Celestica (TSX:CLS): Is the Market Overvaluing This Tech Stock After a Quiet Surge?

Reviewed by Simply Wall St

Celestica (TSX:CLS) has certainly made its way onto investors’ watchlists, thanks in part to a recent move that might seem puzzling in the absence of a major headline event. Sometimes, stock movements happen quietly, prompting investors to pause and wonder if there is a story beneath the surface. Perhaps a new narrative is forming, or it is just the market re-evaluating what the company is worth. Either way, the action around Celestica is capturing attention right now.

Looking at the numbers, it’s clear that momentum has been building throughout the year. Over the past year, Celestica has delivered a strong total return, far outpacing the broader market. Notably, the stock has surged more than fourfold over the past year, capped off by a dramatic rise in recent months. Short-term performance has also been eye-catching, with a substantial jump in the past three months and even more pronounced gains in just the past week.

After such a rapid climb, is Celestica undervalued, or is the market already pricing in every last bit of growth? Let’s dig into the details and see what the numbers really say.

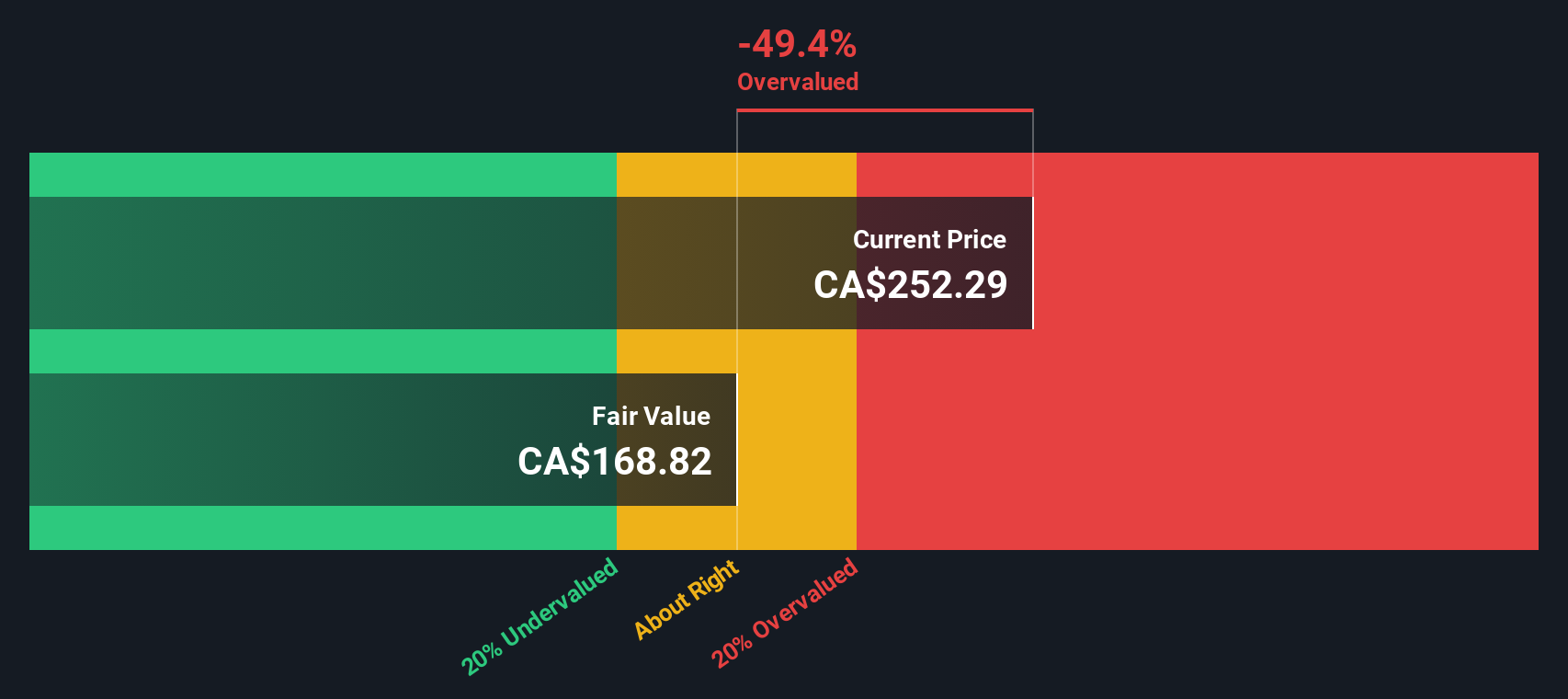

Most Popular Narrative: 8% Overvalued

According to the most widely followed narrative, Celestica is currently trading above what analysts consider its fair value, based on forward-looking financial projections and recent business momentum.

Widespread digital transformation initiatives and technology transitions (AI/ML compute, next-gen racks) across hyperscalers and digital native customers are expanding Celestica's design pipeline and deepening customer engagements. This increases revenue visibility and improves per-customer revenue potential.

Curious about the story behind Celestica’s soaring valuation? There is one crucial growth engine powering these ambitious price targets. It revolves around accelerating demand, new tech investments, and a transformation of the company’s revenue mix. The real surprise? The numbers that analysts are betting on to justify this premium. Do not miss what could be a game-changing set of assumptions fueling this view.

Result: Fair Value of $311.34 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on a handful of major customers and an abrupt slowdown in AI investments could quickly challenge this optimistic outlook.

Find out about the key risks to this Celestica narrative.Another View: What Does Our DCF Model Indicate?

While analyst price targets suggest Celestica is slightly overvalued, our SWS DCF model paints a different picture. This model indicates shares may be trading well above fair value. Could this model be signaling a downside others miss?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Celestica Narrative

If you see things differently or want to dig into the details yourself, creating your own take is straightforward and takes just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Celestica.

Looking for More Investment Ideas?

Step up your investing game by checking out tailored stock ideas you can act on right now. Unique opportunities could be just a click away, so do not let them pass you by.

- Snap up high-yield opportunities by browsing dividend stocks with yields > 3% for stocks that consistently reward shareholders with strong income potential.

- Tap into the AI trend with AI penny stocks for companies that are leading innovation and pushing the boundaries in artificial intelligence.

- Seize undervalued gems using undervalued stocks based on cash flows to help you spot stocks whose potential the market may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:CLS

Celestica

Provides supply chain solutions in Asia, North America, and internationally.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion