- Canada

- /

- Metals and Mining

- /

- TSX:MAG

Undiscovered Gems in Canada to Explore This October 2024

Reviewed by Simply Wall St

The Canadian market has shown robust performance, rising by 1.0% in the last week and achieving a remarkable 27% increase over the past year, with earnings projected to grow by 16% annually. In such a dynamic environment, identifying promising stocks involves looking for companies with strong fundamentals and growth potential that align well with these favorable market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Santacruz Silver Mining | 14.30% | 49.04% | 63.44% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Firan Technology Group | 15.52% | 6.50% | 32.07% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

| Dundee | 5.93% | -38.65% | 39.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Evertz Technologies (TSX:ET)

Simply Wall St Value Rating: ★★★★★★

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally with a market cap of CA$926.74 million.

Operations: Evertz Technologies generates revenue primarily from the Television Broadcast Equipment Market, amounting to CA$500.44 million.

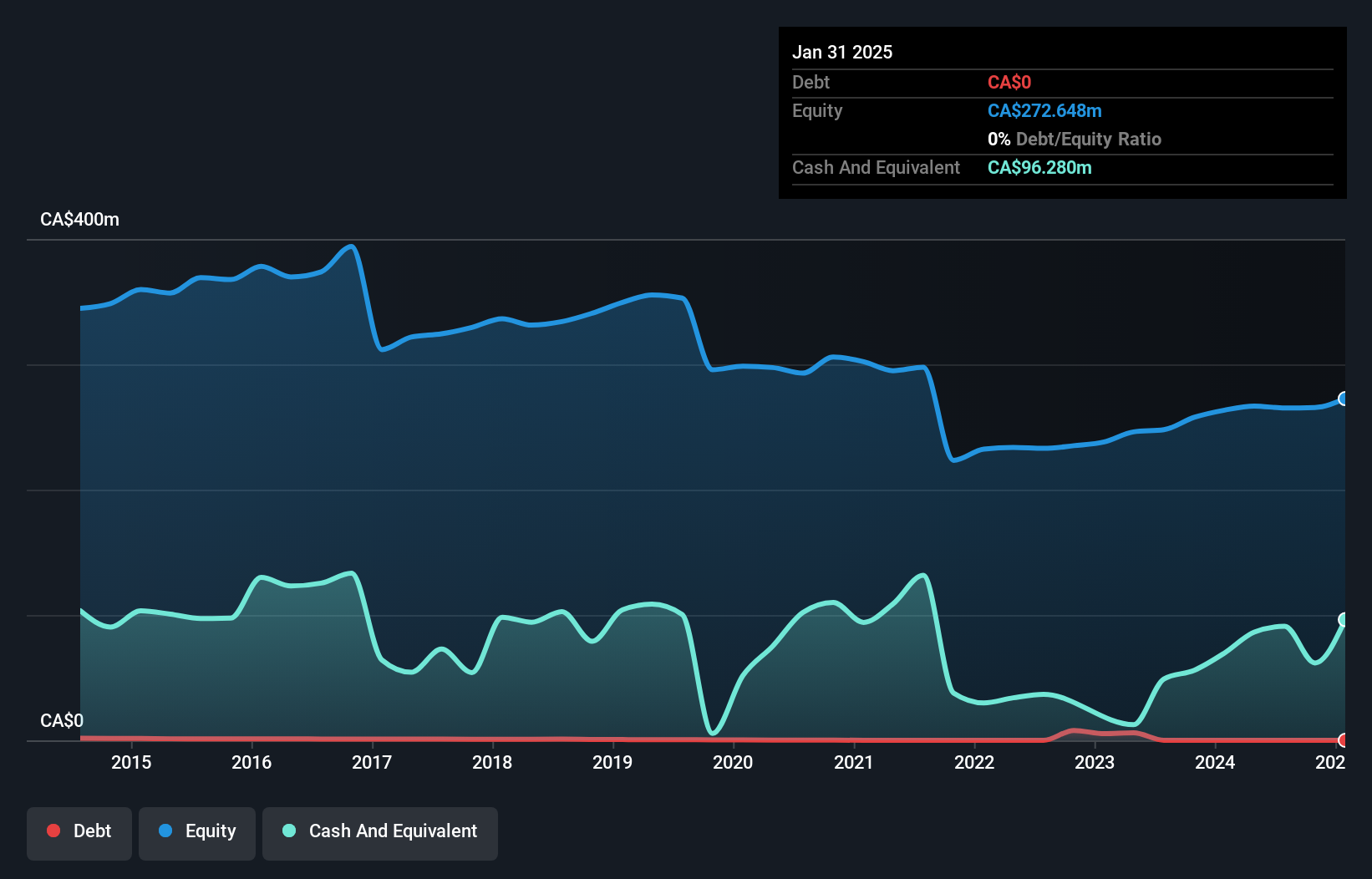

Evertz Technologies, a Canadian small-cap firm, offers an intriguing blend of financial stability and growth potential. Trading at 35.8% below its estimated fair value, it presents a compelling opportunity for investors seeking undervalued assets. Despite recent challenges with earnings decreasing by CAD 6 million year-over-year to CAD 9.67 million in Q1 2024, the company remains debt-free and has reduced its debt-to-equity ratio from 0.1 over five years ago to zero today. With earnings projected to grow at nearly 4% annually, Evertz seems poised for gradual improvement amidst industry headwinds like negative sector growth trends of -9%.

- Delve into the full analysis health report here for a deeper understanding of Evertz Technologies.

Gain insights into Evertz Technologies' past trends and performance with our Past report.

MAG Silver (TSX:MAG)

Simply Wall St Value Rating: ★★★★★★

Overview: MAG Silver Corp. is involved in the development and exploration of precious metal properties in Canada, with a market cap of CA$2.39 billion.

Operations: MAG Silver Corp.'s financial data does not provide specific revenue segments or cost breakdowns, making it challenging to detail its revenue model from the available information.

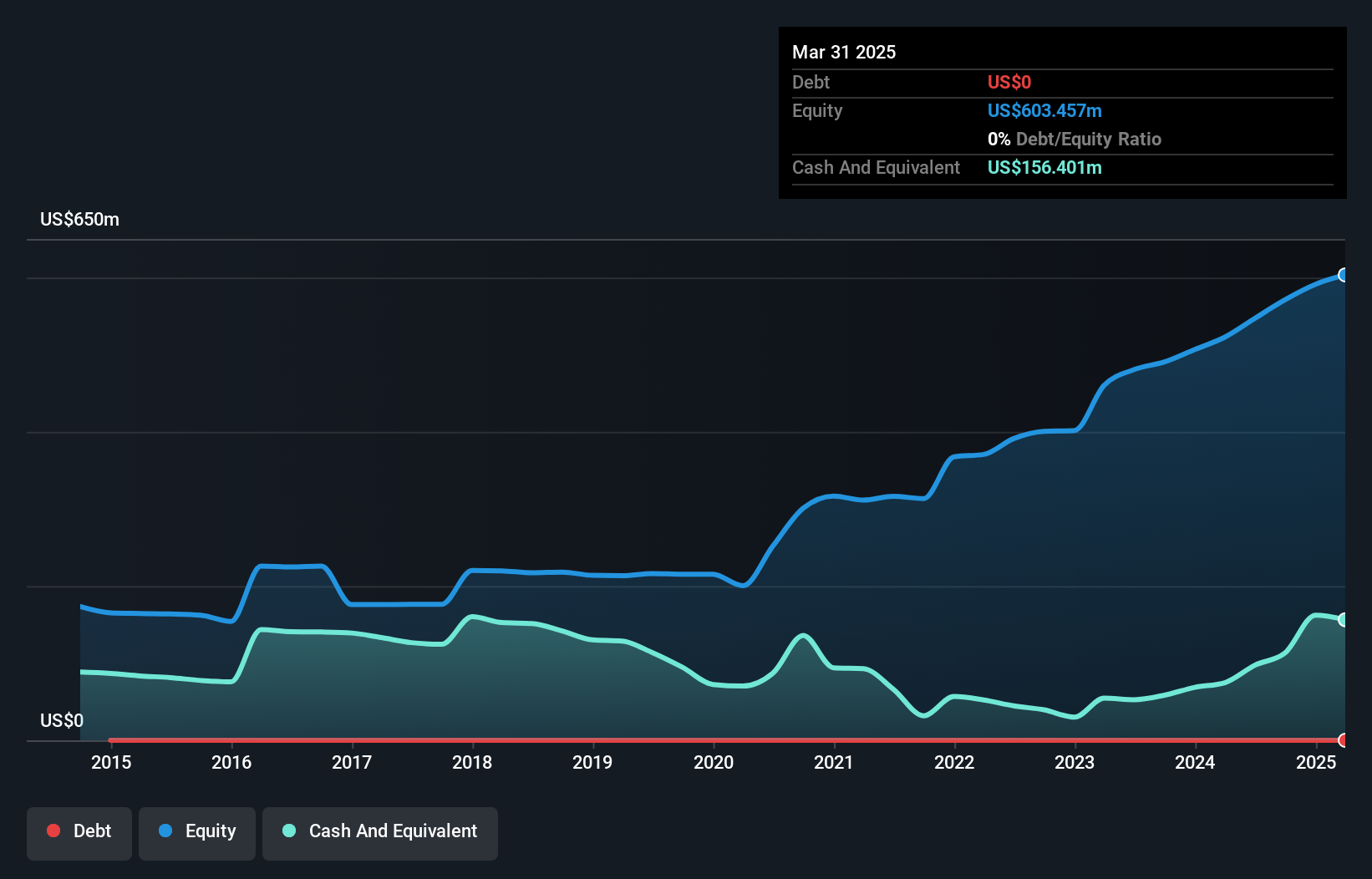

MAG Silver, a dynamic player in the metals and mining sector, showcases impressive growth with earnings surging by 94% over the past year, significantly outpacing the industry average of 4.5%. Despite generating less than US$1 million in revenue, MAG remains debt-free for five years, highlighting its robust financial health. Recent production updates reveal mixed results; silver output dipped to 4.98 million ounces from 5.21 million ounces last year while lead and zinc outputs increased notably to 9.96 million pounds and 18.85 million pounds respectively. Earnings per share rose to US$0.21 from US$0.19 year-on-year for Q2, reflecting solid profitability amidst operational challenges.

- Dive into the specifics of MAG Silver here with our thorough health report.

Examine MAG Silver's past performance report to understand how it has performed in the past.

Taiga Building Products (TSX:TBL)

Simply Wall St Value Rating: ★★★★★★

Overview: Taiga Building Products Ltd. is a wholesale distributor of building products serving markets in Canada and the United States, with a market cap of CA$412.35 million.

Operations: Taiga generates revenue primarily through its wholesale distribution of building products, amounting to CA$1.65 billion. The company's financial performance is influenced by its gross profit margin, which reflects the efficiency of its core operations.

