Quorum Information Technologies Inc. (CVE:QIS) Just Released Its Third-Quarter Earnings: Here's What Analysts Think

It's been a good week for Quorum Information Technologies Inc. (CVE:QIS) shareholders, because the company has just released its latest third-quarter results, and the shares gained 2.9% to CA$1.05. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for Quorum Information Technologies

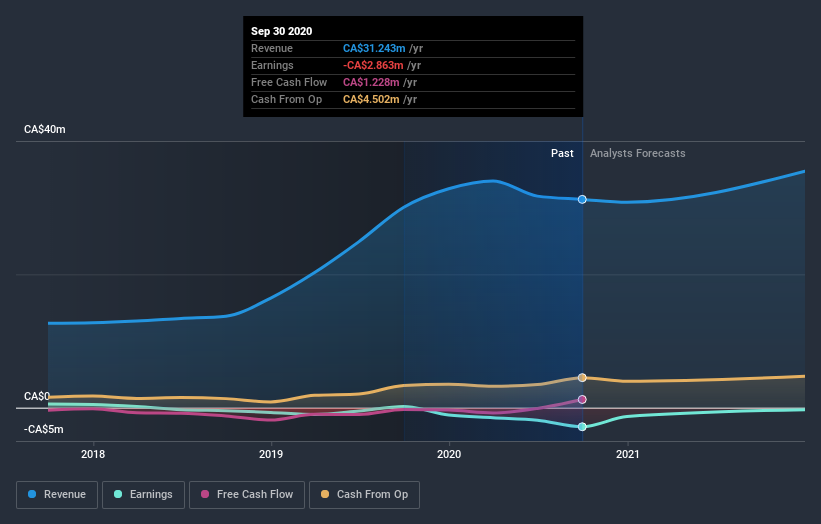

After the latest results, the three analysts covering Quorum Information Technologies are now predicting revenues of CA$35.5m in 2021. If met, this would reflect a meaningful 14% improvement in sales compared to the last 12 months. Before this earnings announcement, the analysts had been modelling revenues of CA$35.5m and losses of CA$0.02 per share in 2021. There was no real change to the revenue estimates, but the analysts do seem more bullish on earnings, given the earnings per share expectations following these results.

We'd also point out that thatthe analysts have made no major changes to their price target of CA$1.63. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on Quorum Information Technologies, with the most bullish analyst valuing it at CA$1.70 and the most bearish at CA$1.50 per share. This is a very narrow spread of estimates, implying either that Quorum Information Technologies is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's pretty clear that there is an expectation that Quorum Information Technologies' revenue growth will slow down substantially, with revenues next year expected to grow 14%, compared to a historical growth rate of 27% over the past five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 16% next year. Factoring in the forecast slowdown in growth, it seems obvious that Quorum Information Technologies is also expected to grow slower than other industry participants.

The Bottom Line

The most important thing to take away is that the analysts now expect Quorum Information Technologies to become profitable next year, compared to previous expectations that it would report a loss. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting sales are tracking in line with expectations - although our data does suggest that Quorum Information Technologies' revenues are expected to perform worse than the wider industry. The consensus price target held steady at CA$1.63, with the latest estimates not enough to have an impact on their price targets.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Quorum Information Technologies going out to 2021, and you can see them free on our platform here..

Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Quorum Information Technologies that you should be aware of.

If you decide to trade Quorum Information Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Quorum Information Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSXV:QIS

Quorum Information Technologies

An information technology company, focuses on the automotive retail business in Canada and the United States.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)