- Canada

- /

- Metals and Mining

- /

- TSXV:NOB

March 2025's Top TSX Penny Stocks To Watch

Reviewed by Simply Wall St

The Canadian market has been navigating a period of sideways consolidation, which may act as a corrective force amid elevated volatility and policy uncertainty. In such conditions, diversification and balance are key strategies for investors looking to fortify their portfolios against potential short-term dips. While the term "penny stocks" might seem outdated, they continue to offer intriguing opportunities for those seeking affordable investments with growth potential, particularly when these companies demonstrate strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.73 | CA$172.56M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.53 | CA$14.32M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.82 | CA$449.82M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.66 | CA$632.31M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$1.00 | CA$35.81M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$3.89 | CA$3.11B | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.12 | CA$30.89M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.81 | CA$298.08M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$1.90 | CA$200.35M | ★★★★★☆ |

| Orezone Gold (TSX:ORE) | CA$0.83 | CA$379.19M | ★★★★★☆ |

Click here to see the full list of 934 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Carlton Precious (TSXV:CPI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Carlton Precious Inc. is involved in the exploration and evaluation of mineral properties across Canada, Australia, Peru, and the United States, with a market cap of CA$4.78 million.

Operations: Carlton Precious Inc. has not reported any revenue segments.

Market Cap: CA$4.78M

Carlton Precious Inc., previously Nubian Resources Ltd., is a pre-revenue company with a market cap of CA$4.78 million, involved in mineral exploration across multiple countries. Despite its unprofitability and recent name change effective January 2025, the company benefits from having no debt and sufficient cash runway for over three years. Its management team and board are experienced, with average tenures of 7.8 and 5.2 years respectively. However, the stock has shown high volatility recently, with weekly volatility increasing to 61%. The company's short-term assets significantly exceed its short-term liabilities by CA$3.67 million.

- Navigate through the intricacies of Carlton Precious with our comprehensive balance sheet health report here.

- Assess Carlton Precious' previous results with our detailed historical performance reports.

Noble Mineral Exploration (TSXV:NOB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Noble Mineral Exploration Inc. is a junior exploration company focused on the exploration and evaluation of mineral properties in Canada, with a market cap of CA$9.49 million.

Operations: There are no reported revenue segments for this junior exploration company focused on mineral properties in Canada.

Market Cap: CA$9.49M

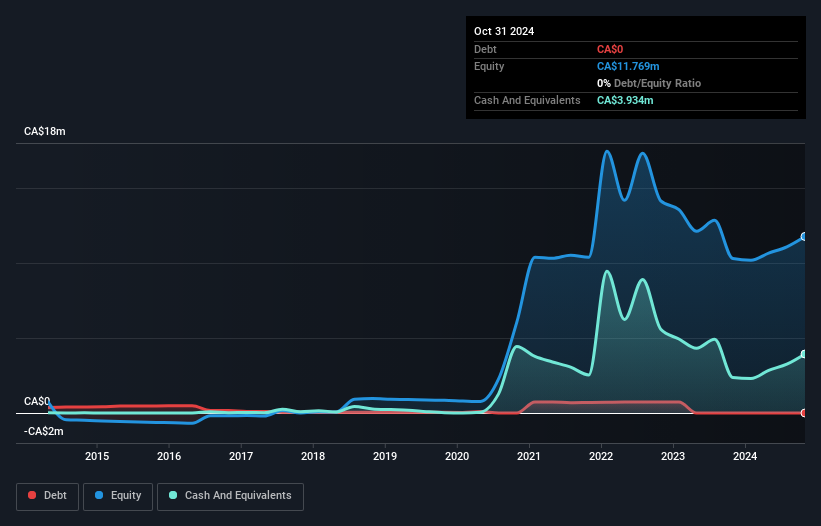

Noble Mineral Exploration Inc., with a market cap of CA$9.49 million, is a pre-revenue junior exploration company focused on mineral properties in Canada. The recent acquisition of additional claims at the Cere Villebon Property and the Chateau Property highlights its strategic expansion efforts. Despite being debt-free and having short-term assets exceeding liabilities by CA$3.1 million, Noble faces challenges with increased losses reported in recent earnings and doubts about its ability to continue as a going concern from auditors. The management team is seasoned, yet the stock remains highly volatile compared to other Canadian stocks.

- Click to explore a detailed breakdown of our findings in Noble Mineral Exploration's financial health report.

- Explore historical data to track Noble Mineral Exploration's performance over time in our past results report.

Pivotree (TSXV:PVT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pivotree Inc. designs, integrates, deploys, and manages digital platforms in commerce, data management, and supply chain for retail and branded manufacturers globally with a market cap of CA$28.25 million.

Operations: Pivotree's revenue is primarily derived from Professional Services, which account for CA$43.05 million, and Managed & IP Solutions (MIPS) & Legacy Managed Services (LMS), contributing CA$37.99 million.

Market Cap: CA$28.25M

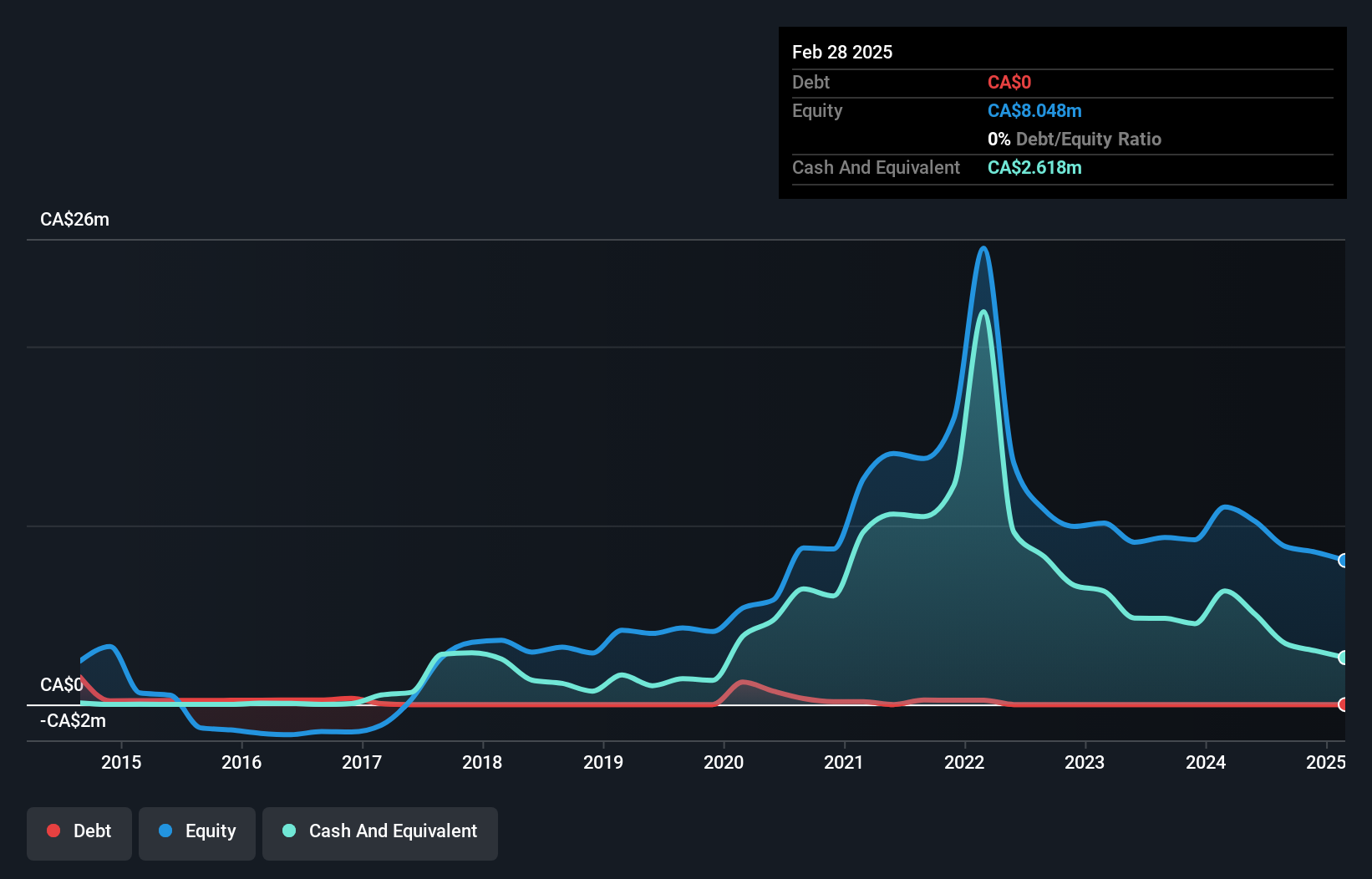

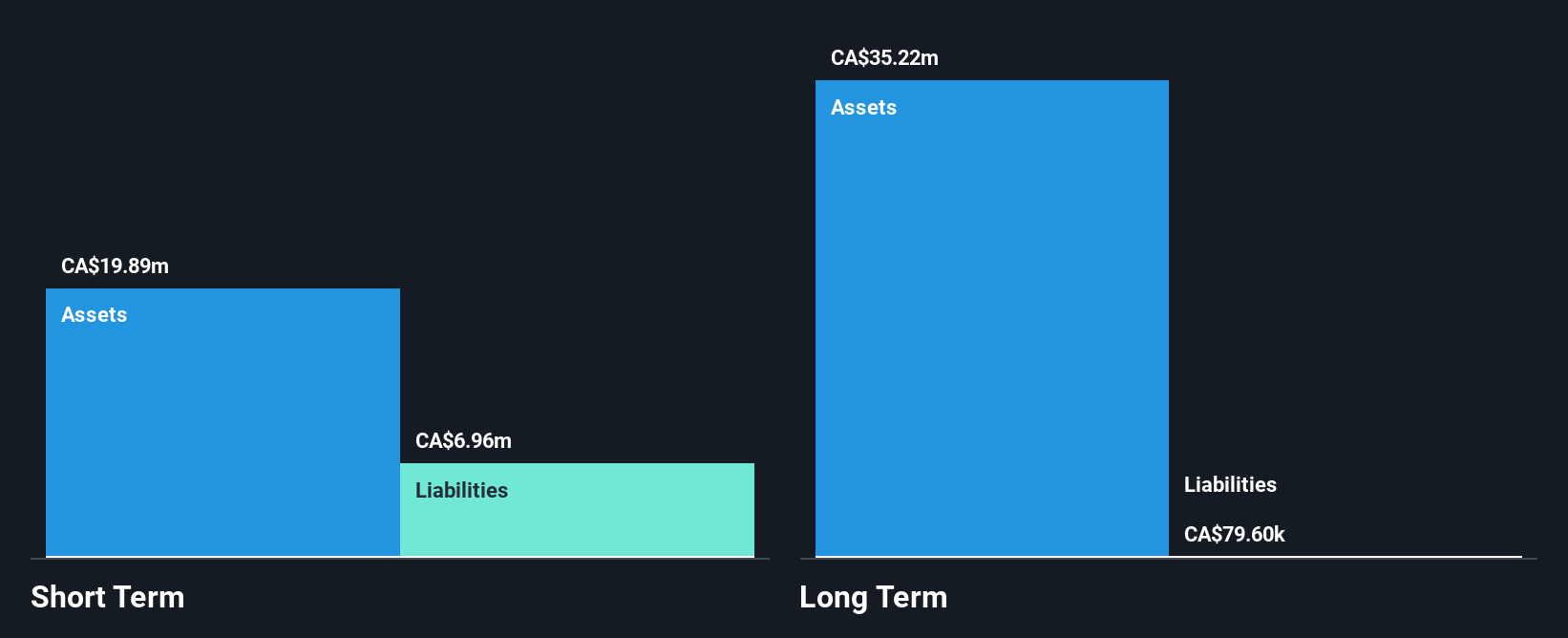

Pivotree Inc., with a market cap of CA$28.25 million, operates in the digital platform sector and remains unprofitable, with losses increasing by 15.2% annually over the past five years. Despite this, it trades at a good value compared to peers and industry standards, being 20.1% below its estimated fair value. The company is debt-free and has stable weekly volatility at 10%. Its short-term assets of CA$19.7 million comfortably cover both short-term liabilities (CA$9.4 million) and long-term liabilities (CA$80.6K). Pivotree's board is experienced with an average tenure of 9.8 years, providing seasoned oversight amidst ongoing financial challenges.

- Take a closer look at Pivotree's potential here in our financial health report.

- Understand Pivotree's earnings outlook by examining our growth report.

Make It Happen

- Jump into our full catalog of 934 TSX Penny Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Noble Mineral Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NOB

Noble Mineral Exploration

A junior exploration company, engages in the exploration and evaluation of mineral properties in Canada.

Flawless balance sheet slight.

Market Insights

Community Narratives