Celestica (TSX:CLS) Valuation in Focus After Next-Gen AI Data Center Switch Launch and Growth Momentum

Reviewed by Kshitija Bhandaru

Celestica (TSX:CLS) just announced the DS6000 and DS6001, its newest 1.6TbE data center switches built on advanced Broadcom chipsets. These models double switch capacity and are aimed at high-bandwidth AI and machine learning workloads.

See our latest analysis for Celestica.

It has been a remarkable run for Celestica. Despite a slight pullback after the latest launch, the company’s recent momentum remains undeniable. Over the past year, Celestica delivered a stunning 293.75% total shareholder return, with especially sharp gains in the last quarter as optimism about its role in the AI and data center ecosystem fueled interest. Momentum is clearly building, and upbeat analyst revisions alongside new product launches are keeping investors’ eyes on what’s next.

If you want to see what other fast-rising tech companies are capturing attention, now’s a great time to discover See the full list for free.

With such rapid gains and sky-high expectations around AI, investors have to ask: is Celestica’s stock still trading below its true worth, or is all that future growth already fully priced in?

Most Popular Narrative: 5.7% Undervalued

Celestica’s fair value estimate stands at CA$362.34 according to the most closely followed narrative, slightly higher than the last close at CA$341.62. That gap highlights steady optimism in analyst expectations for future growth, setting the stage for the core drivers behind this forward-looking valuation.

Global customers are increasingly seeking partners with regional manufacturing diversification for supply chain resilience (Mexico, Thailand, U.S.), positioning Celestica to win expanded market share and mitigate geopolitical risks, supporting long-term revenue growth.

Wondering what’s turbocharging Celestica’s valuation beyond the already sky-high growth narrative? This fair value hinges on projections of accelerating revenues, ambitious profit margin leaps, and a future profit multiple that rivals top global tech names. The assumptions baked in are bolder than you might expect. Are you ready to find out what they are?

Result: Fair Value of $362.34 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Celestica’s heavy reliance on top hyperscaler customers exposes it to sudden revenue shifts if spending by major technology companies slows or if vendor preferences change.

Find out about the key risks to this Celestica narrative.

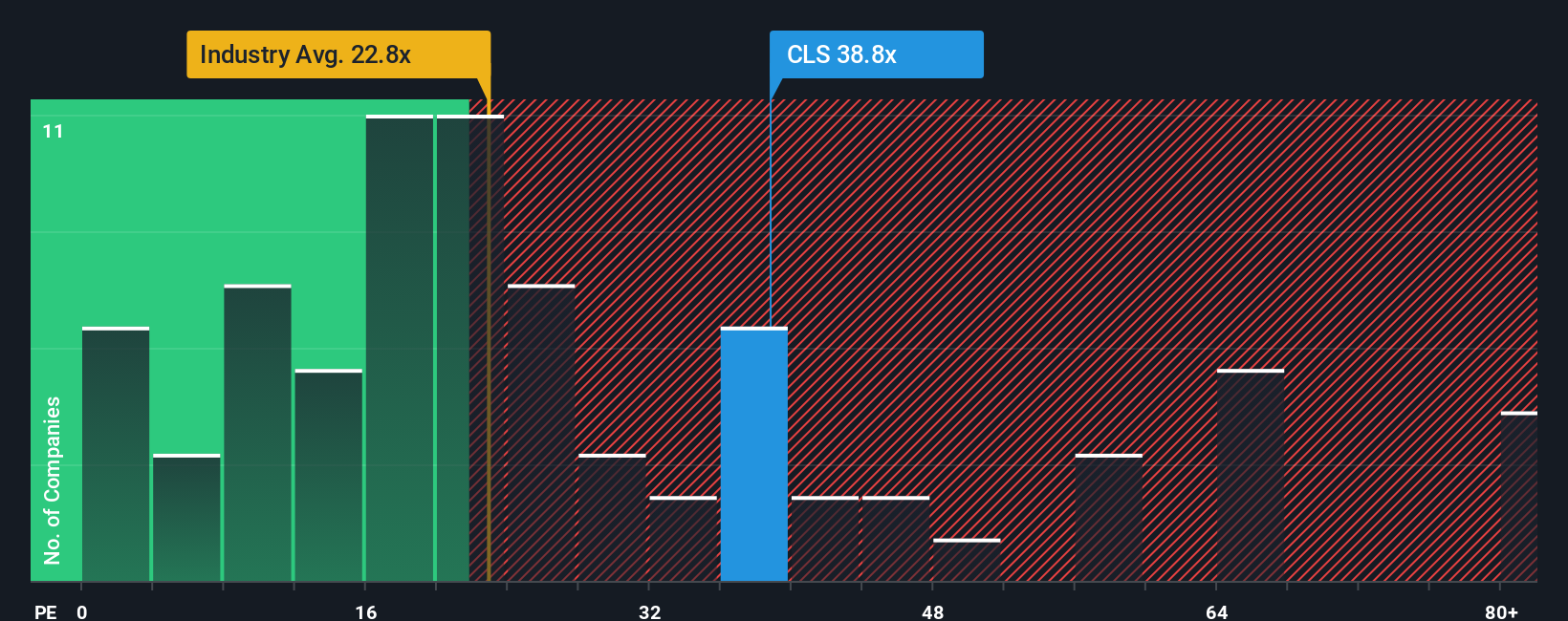

Another View: Multiples Paint a Cautious Picture

While some see Celestica as undervalued based on growth expectations, traditional valuation using price-to-earnings tells a different story. The company trades at 55.5 times earnings, which is far higher than both its industry peers (averaging 29.8x) and the level suggested by our fair ratio (49.5x). This premium hints at high market optimism, but it could also spell risk if future growth slows. Is the momentum baked in, or is the bar now set too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Celestica Narrative

If you have your own take or want to dig into the numbers yourself, it’s easy to build and share your perspective in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Celestica.

Looking for More Smart Investment Ideas?

Why limit your research to just one winner? Stay ahead by tracking stocks with explosive growth, strong financials, or breakthrough innovations using the expert-curated screeners below.

- Boost your portfolio's potential by targeting reliable income streams with these 19 dividend stocks with yields > 3% featuring yields greater than 3% and proven stability.

- Harness the momentum of cutting-edge technology by focusing on these 24 AI penny stocks driving the next AI-powered surge in the markets.

- Tap into future-defining breakthroughs by spotting leaders in quantum computing through these 26 quantum computing stocks as they unlock new frontiers in tech and science.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CLS

Celestica

Provides supply chain solutions in Asia, North America, and internationally.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives