3 TSX Stocks That May Be Undervalued Based On Current Market Estimates

Reviewed by Simply Wall St

As the Canadian market navigates a period of recovery, with the TSX showing resilience by being only 4% off its record high, investors are closely watching for tangible developments that could drive further gains. In this environment of cautious optimism and potential volatility, identifying undervalued stocks can offer opportunities for growth, particularly when these stocks demonstrate solid fundamentals and potential for long-term value appreciation.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Propel Holdings (TSX:PRL) | CA$27.63 | CA$45.42 | 39.2% |

| Computer Modelling Group (TSX:CMG) | CA$7.88 | CA$10.83 | 27.2% |

| Docebo (TSX:DCBO) | CA$43.48 | CA$77.86 | 44.2% |

| Savaria (TSX:SIS) | CA$17.45 | CA$31.01 | 43.7% |

| illumin Holdings (TSX:ILLM) | CA$1.89 | CA$3.19 | 40.8% |

| Lithium Royalty (TSX:LIRC) | CA$5.58 | CA$9.36 | 40.4% |

| First Majestic Silver (TSX:AG) | CA$8.14 | CA$10.65 | 23.5% |

| AtkinsRéalis Group (TSX:ATRL) | CA$70.00 | CA$112.91 | 38% |

| Tidewater Midstream and Infrastructure (TSX:TWM) | CA$0.275 | CA$0.37 | 24.9% |

| CAE (TSX:CAE) | CA$34.72 | CA$64.76 | 46.4% |

Underneath we present a selection of stocks filtered out by our screen.

First Majestic Silver (TSX:AG)

Overview: First Majestic Silver Corp. focuses on the acquisition, exploration, development, and production of mineral properties in North America and has a market cap of approximately CA$4.17 billion.

Operations: The company's revenue is primarily derived from its operations in Mexico, with SAN Dimas generating $198.19 million, Santa Elena contributing $288.20 million, and La Encantada adding $65.34 million; in the United States, First Mint and Jerritt Canyon contribute $16 million and $4 million respectively.

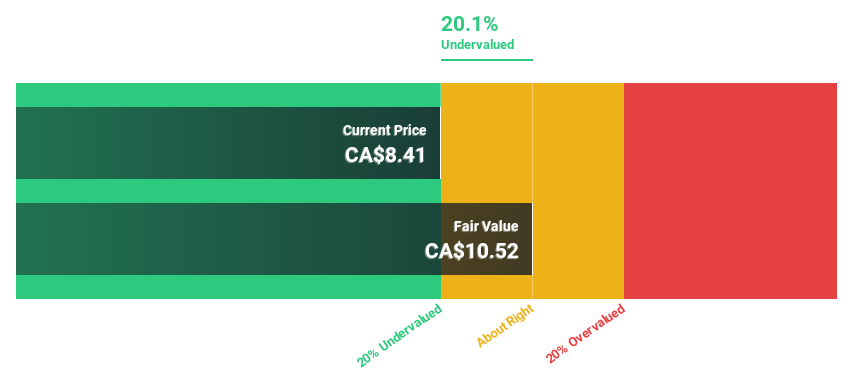

Estimated Discount To Fair Value: 23.5%

First Majestic Silver is trading at CA$8.14, below its estimated fair value of CA$10.65, indicating potential undervaluation based on discounted cash flow analysis. Despite a past year of shareholder dilution and net losses, the company anticipates becoming profitable within three years with revenue growth projected at 26.7% annually, outpacing the Canadian market average. Recent production increases and strategic acquisitions bolster its growth outlook amidst ongoing operational challenges.

- The growth report we've compiled suggests that First Majestic Silver's future prospects could be on the up.

- Take a closer look at First Majestic Silver's balance sheet health here in our report.

Docebo (TSX:DCBO)

Overview: Docebo Inc. develops and provides a learning management platform for training in North America and internationally, with a market cap of CA$1.31 billion.

Operations: The company's revenue segment is primarily derived from educational software, totaling $216.93 million.

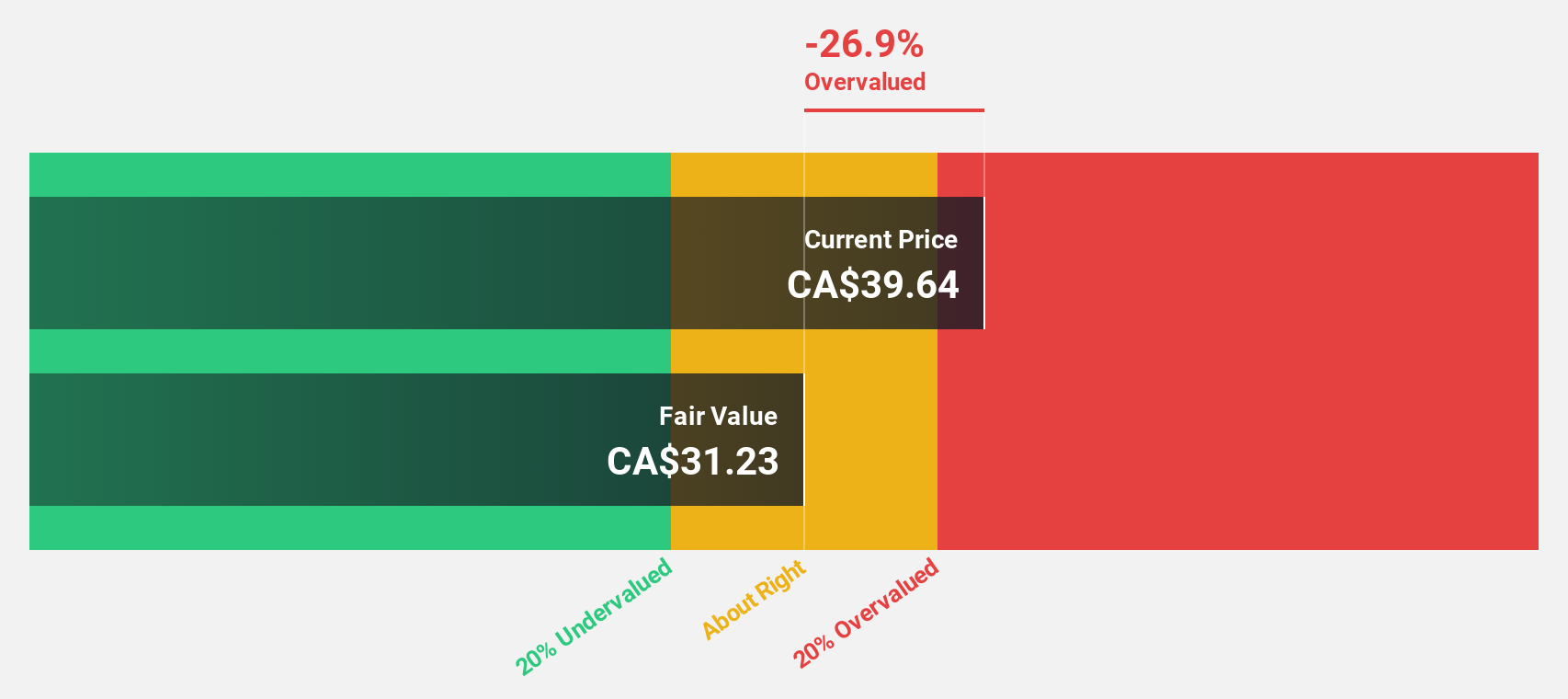

Estimated Discount To Fair Value: 44.2%

Docebo, trading at CA$43.48, is significantly undervalued relative to its estimated fair value of CA$77.86, based on discounted cash flow analysis. The company reported substantial earnings growth last year and forecasts continued annual profit growth of over 20%, surpassing the Canadian market average. Recent product innovations in AI-driven corporate learning and strategic executive appointments further enhance Docebo’s potential for robust future performance despite slower revenue growth projections compared to earnings.

- Our earnings growth report unveils the potential for significant increases in Docebo's future results.

- Unlock comprehensive insights into our analysis of Docebo stock in this financial health report.

Kraken Robotics (TSXV:PNG)

Overview: Kraken Robotics Inc. is a marine technology company that designs, manufactures, and sells sonar and optical sensors, batteries, and underwater robotic equipment for unmanned underwater vehicles used in military and commercial applications globally, with a market cap of CA$646.43 million.

Operations: The company's revenue is derived from two primary segments: Products, generating CA$67.40 million, and Services, contributing CA$23.79 million.

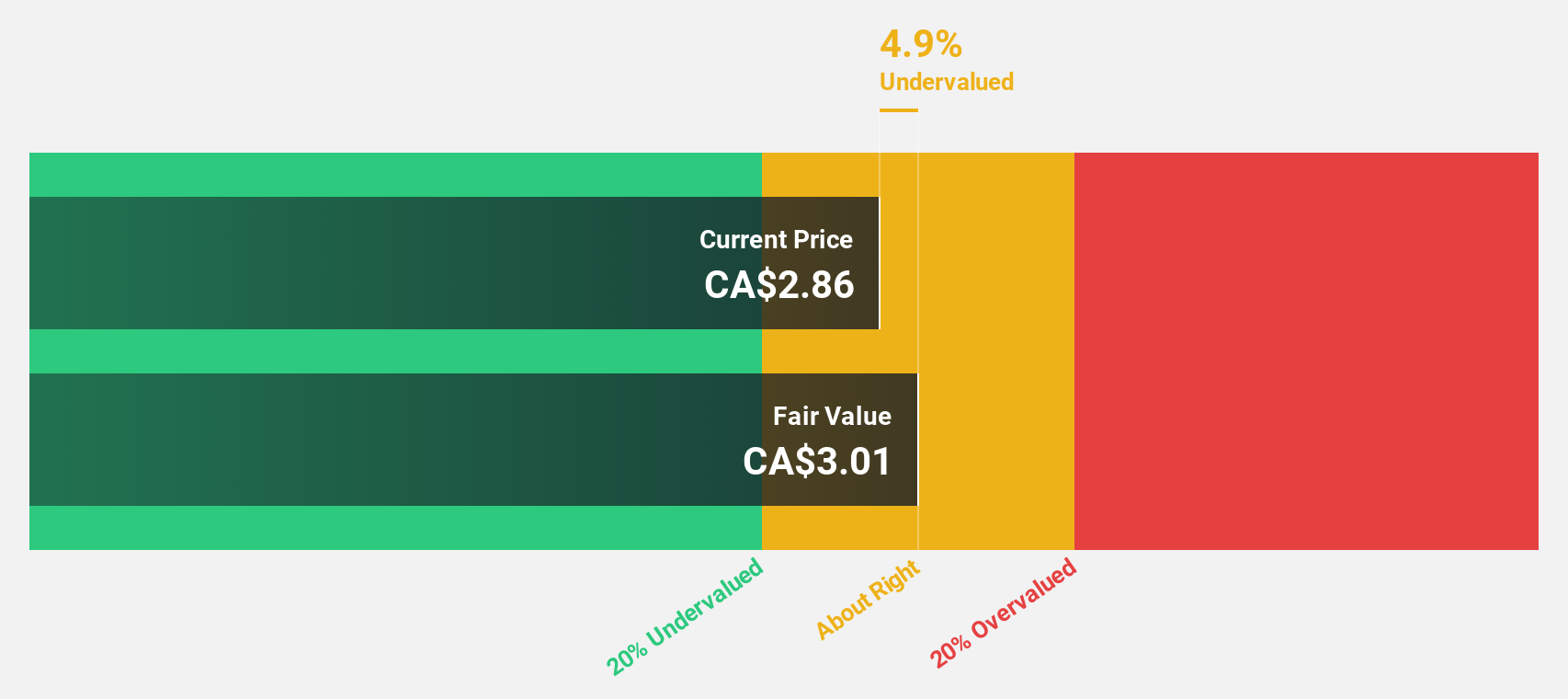

Estimated Discount To Fair Value: 18%

Kraken Robotics, trading at CA$2.48, is undervalued compared to its fair value estimate of CA$3.03 based on discounted cash flow analysis. The company anticipates substantial revenue growth between $120 million and $135 million for 2025, driven by increased demand in the defense sector and expansion plans in Nova Scotia. However, shareholders experienced dilution over the past year. Kraken's subsea power business is poised for growth with new battery orders totaling $45 million year-to-date.

- Our expertly prepared growth report on Kraken Robotics implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Kraken Robotics' balance sheet health report.

Seize The Opportunity

- Dive into all 16 of the Undervalued TSX Stocks Based On Cash Flows we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DCBO

Docebo

Develops and provides a learning management platform for training in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives