Celestica (TSX:CLS): Profit Margin Surges to 6.3%, Challenging Skeptics on Quality of Growth

Reviewed by Simply Wall St

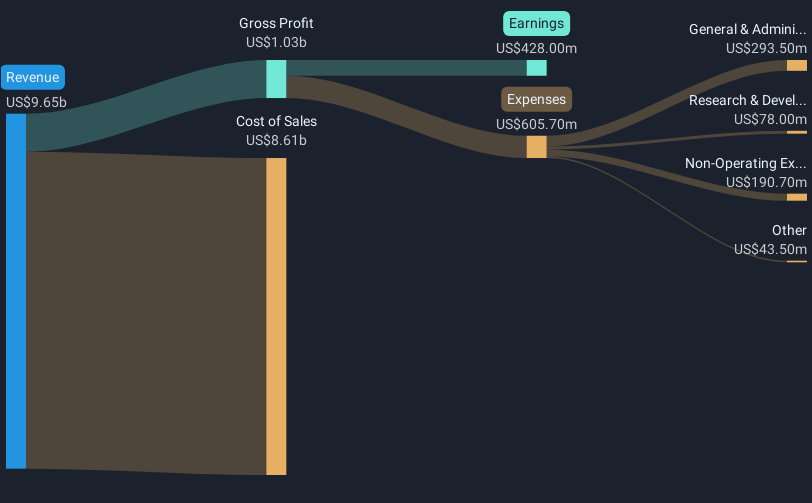

Celestica (TSX:CLS) continued its impressive trajectory with revenue and net profit surging ahead of Canadian market averages. Over the past twelve months, earnings jumped by 97.1% while net profit margins rose to 6.3% from last year’s 3.9%, highlighting stronger profitability. With forecasted annual earnings growth of 16.78% and revenue growth of 16.6%, investors are watching closely as momentum shows no sign of slowing.

See our full analysis for Celestica.Next, we will compare these headline results with the narratives circulating among investors and analysts, exploring which stories are supported by the numbers and where expectations might diverge.

See what the community is saying about Celestica

Profit Margins Expand on High-Margin Mix

- Net profit margin climbed to 6.3% (up from last year’s 3.9%), reflecting a shift toward higher-margin end-markets and services that analysts expect will drive further margin expansion, especially after 2026.

- Analysts' consensus view highlights that Celestica’s focus on advanced networking and AI-driven projects for hyperscaler customers enables robust revenue visibility and supports this margin strength.

- This momentum is reinforced by new segment ramps (800G/1.6T) and a diversification of manufacturing bases, which the consensus believes secures both resiliency and pricing power.

- Some analysts note that despite these margin gains, the company’s revenue remains concentrated among a handful of customers, which could introduce earnings volatility if spending drops off sharply.

- What’s striking is how this quality of earnings growth through strategic customer and segment focus answers calls for more resilient profitability, even against industry cyclicality. 📊 Read the full Celestica Consensus Narrative.

Premium Valuation Far Above Peers

- The current Price-To-Earnings ratio of 52.5x exceeds both the peer average of 32.3x and the industry average of 24.9x, making it nearly twice as expensive as its typical Canadian competitor.

- Consensus narrative emphasizes that this premium valuation reflects optimism about Celestica’s expected compound annual earnings growth of 16.78% and the runway for margin improvement.

- Analysts estimate Celestica would need to trade at a PE of 31.1x on 2028 projected earnings for the current price to be justified, which is still well above the industry norm and includes some execution risk on long-term growth assumptions.

- The share price of 454.11 stands far above the DCF fair value of 58.08, suggesting the market is heavily front-running future profits rather than current fundamentals.

Customer Concentration Increases Revenue Volatility

- Two customers contribute 31% and 13% of total revenue, and a third is close to 10%, meaning more than half of revenues hinge on a very concentrated client base.

- Consensus narrative flags that while large hyperscaler contracts are positive for near-term visibility, this concentration heightens exposure to a pullback in AI and cloud infrastructure spending.

- Nearly three-quarters (72%) of revenue comes from the communications and cloud solutions segment, so any slowdown in those markets could quickly translate to earnings shocks.

- Analysts point out that the anticipated continuing shift toward diversification, both in end-markets and regional manufacturing, will be crucial to dampen future swings in revenue and profitability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Celestica on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? Share your viewpoint and craft your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Celestica.

See What Else Is Out There

Celestica’s premium valuation significantly exceeds industry averages and leaves investors exposed if earnings projections or customer spending fall short.

If you want stocks more attractively priced based on solid fundamentals, check out these 867 undervalued stocks based on cash flows where you’ll find companies better positioned for long-term value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CLS

Celestica

Provides supply chain solutions in Asia, North America, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)