Most Shareholders Will Probably Find That The CEO Compensation For OneSoft Solutions Inc. (CVE:OSS) Is Reasonable

Under the guidance of CEO R. Kushniruk, OneSoft Solutions Inc. (CVE:OSS) has performed reasonably well recently. As shareholders go into the upcoming AGM on 04 May 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

See our latest analysis for OneSoft Solutions

How Does Total Compensation For R. Kushniruk Compare With Other Companies In The Industry?

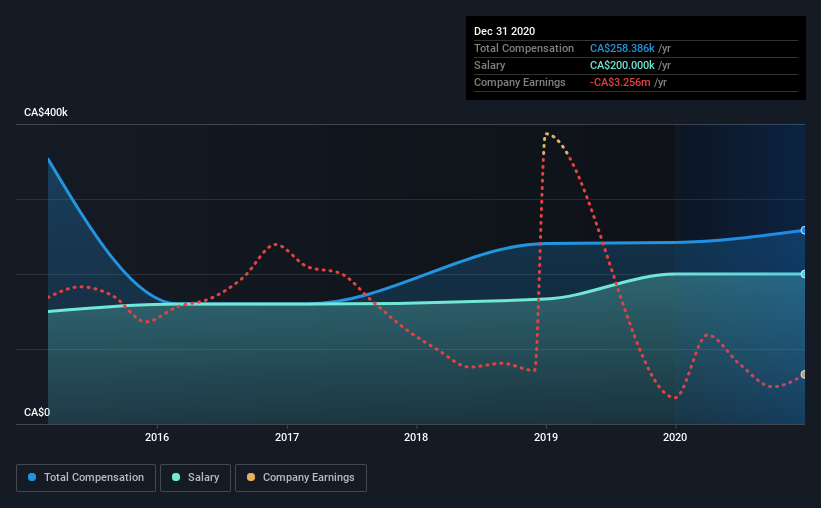

At the time of writing, our data shows that OneSoft Solutions Inc. has a market capitalization of CA$73m, and reported total annual CEO compensation of CA$258k for the year to December 2020. That's just a smallish increase of 6.7% on last year. In particular, the salary of CA$200.0k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under CA$248m, the reported median total CEO compensation was CA$224k. So it looks like OneSoft Solutions compensates R. Kushniruk in line with the median for the industry. What's more, R. Kushniruk holds CA$3.5m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$200k | CA$200k | 77% |

| Other | CA$58k | CA$42k | 23% |

| Total Compensation | CA$258k | CA$242k | 100% |

On an industry level, around 70% of total compensation represents salary and 30% is other remuneration. OneSoft Solutions is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

OneSoft Solutions Inc.'s Growth

Over the past three years, OneSoft Solutions Inc. has seen its earnings per share (EPS) grow by 8.6% per year. Its revenue is up 49% over the last year.

We like the look of the strong year-on-year improvement in revenue. Combined with modest EPS growth, we get a good impression of the company. We'd stop short of saying the business performance is amazing, but there are enough positives to justify further research, or even adding the stock to your watch-list. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has OneSoft Solutions Inc. Been A Good Investment?

Boasting a total shareholder return of 34% over three years, OneSoft Solutions Inc. has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 5 warning signs for OneSoft Solutions you should be aware of, and 1 of them is a bit concerning.

Important note: OneSoft Solutions is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading OneSoft Solutions or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:OSS

OneSoft Solutions

Provides software solutions to the oil and gas pipeline industry in Canada, Australia, and the United States.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.