- Canada

- /

- Oil and Gas

- /

- TSXV:CEI

3 TSX Penny Stocks With Market Caps Over CA$20M

Reviewed by Simply Wall St

The Canadian stock market has recently experienced some volatility, with the TSX index pulling back amid political uncertainties and shifts in economic policies. Despite these fluctuations, investors continue to seek opportunities that align with strong economic fundamentals and growth potential. Penny stocks, often representing smaller or newer companies, remain an intriguing area for exploration; when supported by robust financial health, they can offer unique growth prospects even amidst broader market challenges.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Mandalay Resources (TSX:MND) | CA$4.19 | CA$393.48M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.445 | CA$12.75M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$116.52M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.36 | CA$948.57M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.54 | CA$492.49M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.31 | CA$227.38M | ★★★★★☆ |

| Vox Royalty (TSX:VOXR) | CA$3.31 | CA$167.46M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.25 | CA$33.58M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$1.88 | CA$115.72M | ★★★★☆☆ |

Click here to see the full list of 956 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Coelacanth Energy (TSXV:CEI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Coelacanth Energy Inc. is an oil and natural gas company focused on the acquisition, development, exploration, and production of reserves in northeastern British Columbia, Canada, with a market cap of CA$413.61 million.

Operations: The company's revenue is derived entirely from its oil and gas exploration and production activities, amounting to CA$10.65 million.

Market Cap: CA$413.61M

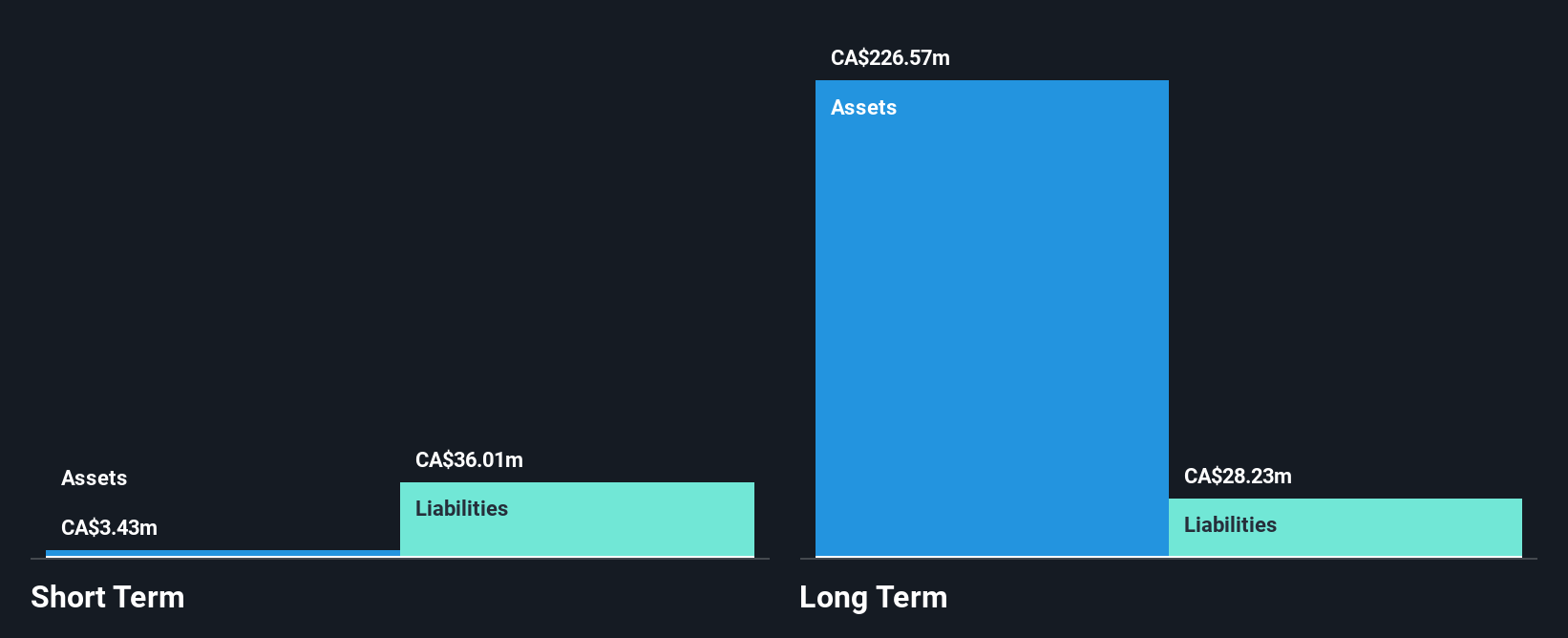

Coelacanth Energy Inc. recently completed and tested four additional wells at its Two Rivers East Project, showing promising production rates that exceeded expectations. Despite this operational success, the company remains unprofitable with a net loss of CA$2.46 million in the third quarter of 2024, although revenue has grown significantly to CA$1.98 million from CA$0.527 million a year ago. The company is debt-free and maintains short-term assets exceeding liabilities, but it has less than a year of cash runway based on current free cash flow trends. Analysts generally expect the stock price to rise significantly from current levels.

- Jump into the full analysis health report here for a deeper understanding of Coelacanth Energy.

- Gain insights into Coelacanth Energy's historical outcomes by reviewing our past performance report.

C-Com Satellite Systems (TSXV:CMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: C-Com Satellite Systems Inc. develops and deploys mobile auto-deploying satellite-based technology for high-speed Internet, VoIP, and video services across various regions globally, with a market cap of CA$51.55 million.

Operations: The company's revenue primarily comes from the design and manufacture of auto-deploying mobile satellite antennas, generating CA$10.34 million.

Market Cap: CA$51.55M

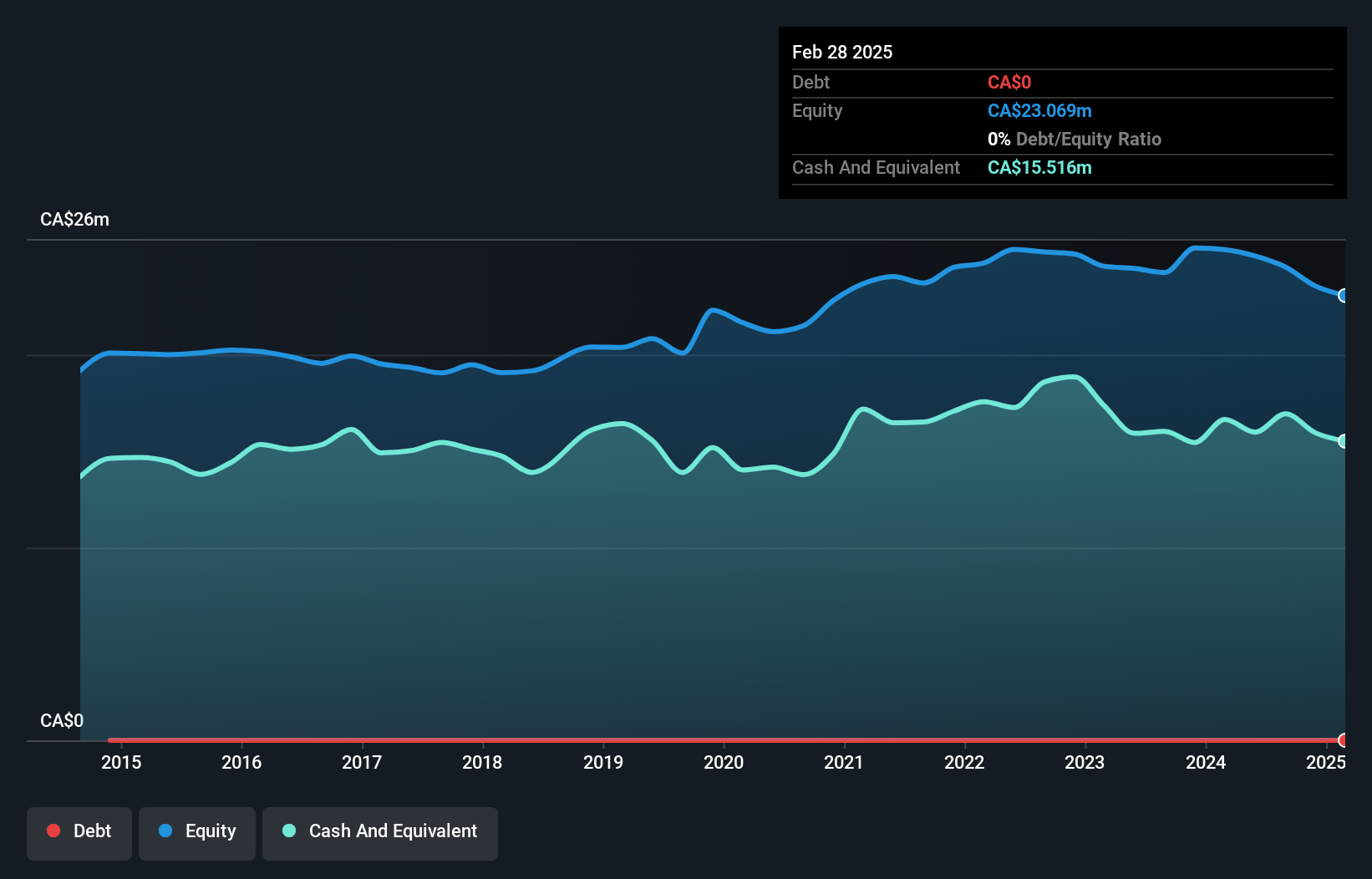

C-Com Satellite Systems Inc. has demonstrated financial stability with short-term assets of CA$25.6 million exceeding both its short and long-term liabilities, and it remains debt-free. The company reported a net income of CA$0.33 million for the first nine months of 2024, marking a shift to profitability despite a historical decline in earnings over the past five years. Its recent quarterly sales increased to CA$1.32 million from CA$1.22 million year-over-year, although Return on Equity remains low at 8.1%. The dividend yield is not fully covered by earnings, indicating potential sustainability concerns despite consistent payouts.

- Get an in-depth perspective on C-Com Satellite Systems' performance by reading our balance sheet health report here.

- Explore historical data to track C-Com Satellite Systems' performance over time in our past results report.

Forum Energy Metals (TSXV:FMC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Forum Energy Metals Corp. is involved in the evaluation, acquisition, exploration, and development of natural resource properties in Canada and the United States with a market cap of CA$20.62 million.

Operations: Forum Energy Metals Corp. does not report any revenue segments.

Market Cap: CA$20.62M

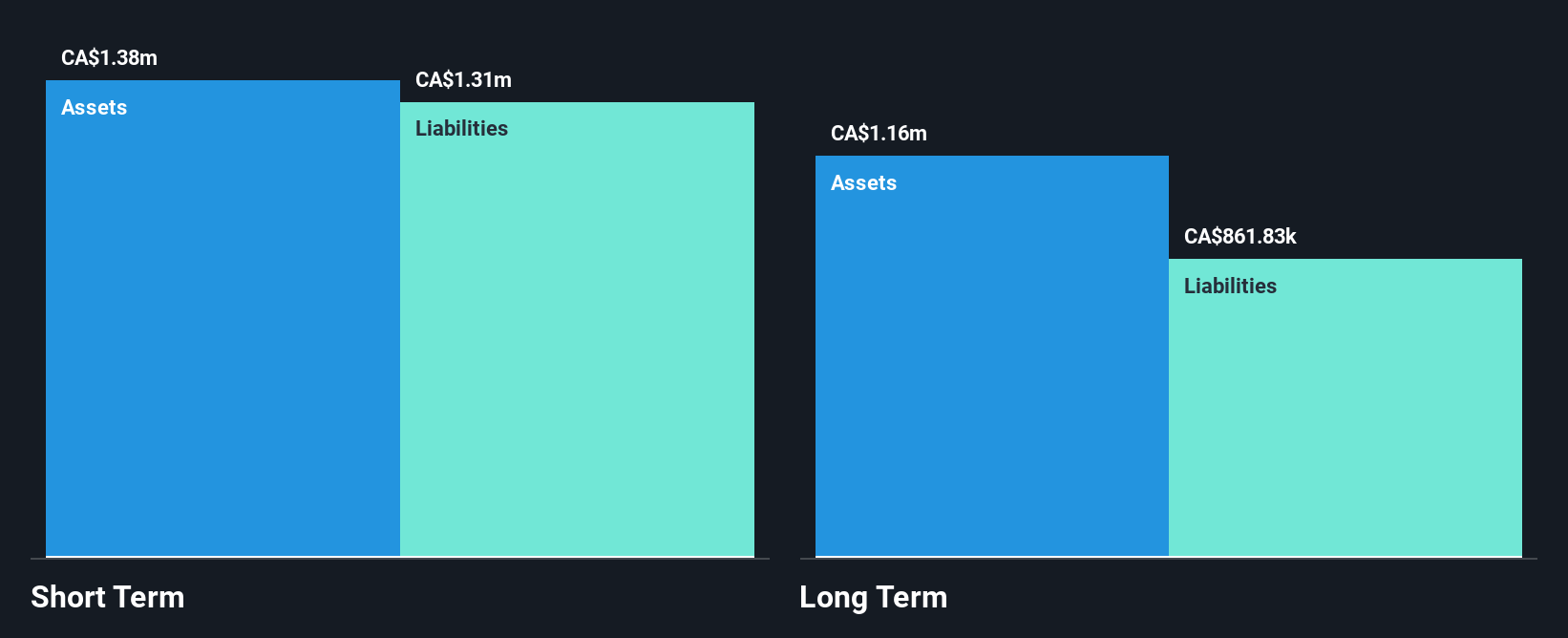

Forum Energy Metals Corp., with a market cap of CA$20.62 million, remains pre-revenue and unprofitable, having reported increased losses over the past five years. The company has recently raised CA$1.25 million through a private placement to support its exploration activities, notably at the Aberdeen Uranium Project where it aims to develop a maiden resource following promising drill results. Despite shareholder dilution and high share price volatility, Forum is debt-free with short-term assets exceeding liabilities, providing some financial stability. The seasoned board brings significant experience as the company navigates its strategic exploration initiatives in Canada and the U.S.

- Click here and access our complete financial health analysis report to understand the dynamics of Forum Energy Metals.

- Understand Forum Energy Metals' track record by examining our performance history report.

Next Steps

- Access the full spectrum of 956 TSX Penny Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CEI

Coelacanth Energy

An oil and natural gas company, engages in the acquisition, development, exploration, and production of oil and natural gas reserves in northeastern British Columbia, Canada.

Slightly overvalued with limited growth.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)