- Canada

- /

- Metals and Mining

- /

- TSXV:FISH

Questerre Energy And 2 Other TSX Penny Stocks To Consider

Reviewed by Simply Wall St

While the recent backup in bond yields has impacted prices, it sets the stage for stronger performance ahead, with bonds potentially outpacing cash returns. In this context, penny stocks—often smaller or newer companies—can offer unique growth opportunities that larger firms might miss. Despite being an outdated term, these stocks remain relevant as they can provide value and growth potential when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.97 | CA$393.48M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.31 | CA$116.42M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.32 | CA$948.57M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.56 | CA$492.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.28 | CA$227.38M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.79 | CA$178.48M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.89 | CA$115.72M | ★★★★☆☆ |

Click here to see the full list of 958 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Questerre Energy (TSX:QEC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Questerre Energy Corporation is an energy technology and innovation company focused on acquiring, exploring, and developing non-conventional oil and gas projects in Canada, with a market cap of CA$98.56 million.

Operations: The company's revenue is primarily derived from its Oil & Gas - Exploration & Production segment, which generated CA$33.37 million.

Market Cap: CA$98.56M

Questerre Energy Corporation, with a market cap of CA$98.56 million, has been navigating challenges in the oil and gas sector. Despite being unprofitable, it has reduced losses over the past five years and maintains more cash than its total debt, reflecting prudent financial management. The recent quarterly revenue was CA$8.47 million, down from last year, with a net loss of CA$0.273 million. The company is engaged in legal proceedings regarding potential license revocation in Québec that could result in significant economic losses if unsuccessful. Its share price remains highly volatile but undiluted over the past year.

- Click here to discover the nuances of Questerre Energy with our detailed analytical financial health report.

- Gain insights into Questerre Energy's historical outcomes by reviewing our past performance report.

Sailfish Royalty (TSXV:FISH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sailfish Royalty Corp. focuses on acquiring precious metals royalty and streaming agreements, with a market cap of CA$96.70 million.

Operations: The company generates revenue primarily through its royalties and stream interests, amounting to $2.83 million.

