As the Canadian economy navigates a period of cooling labor markets and potential rate cuts by the Bank of Canada, investors are keenly observing opportunities that may arise from these shifting economic conditions. Penny stocks, often seen as relics of past market eras, continue to hold potential for those seeking affordable entry points into companies with strong financial foundations. In this article, we will explore three Canadian penny stocks on the TSX that stand out for their financial strength and growth potential amidst current market dynamics.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.98 | CA$182.32M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.65 | CA$593.32M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.75 | CA$290.15M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.31 | CA$117.59M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$222.65M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.40 | CA$11.46M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$5.66M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.42 | CA$321.48M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$4.06 | CA$205.39M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.16 | CA$132.27M | ★★★★☆☆ |

Click here to see the full list of 962 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

INX Digital Company (NEOE:INXD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The INX Digital Company, Inc. operates a trading platform for cryptocurrencies and digital securities, with a market cap of CA$18.89 million.

Operations: INXD generates revenue through its brokerage services, contributing $4.90 million, and digital assets operations, adding $1.04 million.

Market Cap: CA$18.89M

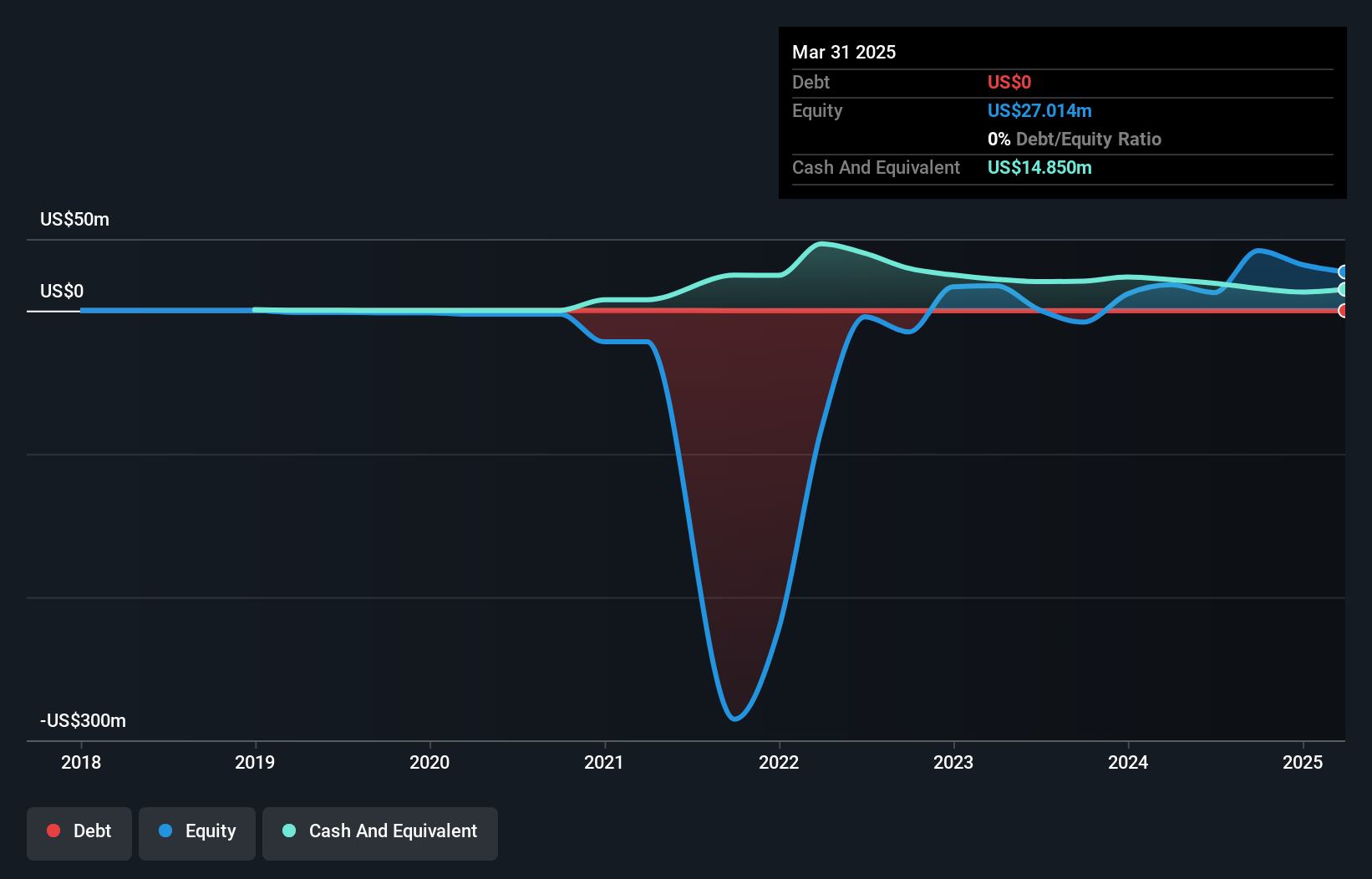

INX Digital Company, Inc. has shown significant earnings growth of 241.5% over the past year, surpassing industry averages, and maintains a strong financial position with no debt and substantial short-term assets ($61.8M) exceeding liabilities. Despite a volatile share price recently, the company boasts an outstanding return on equity (40.1%) and an attractive price-to-earnings ratio (2.7x), much lower than the Canadian market average of 14.9x, suggesting potential value for investors seeking exposure to digital securities trading platforms amidst its ongoing buyback program aimed at enhancing shareholder value.

- Click to explore a detailed breakdown of our findings in INX Digital Company's financial health report.

- Learn about INX Digital Company's historical performance here.

Lithium Chile (TSXV:LITH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lithium Chile Inc. focuses on acquiring and developing lithium properties in Chile and Argentina, with a market cap of CA$134.11 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$134.11M

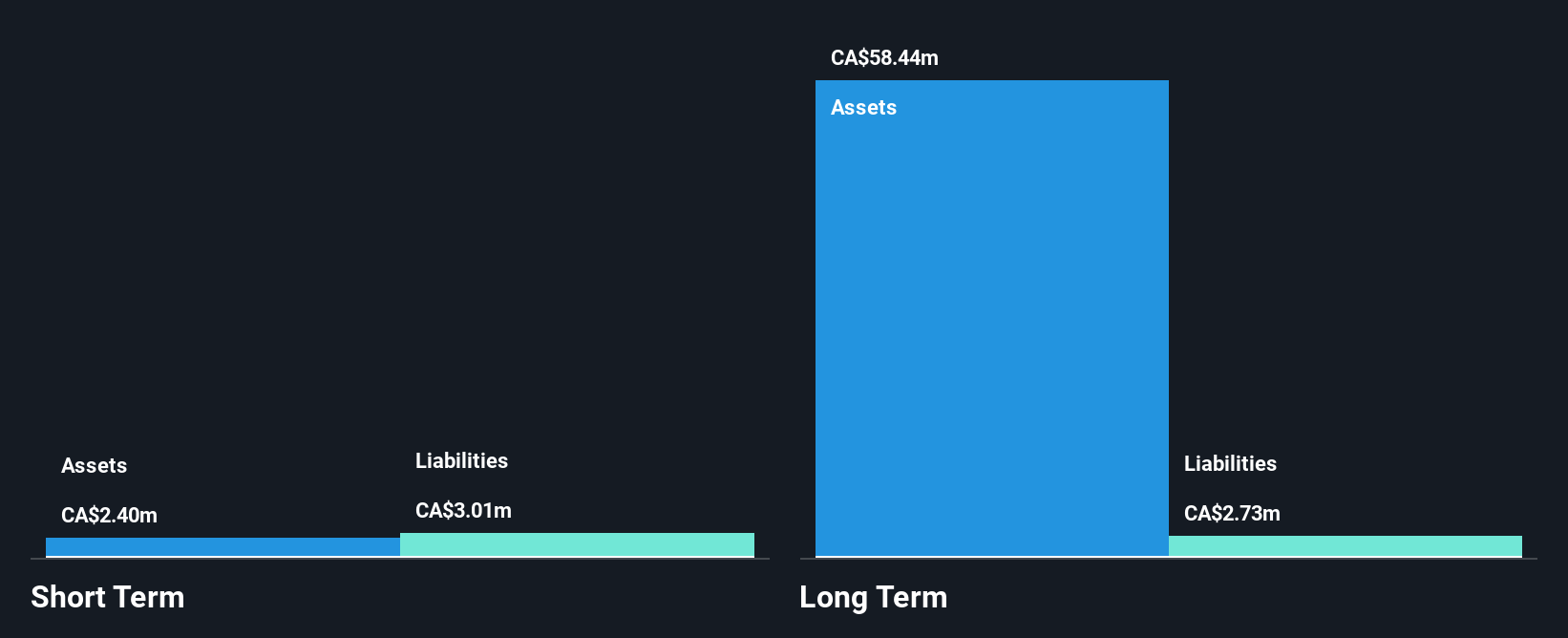

Lithium Chile Inc. has demonstrated impressive earnings growth, with a 1576.4% increase over the past year, transitioning from losses to a net income of CA$5.83 million for the first half of 2024. The company remains debt-free, with short-term assets of CA$7.7 million exceeding both short and long-term liabilities, indicating solid financial health despite being pre-revenue in its lithium ventures across Chile and Argentina. Recent developments include discussions on a potential name change to Charge Lithium Inc., signaling strategic shifts as it continues to capitalize on lithium's growing demand in the energy sector.

- Navigate through the intricacies of Lithium Chile with our comprehensive balance sheet health report here.

- Gain insights into Lithium Chile's past trends and performance with our report on the company's historical track record.

Ynvisible Interactive (TSXV:YNV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ynvisible Interactive Inc. develops and sells electrochromic displays in Europe and North America, with a market cap of CA$18.70 million.

Operations: The company generates revenue from the development and sale of electrochromic displays, amounting to CA$1.24 million.

Market Cap: CA$18.7M

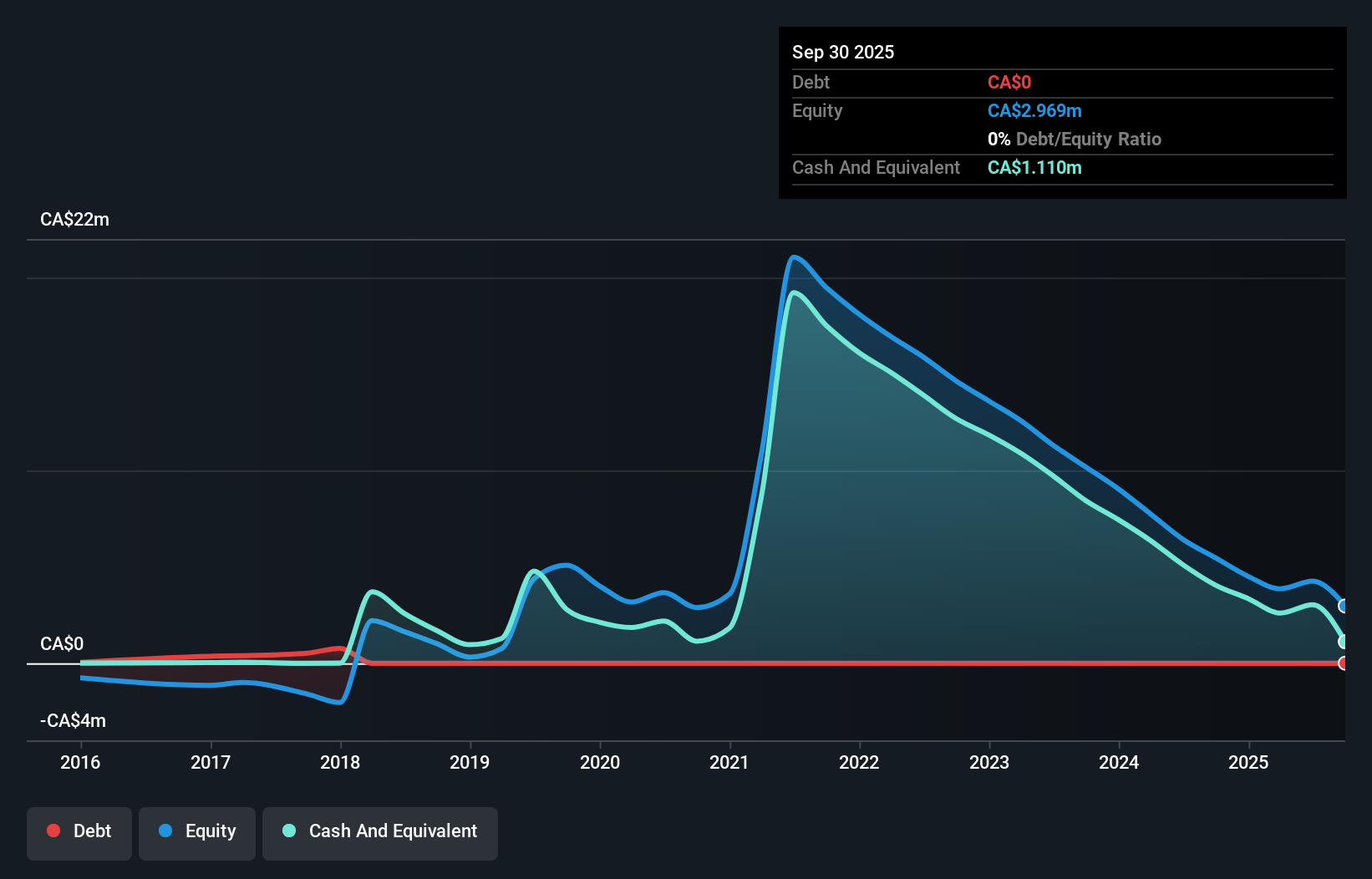

Ynvisible Interactive Inc. is navigating the penny stock landscape with strategic moves, including delivering over 10,000 e-paper displays for FDA-reviewed medical diagnostics and securing a distribution agreement with Crystal Display Systems Ltd. Despite being pre-revenue with CA$1 million in sales, it has no debt and sufficient cash runway exceeding a year. The company recently arranged a private placement to raise CA$500,000, indicating proactive financial management amidst its unprofitability. Ynvisible's seasoned management team and innovative e-paper technology position it well for potential growth in expanding markets like at-home diagnostics and hygiene solutions.

- Click here to discover the nuances of Ynvisible Interactive with our detailed analytical financial health report.

- Evaluate Ynvisible Interactive's historical performance by accessing our past performance report.

Where To Now?

- Get an in-depth perspective on all 962 TSX Penny Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:YNV

Ynvisible Interactive

Develops and sells electrochromic displays in Europe and North America.

Flawless balance sheet slight.

Market Insights

Community Narratives