- Canada

- /

- Metals and Mining

- /

- TSXV:SCOT

3 TSX Penny Stocks With Market Caps Under CA$200M

Reviewed by Simply Wall St

The Canadian market has experienced a pullback recently, with the TSX index losing about 6.5% since its peak, amid political uncertainties and shifts in economic policies. Despite this volatility, long-term investors should remain focused on fundamentals and seek opportunities that align with their risk tolerance and investment goals. Penny stocks, often representing smaller or newer companies, continue to offer intriguing prospects for growth when supported by strong financials; they can be a worthwhile consideration for those looking to uncover hidden value in the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.19 | CA$393.48M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$116.42M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.36 | CA$948.57M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.54 | CA$492.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.31 | CA$227.38M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.83 | CA$178.48M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.88 | CA$115.72M | ★★★★☆☆ |

Click here to see the full list of 958 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Hercules Metals (TSXV:BIG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hercules Metals Corp. is a junior mining company focused on exploring and developing mineral properties in the United States, with a market cap of CA$139.20 million.

Operations: Hercules Metals Corp. currently does not report any revenue segments.

Market Cap: CA$139.2M

Hercules Metals Corp., with a market cap of CA$139.20 million, remains pre-revenue and unprofitable, facing increasing losses. Despite this, the company has no long-term liabilities and its short-term assets cover its short-term liabilities comfortably. Recent metallurgical advancements at their Hercules Project in Idaho show promise for improving silver recovery rates by over 20%, potentially enhancing project viability. However, shareholders experienced dilution with a 9.5% increase in shares outstanding last year. The board's average tenure is low at 2.9 years, suggesting limited experience amidst ongoing exploration efforts to unlock additional mineral resources.

- Dive into the specifics of Hercules Metals here with our thorough balance sheet health report.

- Gain insights into Hercules Metals' historical outcomes by reviewing our past performance report.

CopperCorp Resources (TSXV:CPER)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CopperCorp Resources Inc. focuses on the acquisition, exploration, and evaluation of mineral resources in Australia with a market capitalization of CA$13.33 million.

Operations: CopperCorp Resources Inc. does not report any specific revenue segments.

Market Cap: CA$13.33M

CopperCorp Resources Inc., with a market cap of CA$13.33 million, is pre-revenue and unprofitable but benefits from having no debt and sufficient cash runway for over a year. Its short-term assets significantly exceed liabilities, providing financial stability. Recent drilling at the Jukes prospect in Tasmania revealed promising copper-gold mineralization, including high-grade zones up to 4.2% Cu and 1.66g/t Au, indicating potential resource expansion opportunities. Despite these positive exploration results, the company faces challenges such as high share price volatility and an inexperienced board with an average tenure of just 1.3 years amidst ongoing exploration activities.

- Take a closer look at CopperCorp Resources' potential here in our financial health report.

- Gain insights into CopperCorp Resources' past trends and performance with our report on the company's historical track record.

Scottie Resources (TSXV:SCOT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Scottie Resources Corp. focuses on the identification, acquisition, exploration, and development of mineral properties in British Columbia, Canada with a market cap of CA$43.47 million.

Operations: Scottie Resources Corp. does not report any revenue segments as it is primarily engaged in the exploration and development of mineral properties in British Columbia, Canada.

Market Cap: CA$43.47M

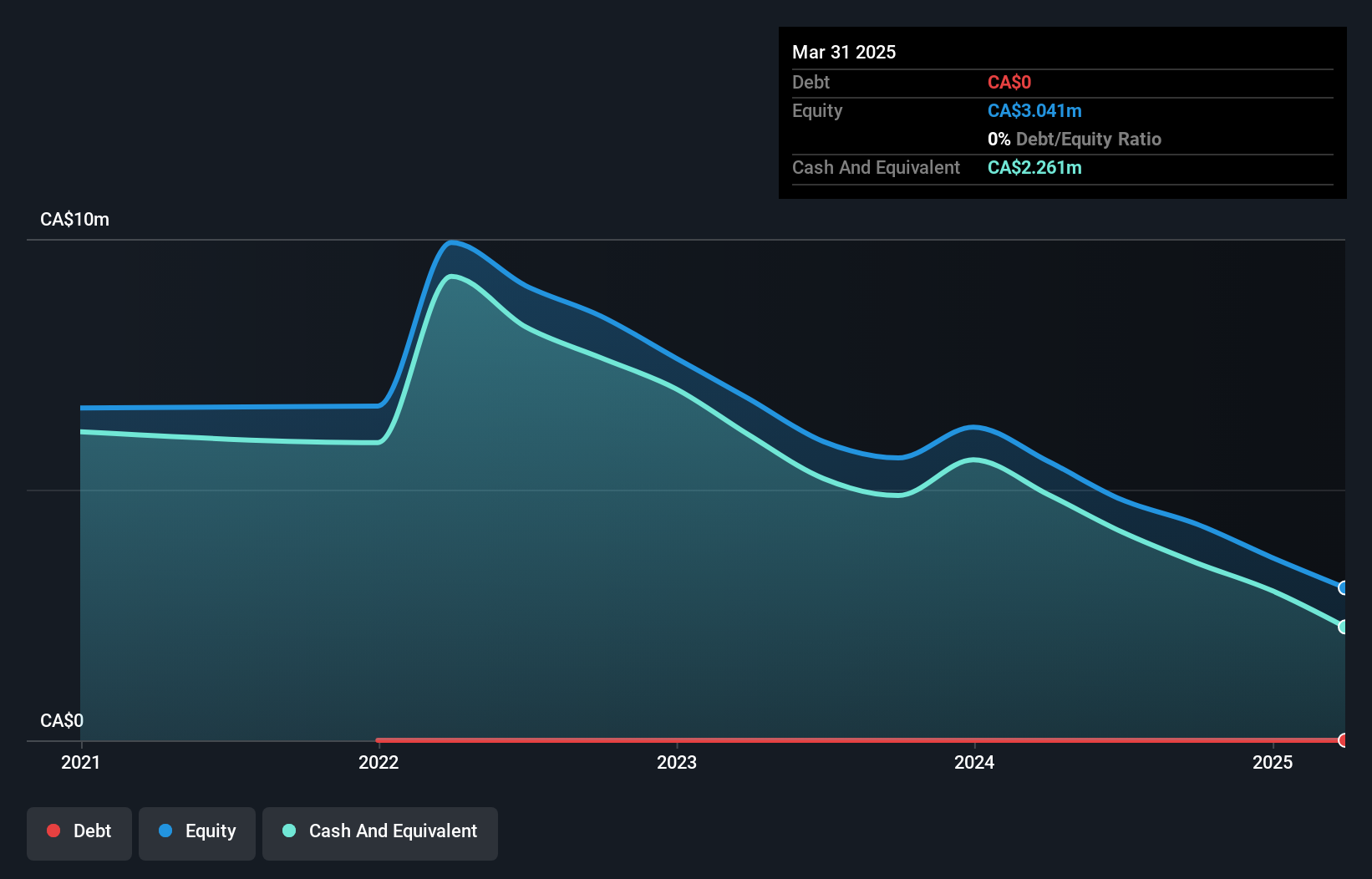

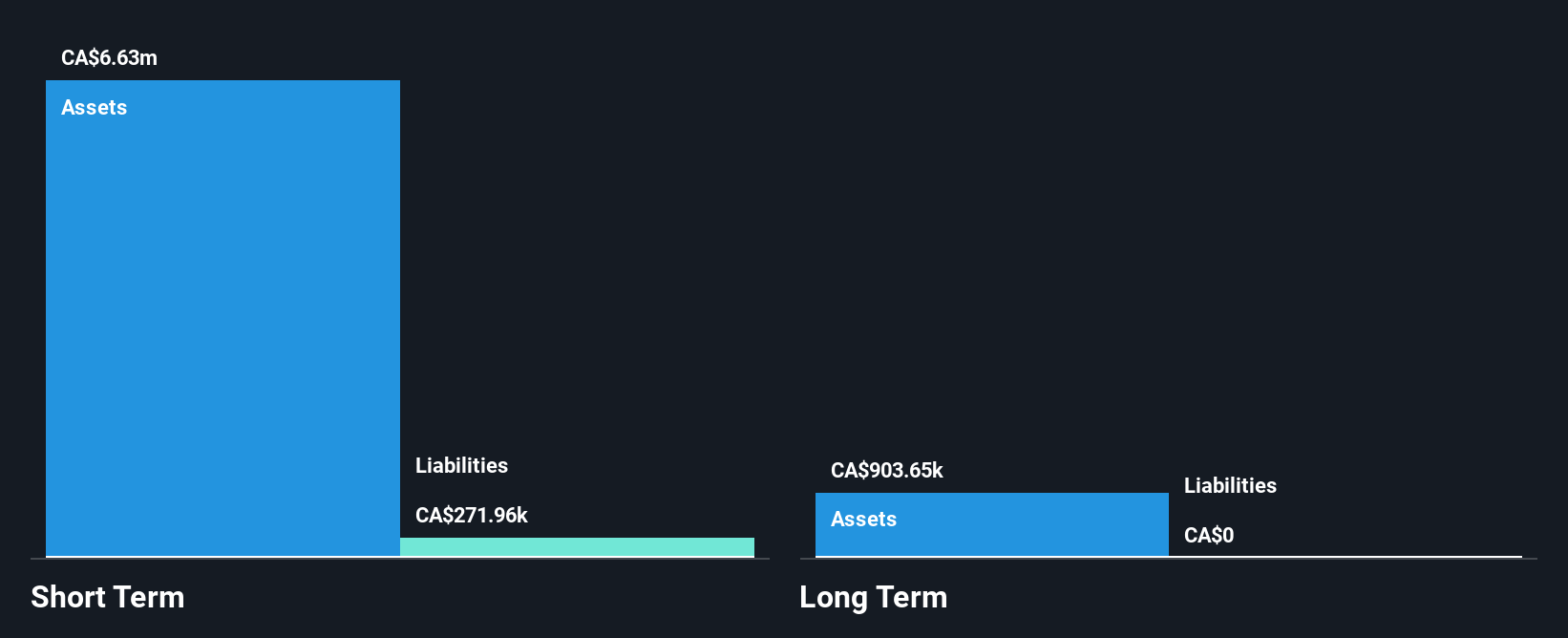

Scottie Resources Corp., with a market cap of CA$43.47 million, is pre-revenue and unprofitable but maintains financial stability with no debt and sufficient cash runway for over three years. The seasoned management team has overseen recent promising exploration results at the Scottie Gold Mine Project in British Columbia, including high-grade gold intercepts such as 37.6 g/t over 4.1 metres in the N Zone and new discoveries like the Wolf Zone. Despite these advancements, challenges include high share price volatility and shareholder dilution over the past year, reflecting typical risks associated with penny stocks in early-stage exploration phases.

- Get an in-depth perspective on Scottie Resources' performance by reading our balance sheet health report here.

- Explore historical data to track Scottie Resources' performance over time in our past results report.

Make It Happen

- Discover the full array of 958 TSX Penny Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SCOT

Scottie Resources

Engages in the identification, acquisition, exploration, and development of mineral properties in British Columbia, Canada.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)