Will the Addition of Google and Global Tech Leaders to the Board Change Lightspeed Commerce's (TSX:LSPD) Narrative

Reviewed by Sasha Jovanovic

- On October 1, 2025, Lightspeed Commerce announced that Sameer Samat, President of the Android Ecosystem at Google, and Odilon Almeida, an experienced global executive, have joined its Board of Directors.

- The addition of these leaders brings advanced technological and industry depth to Lightspeed’s board, supporting the company’s ongoing focus on profitable growth and operational execution.

- We'll explore how the arrival of high-profile board members could reshape Lightspeed’s investment narrative and future strategic direction.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Lightspeed Commerce Investment Narrative Recap

To be a Lightspeed Commerce shareholder, you need to believe in its ability to capture ongoing digital payments adoption and deliver product innovation that drives stronger retention and upsell, while managing persistent profitability challenges. While the appointment of Sameer Samat and Odilon Almeida brings valuable technology and fintech acumen to the board, this is not expected to materially impact the current short-term catalyst, improving cash flow, or shift the biggest risk of ongoing losses and competitive pressure.

Among recent announcements, the launch of Lightspeed’s AI-driven website builder for retail merchants points directly to the company’s focus on greater product innovation, a key catalyst that underpins its strategy to grow software revenue and improve margins. Whether these efforts will outweigh risks from aggressive peers and ongoing profitability constraints remains a central question facing investors.

By contrast, persistent thin or negative free cash flow is a detail investors should be aware of as...

Read the full narrative on Lightspeed Commerce (it's free!)

Lightspeed Commerce's outlook calls for $1.5 billion in revenue and $179.9 million in earnings by 2028. This scenario depends on 11.4% annual revenue growth and a $861.7 million improvement in earnings from the current level of -$681.8 million.

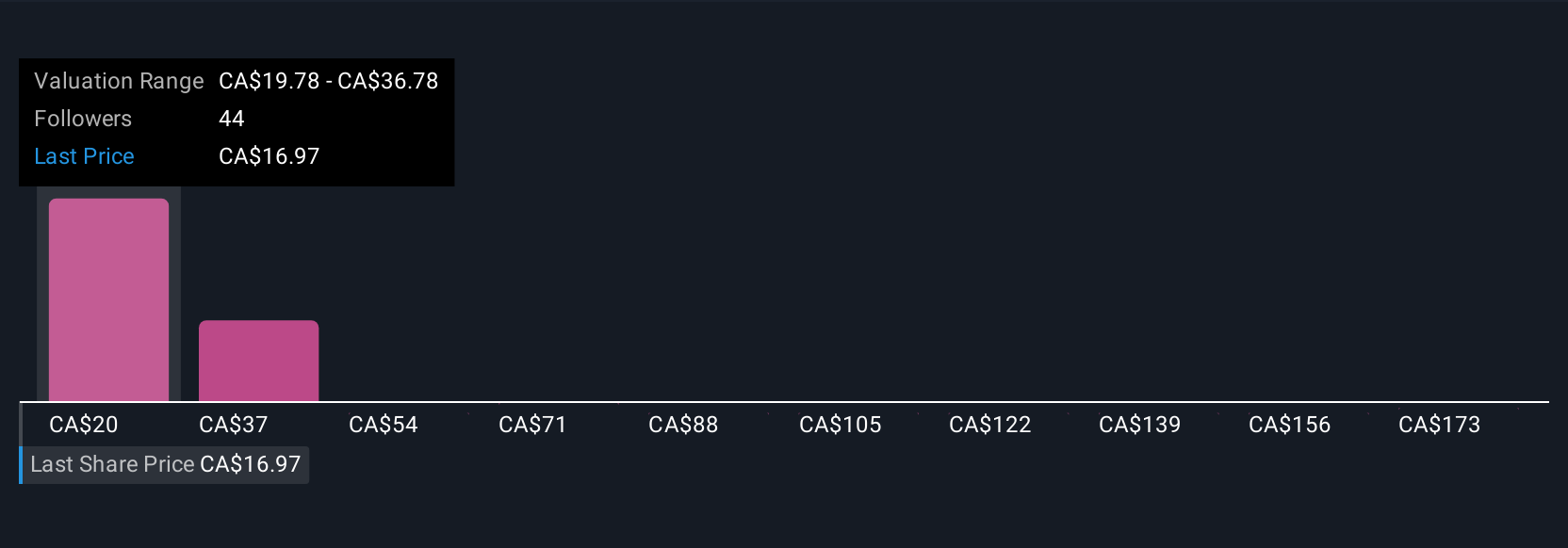

Uncover how Lightspeed Commerce's forecasts yield a CA$21.28 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Eleven members of the Simply Wall St Community shared fair value estimates for Lightspeed, spanning a wide range from US$21.28 to US$189.71 per share. While this reveals wide differences in outlook, remember thin or negative free cash flow continues to be a pressing challenge for the company, so reviewing alternate viewpoints is essential.

Explore 11 other fair value estimates on Lightspeed Commerce - why the stock might be a potential multi-bagger!

Build Your Own Lightspeed Commerce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lightspeed Commerce research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lightspeed Commerce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lightspeed Commerce's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LSPD

Lightspeed Commerce

Engages in sale of cloud-based software subscriptions and payments solutions for single and multi-location retailers, restaurants, golf course operators, and other businesses.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives