The Canadian market has experienced some recent pullback amid political uncertainty, yet it remains buoyed by strong economic growth and easing inflation. In such a landscape, identifying promising investment opportunities requires a focus on companies with solid financials and potential for long-term success. Penny stocks, despite their seemingly outdated label, represent an intriguing area for investors seeking growth at lower price points; when backed by robust fundamentals, they can offer significant upside potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.19 | CA$393.48M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$116.42M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.36 | CA$948.57M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.54 | CA$492.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.31 | CA$227.38M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.13 | CA$101.79M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$178.48M | ★★★★★☆ |

Click here to see the full list of 958 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Gatekeeper Systems (TSXV:GSI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gatekeeper Systems Inc. designs, manufactures, markets, and sells video security solutions for mobile and transportation environments focused on children, passengers, and public safety in Canada and the United States with a market cap of CA$55.29 million.

Operations: The company generates revenue of CA$37.81 million from its electronic security devices segment.

Market Cap: CA$55.29M

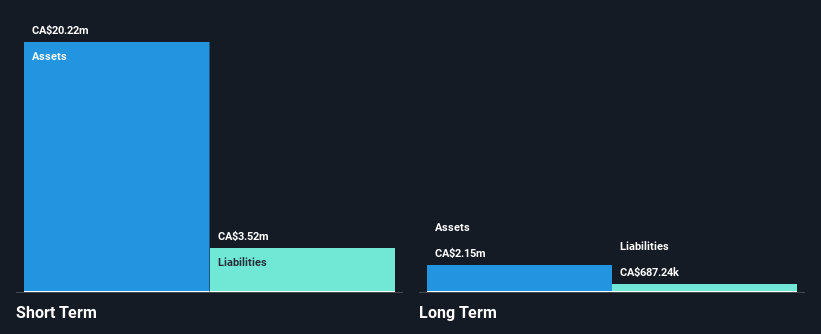

Gatekeeper Systems Inc., with a market cap of CA$55.29 million, has shown revenue growth to CA$37.81 million but experienced a decline in net income to CA$1.99 million for the fiscal year ended August 31, 2024. The company remains debt-free and has not diluted shareholders recently, indicating financial stability despite lower profit margins compared to last year. A significant contract with Lexington County School District One highlights its technological capabilities and market penetration in providing advanced video security solutions for school buses, which could enhance future business prospects despite recent negative earnings growth trends.

- Click to explore a detailed breakdown of our findings in Gatekeeper Systems' financial health report.

- Gain insights into Gatekeeper Systems' historical outcomes by reviewing our past performance report.

Nickel 28 Capital (TSXV:NKL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nickel 28 Capital Corp. is a base metals company with a market capitalization of CA$62.27 million.

Operations: Nickel 28 Capital Corp. has not reported any specific revenue segments.

Market Cap: CA$62.27M

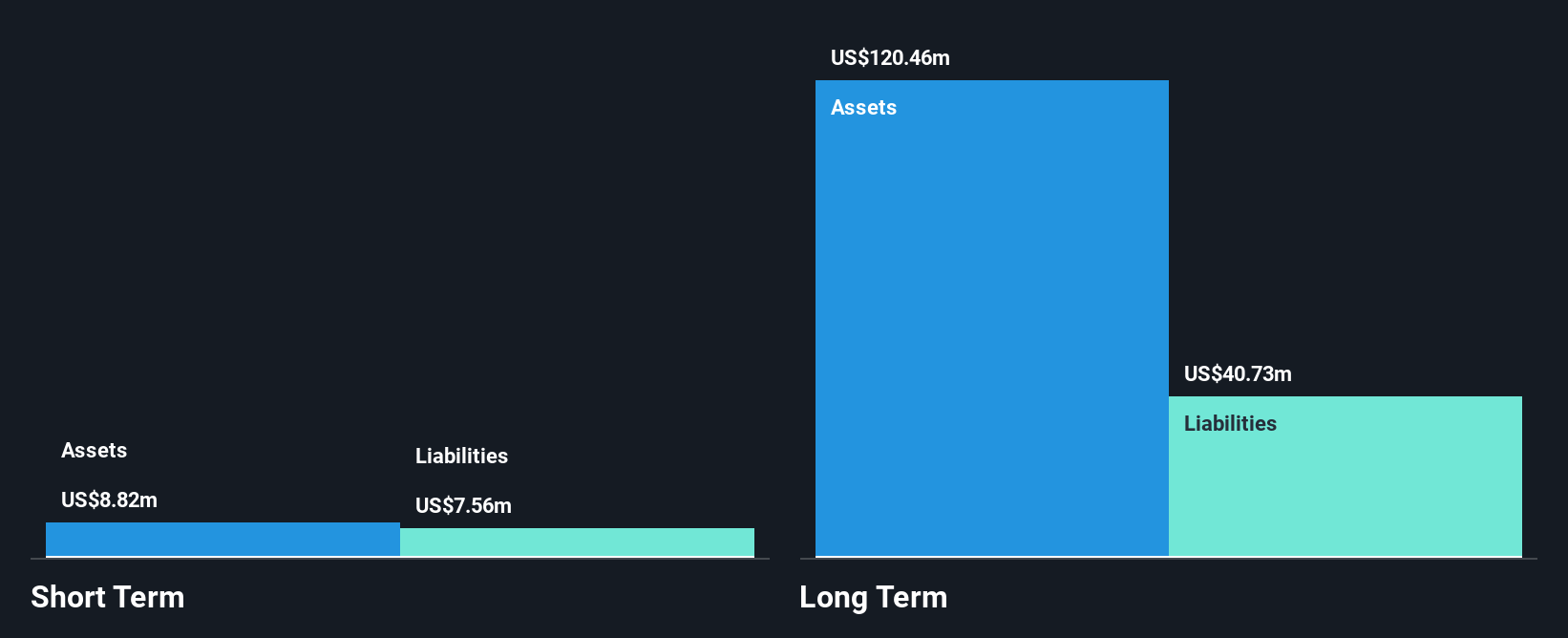

Nickel 28 Capital Corp., with a market cap of CA$62.27 million, is currently pre-revenue and unprofitable, facing challenges such as increased losses over the past five years. The company's short-term assets are insufficient to cover its liabilities, though its net debt to equity ratio is satisfactory at 33.1%. Recent executive changes aim to streamline operations following legal disputes involving former executives. Despite these hurdles, Nickel 28 reported improved earnings for the third quarter of 2024 and completed a share buyback program, reflecting efforts to stabilize its financial position amidst ongoing operational adjustments.

- Get an in-depth perspective on Nickel 28 Capital's performance by reading our balance sheet health report here.

- Gain insights into Nickel 28 Capital's past trends and performance with our report on the company's historical track record.

Zoomd Technologies (TSXV:ZOMD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zoomd Technologies Ltd. is a global marketing technology company that provides user-acquisition and engagement solutions, with a market cap of CA$85.84 million.

Operations: The company generates revenue of $46.95 million from its Internet Software & Services segment.

Market Cap: CA$85.84M

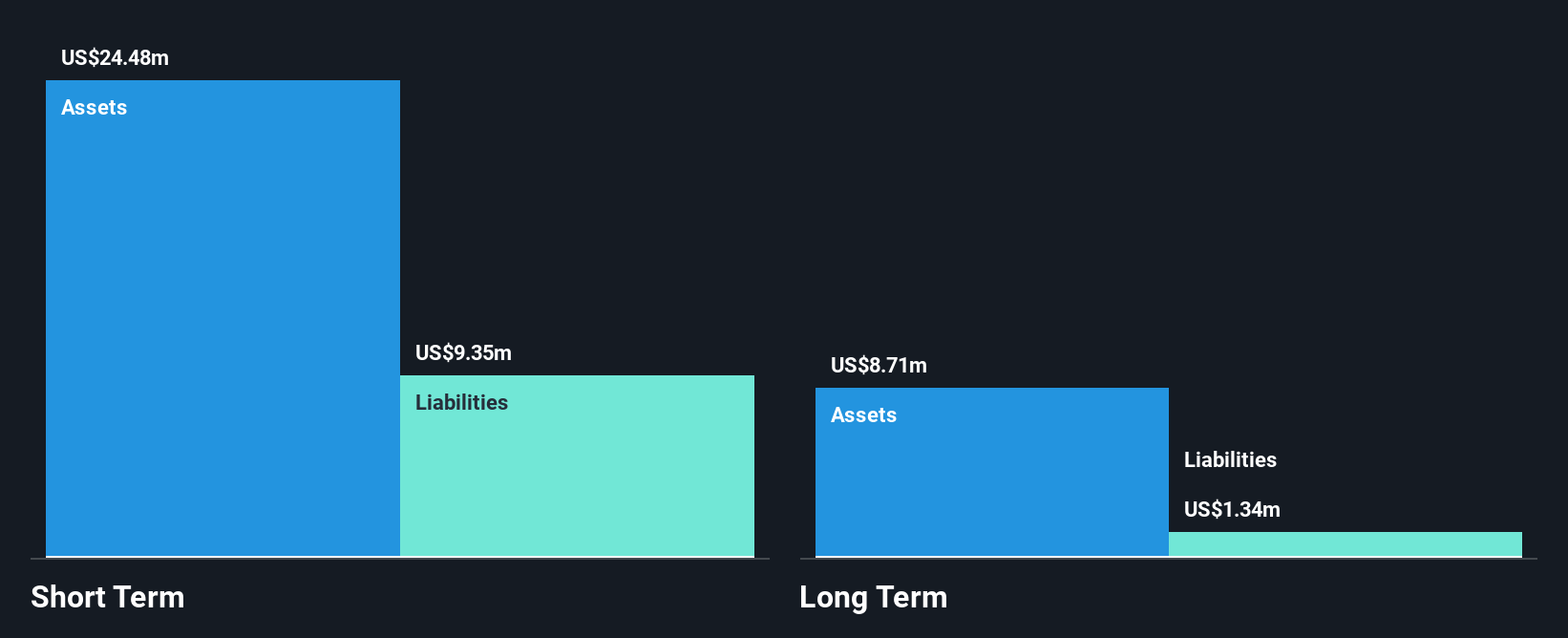

Zoomd Technologies Ltd., with a market cap of CA$85.84 million, has demonstrated significant financial improvement, reporting third-quarter sales of US$16.71 million and net income of US$3.16 million, marking a turnaround from previous losses. The company's profitability is supported by high-quality earnings and robust cash flow that comfortably covers its debt levels, while short-term assets exceed liabilities. Despite recent insider selling and share price volatility, Zoomd's return on equity is strong at 39.8%, indicating efficient management performance amidst industry challenges in the Internet Software & Services sector.

- Navigate through the intricacies of Zoomd Technologies with our comprehensive balance sheet health report here.

- Assess Zoomd Technologies' previous results with our detailed historical performance reports.

Key Takeaways

- Investigate our full lineup of 958 TSX Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GSI

Gatekeeper Systems

Designs, manufactures, markets, and sells video security solutions for mobile and transportation environment for children, passengers, and public safety in Canada and the United States.

Flawless balance sheet and good value.

Market Insights

Community Narratives