- Canada

- /

- Communications

- /

- TSX:ET

Top TSX Dividend Stocks To Consider In November 2024

Reviewed by Simply Wall St

As the Canadian economy shows signs of slowing, with a cooling labor market and anticipated rate cuts from the Bank of Canada, investors are eyeing dividend stocks for their potential stability and income generation. In this environment, selecting dividend stocks that offer consistent payouts and have strong fundamentals can be a strategic move to navigate market volatility while benefiting from potential long-term growth.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.00% | ★★★★★★ |

| Acadian Timber (TSX:ADN) | 6.52% | ★★★★★★ |

| Labrador Iron Ore Royalty (TSX:LIF) | 8.30% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.99% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.23% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.51% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.78% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.41% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.33% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.05% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top TSX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

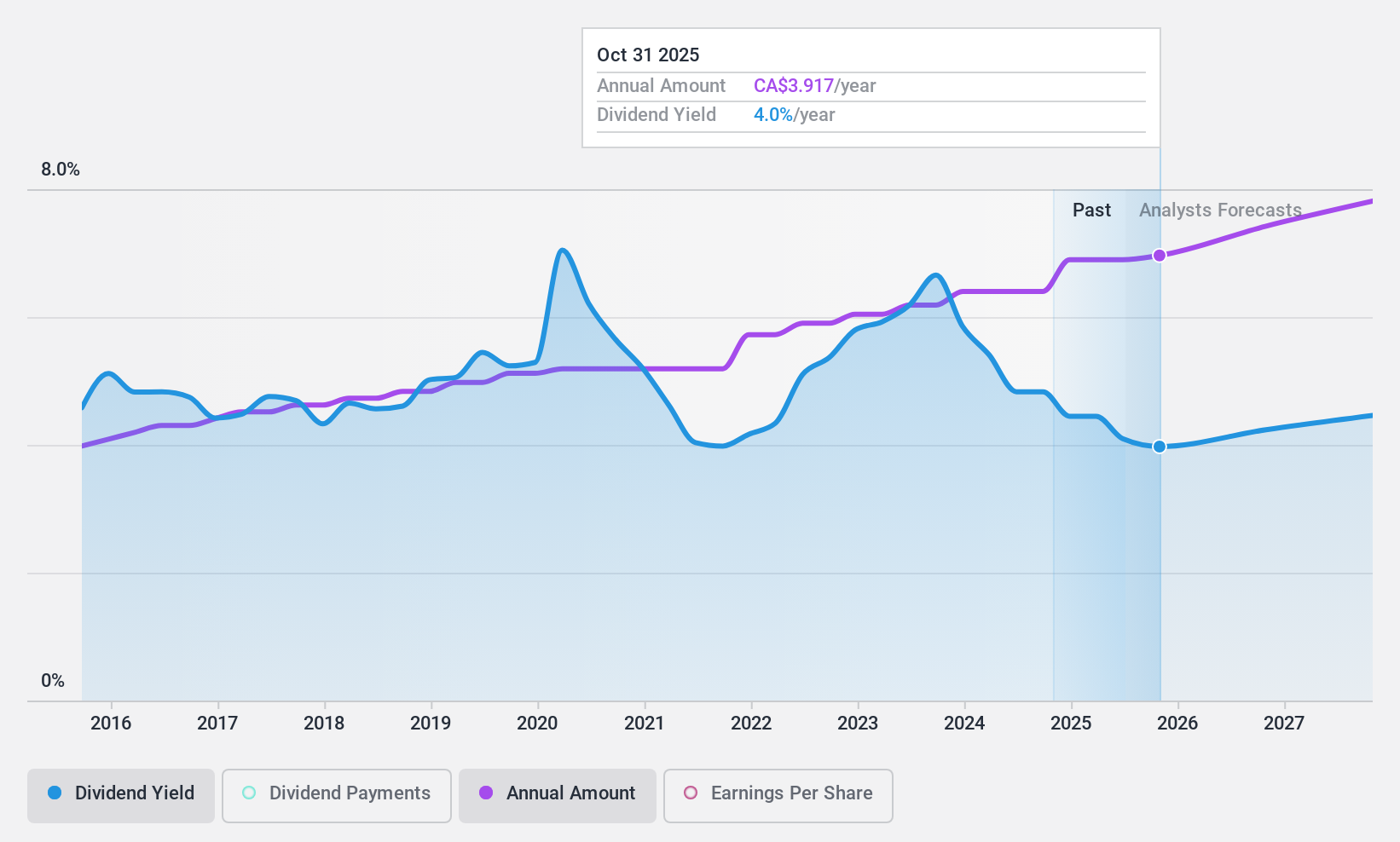

Canadian Imperial Bank of Commerce (TSX:CM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce is a diversified financial institution offering a range of financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally with a market cap of CA$83.04 billion.

Operations: Canadian Imperial Bank of Commerce generates revenue through its Canadian Personal and Business Banking (CA$8.80 billion), Capital Markets and Direct Financial Services (CA$5.61 billion), U.S. Commercial Banking and Wealth Management (CA$2.02 billion), and Canadian Commercial Banking and Wealth Management (CA$5.46 billion) segments.

