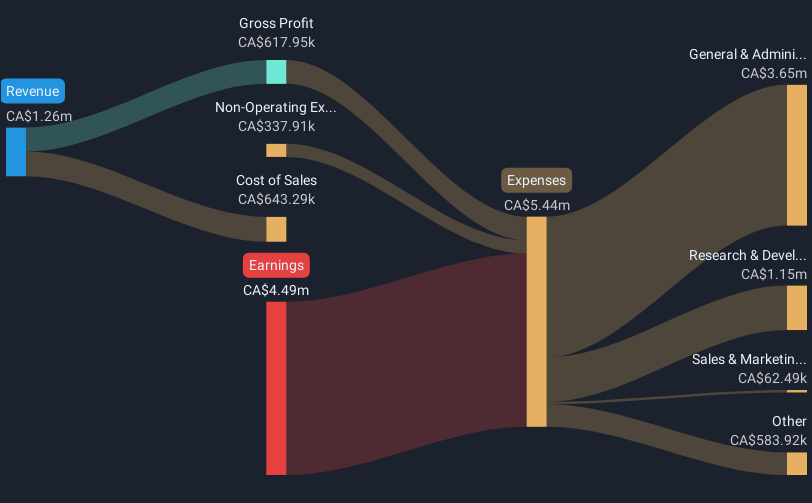

Ynvisible Interactive Inc., with a market cap of CA$23.34 million, is a pre-revenue company focused on electrochromic displays. The management and board are experienced, with average tenures of 5.6 and 4.3 years respectively, providing seasoned leadership amidst financial challenges. Despite being debt-free and having short-term assets exceeding liabilities by CA$3.8 million, the company remains unprofitable with increased losses over five years at an annual rate of 6.6%. Recent private placements raised approximately CA$1.15 million to bolster its cash runway beyond the current forecasted 12 months based on free cash flow estimates.

- Click to explore a detailed breakdown of our findings in Ynvisible Interactive's financial health report.

- Assess Ynvisible Interactive's previous results with our detailed historical performance reports.

Make It Happen

- Unlock more gems! Our TSX Penny Stocks screener has unearthed 926 more companies for you to explore.Click here to unveil our expertly curated list of 929 TSX Penny Stocks.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:YNV

Ynvisible Interactive

Develops and sells electrochromic displays in Europe, Asia, and North America.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)