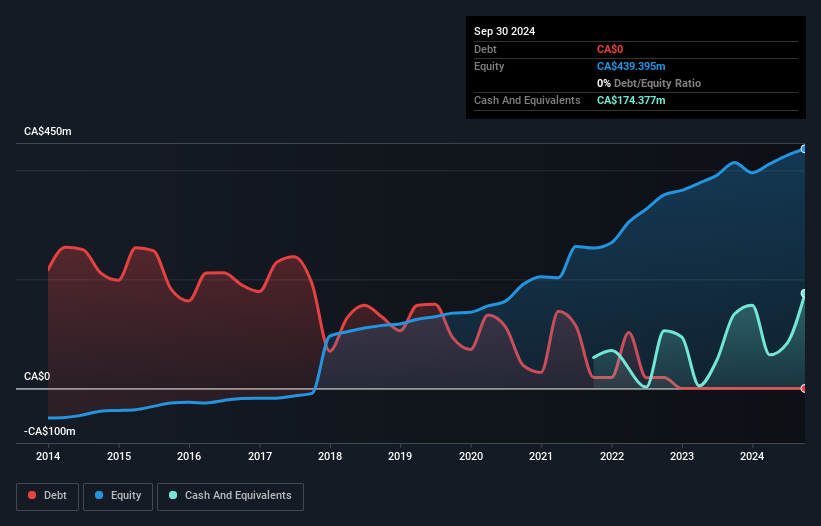

Taiga Building Products, a nimble player in the Canadian market, is trading at 50.4% below its estimated fair value, showcasing potential for savvy investors. The company has successfully shed all debt over the past five years from a debt to equity ratio of 117.2%, enhancing its financial stability and eliminating concerns over interest payments. Despite reporting negative earnings growth of -2.2% compared to an industry average of -12.3%, Taiga remains profitable with positive free cash flow and high-quality past earnings. Recent initiatives include a share repurchase program targeting up to 5% of outstanding shares by September 2025, reflecting confidence in its valuation amidst slightly declining sales and net income figures year-over-year for the second quarter ending June 2024 (CAD 427.82 million sales vs CAD 446.9 million; CAD 13.93 million net income vs CAD 16.99 million).

- Click here to discover the nuances of Taiga Building Products with our detailed analytical health report.

Assess Taiga Building Products' past performance with our detailed historical performance reports.

Seize The Opportunity

- Discover the full array of 53 TSX Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MAG

MAG Silver

Develops and explores for precious metal properties in Canada.

Flawless balance sheet with acceptable track record.