Dividend Yield: 4.1%

Canadian Imperial Bank of Commerce (CIBC) offers a reliable dividend, with stable and growing payments over the past decade. Its dividends are well-covered by earnings, maintaining a payout ratio around 51.7%. However, recent insider selling and trading below estimated fair value may be concerns for investors. The bank's strategic leadership changes and fixed-income offerings indicate ongoing efforts to strengthen its market position and financial stability, which could impact future dividend sustainability.

- Click to explore a detailed breakdown of our findings in Canadian Imperial Bank of Commerce's dividend report.

- Our valuation report here indicates Canadian Imperial Bank of Commerce may be undervalued.

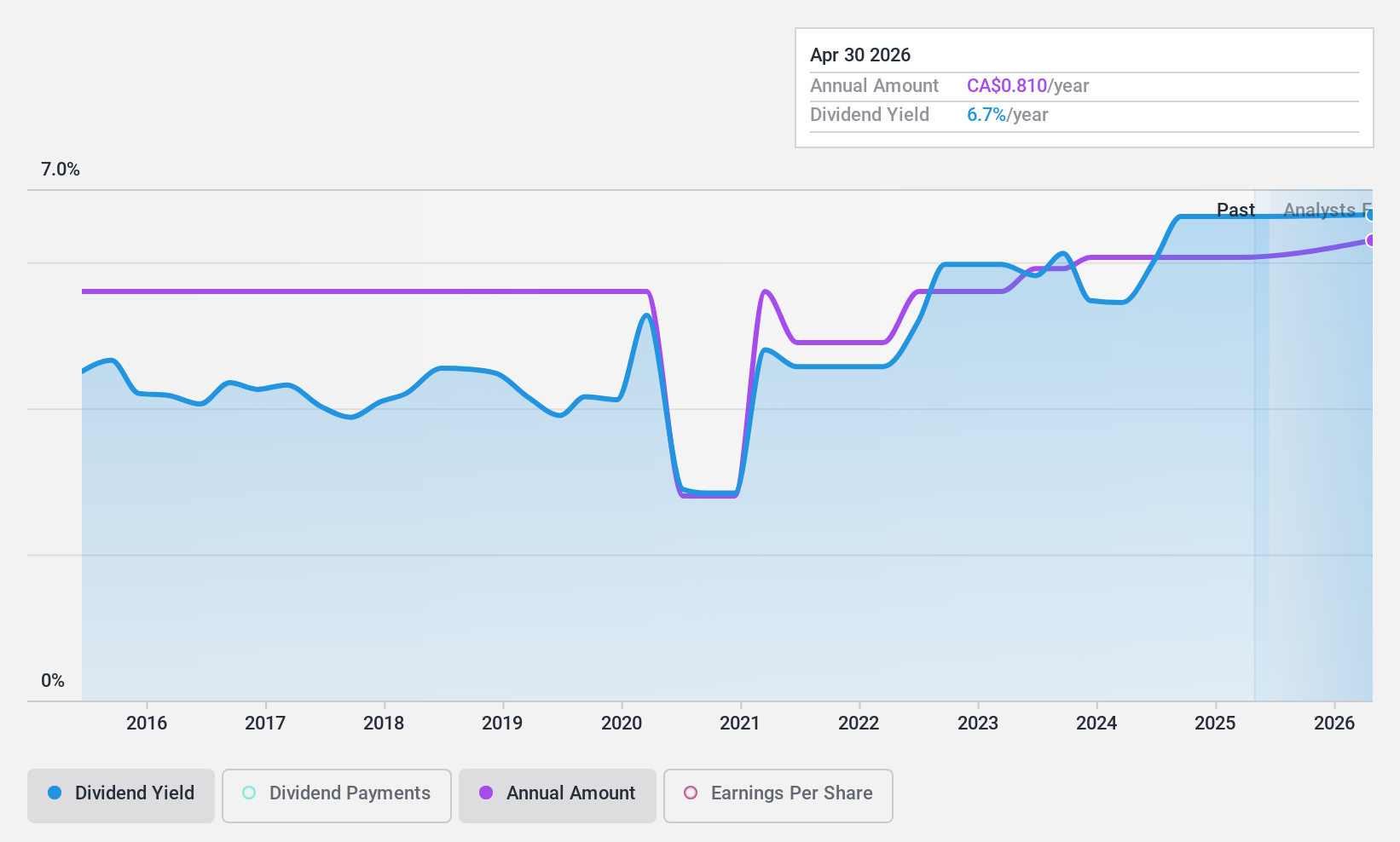

Evertz Technologies (TSX:ET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally with a market cap of CA$903.93 million.

Operations: Evertz Technologies generates revenue primarily from the Television Broadcast Equipment Market, amounting to CA$500.44 million.

Dividend Yield: 6.5%

Evertz Technologies offers a high dividend yield, ranking in the top 25% of Canadian dividend payers. However, its dividends are not well-covered by earnings due to a high payout ratio of 92.4%, though cash flow coverage is reasonable at 60.1%. The company has experienced volatility in dividend payments over the past decade. Recent earnings showed a decline, with sales and net income down compared to last year, potentially impacting future payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Evertz Technologies.

