These 4 Measures Indicate That Quisitive Technology Solutions (CVE:QUIS) Is Using Debt Extensively

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Quisitive Technology Solutions, Inc. (CVE:QUIS) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Quisitive Technology Solutions

What Is Quisitive Technology Solutions's Debt?

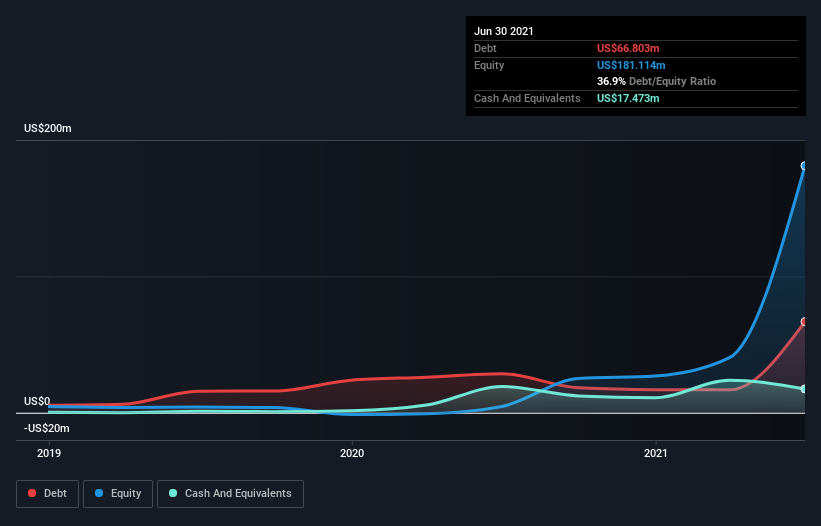

You can click the graphic below for the historical numbers, but it shows that as of June 2021 Quisitive Technology Solutions had US$66.8m of debt, an increase on US$28.6m, over one year. However, it also had US$17.5m in cash, and so its net debt is US$49.3m.

How Healthy Is Quisitive Technology Solutions' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Quisitive Technology Solutions had liabilities of US$31.6m due within 12 months and liabilities of US$83.6m due beyond that. Offsetting this, it had US$17.5m in cash and US$15.7m in receivables that were due within 12 months. So it has liabilities totalling US$82.0m more than its cash and near-term receivables, combined.

Quisitive Technology Solutions has a market capitalization of US$298.0m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Weak interest cover of 0.45 times and a disturbingly high net debt to EBITDA ratio of 8.5 hit our confidence in Quisitive Technology Solutions like a one-two punch to the gut. The debt burden here is substantial. One redeeming factor for Quisitive Technology Solutions is that it turned last year's EBIT loss into a gain of US$1.4m, over the last twelve months. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Quisitive Technology Solutions's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. During the last year, Quisitive Technology Solutions burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Quisitive Technology Solutions's interest cover and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. But at least its level of total liabilities is not so bad. Overall, we think it's fair to say that Quisitive Technology Solutions has enough debt that there are some real risks around the balance sheet. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Quisitive Technology Solutions (of which 2 don't sit too well with us!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Quisitive Technology Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:QUIS

Quisitive Technology Solutions

Through its subsidiaries, provides Microsoft solutions primarily in North America and South Asia.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)