As global markets continue to react to political developments and economic indicators, U.S. stocks have been buoyed by optimism surrounding potential trade deals and advancements in artificial intelligence, with major indices like the S&P 500 reaching new highs. In this environment of heightened enthusiasm for technology-driven growth, identifying promising stocks involves looking at companies that are well-positioned to capitalize on emerging trends such as AI infrastructure investments and those demonstrating resilience amid shifting geopolitical landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1226 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Shanghai OPM Biosciences (SHSE:688293)

Simply Wall St Growth Rating: ★★★★★☆

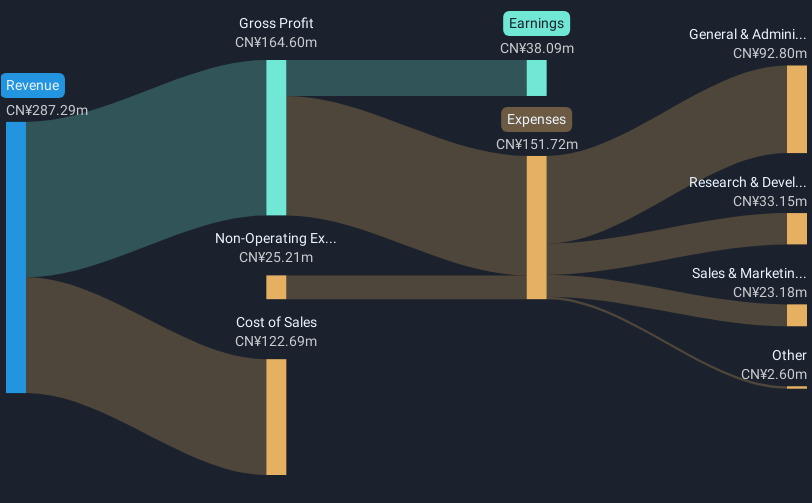

Overview: Shanghai OPM Biosciences Co., Ltd. operates in the biotechnology sector, offering cell culture media and CDMO services both within China and globally, with a market capitalization of CN¥4.45 billion.

Operations: The company focuses on the production and distribution of cell culture media and provides contract development and manufacturing organization (CDMO) services. Its revenue is primarily derived from these two segments, catering to both domestic and international markets.

Shanghai OPM Biosciences, amid a challenging market, is navigating with promising financial dynamics. The company's revenue is expected to grow at an annual rate of 36.6%, outpacing the Chinese market average of 13.4%. Despite a recent dip in profit margins from 26.9% to 13.3%, earnings are projected to surge by 60% annually, significantly above the national growth rate of 25.1%. This robust financial outlook is shadowed by recent events including its removal from the S&P Global BMI Index and a notable one-off gain of CN¥9.5M affecting its latest financial results, which investors should consider while assessing its future trajectory in biotech innovation and market adaptation.

- Get an in-depth perspective on Shanghai OPM Biosciences' performance by reading our health report here.

Evaluate Shanghai OPM Biosciences' historical performance by accessing our past performance report.

Softchoice (TSX:SFTC)

Simply Wall St Growth Rating: ★★★★☆☆

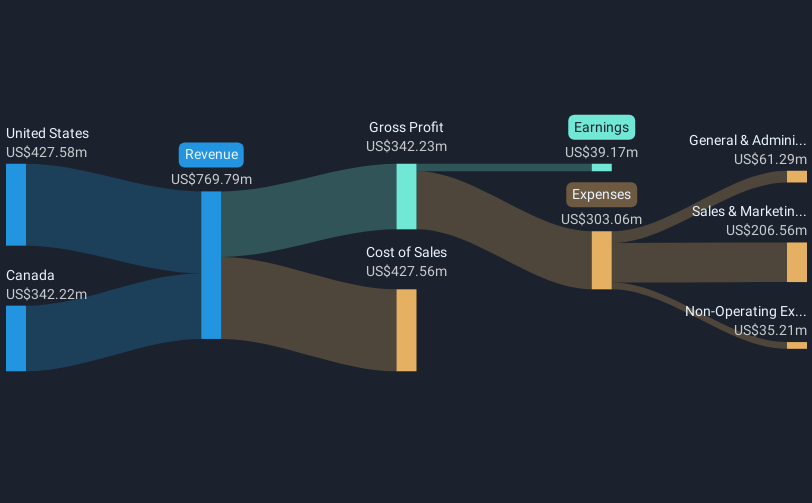

Overview: Softchoice Corporation operates by designing, procuring, implementing, and managing IT solutions across Canada and the United States, with a market capitalization of CA$1.47 billion.

Operations: Softchoice generates revenue primarily through its Direct Marketing segment, which accounts for $769.79 million. The company focuses on providing comprehensive IT solutions in Canada and the United States.

Amidst a dynamic tech landscape, Softchoice's strategic maneuvers underscore its adaptability and potential for sustained growth. The company's revenue is poised to grow at 4.9% annually, slightly outpacing the Canadian market average of 4.7%. This growth trajectory is further complemented by an impressive projected annual earnings increase of 25.4%, significantly above the broader market's 15.7%. Notably, Softchoice has entered into a definitive agreement to be acquired by World Wide Technology for CAD 1.8 billion, a move that will see it delisted from the TSX post-transaction completion expected in early Q2 2025. This acquisition highlights not only its current valuation but also the strategic interest in its operational model and market position within the tech sector.

- Click here and access our complete health analysis report to understand the dynamics of Softchoice.

Understand Softchoice's track record by examining our Past report.

Sangoma Technologies (TSX:STC)

Simply Wall St Growth Rating: ★★★★☆☆

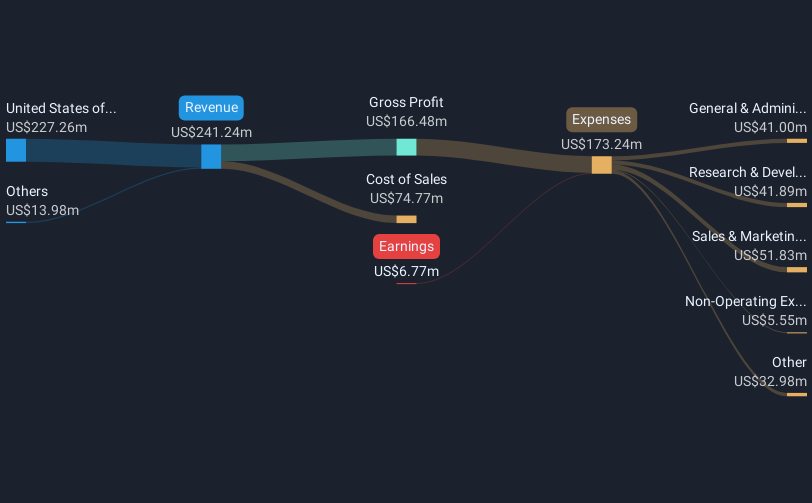

Overview: Sangoma Technologies Corporation, along with its subsidiaries, is involved in the development, manufacturing, distribution, and support of voice and data connectivity components for software-based communication applications both in the United States and internationally, with a market capitalization of CA$369.91 million.

Operations: The company generates revenue primarily from voice and data connectivity components, amounting to $244.41 million. The business focuses on software-based communication applications across various regions, including the United States and international markets.

Sangoma Technologies is making significant strides in the healthcare sector by partnering with Sphinx Medical Technologies to launch a new Patient Relationship Management system, enhancing communication between doctors and patients. This collaboration integrates Sangoma's unified communications platform with Sphinx's AI-driven CallMyDoc®, offering features like real-time access to patient records and multilingual support, which are crucial for improving operational efficiency and patient care. With an expected revenue growth of 6.1% annually, Sangoma is not only expanding its technological footprint but also aligning its growth with innovative solutions that meet critical healthcare needs, positioning it well within the high-growth tech landscape despite recent financial challenges indicated by a net loss of $1.91 million in Q1 2025.

- Take a closer look at Sangoma Technologies' potential here in our health report.

Gain insights into Sangoma Technologies' past trends and performance with our Past report.

Turning Ideas Into Actions

- Explore the 1226 names from our High Growth Tech and AI Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SFTC

Softchoice

Designs, procures, implements, and manages information technology (IT) solutions in Canada and the United States.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)