- According our valuation report, there's an indication that Evertz Technologies' share price might be on the cheaper side.

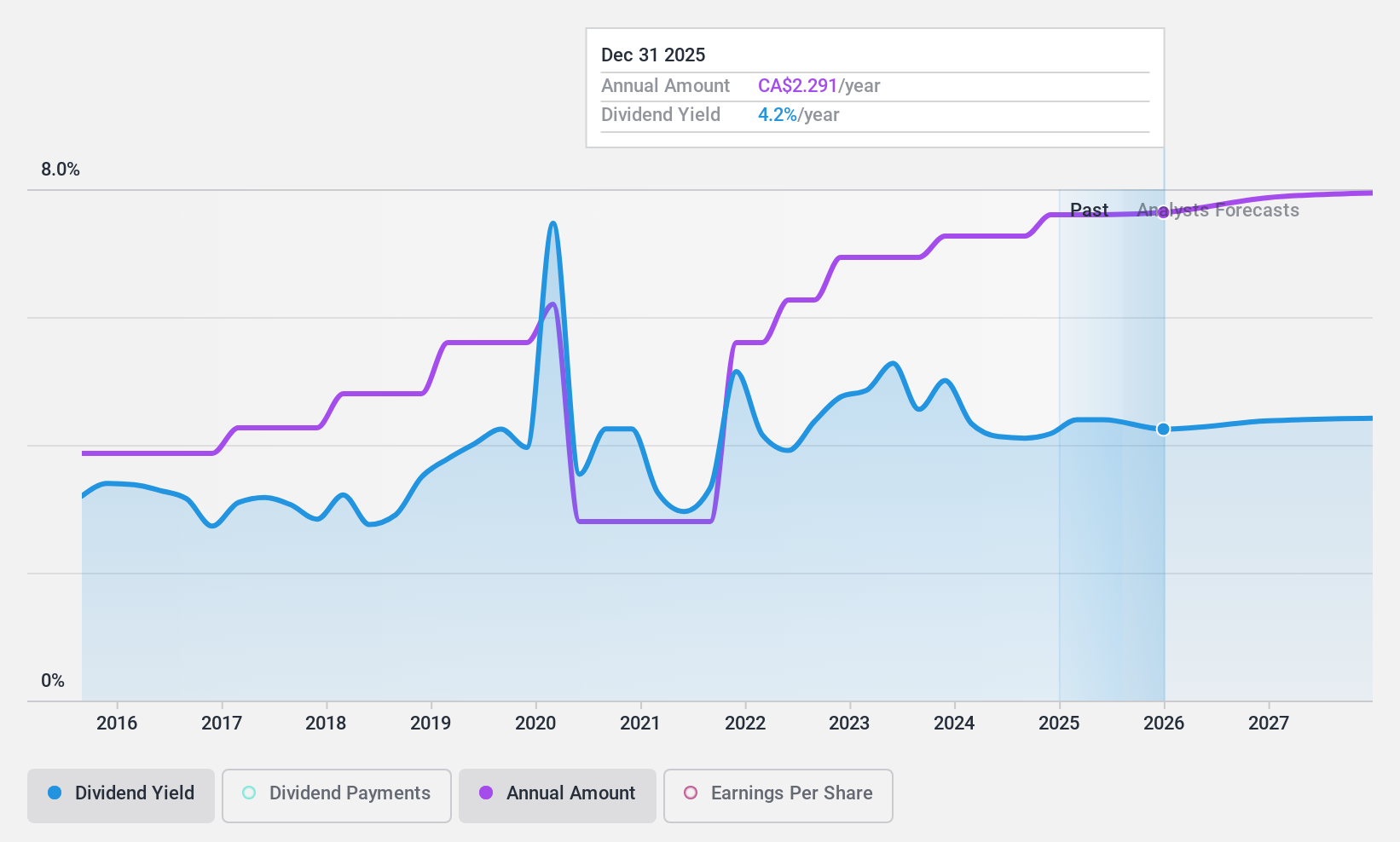

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company with operations in Canada, the United States, and internationally, and has a market cap of CA$66.99 billion.

Operations: Suncor Energy Inc.'s revenue is primarily derived from its Oil Sands segment at CA$24.61 billion, Refining and Marketing at CA$32.29 billion, and Exploration and Production at CA$2.03 billion.

Dividend Yield: 4.1%

Suncor Energy's dividend payments are well-covered by earnings and cash flows, with payout ratios of 36.9% and 31.9%, respectively. Despite a history of volatility in dividends over the past decade, Suncor has increased its dividends during this period. The company recently expanded its debt tender offers to CAD 1 billion for Pool 1 Notes, indicating active financial management. However, forecasted earnings declines could impact future dividend stability and growth potential.

- Take a closer look at Suncor Energy's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Suncor Energy shares in the market.

Key Takeaways

- Investigate our full lineup of 30 Top TSX Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evertz Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ET

Evertz Technologies

Engages in the design, manufacture, and distribution of video and audio infrastructure solutions for the production, post-production, broadcast, and telecommunications markets in Canada, the United States, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives