Benign Growth For Optiva Inc. (TSE:OPT) Underpins Stock's 38% Plummet

Unfortunately for some shareholders, the Optiva Inc. (TSE:OPT) share price has dived 38% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 72% share price decline.

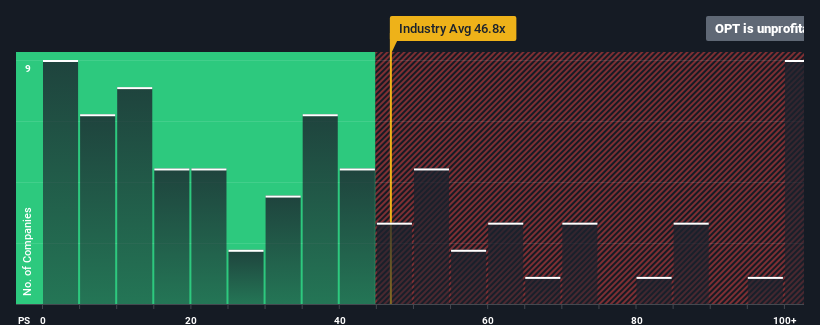

Following the heavy fall in price, Optiva may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of -7.9x, since almost half of all companies in Canada have P/E ratios greater than 11x and even P/E's higher than 25x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

For example, consider that Optiva's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Optiva

Is There Any Growth For Optiva?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Optiva's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 207%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 11% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Optiva's P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Optiva's P/E

Optiva's P/E looks about as weak as its stock price lately. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Optiva maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for Optiva (1 is significant!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:OPT

Optiva

Provides cloud-native monetization and business support systems products to communication service providers (CSP) in Europe, the Middle East, Africa, North America, Latin America, the Caribbean, Asia, and the Pacific Rim.

Good value low.

Similar Companies

Market Insights

Community Narratives