Top Canadian Undervalued Small Caps With Insider Action In October 2024

Reviewed by Simply Wall St

Over the past 12 months, the Canadian market has experienced a robust 27% increase, with earnings projected to grow by 16% annually. In this thriving environment, identifying stocks that are perceived as undervalued and exhibit insider activity can offer intriguing opportunities for investors seeking to capitalize on potential growth within the small-cap sector.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First National Financial | 10.6x | 3.4x | 49.32% | ★★★★★☆ |

| Trican Well Service | 7.2x | 0.9x | 19.25% | ★★★★★☆ |

| Spartan Delta | 4.0x | 2.0x | 43.09% | ★★★★★☆ |

| AutoCanada | NA | 0.1x | 40.55% | ★★★★★☆ |

| Nexus Industrial REIT | 3.6x | 3.6x | 19.29% | ★★★★☆☆ |

| Rogers Sugar | 15.5x | 0.6x | 47.90% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 13.0x | 3.5x | 44.13% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -45.47% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | 18.09% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.2x | -208.69% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Badger Infrastructure Solutions (TSX:BDGI)

Simply Wall St Value Rating: ★★★★☆☆

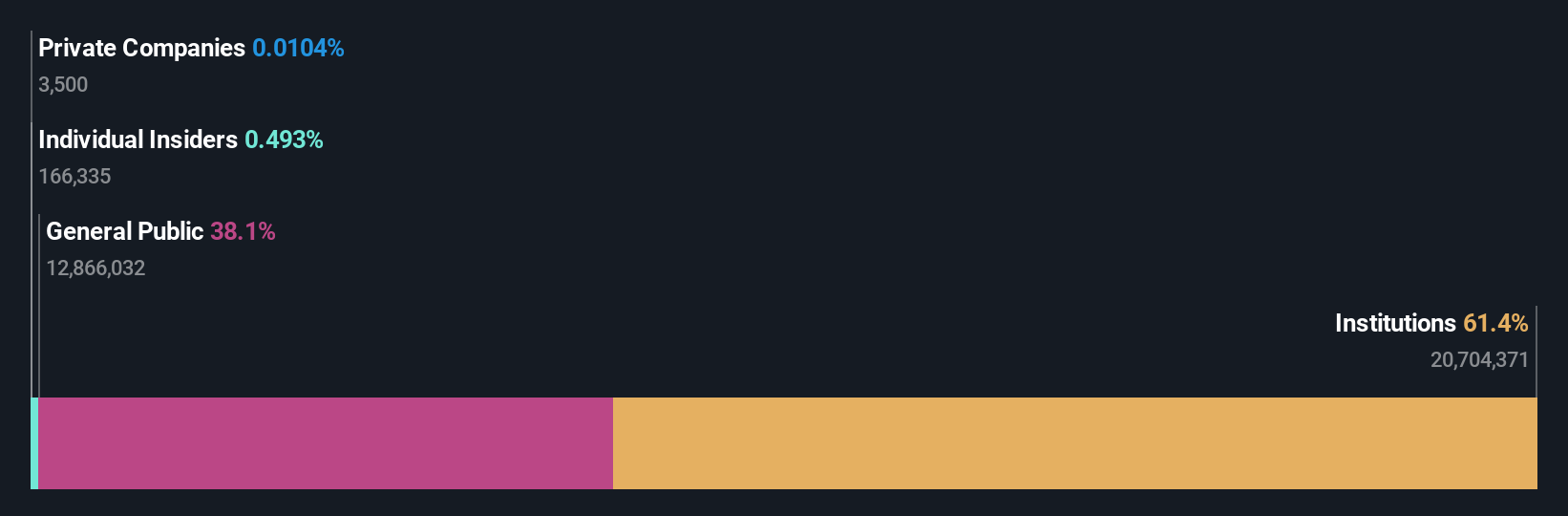

Overview: Badger Infrastructure Solutions specializes in providing non-destructive excavating services and has a market capitalization of approximately CAD $1.07 billion.

Operations: The company's revenue reached $717.10 million from its core service offerings, with cost of goods sold (COGS) amounting to $514.27 million, resulting in a gross profit margin of 28.29%. Operating expenses were recorded at $140.22 million, while non-operating expenses stood at $20.93 million for the latest period ending October 21, 2024.

PE: 24.6x

Badger Infrastructure Solutions, a Canadian small-cap company, is seeing insider confidence with share purchases in 2024. Despite having a high debt level and relying on external borrowing, it reported increased sales of US$186.84 million for Q2 2024, up from US$171.89 million the previous year. Earnings per share rose to US$0.35 from US$0.32, indicating potential growth prospects with forecasted earnings growth of 36% annually. The Board considers a share repurchase program alongside affirming quarterly dividends of C$0.18 per share for Q3 2024.

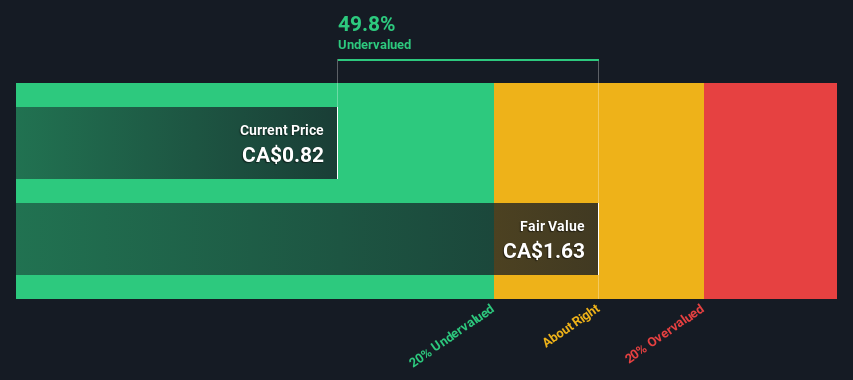

Queen's Road Capital Investment (TSX:QRC)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Queen's Road Capital Investment focuses on the selection, acquisition, and management of investments with a market capitalization of approximately CAD $0.31 billion.

Operations: Queen's Road Capital Investment generates revenue primarily from the selection, acquisition, and management of investments, with recent figures showing a revenue of $115.10 million. The company consistently achieves a gross profit margin of 100%, indicating that its cost structure is effectively managed to maximize profitability. Operating expenses have been recorded at $3.72 million, highlighting efficient operational management relative to its revenue scale.

PE: 2.5x

Queen's Road Capital Investment, a Canadian company with high-quality earnings, recently increased its annual dividend by CAD 0.002 per share to CAD 0.021, reflecting an 11% rise over the past year due to growth in its convertible debenture portfolio. Despite having primarily external borrowing as funding, they closed a fully subscribed private placement of 21.4 million shares at CAD 0.70 each in September, raising nearly CAD 15 million and signaling insider confidence in the company's potential growth trajectory.

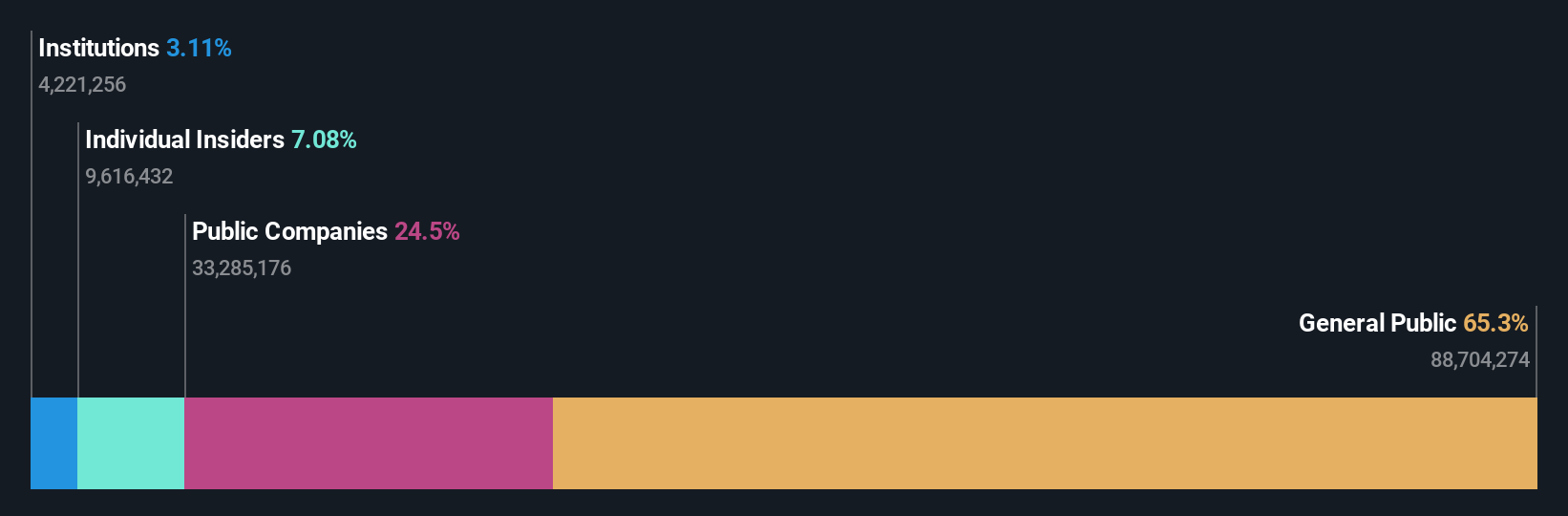

Sagicor Financial (TSX:SFC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sagicor Financial is a financial services company operating through segments such as Sagicor Life, Sagicor Jamaica, and Sagicor Life USA, with a market capitalization of approximately $1.83 billion.

Operations: Sagicor Financial's revenue is primarily derived from its segments, with notable figures including $346.52 million from Sagicor Life and $643.42 million from Sagicor Jamaica. The company's gross profit margin has shown variability, reaching as high as 48.19% in recent periods. Operating expenses and non-operating expenses are significant components of the cost structure, impacting overall profitability trends over time.

PE: 1.3x

Sagicor Financial, a Canadian company with a smaller market capitalization, has seen insider confidence as Gilbert Palter recently purchased 225,000 shares for approximately US$1.26 million in August 2024. Despite reporting a net loss of US$40.24 million for Q2 2024 compared to last year's income of US$48.84 million, Sagicor continues its dividend streak with a declared quarterly payout of US$0.06 per share. The company completed share repurchases worth US$1.8 million between April and June 2024 but faces earnings challenges ahead with forecasts indicating potential declines over the next three years due to reliance on external borrowing as its funding source.

Where To Now?

- Take a closer look at our Undervalued TSX Small Caps With Insider Buying list of 22 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SFC

Sagicor Financial

Provides insurance products and related financial services in Jamaica, Barbados, Trinidad, Tobago, other Caribbean region, and the United States.

Solid track record and good value.