- Canada

- /

- Metals and Mining

- /

- TSXV:CN

3 TSX Penny Stocks With Market Caps Under CA$90M

Reviewed by Simply Wall St

In Canada, recent economic indicators show signs of stabilization, with the labor market steadying and inflation metrics aligning with expectations. As the broader stock market experiences a period of momentum and potential volatility, investors might find opportunities in lesser-known areas like penny stocks. Although considered niche today, penny stocks can offer significant growth potential when they are backed by strong financial fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$3.22 | CA$81.4M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.54 | CA$2.38M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.36 | CA$54.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.37 | CA$878.19M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.05 | CA$22.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.72 | CA$436.03M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.57 | CA$180.69M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.18 | CA$213.59M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.84 | CA$10.7M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 414 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Medicenna Therapeutics (TSX:MDNA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Medicenna Therapeutics Corp. is a clinical-stage immunotherapy company focused on developing and commercializing Superkines and empowered Superkines for treating cancer, inflammation, and immune-mediated diseases, with a market cap of CA$80.07 million.

Operations: Medicenna Therapeutics Corp. currently does not have any reported revenue segments.

Market Cap: CA$80.07M

Medicenna Therapeutics, a pre-revenue biotech firm with a market cap of CA$80.07 million, is focused on developing immunotherapies. Despite being unprofitable with increasing losses over the past five years, the company maintains a strong financial position with short-term assets significantly exceeding both its short and long-term liabilities. The management team is seasoned with an average tenure of 11.1 years, and there has been no significant shareholder dilution recently. Although not expected to achieve profitability in the near term, Medicenna's revenue is forecast to grow substantially at 65.07% annually according to consensus estimates.

- Click to explore a detailed breakdown of our findings in Medicenna Therapeutics' financial health report.

- Learn about Medicenna Therapeutics' future growth trajectory here.

BIGG Digital Assets (TSXV:BIGG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BIGG Digital Assets Inc. owns, operates, and invests in businesses within the digital assets industry across Canada, the USA, Europe, and internationally with a market cap of CA$42.69 million.

Operations: The company's revenue is primarily generated in Canada (CA$10.70 million), followed by the USA (CA$1.01 million) and Europe (CA$0.40 million).

Market Cap: CA$42.69M

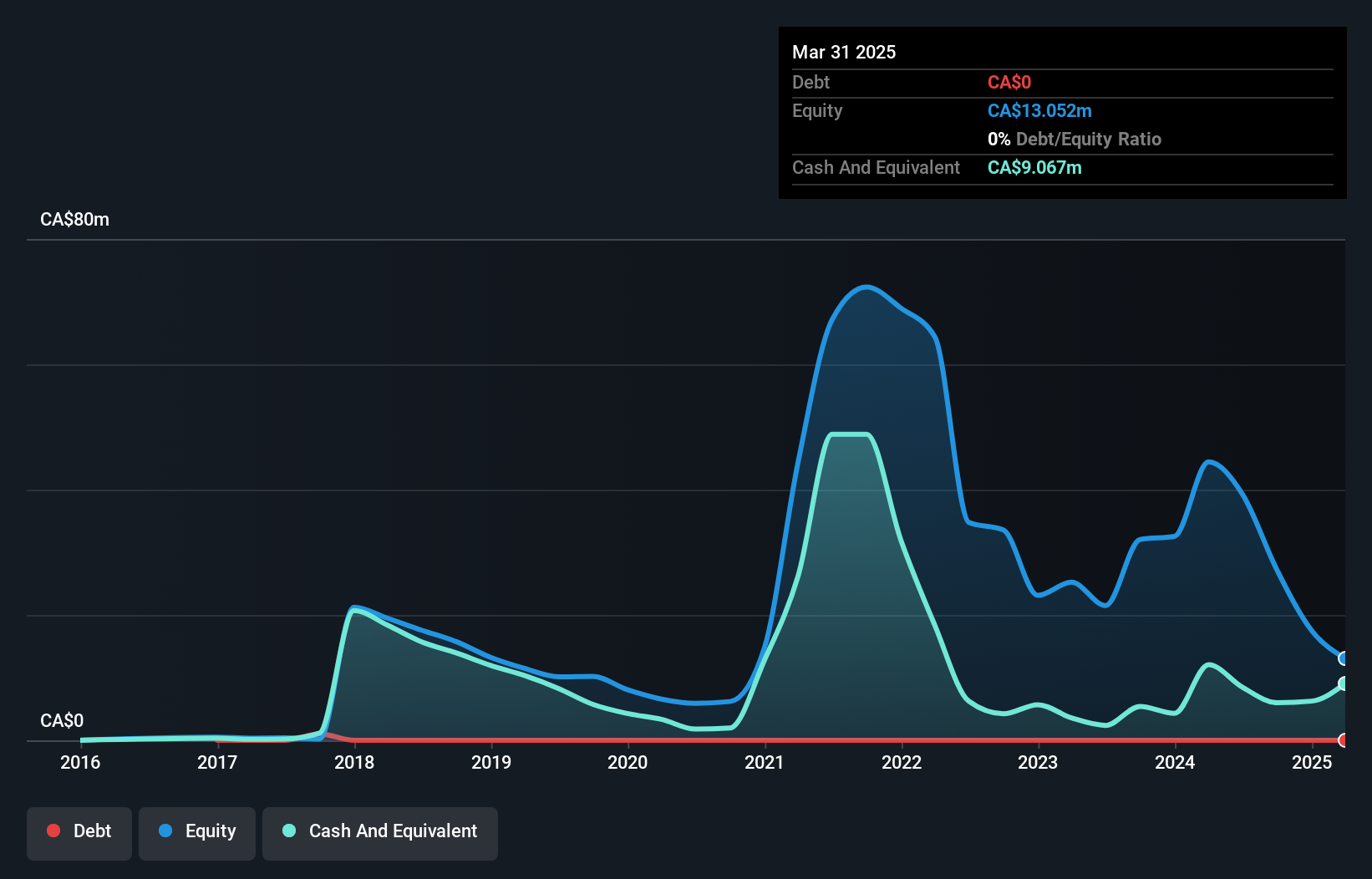

BIGG Digital Assets, with a market cap of CA$42.69 million, is navigating the digital assets sector while remaining unprofitable. Recent earnings show modest revenue growth to CA$2.66 million for Q2 2025, yet net losses persist at CA$0.12 million compared to last year’s larger loss of CA$5.01 million. The company is debt-free and has short-term assets exceeding liabilities, but its cash runway remains under a year if current free cash flow trends continue. Despite an experienced management team and board, profitability isn't expected soon; however, their expansion in crypto offerings could attract new investor interest.

- Jump into the full analysis health report here for a deeper understanding of BIGG Digital Assets.

- Review our growth performance report to gain insights into BIGG Digital Assets' future.

Condor Resources (TSXV:CN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Condor Resources Inc. is an exploration stage company focused on acquiring and exploring mineral properties in Peru, with a market cap of CA$23.24 million.

Operations: Condor Resources Inc. does not have any reported revenue segments as it is an exploration stage company.

Market Cap: CA$23.24M

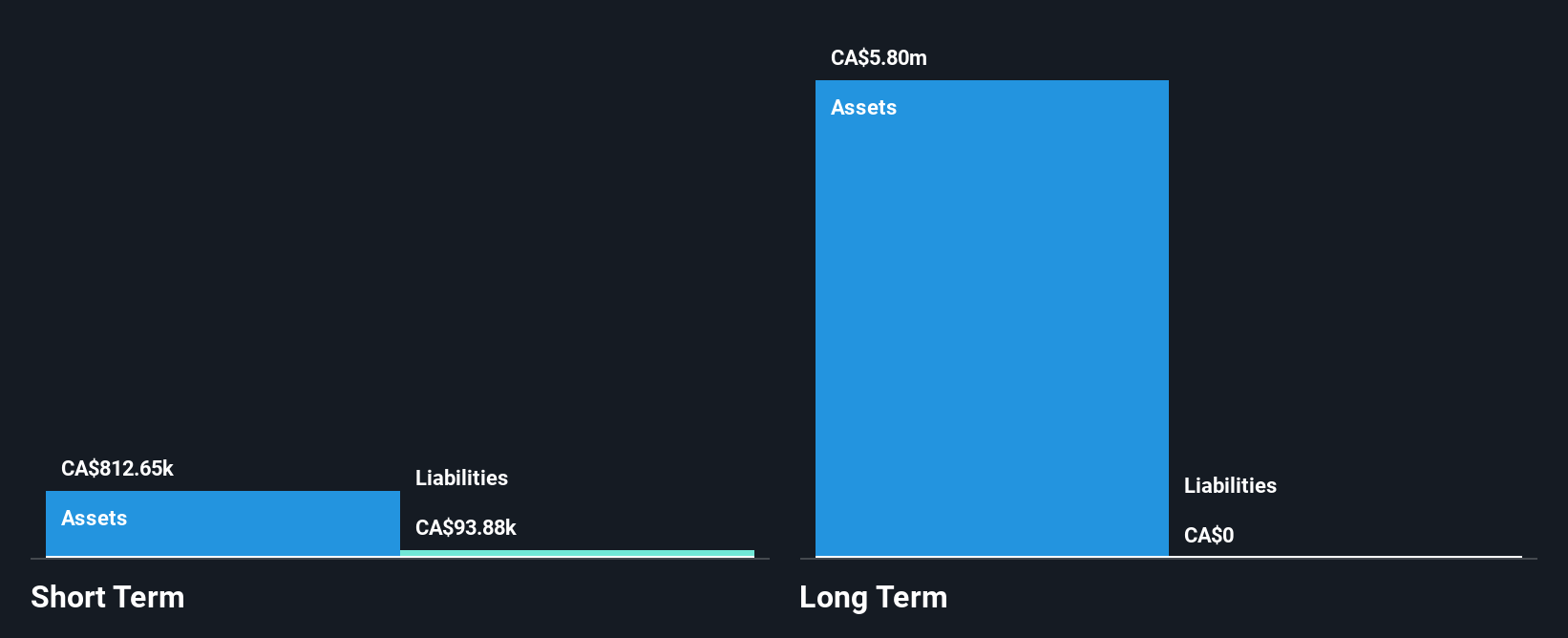

Condor Resources Inc., with a market cap of CA$23.24 million, remains pre-revenue as it focuses on mineral exploration in Peru. Despite being debt-free and having short-term assets of CA$812.7K that exceed its liabilities, the company reported an increased net loss for Q1 2025 at CA$0.21 million compared to last year's CA$0.18 million loss. The management and board are seasoned, with average tenures of 14.5 and 9.7 years respectively, but the company's negative return on equity (-73.12%) highlights ongoing profitability challenges amid stable weekly volatility over the past year at 13%.

- Dive into the specifics of Condor Resources here with our thorough balance sheet health report.

- Gain insights into Condor Resources' past trends and performance with our report on the company's historical track record.

Next Steps

- Gain an insight into the universe of 414 TSX Penny Stocks by clicking here.

- Contemplating Other Strategies? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CN

Condor Resources

An exploration stage company, engages in the acquisition and exploration of mineral properties in Peru.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)