CMC Metals And 2 Other TSX Penny Stocks With Promising Prospects

Reviewed by Simply Wall St

The Canadian market has been experiencing significant shifts following the decisive U.S. election outcome, which alleviated some uncertainties and led to a notable post-election rally. In light of these changes, investors are increasingly focusing on long-term fundamentals and opportunities within various sectors. Penny stocks, while an older term, continue to represent intriguing prospects for those interested in smaller or newer companies with potential growth opportunities at lower price points. By examining their financial health and growth potential, investors can identify promising penny stocks that may offer both stability and upside in the current market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.63 | CA$593.2M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.69 | CA$273.57M | ★★★★★☆ |

| Alvopetro Energy (TSXV:ALV) | CA$4.825 | CA$176.46M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.26 | CA$116.54M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.44 | CA$12.46M | ★★★★★☆ |

| Mandalay Resources (TSX:MND) | CA$3.30 | CA$308.29M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.20 | CA$5.34M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.21 | CA$219.69M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$30.36M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

Click here to see the full list of 964 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

CMC Metals (TSXV:CMB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CMC Metals Ltd. is involved in the acquisition and exploration of mineral properties in Canada and the United States, with a market cap of CA$3.15 million.

Operations: There are no reported revenue segments for CMC Metals Ltd.

Market Cap: CA$3.15M

CMC Metals Ltd., with a market cap of CA$3.15 million, is pre-revenue and has seen shareholder dilution with shares outstanding increasing by 7.9% over the past year. Despite having more cash than debt, CMC faces financial constraints with less than a year of cash runway if free cash flow continues to decline at historical rates. The company has been actively exploring its properties, including the Amy and Silverknife sites, identifying promising drill targets for potential mineralization. Recent management changes and board appointments reflect ongoing strategic adjustments as the company navigates its exploration-focused business model amidst high share price volatility.

- Get an in-depth perspective on CMC Metals' performance by reading our balance sheet health report here.

- Evaluate CMC Metals' historical performance by accessing our past performance report.

Rubicon Organics (TSXV:ROMJ)

Simply Wall St Financial Health Rating: ★★★★★★

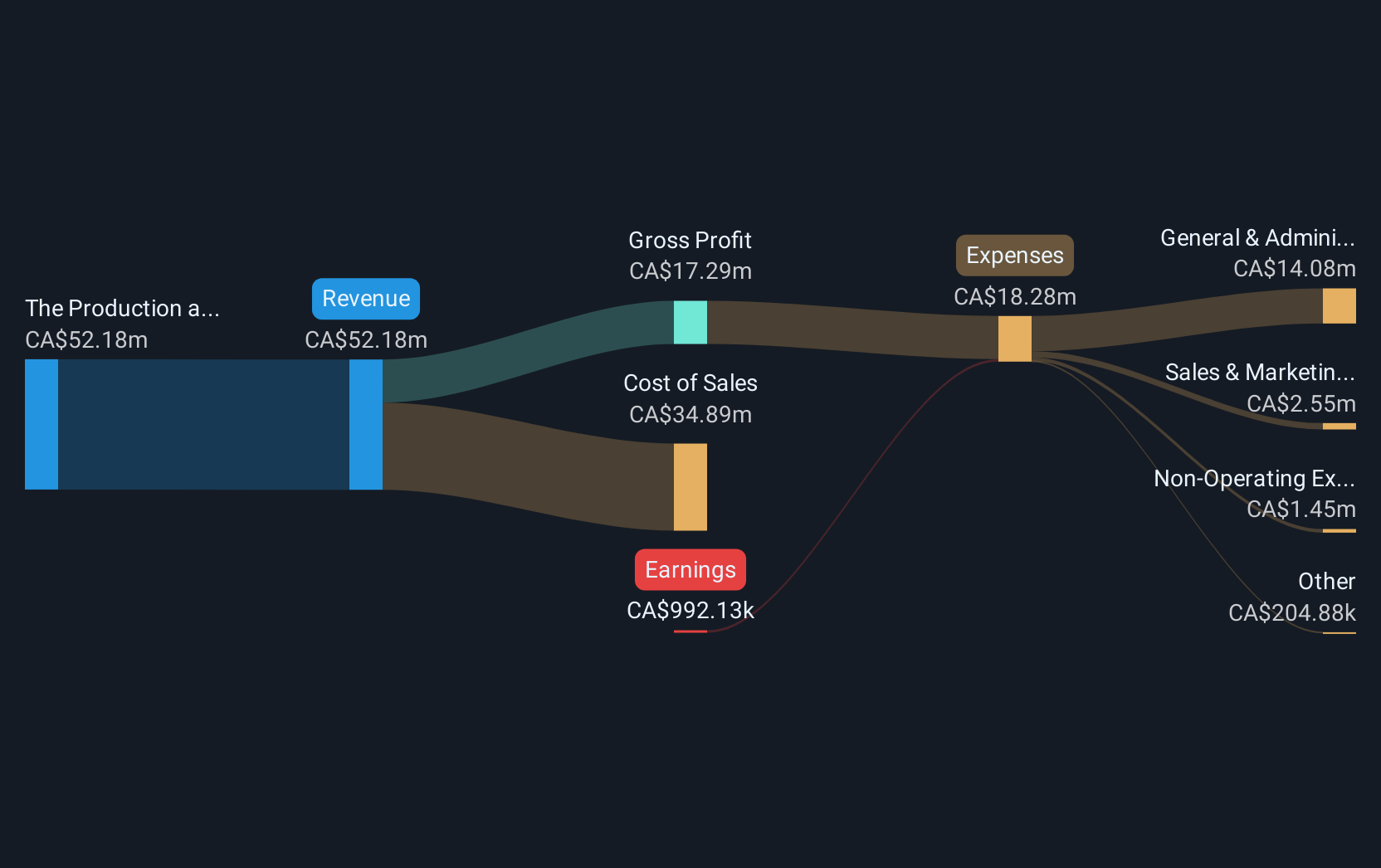

Overview: Rubicon Organics Inc. operates in the production, processing, and sale of organic cannabis for recreational and medical use in Canada, with a market cap of CA$20.33 million.

Operations: The company generates CA$41.03 million in revenue from its cannabis production and sales activities.

Market Cap: CA$20.33M

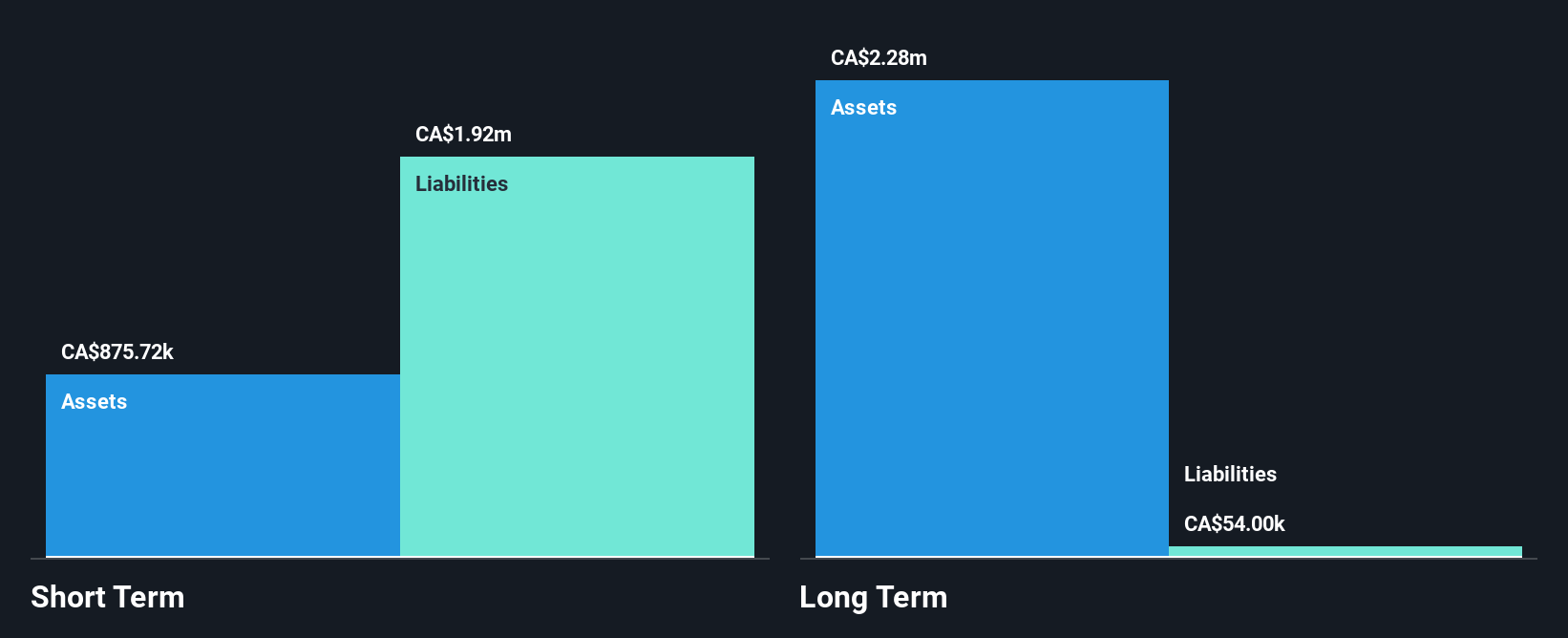

Rubicon Organics Inc., with a market cap of CA$20.33 million, is navigating the cannabis sector with modest revenue growth, reporting CA$13.5 million in Q3 2024 compared to CA$10.04 million the previous year. Despite being unprofitable, it has reduced its net loss significantly and maintains a strong cash position exceeding its debt obligations, ensuring more than three years of operational runway if current free cash flow trends persist. The company’s strategic focus on enhancing operating leverage and recent board changes indicate efforts to stabilize operations amidst an evolving industry landscape marked by volatility and competitive pressures.

- Click here and access our complete financial health analysis report to understand the dynamics of Rubicon Organics.

- Review our growth performance report to gain insights into Rubicon Organics' future.

Voyageur Pharmaceuticals (TSXV:VM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Voyageur Pharmaceuticals Ltd., along with its subsidiaries, focuses on acquiring, exploring, and developing raw materials for pharmaceutical products in British Columbia, Canada, and Utah, with a market cap of CA$9.07 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$9.07M

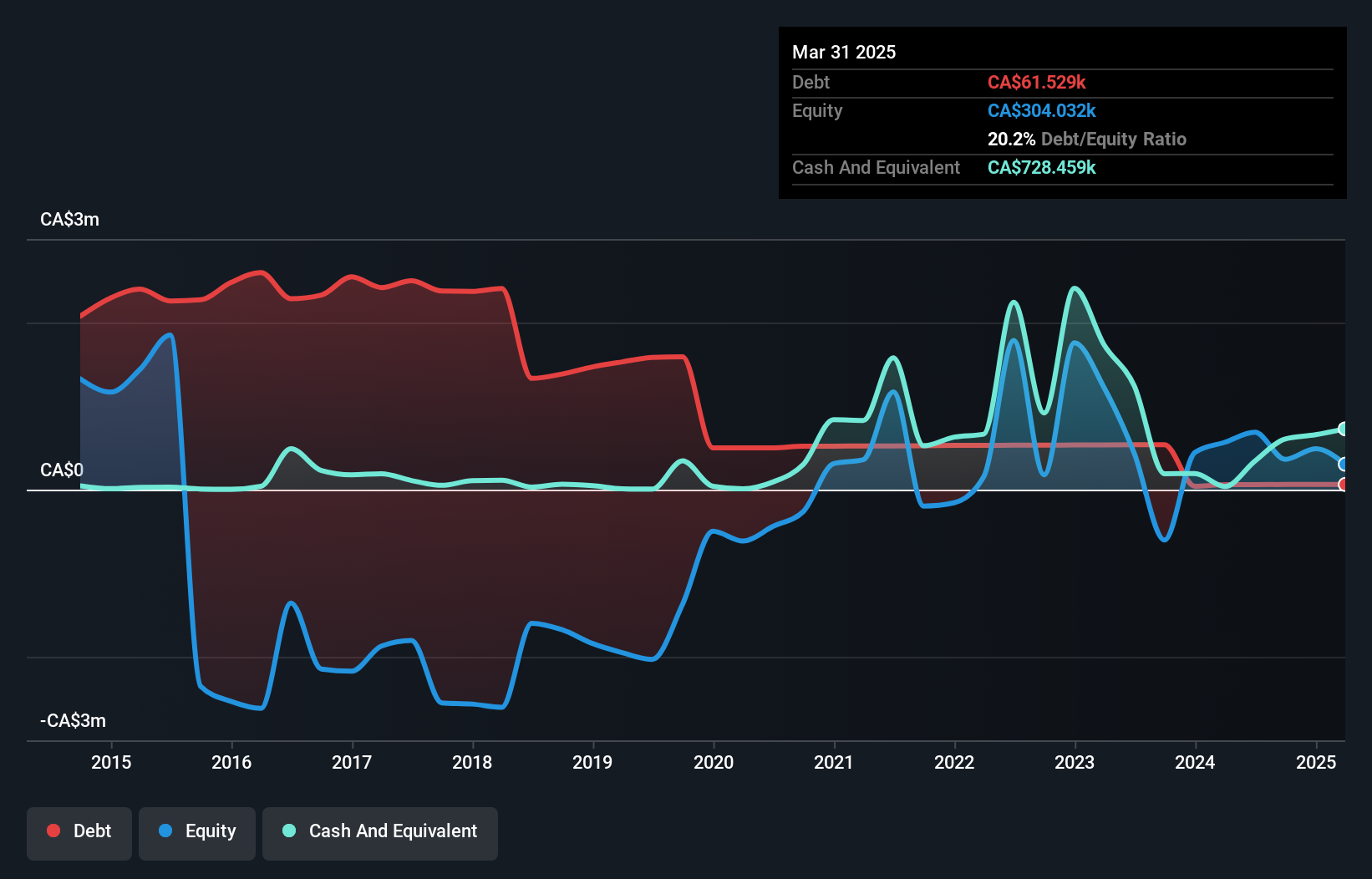

Voyageur Pharmaceuticals Ltd., with a market cap of CA$9.07 million, is pre-revenue and currently unprofitable, having reported an increased net loss in recent quarters. The company has undertaken a private placement to raise up to CA$1 million, which could provide much-needed capital as it progresses through clinical testing phases for its new product line. Despite the lack of significant revenue streams, Voyageur's strategic focus on innovative pharmaceutical formulations and the appointment of a new Chief Science Officer with extensive expertise highlight its commitment to advancing its product pipeline in competitive markets.

- Click to explore a detailed breakdown of our findings in Voyageur Pharmaceuticals' financial health report.

- Explore historical data to track Voyageur Pharmaceuticals' performance over time in our past results report.

Summing It All Up

- Navigate through the entire inventory of 964 TSX Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:VM

Voyageur Pharmaceuticals

Engages in acquiring, exploring, and developing raw materials for pharmaceutical products in the United States of America, the province of British Columbia, Canada, and the state of Utah.

Medium-low with mediocre balance sheet.

Market Insights

Community Narratives