- Canada

- /

- Communications

- /

- TSX:STC

More Unpleasant Surprises Could Be In Store For Sangoma Technologies Corporation's (TSE:STC) Shares After Tumbling 27%

Sangoma Technologies Corporation (TSE:STC) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Looking at the bigger picture, even after this poor month the stock is up 52% in the last year.

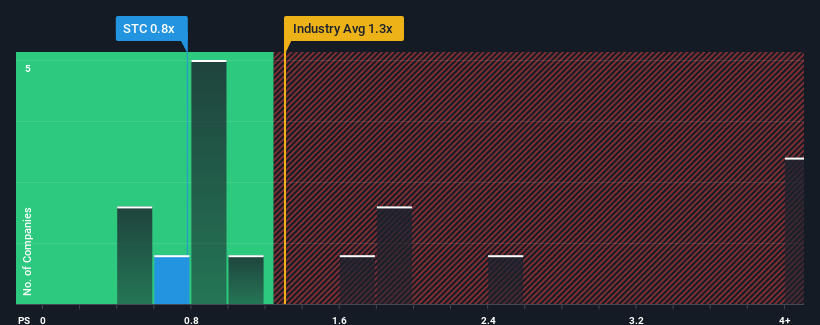

Even after such a large drop in price, it's still not a stretch to say that Sangoma Technologies' price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" compared to the Communications industry in Canada, where the median P/S ratio is around 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Sangoma Technologies

What Does Sangoma Technologies' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Sangoma Technologies' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Sangoma Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Sangoma Technologies?

Sangoma Technologies' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.2%. Still, the latest three year period has seen an excellent 32% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 0.3% during the coming year according to the five analysts following the company. Meanwhile, the broader industry is forecast to expand by 3.1%, which paints a poor picture.

In light of this, it's somewhat alarming that Sangoma Technologies' P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What We Can Learn From Sangoma Technologies' P/S?

Sangoma Technologies' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our check of Sangoma Technologies' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Sangoma Technologies that you need to be mindful of.

If these risks are making you reconsider your opinion on Sangoma Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:STC

Sangoma Technologies

Develops, manufactures, distributes, and supports voice and data connectivity components for software-based communication applications in the United States of America and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)