Market Cap: CA$96.7M

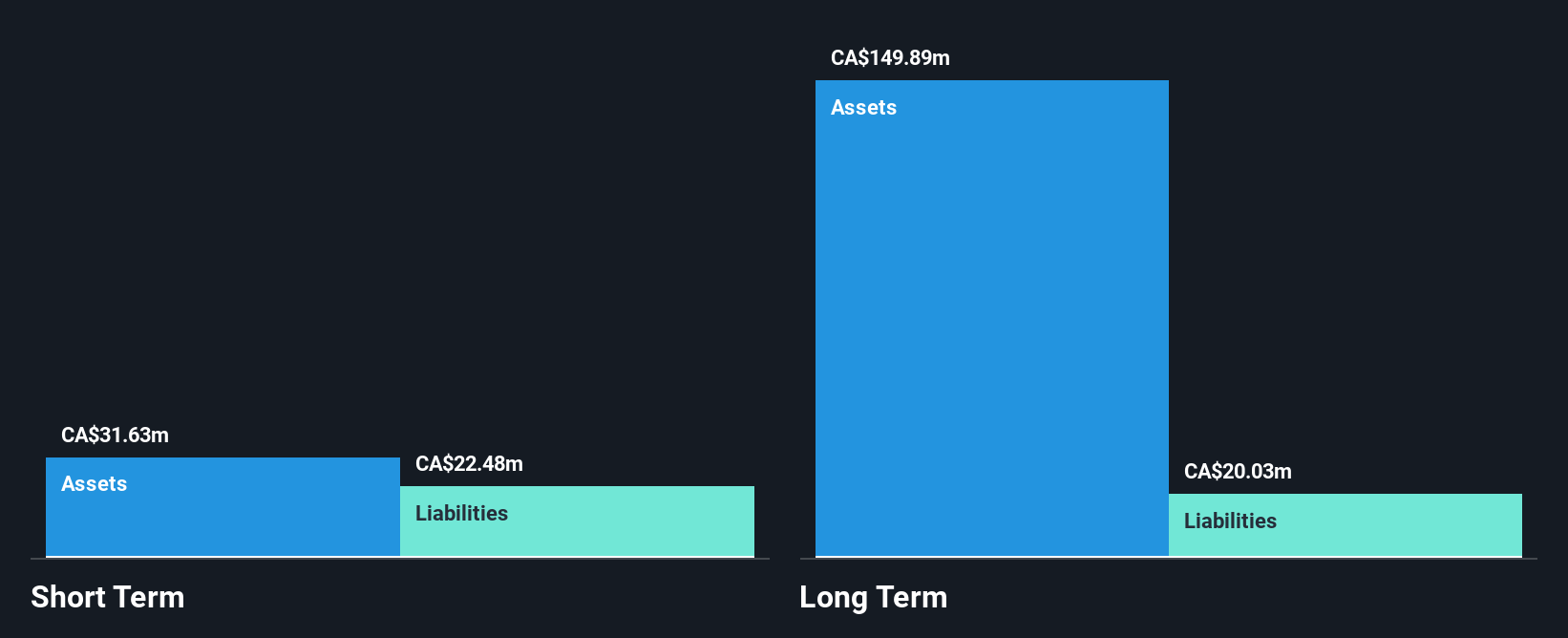

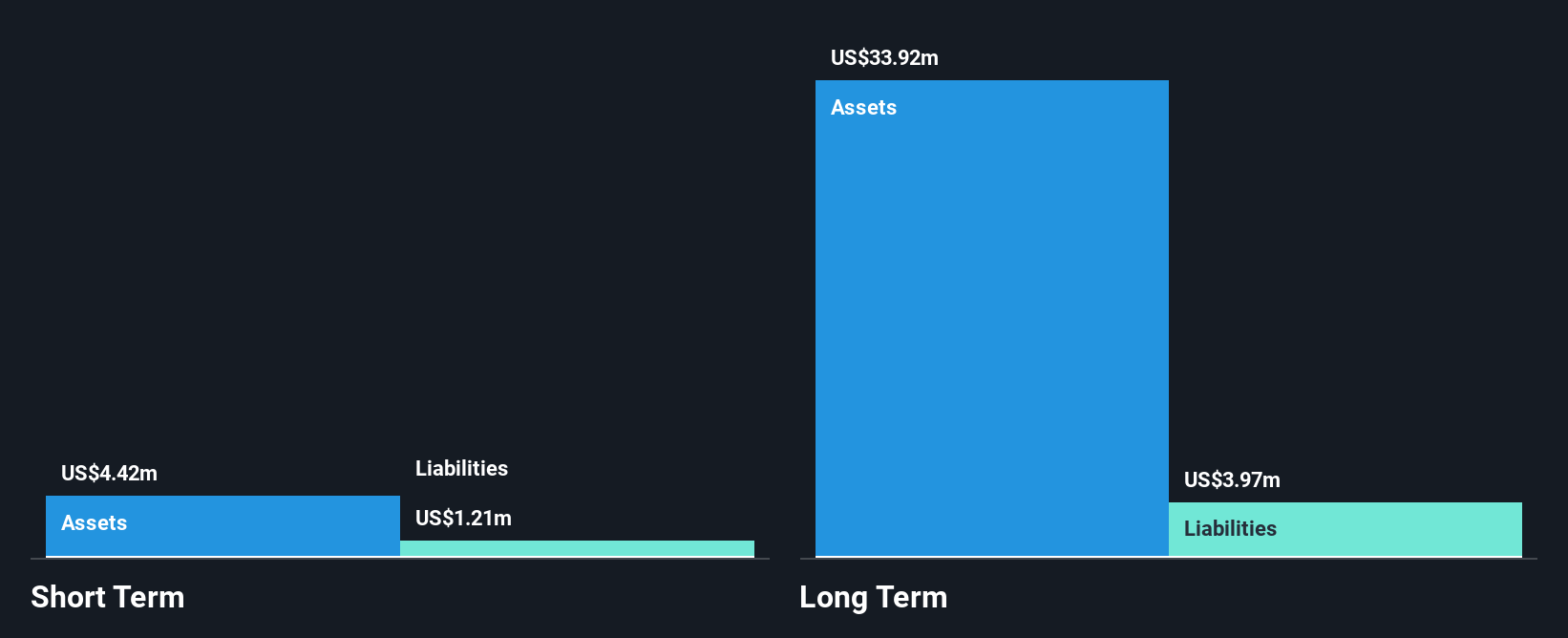

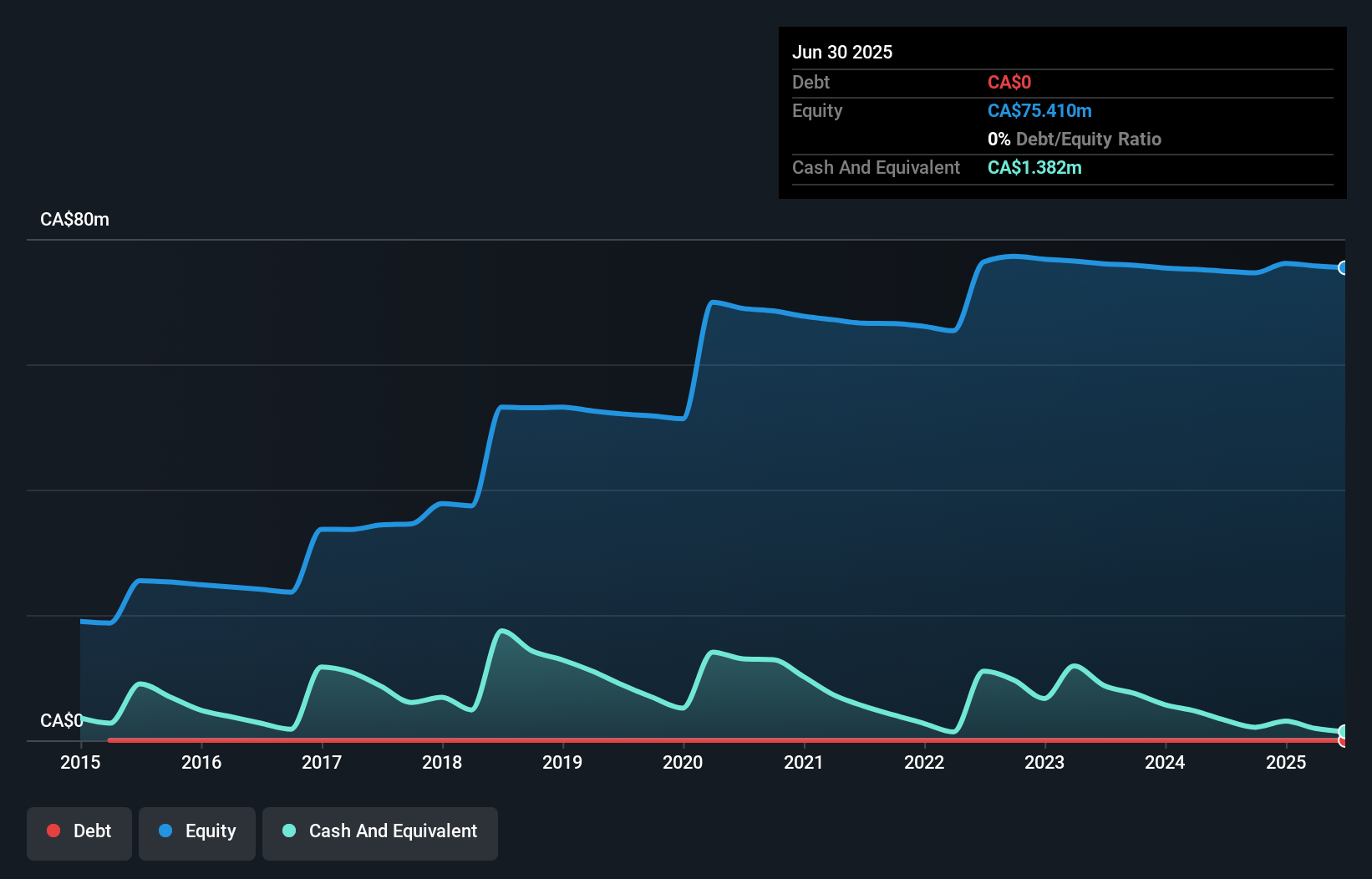

Sailfish Royalty Corp., with a market cap of CA$96.70 million, focuses on precious metals royalties and streaming agreements. The company has recently become profitable, reporting US$1.15 million in net income for the past nine months despite low revenue of US$2.11 million. Its short-term assets significantly exceed both short and long-term liabilities, indicating solid liquidity management. However, its return on equity is low at 3.9%, and earnings are forecast to decline by an average of 17.8% over the next three years, posing potential challenges ahead despite stable weekly volatility and no significant shareholder dilution recently.

- Click to explore a detailed breakdown of our findings in Sailfish Royalty's financial health report.

- Assess Sailfish Royalty's future earnings estimates with our detailed growth reports.

Tinka Resources (TSXV:TK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tinka Resources Limited is involved in the acquisition and exploration of base and precious metals mineral properties in Peru, with a market cap of CA$37.17 million.

Operations: Tinka Resources Limited does not report any revenue segments.

Market Cap: CA$37.17M

Tinka Resources, with a market cap of CA$37.17 million, operates in the exploration of base and precious metals in Peru and is currently pre-revenue. The company is debt-free and has recently raised capital to extend its cash runway beyond seven months. Its seasoned management team has focused on advancing the Ayawilca zinc-silver-tin project, which boasts robust economic fundamentals as per the 2024 Preliminary Economic Assessment. Recent geological reinterpretation at Ayawilca has enhanced resource confidence and identified promising new exploration targets, supported by strategic investments from major industry players like Buenaventura and Nexa Resources.

- Unlock comprehensive insights into our analysis of Tinka Resources stock in this financial health report.

- Review our historical performance report to gain insights into Tinka Resources' track record.

Key Takeaways

- Click this link to deep-dive into the 958 companies within our TSX Penny Stocks screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Sailfish Royalty, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:FISH

Sailfish Royalty

Engages in the acquisition of precious metals royalty and streaming agreements.

Adequate balance sheet slight.