3 TSX Stocks Estimated To Be Trading Up To 43.8% Below Intrinsic Value

Reviewed by Simply Wall St

The Canadian market has experienced a notable upswing, rising 1.0% in the past week and an impressive 27% over the last year, with earnings anticipated to grow by 16% annually in the coming years. In this thriving environment, identifying stocks that are trading below their intrinsic value can offer investors potential opportunities for growth and value realization.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$182.48 | CA$358.93 | 49.2% |

| Computer Modelling Group (TSX:CMG) | CA$12.17 | CA$21.87 | 44.3% |

| VersaBank (TSX:VBNK) | CA$20.85 | CA$41.37 | 49.6% |

| Trisura Group (TSX:TSU) | CA$44.57 | CA$87.95 | 49.3% |

| Kinaxis (TSX:KXS) | CA$155.23 | CA$284.83 | 45.5% |

| Aya Gold & Silver (TSX:AYA) | CA$18.88 | CA$33.59 | 43.8% |

| Endeavour Mining (TSX:EDV) | CA$34.07 | CA$56.35 | 39.5% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Sandstorm Gold (TSX:SSL) | CA$8.48 | CA$14.42 | 41.2% |

| Blackline Safety (TSX:BLN) | CA$6.14 | CA$10.98 | 44.1% |

Let's dive into some prime choices out of the screener.

Aya Gold & Silver (TSX:AYA)

Overview: Aya Gold & Silver Inc., along with its subsidiaries, focuses on the exploration, evaluation, and development of precious metals projects in Morocco and has a market cap of CA$2.46 billion.

Operations: Aya's revenue primarily comes from the production at the Zgounder Silver Mine in Morocco, amounting to $41.54 million.

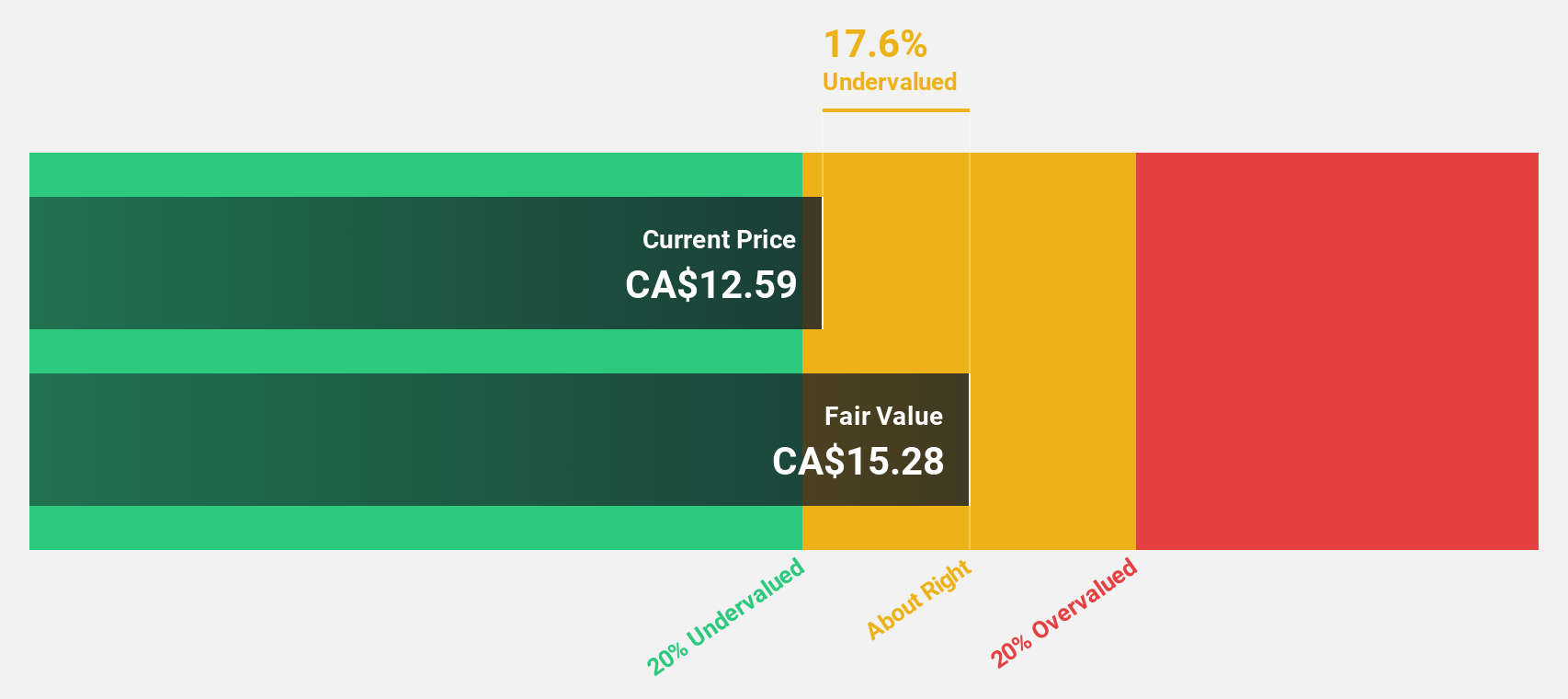

Estimated Discount To Fair Value: 43.8%

Aya Gold & Silver appears undervalued, trading at CA$18.88 against a fair value estimate of CA$33.59, with earnings forecasted to grow significantly over the next three years. Recent high-grade drill results from Boumadine and Zgounder indicate strong exploration potential, while expansion efforts at Zgounder face minor delays. The company’s strategic spinout of the Amizmiz Gold Project could unlock additional value, though past shareholder dilution is a consideration for investors.

- Our growth report here indicates Aya Gold & Silver may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Aya Gold & Silver.

Docebo (TSX:DCBO)

Overview: Docebo Inc. is a learning management software company offering an AI-powered learning platform across North America and internationally, with a market cap of CA$1.92 billion.

Operations: The company's revenue segment is primarily derived from its educational software, amounting to $200.24 million.

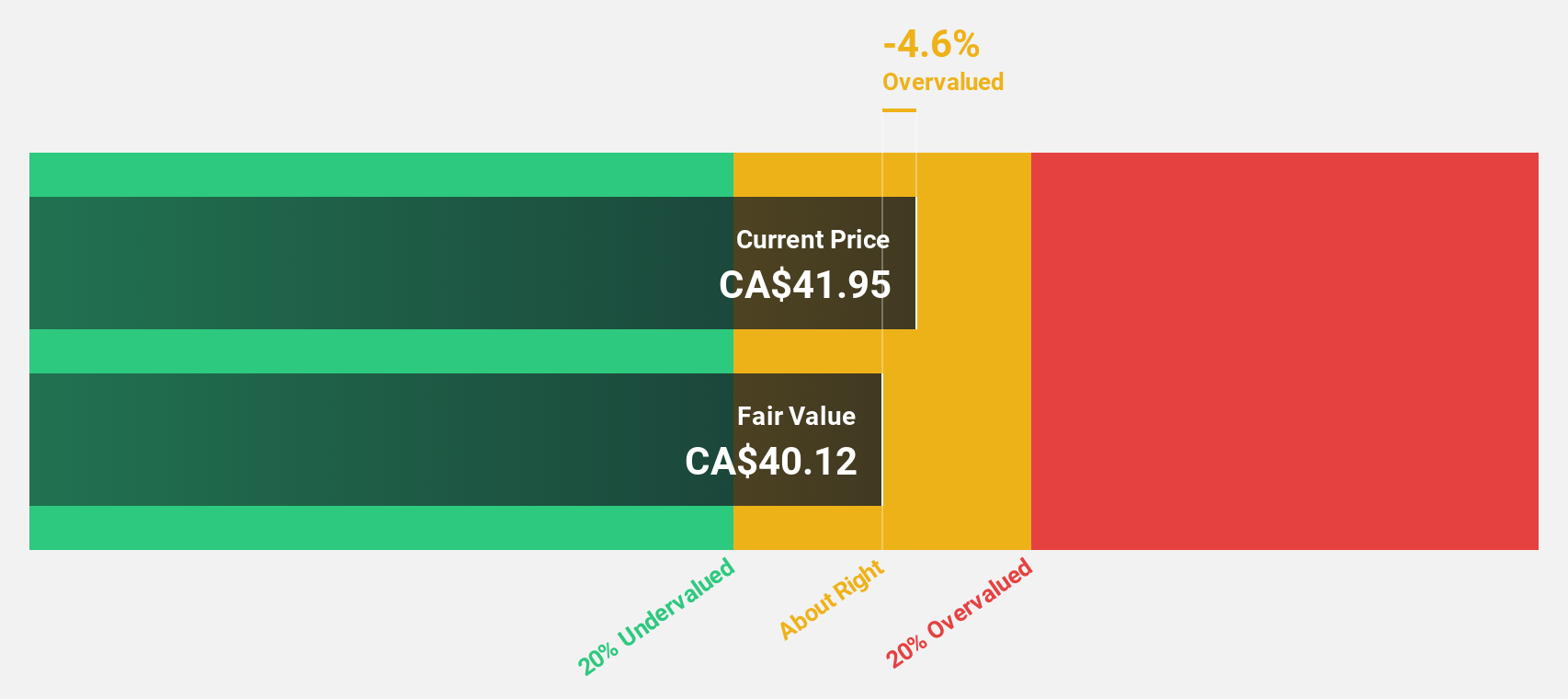

Estimated Discount To Fair Value: 12.1%

Docebo trades at CA$64.04, below its fair value estimate of CA$72.86, suggesting potential undervaluation based on cash flows. The company reports strong earnings growth, with a recent shift from a net loss to a net income of US$4.7 million in Q2 2024 and forecasts significant profit growth over the next three years. Recent strategic moves include appointing Alessio Artuffo as CEO and partnering with TEDAI for AI-driven enterprise learning initiatives.

- According our earnings growth report, there's an indication that Docebo might be ready to expand.

- Dive into the specifics of Docebo here with our thorough financial health report.

Endeavour Mining (TSX:EDV)

Overview: Endeavour Mining plc, along with its subsidiaries, is a gold mining company operating in West Africa with a market capitalization of approximately CA$8.29 billion.

Operations: The company's revenue segments include $612.70 million from Houndé Mine, $509.60 million from Sabodala Massawa Mine, $308.40 million from Mana Mine Burkina Faso, and $708.10 million from Ity Mine Côte D’Ivoire.

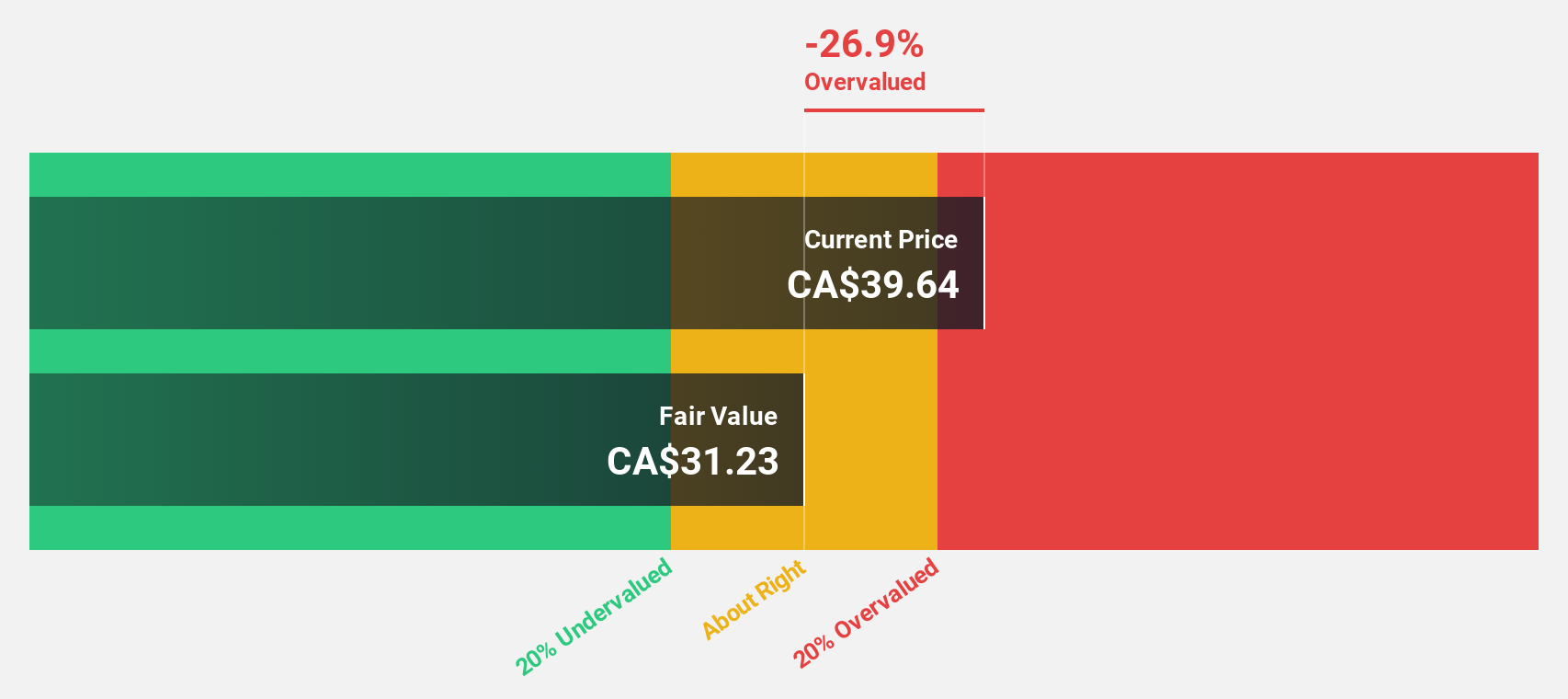

Estimated Discount To Fair Value: 39.5%

Endeavour Mining, trading at CA$34.07, is significantly undervalued with a fair value estimate of CA$56.35. The company has achieved commercial production at its Sabodala-Massawa and Lafigué mines, enhancing cash flow potential. Despite recent net losses, Endeavour's earnings are forecast to grow substantially by 63% annually over the next three years. However, the dividend coverage remains weak due to insufficient earnings or free cash flows, and insider selling has been significant recently.

- In light of our recent growth report, it seems possible that Endeavour Mining's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Endeavour Mining's balance sheet health report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 24 Undervalued TSX Stocks Based On Cash Flows now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DCBO

Docebo

Operates as a learning management software company that provides artificial intelligence (AI)-powered learning platform in North America and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives