The Canadian market has experienced a positive trend, increasing by 1.0% over the last week and showing a robust 27% rise over the past year, with earnings projected to grow by 16% annually. In this thriving environment, dividend stocks can offer investors a blend of income and potential growth, making them an attractive option for those looking to capitalize on current market conditions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 6.99% | ★★★★★★ |

| Labrador Iron Ore Royalty (TSX:LIF) | 8.15% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.06% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.32% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.12% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.63% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.33% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.25% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.11% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.28% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Canadian Imperial Bank of Commerce (TSX:CM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce is a diversified financial institution offering a range of financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally, with a market cap of CA$81.68 billion.

Operations: Canadian Imperial Bank of Commerce generates revenue from several segments: Canadian Personal and Business Banking (CA$8.80 billion), Capital Markets and Direct Financial Services (CA$5.61 billion), U.S. Commercial Banking and Wealth Management (CA$2.02 billion), and Canadian Commercial Banking and Wealth Management (CA$5.46 billion).

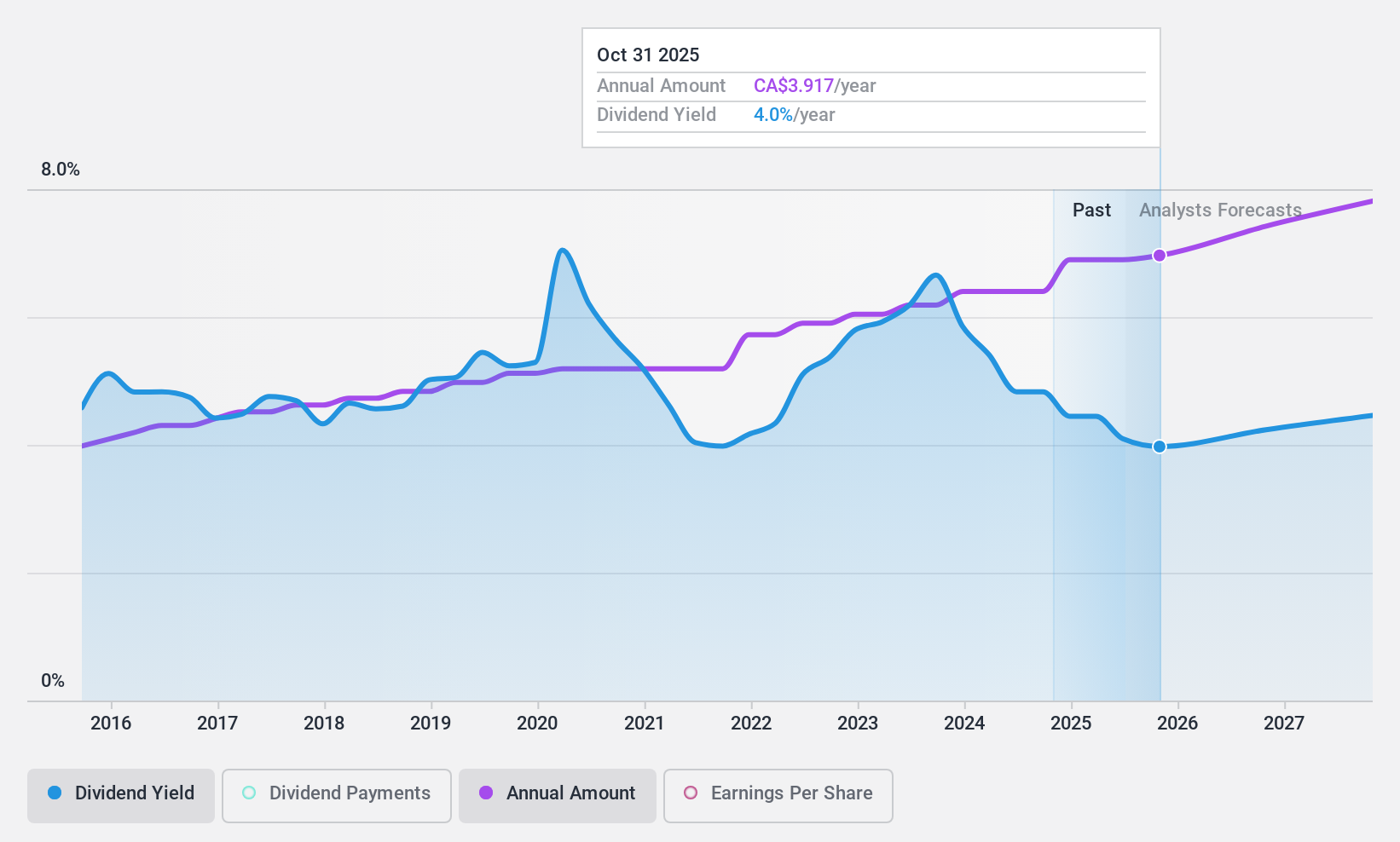

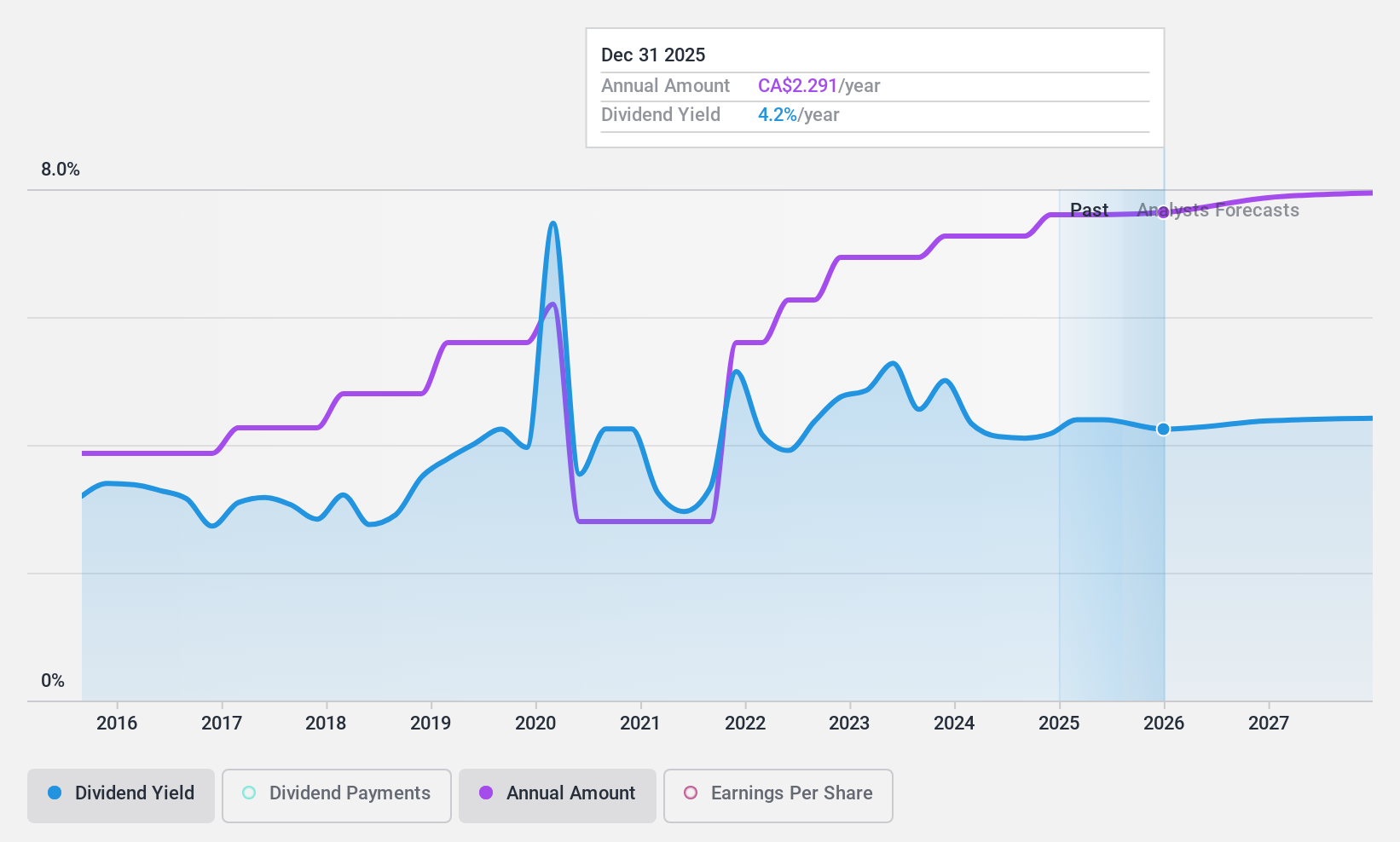

Dividend Yield: 4.2%

Canadian Imperial Bank of Commerce offers a reliable dividend yield of 4.17%, supported by a sustainable payout ratio of 51.7%. While its yield is below the Canadian market's top quartile, dividends have grown consistently over the past decade with minimal volatility. Recent financial results show strong earnings growth, enhancing dividend coverage and potential resilience. Despite shareholder dilution last year and insider selling, CIBC's strategic initiatives may bolster future performance and dividend stability.

- Unlock comprehensive insights into our analysis of Canadian Imperial Bank of Commerce stock in this dividend report.

- Our valuation report unveils the possibility Canadian Imperial Bank of Commerce's shares may be trading at a discount.

Evertz Technologies (TSX:ET)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally with a market cap of CA$926.74 million.

Operations: Evertz Technologies Limited generates revenue from its Television Broadcast Equipment Market segment, amounting to CA$500.44 million.

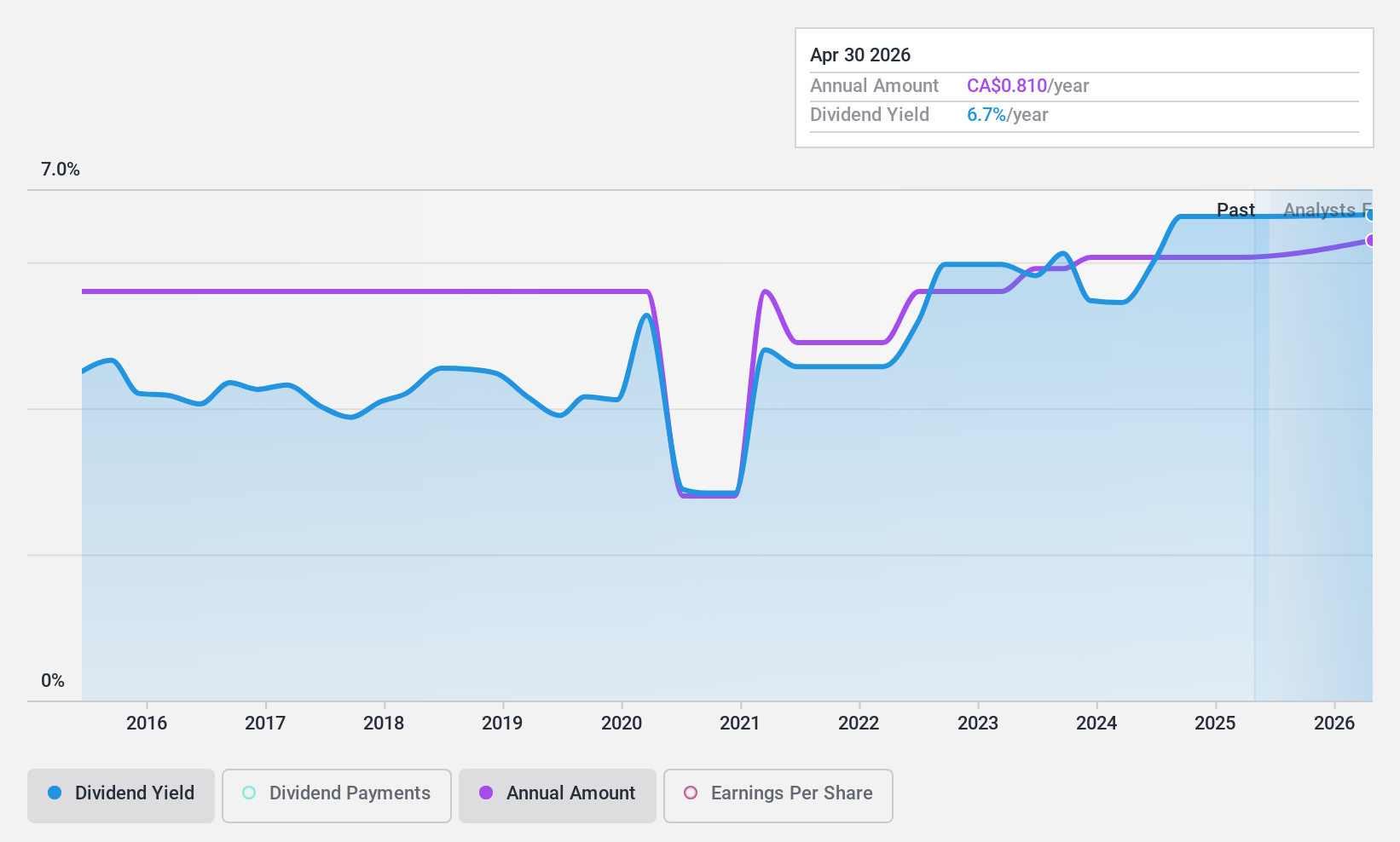

Dividend Yield: 6.3%

Evertz Technologies offers a competitive dividend yield of 6.31%, placing it among the top Canadian dividend payers. However, its high payout ratio of 92.4% indicates dividends are not well-covered by earnings, though cash flows provide some support with a reasonable cash payout ratio of 60.1%. Dividends have been volatile over the past decade despite recent growth. Recent financials show decreased sales and net income, while strategic buybacks signal shareholder value focus amidst leadership changes.

- Click here and access our complete dividend analysis report to understand the dynamics of Evertz Technologies.

- Insights from our recent valuation report point to the potential undervaluation of Evertz Technologies shares in the market.

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company operating in Canada, the United States, and internationally with a market cap of CA$68.14 billion.

Operations: Suncor Energy Inc.'s revenue segments include Oil Sands at CA$24.61 billion, Refining and Marketing at CA$32.29 billion, and Exploration and Production at CA$2.03 billion.

Dividend Yield: 4%

Suncor Energy's dividend yield of 4.04% is below the top tier in Canada, but dividends are well-covered by earnings and cash flows with payout ratios of 36.9% and 31.9%, respectively. Despite a volatile dividend history over the past decade, recent increases have been noted. The company recently expanded its debt tender offers to CAD 1 billion for certain notes, indicating strategic financial management amidst fluctuating earnings and revenue figures in recent quarters.

- Navigate through the intricacies of Suncor Energy with our comprehensive dividend report here.

- The analysis detailed in our Suncor Energy valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Get an in-depth perspective on all 29 Top TSX Dividend Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CM

Canadian Imperial Bank of Commerce

A diversified financial institution, provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.