- Canada

- /

- Metals and Mining

- /

- TSXV:SLI

Discovering Canada's Undiscovered Gems in November 2024

Reviewed by Simply Wall St

As the Canadian market rides strong momentum into 2025, investors are keeping a watchful eye on potential curveballs that could impact their portfolios. Amidst this backdrop, discovering stocks with solid fundamentals and attractive valuations becomes crucial, especially in sectors that have lagged behind the recent bull market surge.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Corby Spirit and Wine | 65.79% | 7.46% | -5.76% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| Queen's Road Capital Investment | 12.65% | 16.00% | 17.29% | ★★★★☆☆ |

| Genesis Land Development | 47.40% | 28.61% | 52.30% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Dundee | 3.76% | -37.57% | 44.64% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Headwater Exploration (TSX:HWX)

Simply Wall St Value Rating: ★★★★★★

Overview: Headwater Exploration Inc. is a Canadian company focused on the exploration, development, and production of petroleum and natural gas, with a market capitalization of approximately CA$1.68 billion.

Operations: Headwater Exploration generates revenue primarily from the exploration, development, and production of petroleum and natural gas, amounting to CA$490.27 million. The company's market capitalization stands at approximately CA$1.68 billion.

Headwater Exploration, a promising player in the Canadian energy sector, has shown strong earnings growth of 22.7% over the past year, outpacing a -19.4% industry trend. This debt-free company is attractive with a price-to-earnings ratio of 9.1x compared to the broader Canadian market's 14.5x, suggesting potential undervaluation. Recent financial results highlight sales of CAD 158 million for Q3 2024 and net income at CAD 47 million, though slightly down from last year’s CAD 50 million for the same period. The firm declared a quarterly dividend of $0.10 per share and forecasts production at an average of 20,250 boe/d for the year.

- Click here and access our complete health analysis report to understand the dynamics of Headwater Exploration.

Assess Headwater Exploration's past performance with our detailed historical performance reports.

Kraken Robotics (TSXV:PNG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kraken Robotics Inc. is a marine technology company that designs, manufactures, and sells sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications globally, with a market cap of CA$478.17 million.

Operations: Kraken Robotics generates revenue through the sale of sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles. The company operates across various regions including Canada, Asia Pacific, Europe, the Middle East, Africa, and North America.

Kraken Robotics, a nimble player in the tech space, has shown resilience with earnings growth of 431% over the past year, outpacing industry averages. Its net debt to equity ratio stands at a satisfactory 2.7%, indicating manageable leverage. Recent strategic moves include securing $13 million in orders for its SeaPower subsea batteries and completing a CAD 45 million equity offering. Despite an increase in debt to equity from 3.5% to 28% over five years, interest payments are well-covered at 7.4x EBIT, reflecting robust financial health amidst shareholder dilution and notable insider selling recently observed.

- Dive into the specifics of Kraken Robotics here with our thorough health report.

Gain insights into Kraken Robotics' historical performance by reviewing our past performance report.

Standard Lithium (TSXV:SLI)

Simply Wall St Value Rating: ★★★★★★

Overview: Standard Lithium Ltd. focuses on exploring, developing, and processing lithium brine properties in the United States, with a market cap of CA$472.04 million.

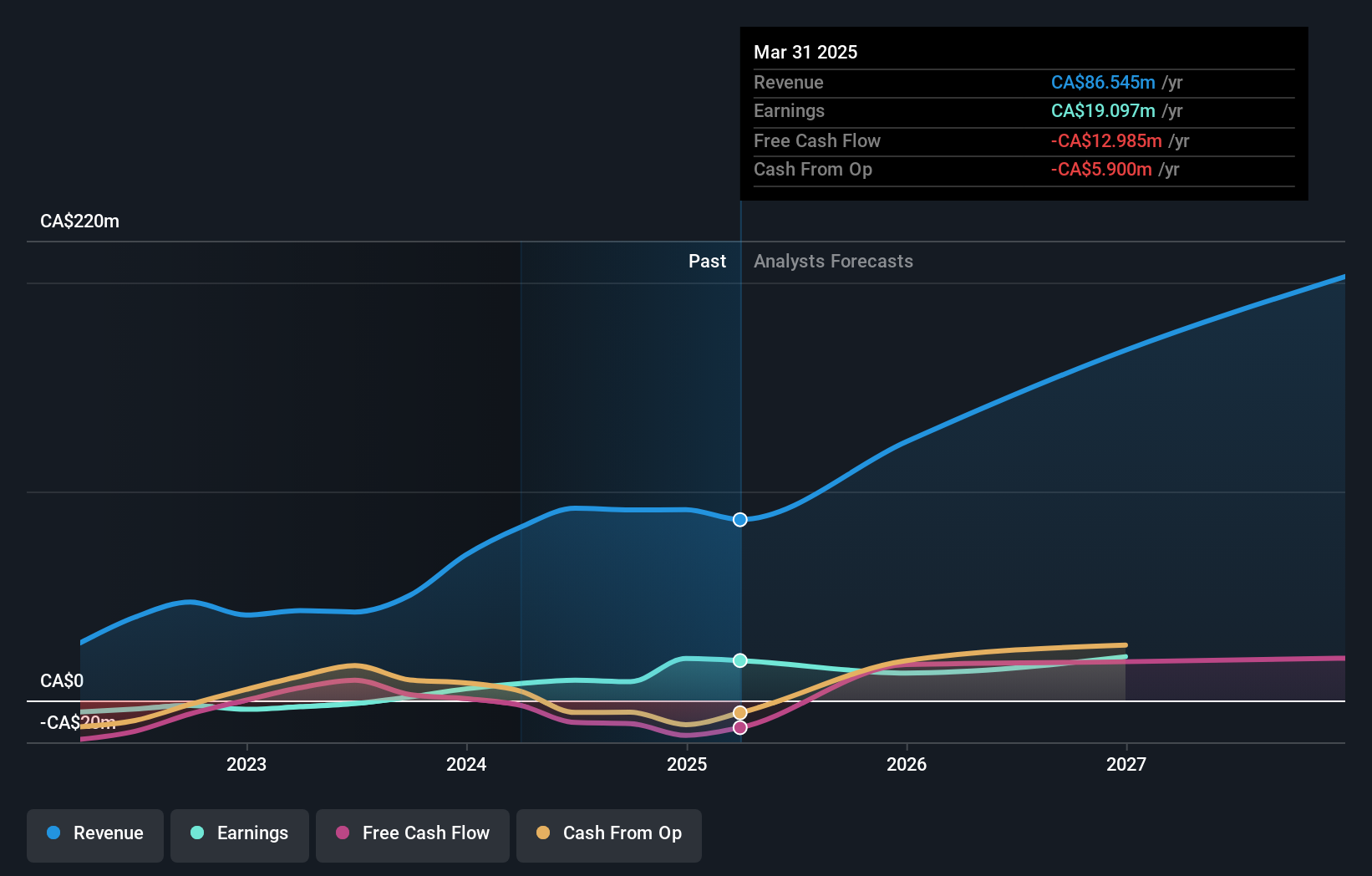

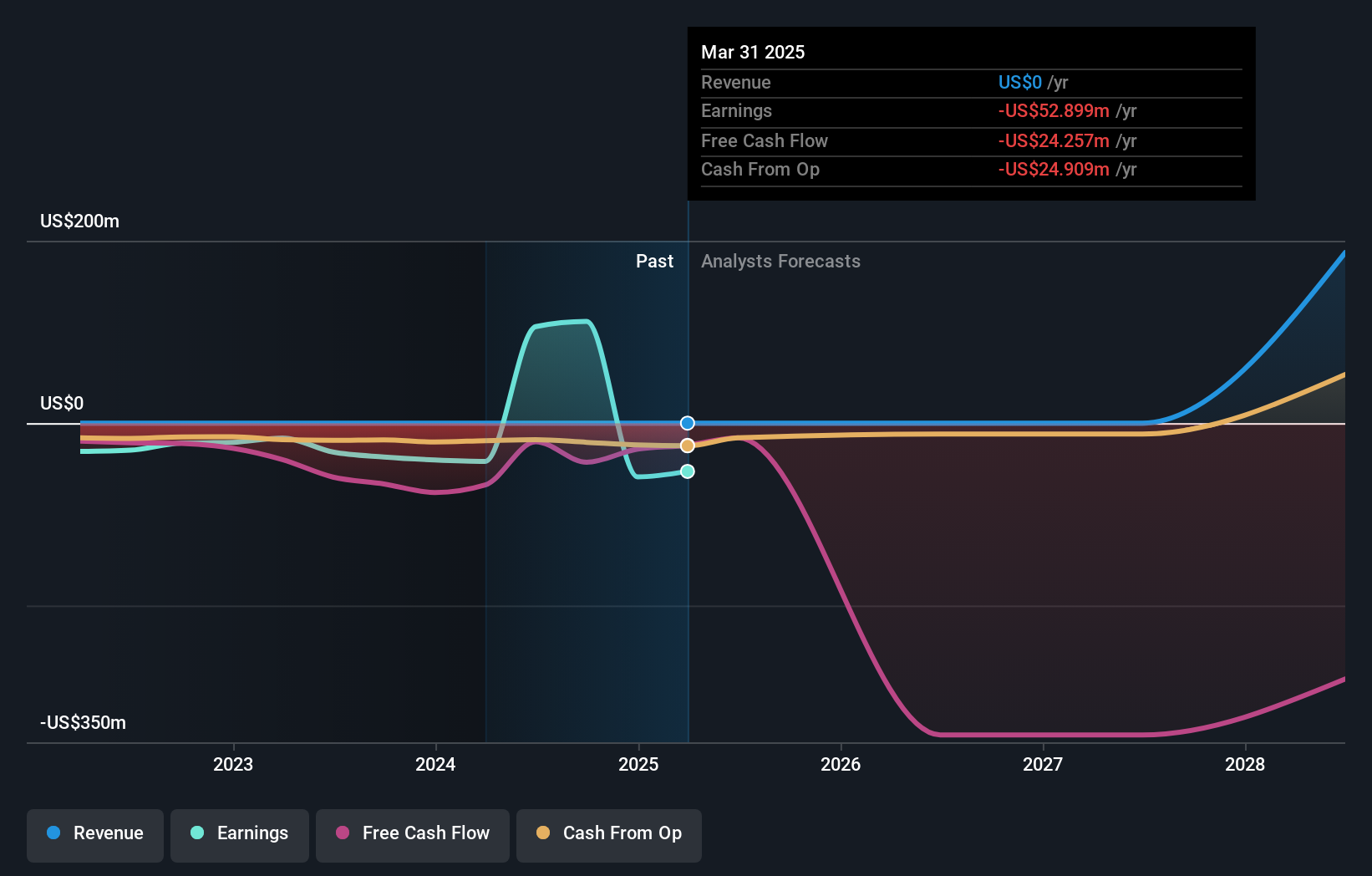

Operations: Standard Lithium Ltd. does not currently report any revenue from its operations, focusing instead on the exploration and development of lithium brine properties in the United States.

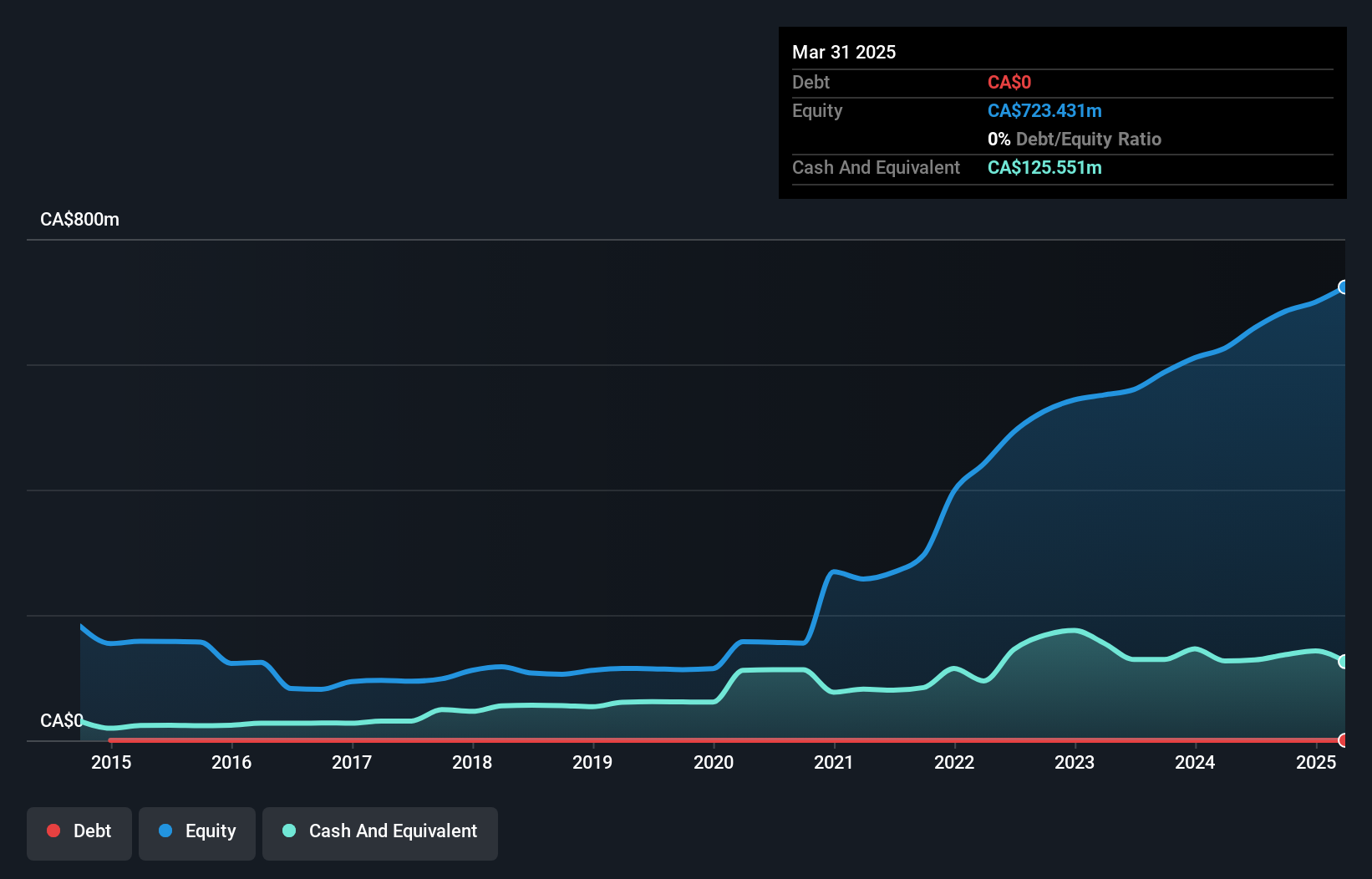

Standard Lithium, a nimble player in the lithium sector, has recently turned profitable with a net income of CAD 147.45 million for the full year ending June 2024, compared to a loss of CAD 41.99 million previously. Despite its volatile share price over the past three months and significant insider selling, this company is debt-free with a price-to-earnings ratio of 3x—substantially lower than the Canadian market average of 14.5x—indicating potential undervaluation. The recent USD$225 million award negotiation from the U.S. Department of Energy underscores its strategic role in critical minerals production through innovative Direct Lithium Extraction technology.

- Click here to discover the nuances of Standard Lithium with our detailed analytical health report.

Gain insights into Standard Lithium's past trends and performance with our Past report.

Make It Happen

- Click through to start exploring the rest of the 42 TSX Undiscovered Gems With Strong Fundamentals now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SLI

Standard Lithium

Explores for, develops, and processes lithium brine properties in the United States.

Flawless balance sheet moderate.